Please note: the Employment Wage Subsidy Scheme (EWSS) has now ended.

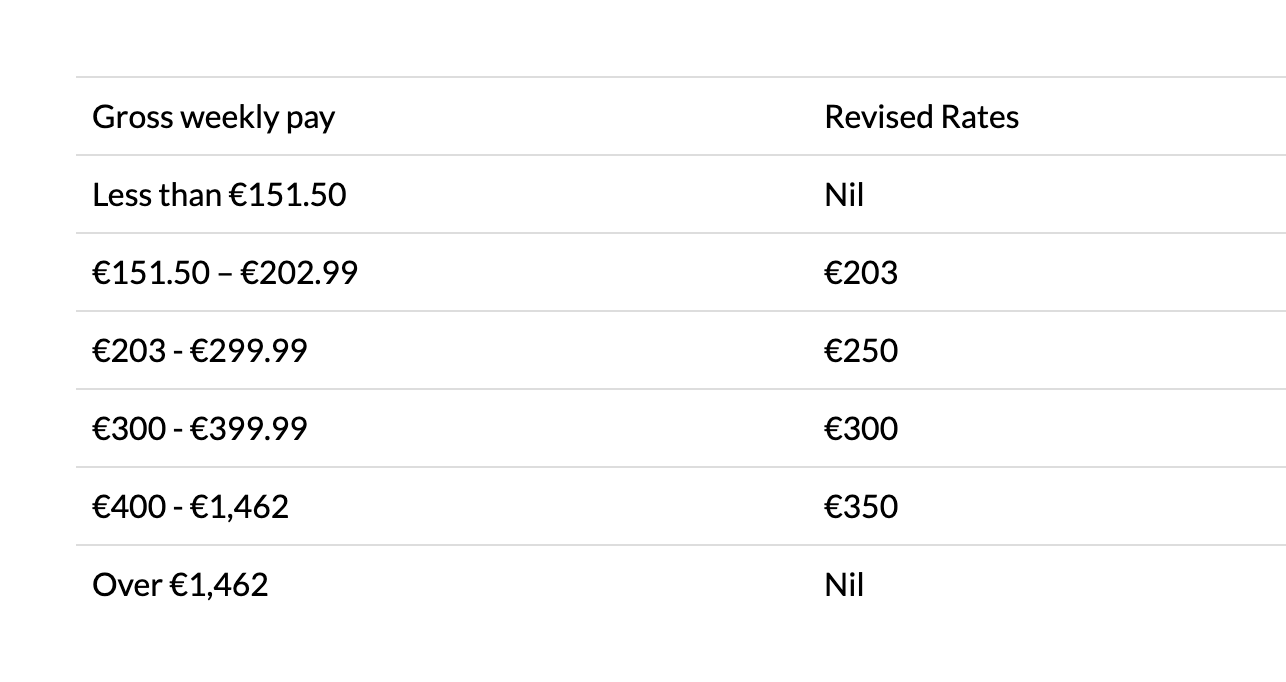

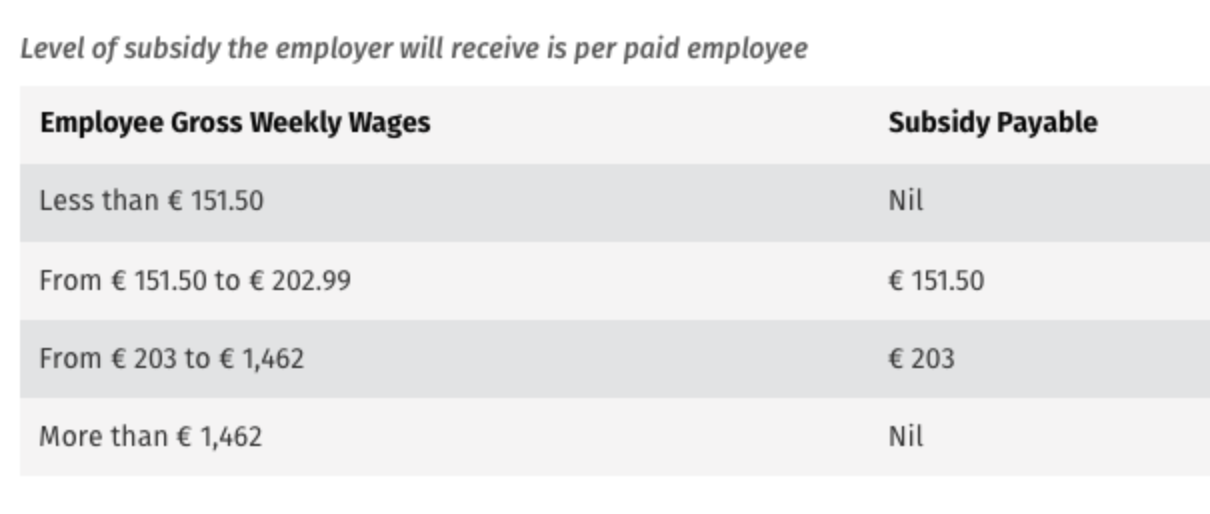

If you are a business that was directly impacted by the specific terms of the Public Health Restrictions (PHR) introduced in December 2021, additional support has been announced which extends the EWSS scheme for a further month, with the following subsidy payment structure in place:

Employer PRSI:

In addition, the 0.5% rate of employers PRSI will continue to apply to employments that are eligible for the subsidy until the end of February 2022.

From the 1st February 2022, for eligible businesses who meet the EWSS eligibility rules and wish to claim this additional EWSS support, this must be administered through the payroll.

The steps to complete within the software are provided below.

