1) Click ‘Payroll’ on the menu bar and select the relevant employee’s name in the summary view.

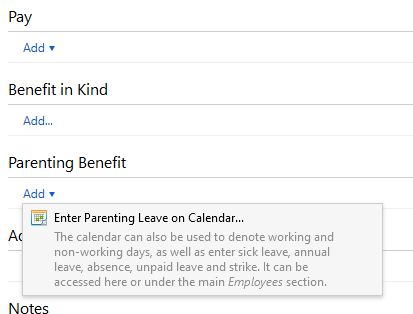

2) Within the ‘Parenting Benefit’ section on the employee’s payslip, click on 'Add > Enter Parenting Leave on Calendar...':

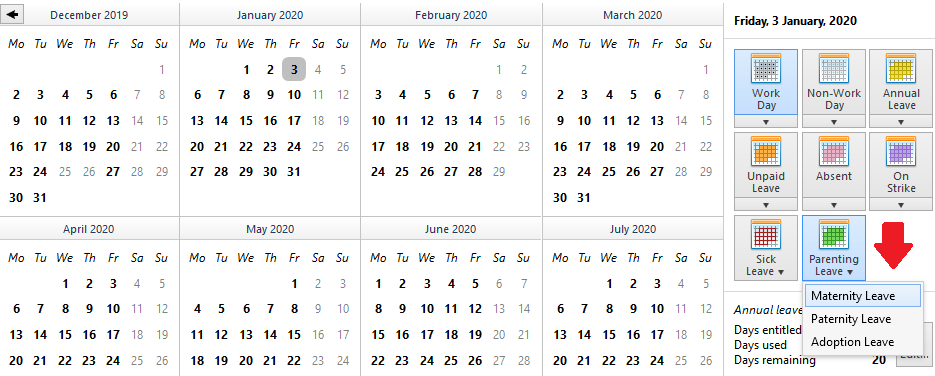

3) Highlight the start of leave date and press 'Parenting Leave' > 'Maternity Leave' at the top right of the calendar.

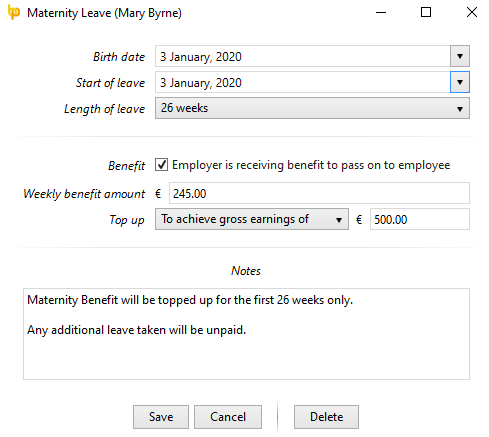

4) Enter the start of leave date and select the length of leave from the drop down menu.

5) If the employer will be receiving the Maternity Benefit to pass on to the employee, tick the box provided to indicate this and enter the periodic benefit amount.

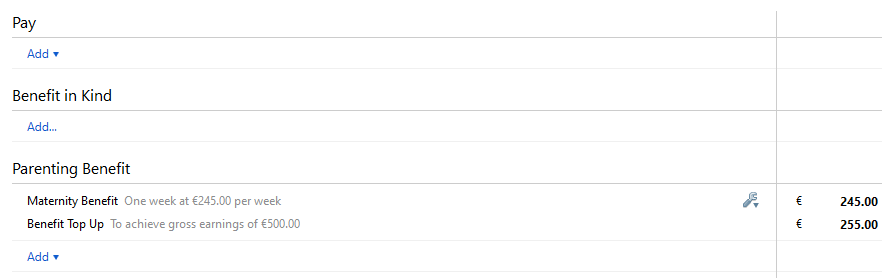

6) From the drop down menu, select whether the employer will be topping up the maternity benefit with any pay. If topping up, first ensure that any pay items already entered on the employee's payslip are zero-ised first, then select whether you will be topping up by a fixed amount or to achieve a gross earnings total. Enter the amount of the top-up accordingly.

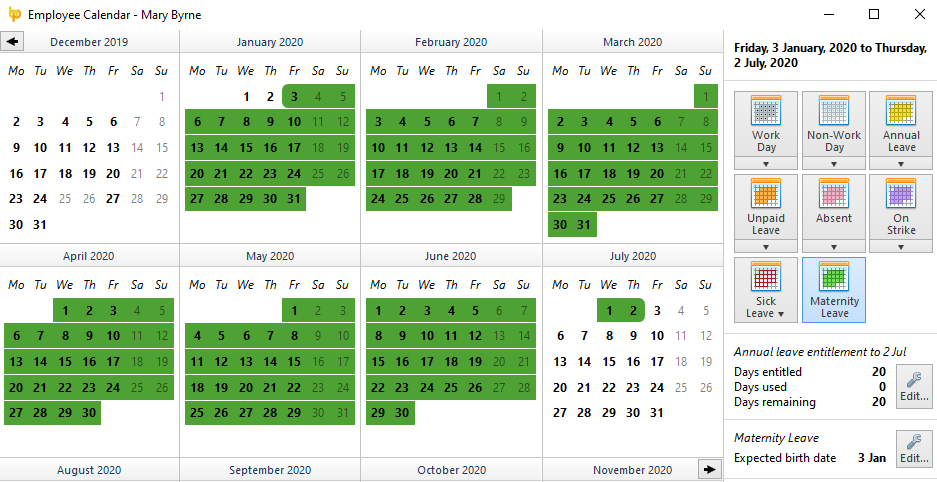

7) Enter any additional notes, as desired, and click 'Save'. The date range of the planned maternity leave will be updated.

8) Close the calendar to return to the employee's payslip. Any maternity benefit to be accounted for will be automatically be applied to the first affected payslip.

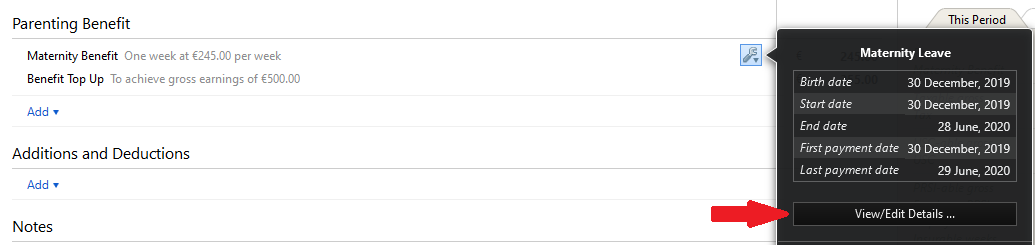

9) To view/edit the maternity leave details at a later stage, simply click the 'Edit' button within the 'Parenting Benefit' section, followed by 'View/Edit Details'.

The original maternity leave entry will be displayed, amend and 'Save' if required.

Need help? Support is available at 01 8352074 or [email protected].