PRSI adjustments for ineligible TWSS payslips:

Where an employer applied the J9 PRSI class to a payslip and:

then adjustments may be required to correct the position.

The adjustments will correct the employee's PRSI class and associated insurable weeks, the employee's PRSI and the employer's PRSI liability. The employee's Income Tax and USC is addressed via the employee's end of year statement.

Please note, if a PAYE or PRSI assessment has been raised by Revenue on the employer for some, or all, of the period 26th March 2020 to 31st August 2020 then the employer should confirm with the Revenue caseworker before making further adjustments.

Correcting Insurable weeks and PRSI

When making these adjustments, employers should not correct the original payslip. Instead, a single adjusting payroll submission should be used to make the relevant adjustments for the employee.

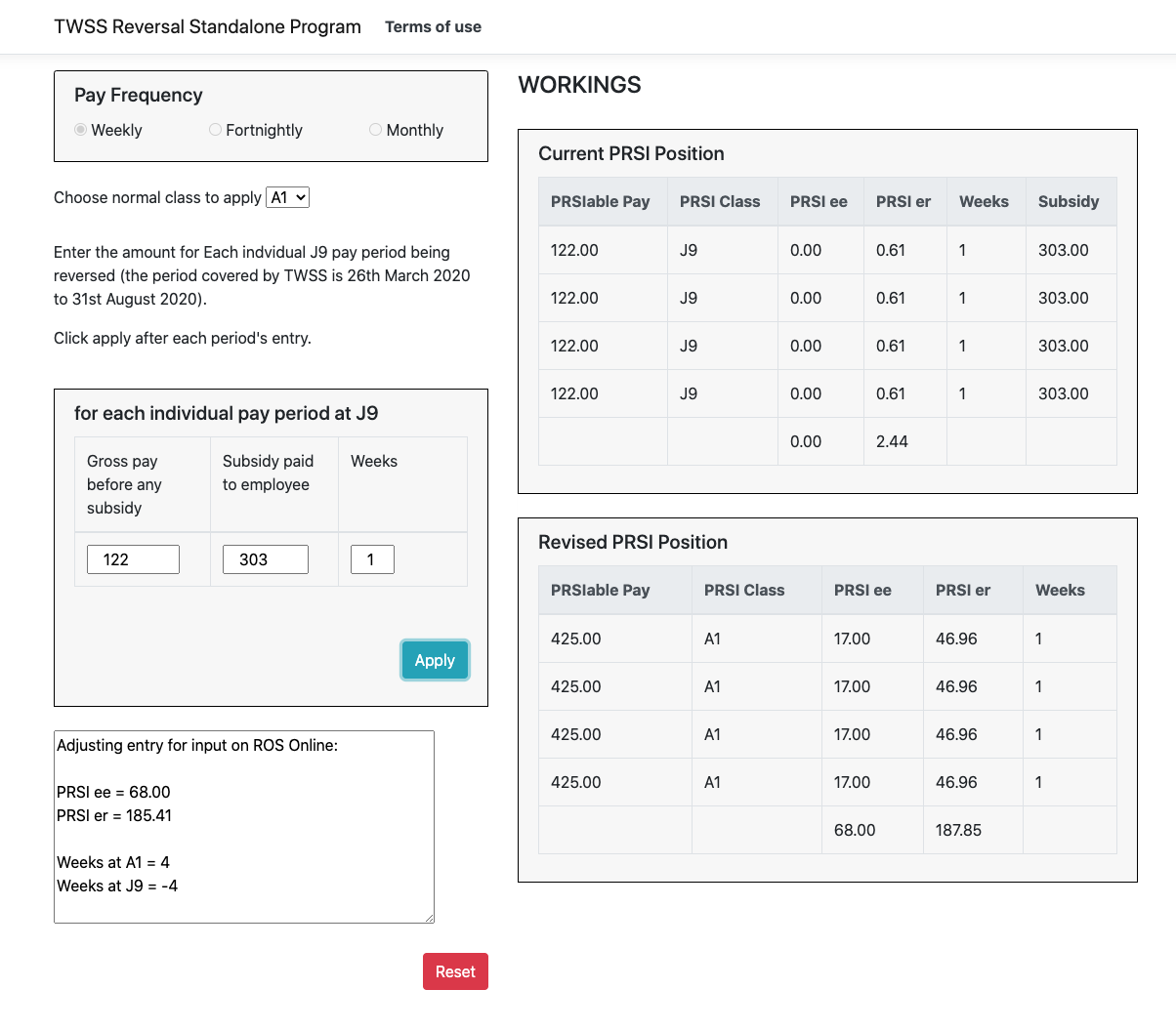

Please note, the adjusting payroll submission cannot be done using BrightPay. It can be submitted online via ROS, to assist with this we have a standalone TWSS reversal utility to help with the calculations and the entry required. The TWSS reversal utility can be accessed here

The adjusting submission should report a reduction in J9 insurable weeks and an increase in the number of non J9 insurable weeks for the TWSS ineligible payslips. It should also correct the employee and employer PRSI, PRSI should be recalculated taking the gross pay plus the subsidy paid into account.

Example: Employee received a total weekly pay of €425 (gross pay of €122 plus a subsidy paid of €303) for 4 weeks, the correction should be as follows:

Employee PRSI:

€425 * 4% = €17

Total Employee PRSI €68 (€17 * 4)

Employer PRSI:

€425 * 11.05% = €46.96 less PRSI already charged €0.61 (€122 * 0.5%) = €46.35

Total Employer PRSI Difference = €46.35 * 4 = €185.40

Adjusting Payroll Submission Details:

J9 - 4 weeks

A1 + 4 weeks

Employee PRSI €68

Employer PRSI €185.40

The TWSS reversal utility can be used to enter the required information for the relevant pay periods, it will perform the calculations and provide the details for the entry on ROS.

Creating the submission using ROS

Please note, as there is no pay for this payslip, the default values in both sections will have to be edited to zero values.

The submission should be made with a pay date between 1st September 2020 and 29th December 2020. It may be beneficial to use the 25th December as the pay date as it is unlikely to conflict with normal pay dates and would make these submissions easier to identify.

If you are happy that all the information is correct, please select 'I confirm these details are correct' > 'Save' > 'Submit Payroll' > 'Sign & Submit'.

Further information on TWSS PRSI adjustments can be found in the Revenue guidance which can be accessed here

Please note, the TWSS reversal utility is provided to assist with the preparation of a PRSI correction resulting from a TWSS reversal. Users should check the results displayed. Thesaurus Software Ltd accepts no responsibility for errors or omissions.

Need help? Support is available at 01 8352074 or [email protected].