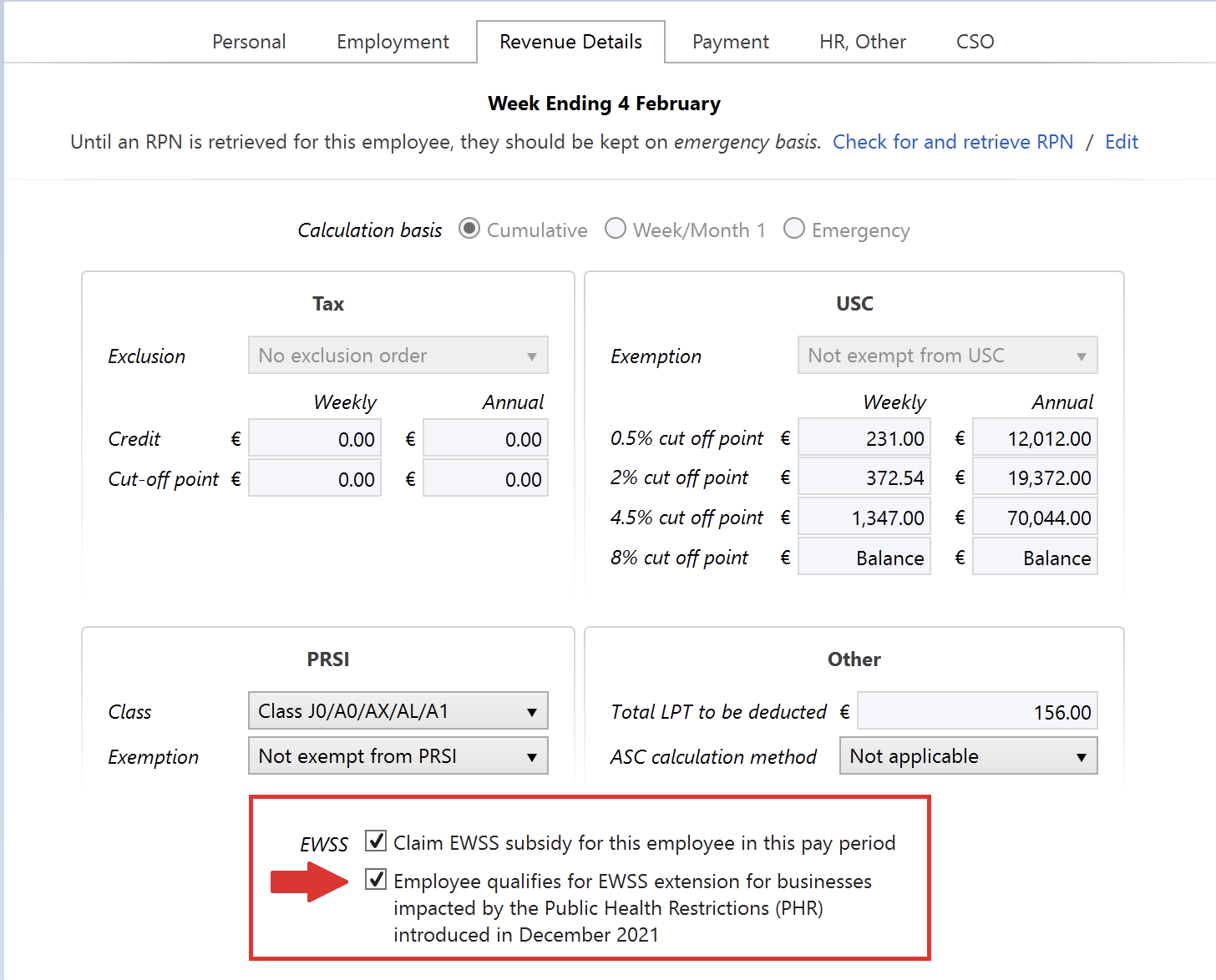

Should you have any employees that qualify for the EWSS extension because your business was impacted by the Public Health Restrictions (PHR) introduced in December 2021, you must first instruct the software which employees you wish to claim this for.

This instruction will place an EWSS marker entitled 'EWSS_PHR' on your payroll submission for each applicable employee, which in turn will notify Revenue which employees you wish to claim EWSS-PHR for.

After performing step 1, simply process your payroll in the normal manner.

Under EWSS, employers are required to pay the employee as normal, calculating income tax, employee PRSI and USC in the normal manner.

