Adding a Revenue Digital Certificate - Agents

PAYE Modernisation has introduced two new processes - the automated retrieval of Revenue Payroll Notifications for each of your employees from Revenue and the submission of your payroll data each payroll run to Revenue.

For this two-way communication to take place between BrightPay and Revenue’s systems, your ROS digital certificate will be used.

If you process payroll on behalf of clients and hold an agent certificate, your agent certificate will need to be added into the software before you can commence processing payroll for any of your clients.

Adding an Agent Digital Certificate

To add an agent digital certificate into the software:

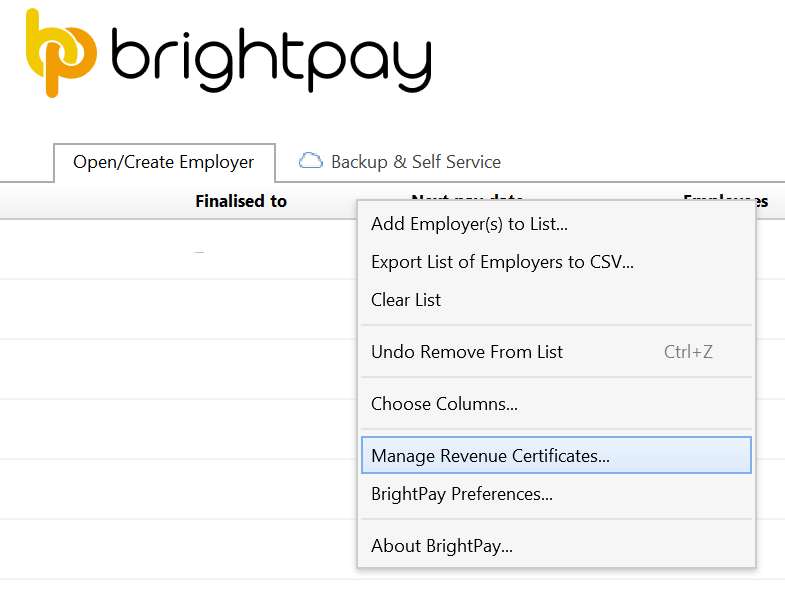

- On the BrightPay Open Company screen, right click and select Manage Revenue Certificates...

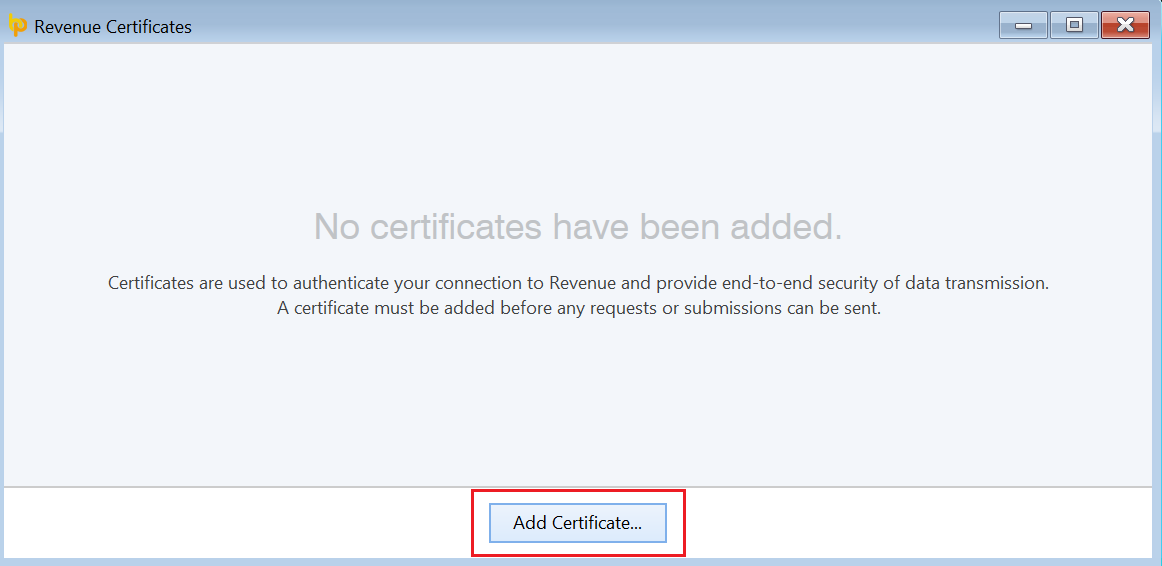

- Click Add Certificate...

