PAYE Modernisation introduces two new processes - the automated retrieval of Revenue Payroll Notifications for each of your employees from Revenue and the submission of your payroll data each payroll run to Revenue.

For this two-way communication to take place between BrightPay and Revenue’s systems, your ROS digital certificate will be used.

Therefore, the computer that you run your payroll on will need to have your ROS Digital Certificate saved on it also.

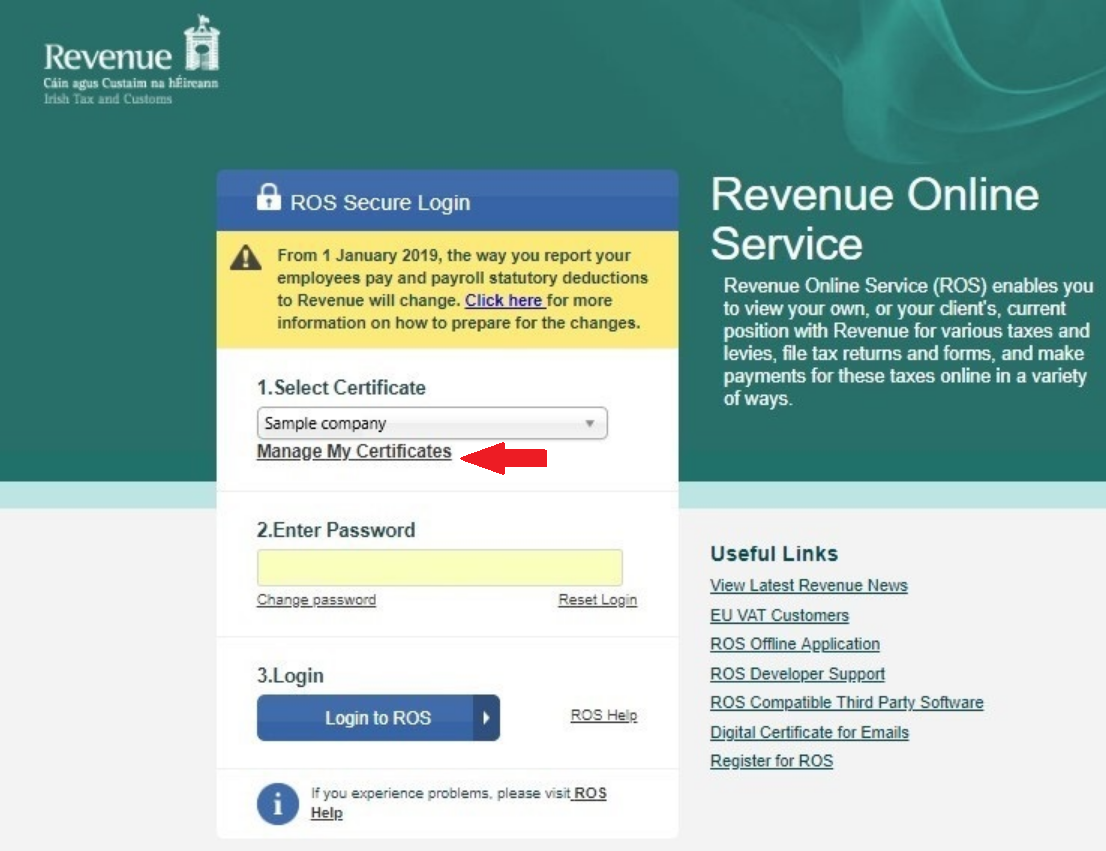

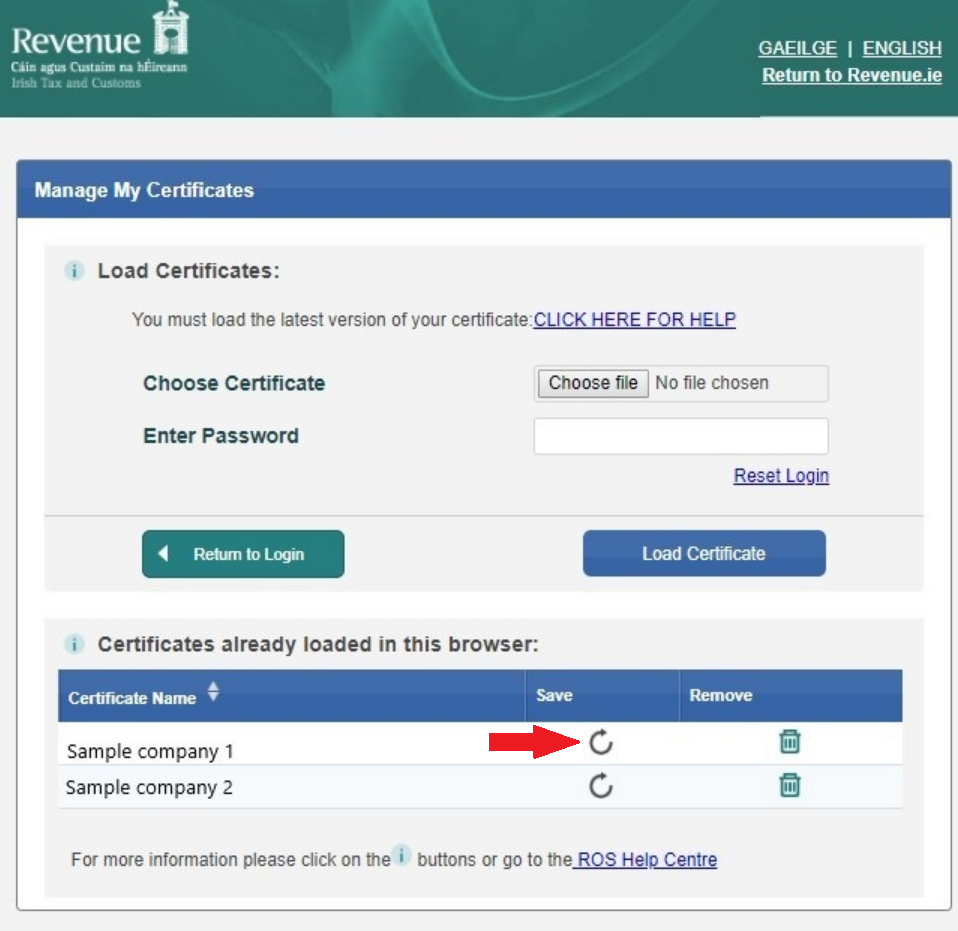

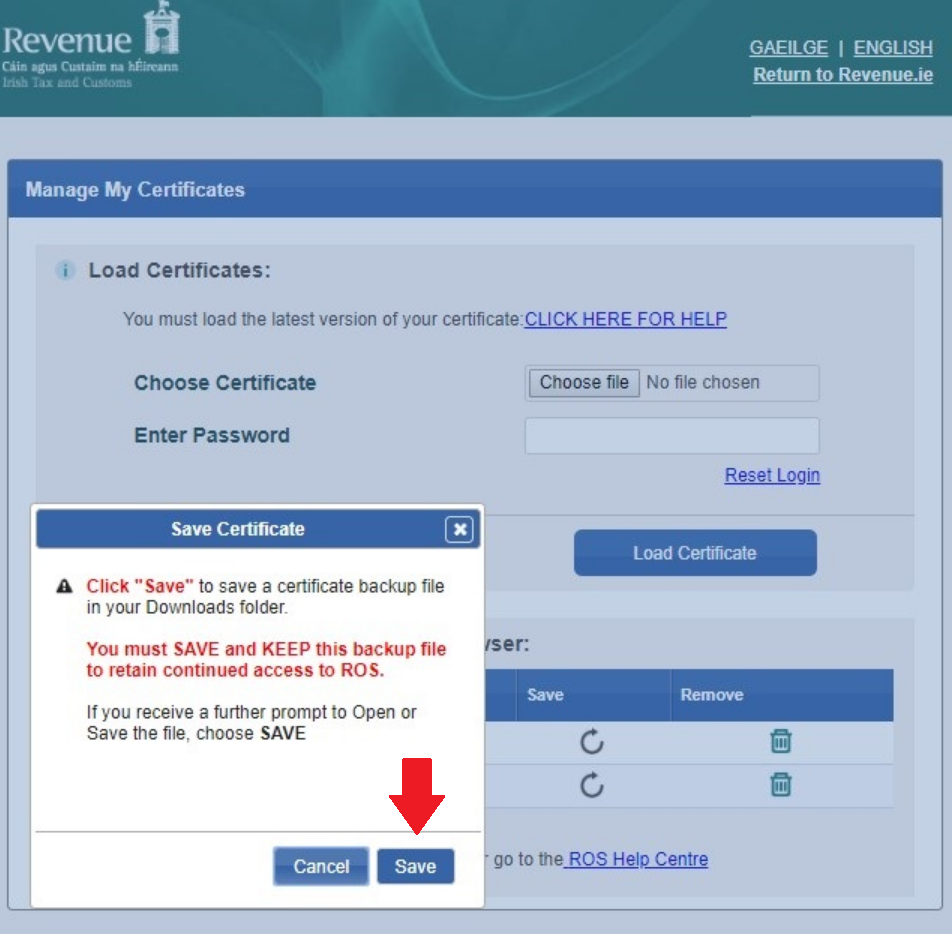

In the event that you need to save your digital certificate to the computer on which you will be running BrightPay, the following ROS guidance is provided:

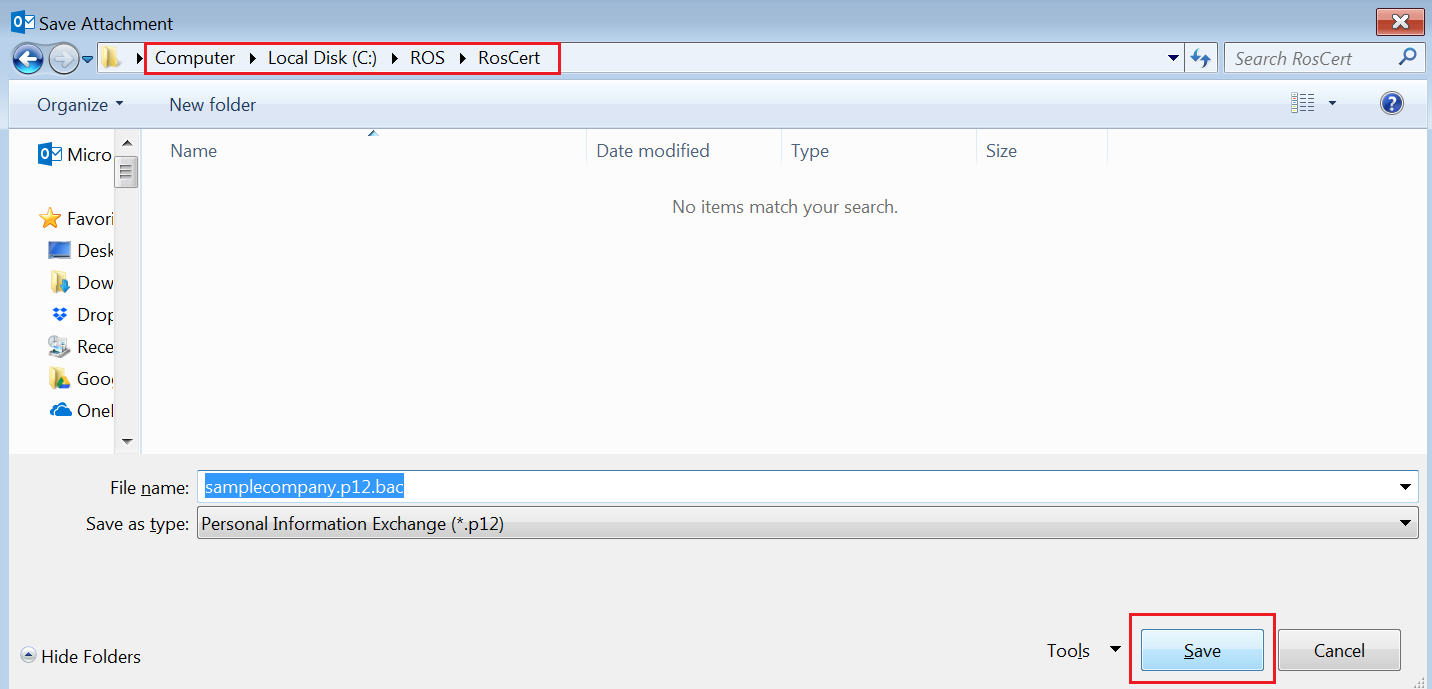

Depending on the browser you are using on your computer, the certificate will now either save automatically into your Downloads folder, or ask you to save the certificate to a folder of your choice.

If asked to save to a folder of your choice, it is recommended that you save the certificate into your RosCert folder, which is located in your ROS folder on your C drive.

Please note: your certificate will save as a '.p12.bac' file.

As soon as your certificate is saved, you will now be ready to add your certificate into BrightPay.

Need help? Support is available at 01 8352074 or [email protected].