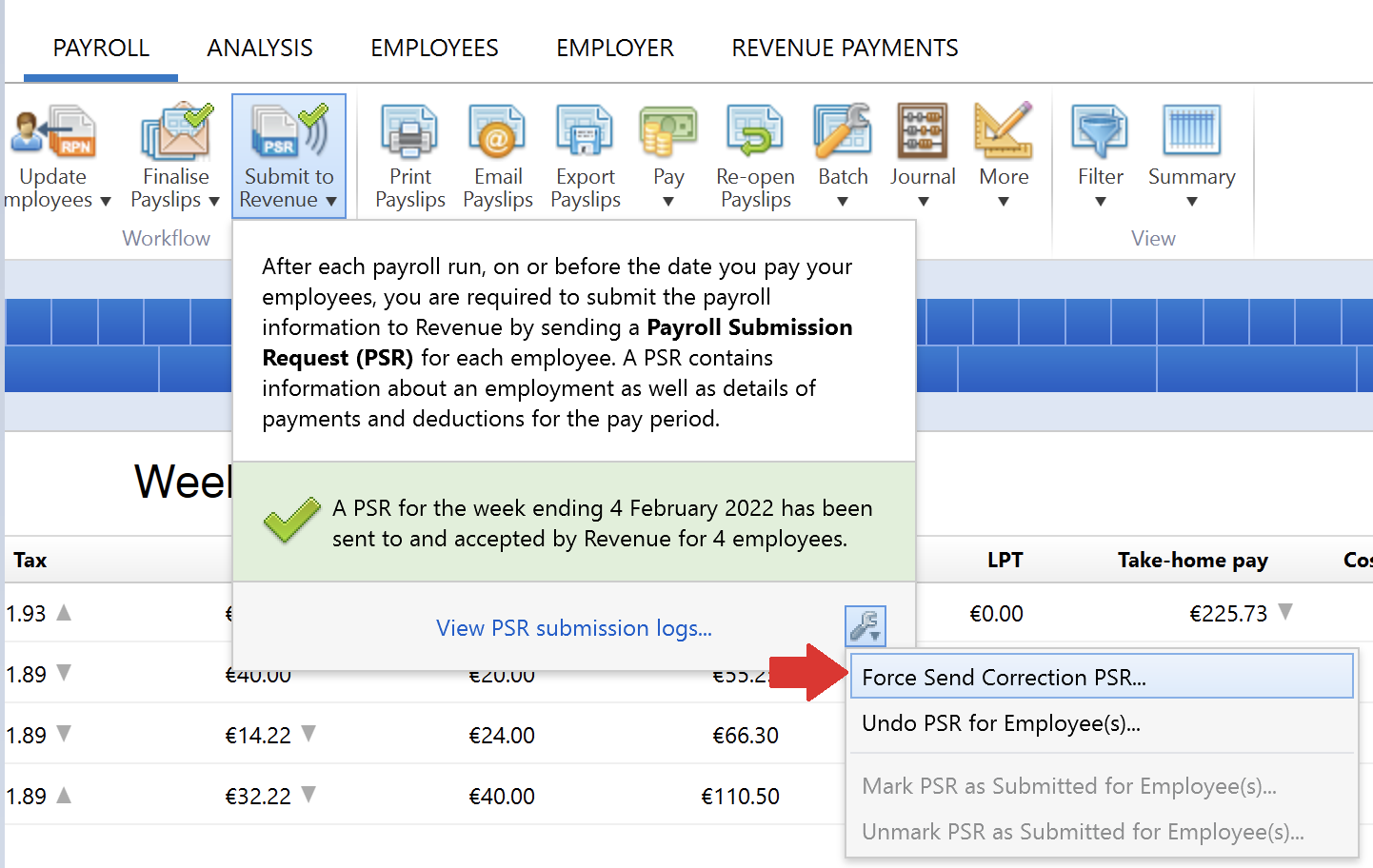

On finalising each pay run, your associated payroll submission (PSR) will notify Revenue of the employees you wish to claim the EWSS-PHR for. Submit this to Revenue in the normal manner.

On receipt of your payroll submission, Revenue will then determine the applicable subsidy amount payable.

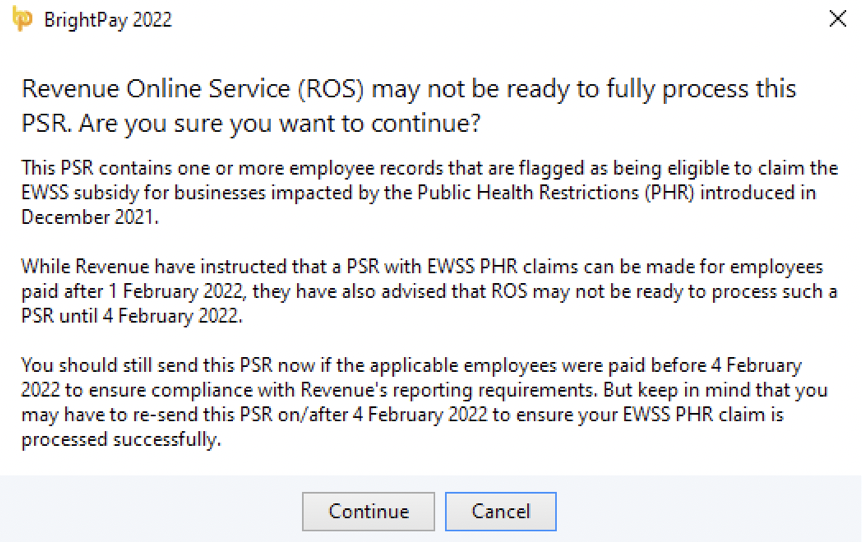

While Revenue have instructed that PSRs with EWSS-PHR claims can be made for employees paid after 1st February 2022, they have also advised that ROS may not be ready to process such a PSR until 4th February 2022.

Where it is detected that you are attempting to submit such a PSR before Revenue's systems are ready, this will be brought to your attention on screen.

In this instance, you should still submit the relevant PSR, however the EWSS subsidy amounts you will initially receive will be for the reduced rates of EWSS only.

Once Revenue's systems are ready to process EWSS-PSR claims, a correction PSR must subsequently be sent from within BrightPay to claim the correct amount of EWSS-PHR due to you.

Need help? Support is available at 01 8352074 or [email protected].