Temporary Wage Subsidy Scheme (TWSS) Reconciliation

Stage two of the Temporary Wage Subsidy Scheme (TWSS) reconciliation process commenced on March 22nd 2021.

Employers will receive a ROS Inbox Notification when their reconciliation information is available in ROS.

The scheme was in operation between 26th March 2020 and 31st August 2020. The reconciliation is reconciling the subsidy amounts refunded by Revenue and the amounts of subsidy that were paid to employees by employers.

Employers have until the end of June 2021 to review the detailed information provided by Revenue and accept the reconciliation amounts.

Stage one of the TWSS reconciliation required employers to report the subsidy paid to each employee in respect of each pay date.

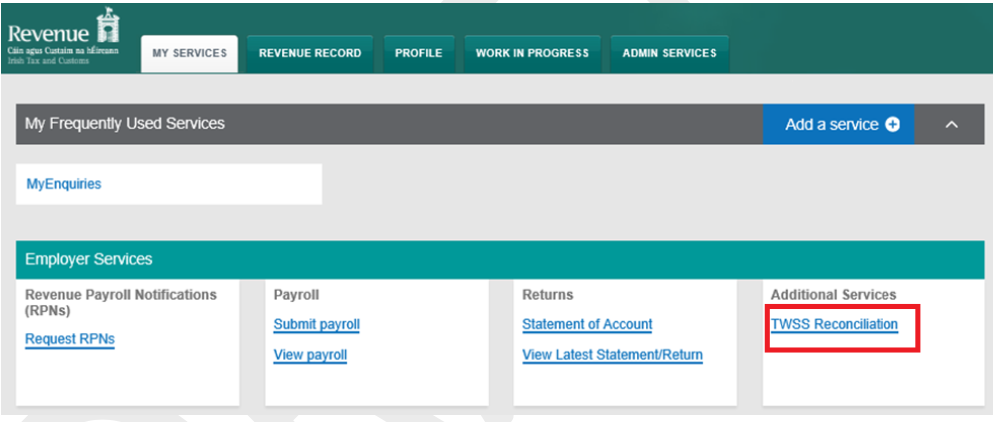

Employers can view their up-to-date position of subsidy paid data through the Revenue Online Service (ROS) under the category 'TWSS Reconciliation'.

Employers have until the end of June 2021 to:

- Accept the reconciliation calculation issued by Revenue

- Make corrections to payslips if necessary

- Make an enquiry through MyEnquiries

When a reconciliation is accepted a Statement of Account will be sent via the ROS Inbox. Employers will be required to pay any additional amount owed to Revenue or, if necessary, they will be paid any additional amount owed by Revenue to them.

Employers cannot accept their reconciliation until all subsidy data has been reported.

