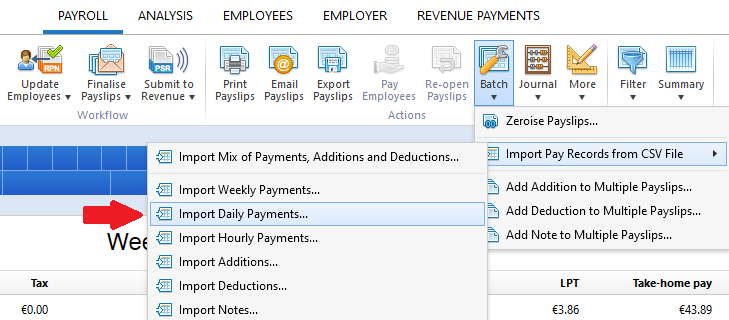

To import daily payments each pay period, go to Payroll > Batch > Import Pay Records from CSV File > Import Daily Payments:

1) Browse to the location of your CSV File

2) Select the required file and click 'Open'

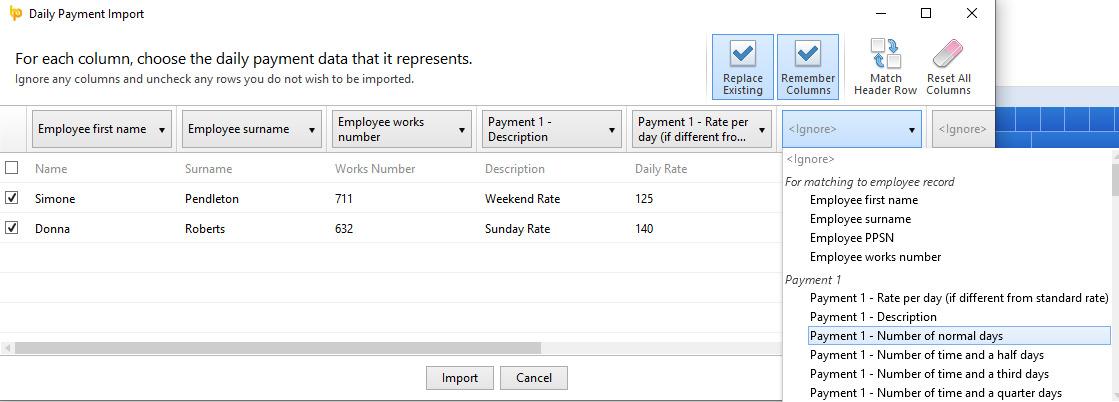

3) Your employee data will be displayed on screen. For each column, choose the payment data it represents. Ignore any columns and uncheck any rows you do not wish to be imported.

4) Click Import to complete the import of your payment information.

For matching to employee record:

Employee first name

Employee surname

Employee PPSN

Employee works number

Payment using employer daily rate:

Number of days at a daily rate set up within the Employer utility

Payment 1:

Rate per day (if different from standard rate)

Description

Number of normal days

Number of time and a half days

Number of time and a third days

Number of time and a quarter days

Number of double time days

Number of triple time days

Number of quadruple time days

Department

Code

Is tax deductible

Is employee PRSI deductible

Is employer PRSI deductible

Is USC deductible

Is ASC deductible

Is pension deductible

Payment 2:

Rate per day (if different from standard rate)

Description

Number of normal days

Number of time and a half days

Number of time and a third days

Number of time and a quarter days

Number of double time days

Number of triple time days

Number of quadruple time days

Department

Code

Is tax deductible

Is employee PRSI deductible

Is employer PRSI deductible

Is USC deductible

Is ASC deductible

Is pension deductible

Payment 3:

Rate per day (if different from standard rate)

Description

Number of normal days

Number of time and a half days

Number of time and a third days

Number of time and a quarter days

Number of double time days

Number of triple time days

Number of quadruple time days

Department

Code

Is tax deductible

Is employee PRSI deductible

Is employer PRSI deductible

Is USC deductible

Is ASC deductible

Is pension deductible

Payment 4:

Rate per day (if different from standard rate)

Description

Number of normal days

Number of time and a half days

Number of time and a third days

Number of time and a quarter days

Number of double time days

Number of triple time days

Number of quadruple time days

Department

Code

Is tax deductible

Is employee PRSI deductible

Is employer PRSI deductible

Is USC deductible

Is ASC deductible

Is pension deductible

Payment 5:

Rate per day (if different from standard rate)

Description

Number of normal days

Number of time and a half days

Number of time and a third days

Number of time and a quarter days

Number of double time days

Number of triple time days

Number of quadruple time days

Department

Code

Is tax deductible

Is employee PRSI deductible

Is employer PRSI deductible

Is USC deductible

Is ASC deductible

Is pension deductible

Need help? Support is available at 01 8352074 or [email protected].