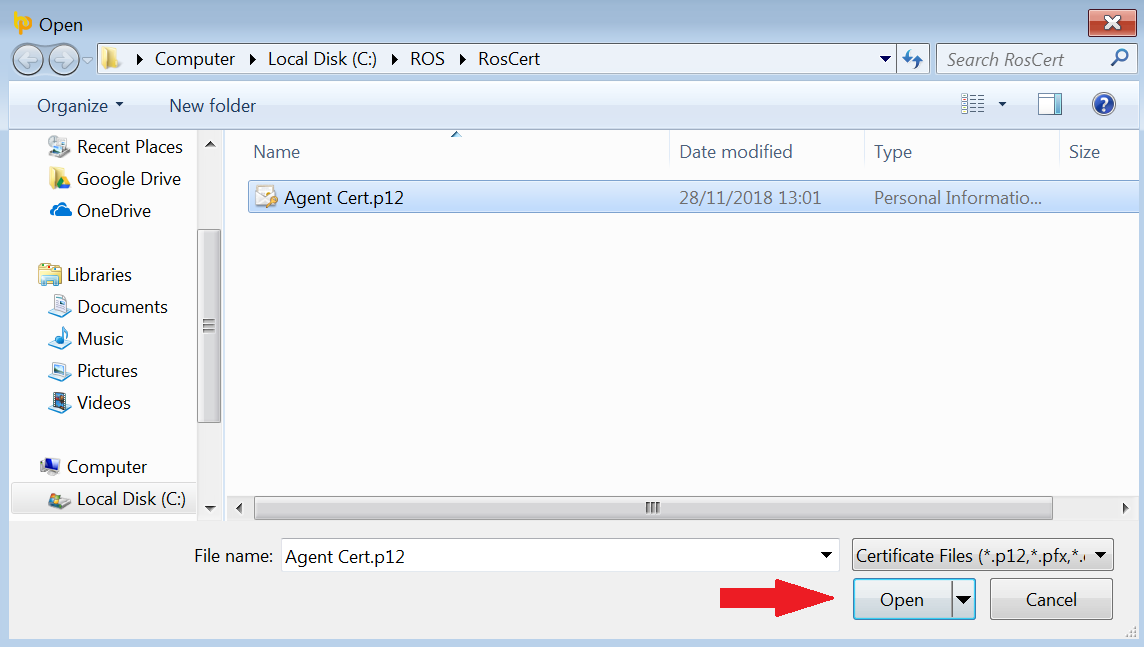

- Browse to the location of where your digital certificate resides.

The file extension of your digital certificate will either be .p12 or .bac. In the event that you are unable to locate your digital certificate, a search can be performed on your machine by typing in '.p12' or '.bac' in your search facility. - Select your digital certificate and press Open:

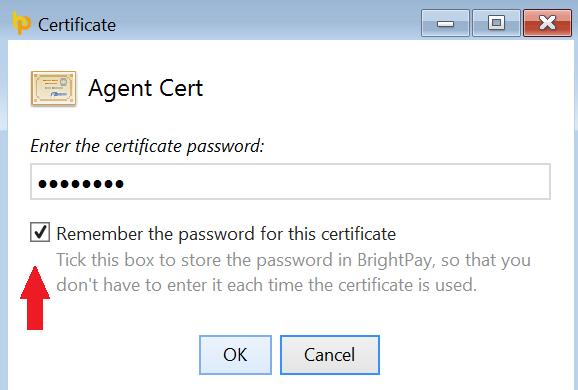

- After selecting your agent digital certificate, you will be prompted to enter your associated certificate password.

- Also tick the box in order to store the password in BrightPay, so that you don't have to enter each time the certificate is used.

- Click ‘OK’ when complete.

