Stage two of the Temporary Wage Subsidy Scheme (TWSS) reconciliation process commenced on March 22nd 2021.

Employers will receive a ROS Inbox Notification when their reconciliation information is available in ROS.

The scheme was in operation between 26th March 2020 and 31st August 2020. The reconciliation is reconciling the subsidy amounts refunded by Revenue and the amounts of subsidy that were paid to employees by employers.

Employers have until the end of June 2021 to review the detailed information provided by Revenue and accept the reconciliation amounts.

Stage one of the TWSS reconciliation required employers to report the subsidy paid to each employee in respect of each pay date.

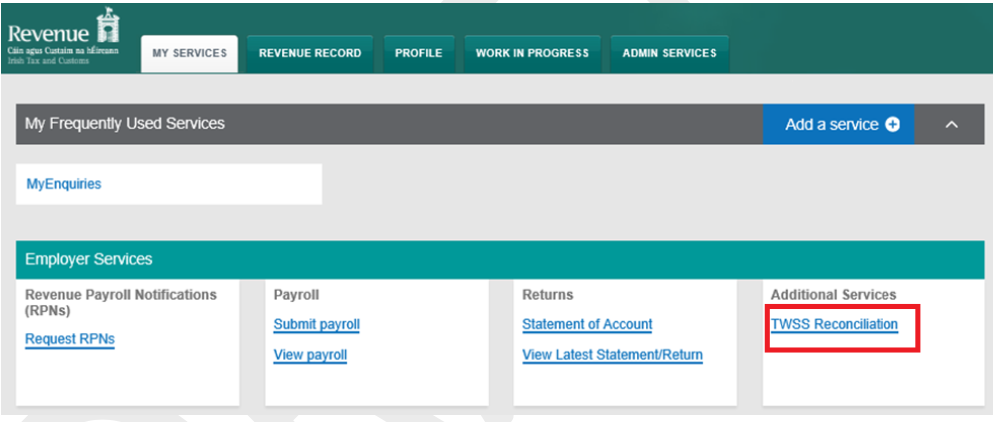

Employers can view their up-to-date position of subsidy paid data through the Revenue Online Service (ROS) under the category 'TWSS Reconciliation'.

Employers have until the end of June 2021 to:

When a reconciliation is accepted a Statement of Account will be sent via the ROS Inbox. Employers will be required to pay any additional amount owed to Revenue or, if necessary, they will be paid any additional amount owed by Revenue to them.

Employers cannot accept their reconciliation until all subsidy data has been reported.

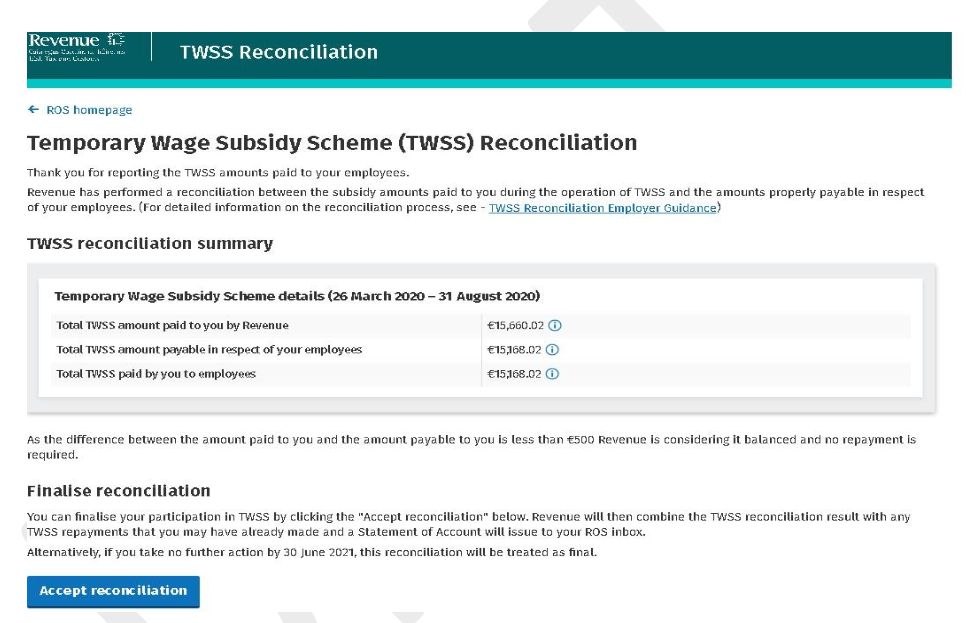

TWSS Reconciliation Summary

The reconciliation screen will reflect the employer's current reconciliation position. The information displayed will vary depending on the information the employer has submitted and the employer's balance.