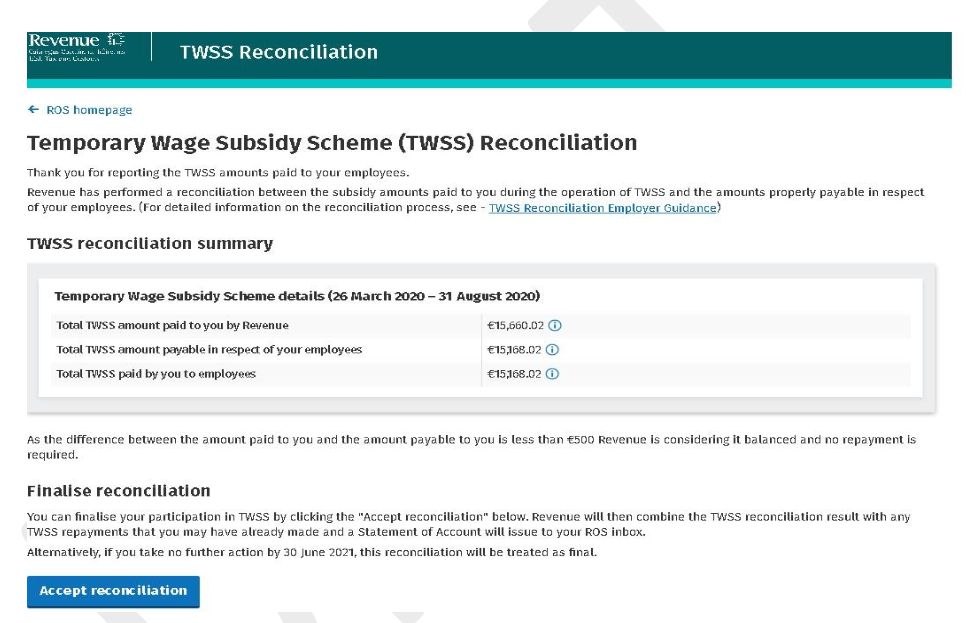

TWSS Reconciliation Summary

The reconciliation screen will reflect the employer's current reconciliation position. The information displayed will vary depending on the information the employer has submitted and the employer's balance.

- If an employer has reported the subsidy paid information on all J9 payslips, the reconciliation screens will show the summary information allowing the employer to review and accept the reconciliation.

- Employers that have not yet reported the subsidy paid data for all J9 payslips, or whose reconciliation is not yet available, will be shown information on the actions they are to take.

Employers that have reported subsidy paid data for all the active TWSS J9 payslips

- Where an employer has reported the subsidy paid information on all J9 payslips and the 'TWSS amount paid to you by Revenue' either equals, or does not exceed the 'Total TWSS amount payable in respect of your employees ' by more than €500, then Revenue considers this reconciliation to be balanced.

- Where the employer's reconciliation is balanced, there is a liability due to Revenue or an additional payment is due to the employer, then, the employer is given a reconciliation summary, access to download the reconciliation CSV file and the option to accept the reconciliation.

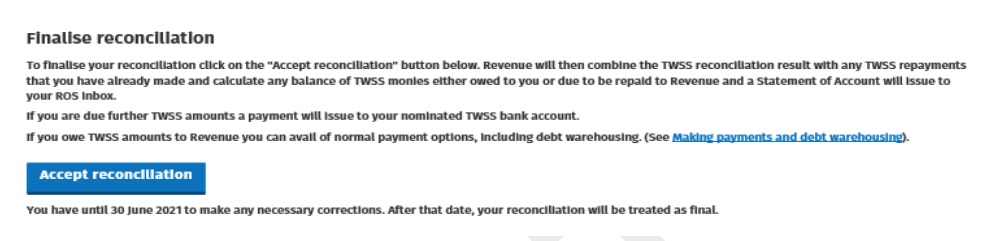

Finalise Reconciliation

Employers can finalise their participation in TWSS by clicking 'Accept reconciliation'. Revenue will then combine the TWSS reconciliation result with any TWSS repayments that have already been made and a Statement of Account will issue to the ROS Inbox.

It no action is taken by June 30 2021, the reconciliation will be treated as final.

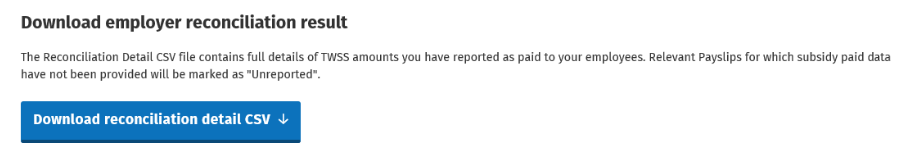

Reconciliation CSV

Employers can download a reconciliation detail CSV file, this will contain a complete record of the TWSS related payslip information provided by the employer at payslip level and Revenue's reconciliation calculation.

Employers whose reconciliation is not yet available

A small number of employers will not get the notification that their reconciliation is available until a later date, these include:

- Employers that have raised issues with Revenue which Revenue is processing. When this process is complete, and the reconciliation is available the employer will receive a ROS Inbox notification.

- Employers that Revenue is engaging with and Revenue is awaiting further information from the employer before the reconciliation can be made available. Employers are encouraged to check their MyEnquiries and provide any such requested information.