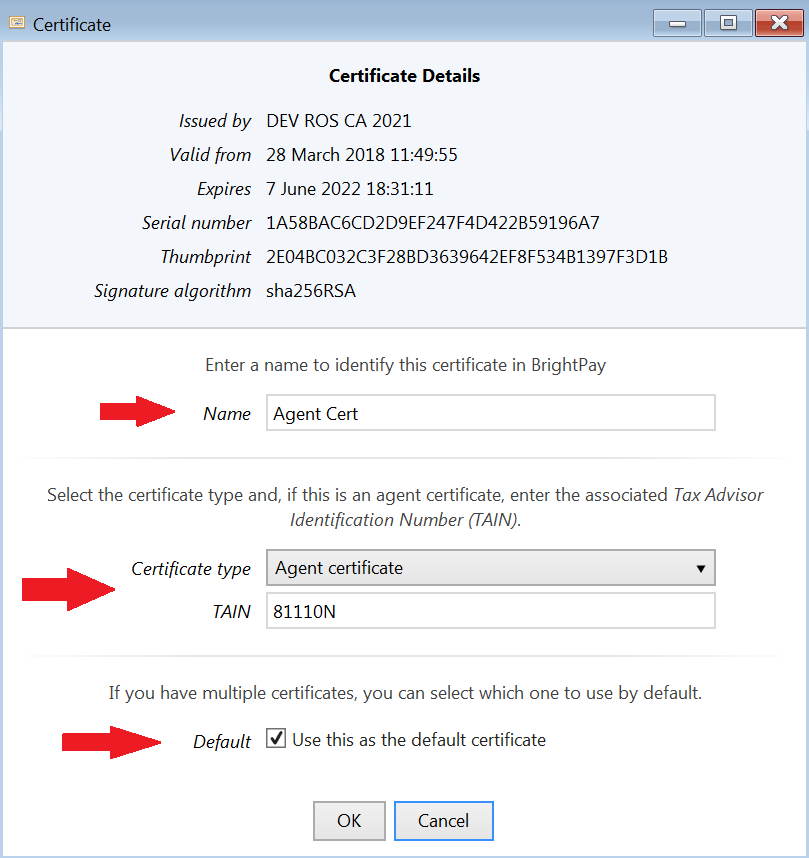

- On the next screen, should you wish to enter a Name to identify the certificate more easily in BrightPay (useful if you have multiple companies for which various digital certificates apply), do so in the field provided.

- Choose 'Agent Certificate' as your certificate type using the Certificate Type drop down menu.

- Enter your Agent TAIN

- Should you have multiple digital certificates and wish to set this agent certificate to be the default to use in company files, tick the box provided

- Click OK

Your Agent Certificate will now be added into the BrightPay software.

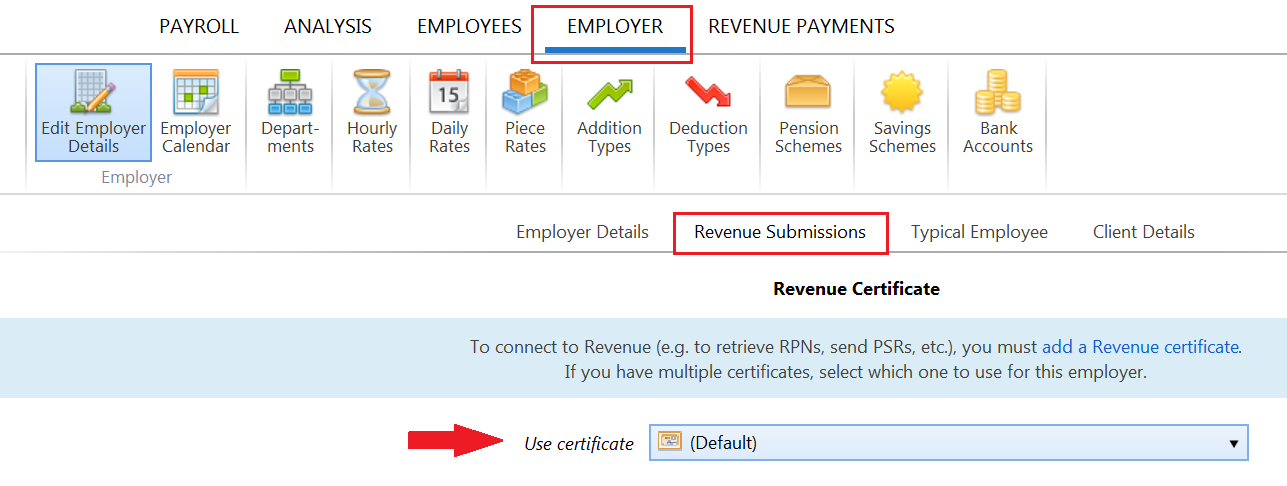

By default, each employer file will use the default agent certificate you have added to the software for retrieving RPNs and sending payroll submissions to Revenue.