Employers that have reported subsidy paid data for all the active TWSS J9 payslips

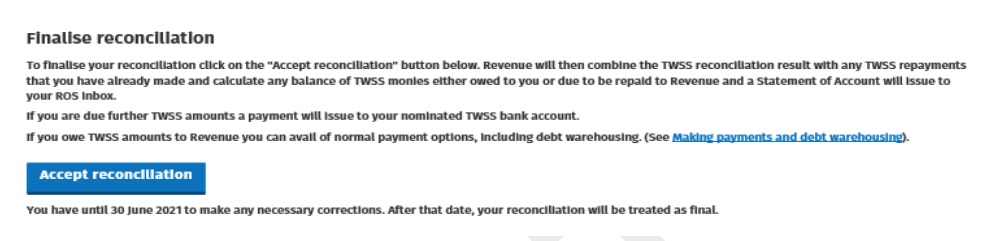

Finalise Reconciliation

Employers can finalise their participation in TWSS by clicking 'Accept reconciliation'. Revenue will then combine the TWSS reconciliation result with any TWSS repayments that have already been made and a Statement of Account will issue to the ROS Inbox.

It no action is taken by June 30 2021, the reconciliation will be treated as final.

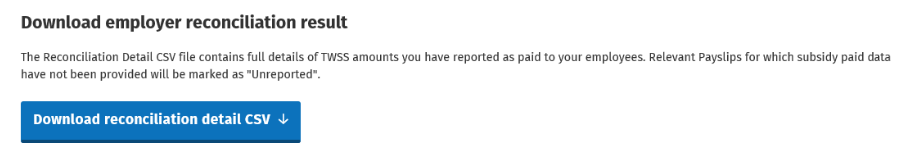

Reconciliation CSV

Employers can download a reconciliation detail CSV file, this will contain a complete record of the TWSS related payslip information provided by the employer at payslip level and Revenue's reconciliation calculation.

Employers whose reconciliation is not yet available

A small number of employers will not get the notification that their reconciliation is available until a later date, these include:

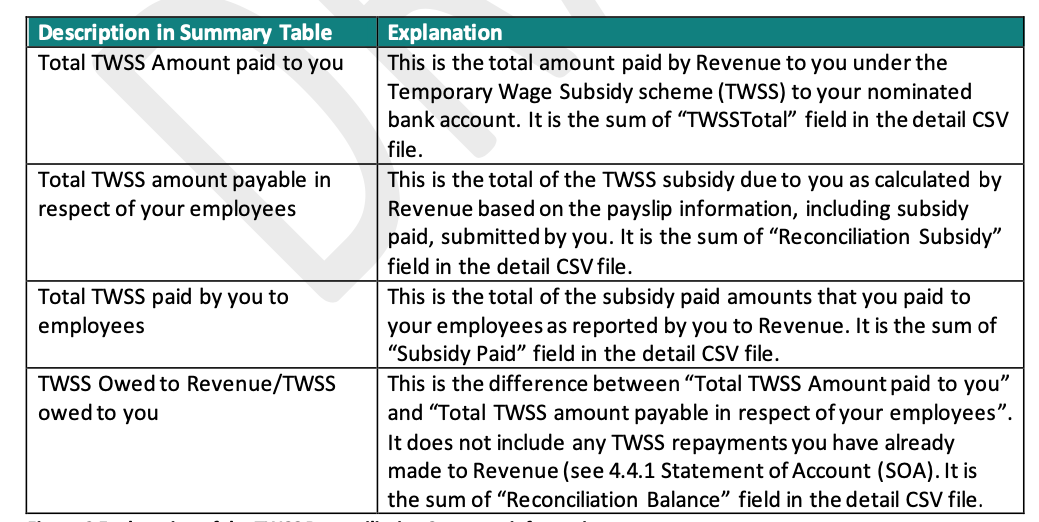

TWSS Reconciliation Summary table

The TWSS reconciliation summary table will include the:

Total TWSS paid by you to employees

The 'Total TWSS paid by you to employees' should match the subsidy paid figure on your payroll software. This should have been reported to Revenue using the TWSS CSV file/Reconciliation CSV File.

You can confirm this figure matches by running the report in the payroll software again.

This can be done by selecting Employees, followed by 'Reconciliation CSV File', if required, amend the date range > 'Continue', a 'Total' figure will be displayed at the end of the report.

Finalising Reconciliation

When an employer is satisfied with the information in the reconciliation result, they should click the 'Accept' button on the TWSS Reconciliation screen.

Statement of Account (SOA)

A Statement of Account will issue to the employer's ROS Inbox when:

Reconciliation closes on June 30th 2021

Please note, Revenue strongly recommend that employers take the time to read & understand their TWSS Reconciliation guidance before accepting the reconciliation.

Further information on the TWSS reconciliation can be found on the Revenue website.

Need help? Support is available at 01 8352074 or [email protected].