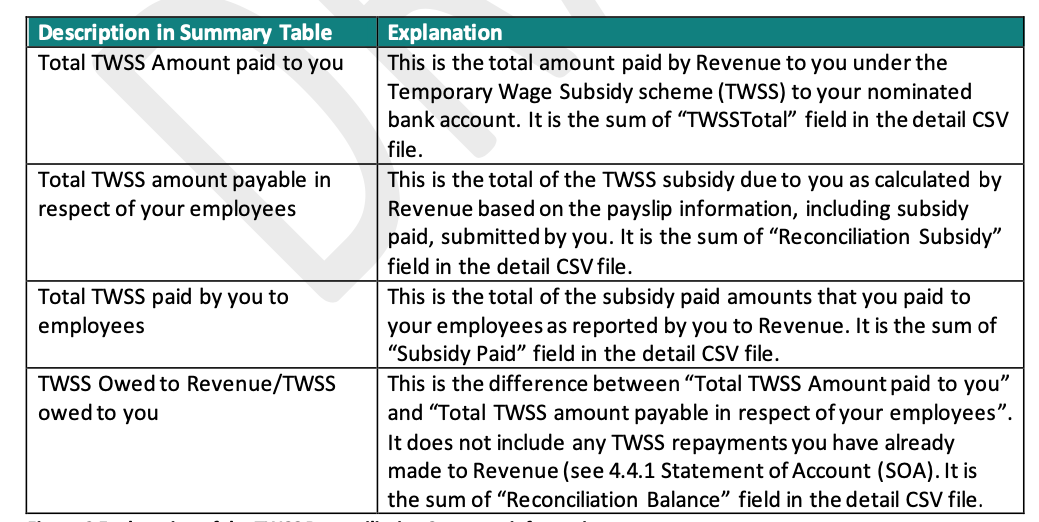

TWSS Reconciliation Summary table

The TWSS reconciliation summary table will include the:

- Total amount of TWSS paid to the employer by Revenue

- Total amount payable in respect of employees

- Total TWSS paid to the employees

- Result of the reconciliation

Total TWSS paid by you to employees

The 'Total TWSS paid by you to employees' should match the subsidy paid figure on your payroll software. This should have been reported to Revenue using the TWSS CSV file/Reconciliation CSV File.

You can confirm this figure matches by running the report in the payroll software again.

This can be done by selecting Employees, followed by 'Reconciliation CSV File', if required, amend the date range > 'Continue', a 'Total' figure will be displayed at the end of the report.

Finalising Reconciliation

When an employer is satisfied with the information in the reconciliation result, they should click the 'Accept' button on the TWSS Reconciliation screen.

- A ROS notification will be sent to the employer's ROS Inbox, advising that a Statement of Account (SOA) will issue.

- The values from the reconciliation summary screen will be combined with any repayments already made and a Statement of Account will be sent to the employers ROS Inbox the following day.

- Where an additional amount of TWSS is due to the employer, Revenue will process this and the additional payment will be made to the nominated bank account of the employer.

- Where there is an amount owing back to Revenue the employer can pay it via RevPay in ROS, or, alternatively, eligible employers can avail of debt warehousing.

Statement of Account (SOA)

A Statement of Account will issue to the employer's ROS Inbox when:

- The employer accepts the reconciliation, or

- after having accepted the reconciliation,

- the employer makes a correction that updates the reconciliation balance value or

- Revenue makes an adjustment to the Employer's TWSS account.

Reconciliation closes on June 30th 2021

- By June 30th 2021, employers must have reviewed their reconciliation information, made any necessary corrections and have accepted their reconciliation.

- If after June 30th 2021, an employer has not reported all Subsidy Paid data, Revenue will recoup the total TWSS paid and related interest charges.

- If, after June 30th 2021, an employer has reported all Subsidy Paid data but has not 'Accepted' the result of the reconciliation, a notification will issue for any amounts due to be repaid to Revenue per the reconciliation calculation and normal collection and enforcement processes will begin.

Please note, Revenue strongly recommend that employers take the time to read & understand their TWSS Reconciliation guidance before accepting the reconciliation.

Further information on the TWSS reconciliation can be found on the Revenue website.

Need help? Support is available at 01 8352074 or [email protected].