Pay As You Earn (PAYE)

Earned Income Tax Credit

Dependent Relative Tax Credit

Universal Social Charge (USC)

National Minimum Wage

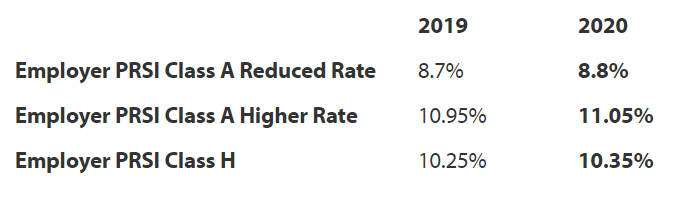

Pay Related Social Insurance (PRSI)

State Pension Age

Illness Benefit

Parent’s Leave

Wage Subsidy Scheme

VAT

MINIMUM WAGE INCREASE - 1st FEBRUARY 2020:

PRSI:

PARENT'S LEAVE & BENEFIT BILL

The Parent's Leave and Benefit Act 2019 introduces two weeks' paid parents leave for any child born / adopted on or after 1st November 2019, in order to allow working parents to spend more time with their baby or adopted child during the first year.

Further information on Parent's Leave and Parent's Benefit can be found here

Need help? Support is available at 01 8352074 or [email protected].