Employers should be aware of the difference between USC exempt status (as per RPN/Tax Credit Certificate) and employees in receipt of USC exempt income.

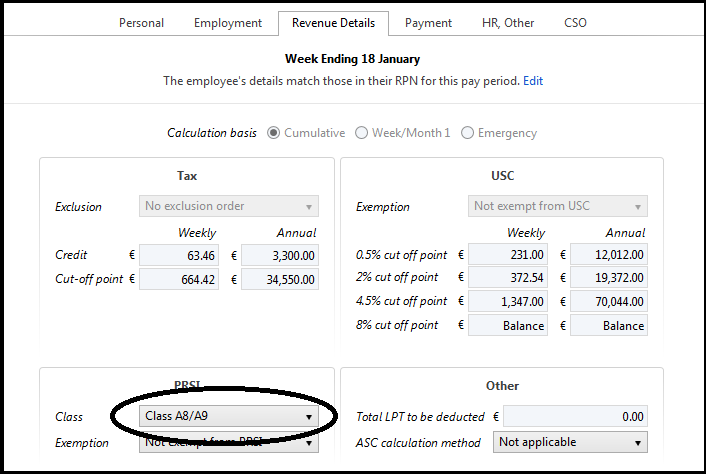

Community Employment Participants are allocated PRSI class A8 or A9.

Once the PRSI category of Community Employment, A8 or A9 is assigned to the employee's record in 'Revenue Details', all income for the employee will be classified as USC exempt (regardless of any USC rates or bands which may be updated from the RPN).

Need help? Support is available at 01 8352074 or [email protected].