This can be checked at any time by opening an employer file and accessing the 'Revenue Submissions' section within the Employer utility:

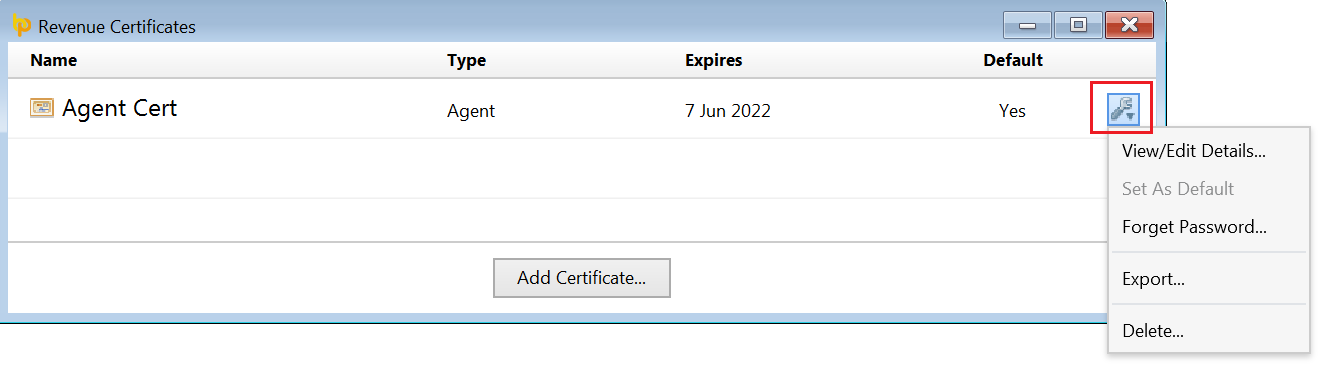

Once your certificate has been added, further functionality can be accessed at any time by going to 'File > Manage Revenue Certificates' and clicking the Edit button.

- For example, if you wish to change the name of the certificate within BrightPay, if you wish to remove the certificate password, or export the digital certificate.

Multiple Revenue Certificates

In the event you need to add an additional agent certificate to the software, or you have an employer file set up which is not linked to any agent certificate but for whom you have an employer certificate instead, repeat the steps above for adding your additional certificate(s) into the software.

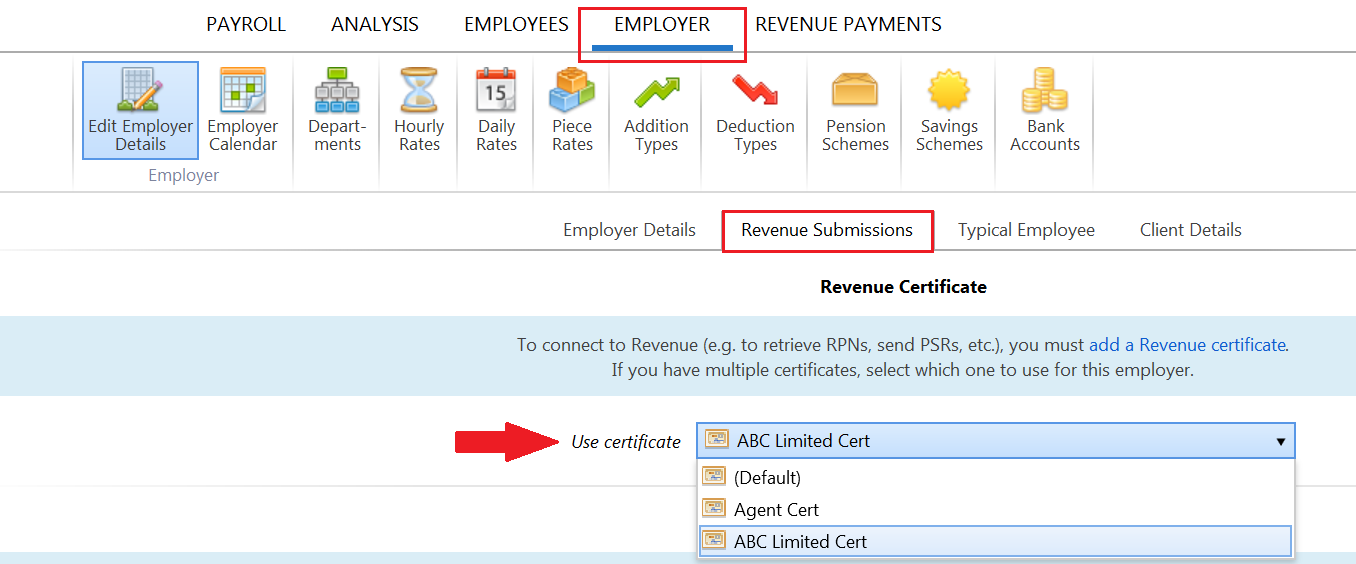

Once you have added your additional certificate(s) to the software, you will now be able to link the relevant employer file to its correct certificate.

To do so:

- Open the company in question through the Open Company screen

- Go to Employer > Revenue Submissions

- Using the drop down menu, choose the certificate you wish to use for the employer

- Save changes when complete

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.