Local Property Tax (LPT) is a tax payable on the market value of residential properties and is administered by Revenue.

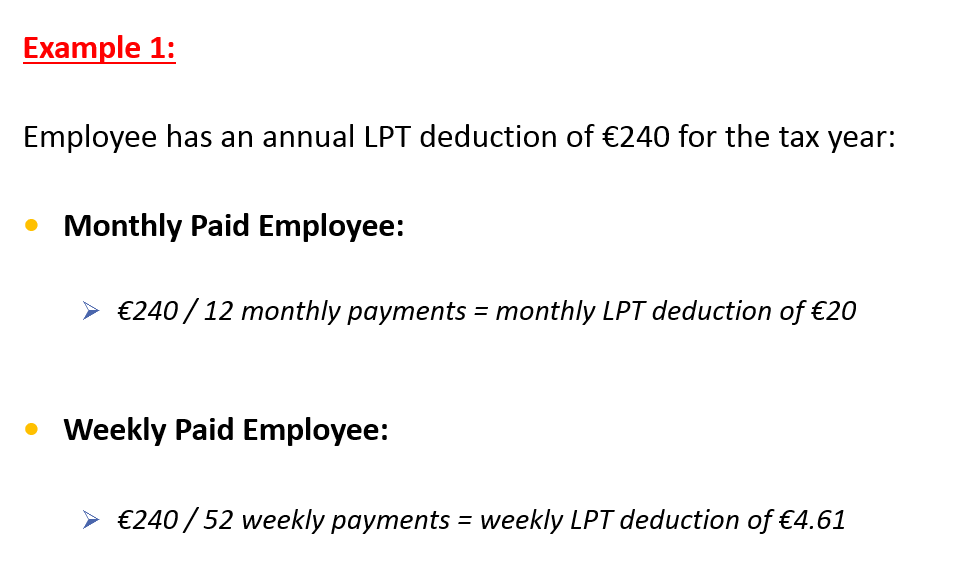

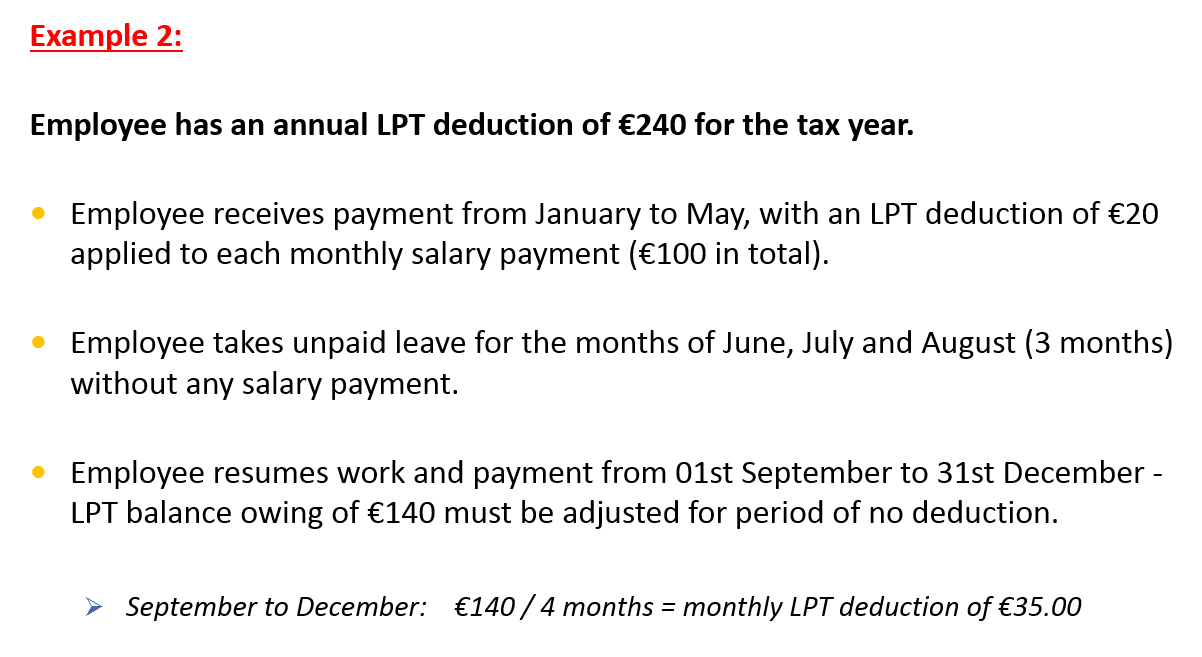

Property owners have a number of payment options available to them - one of which is a deduction from their periodic payroll.

There are 2 circumstances under which LPT may be deducted from an employee’s salary:

LPT is a statutory deduction and is to be deducted from an employee’s Net Pay.

An employer must include the amount of LPT deducted from each employee (where applicable) on their payroll submission to Revenue.

The LPT deducted must then be paid over to Revenue at the same time as their PAYE, PRSI and USC liability is due.

If an AEO is already in place when an LPT instruction is received for an employee, the AEO will take priority over the LPT. Similarly, if an LPT instruction is in place prior to the issuing of an AEO, LPT will take priority.

As a default, LPT deductions are taken as priority over all other deductions in Thesaurus Payroll Manager.

To give priority to an AEO instead:

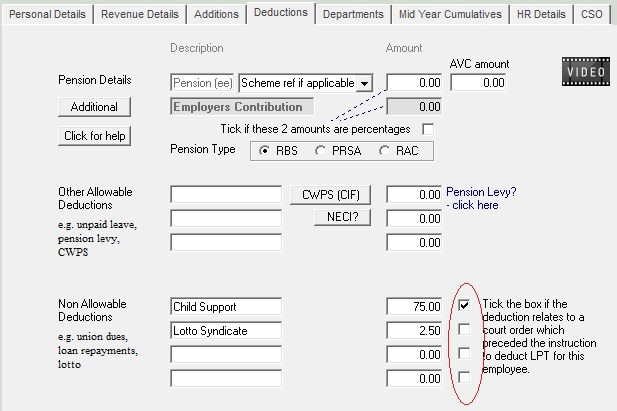

Go to Employees > Add/Amend Employees > select employee

Choose Deductions

Set up the periodical deduction to be applied to the payslip and enter a narrative as it is to appear on the employee payslip

To give the deduction priority over LPT, press function key F2

Tick each deduction which is to take priority over LPT, so that it is deducted before the LPT

Need help? Support is available at 01 8352074 or [email protected].