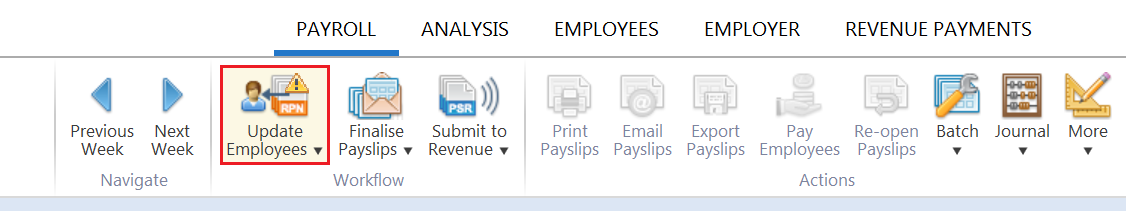

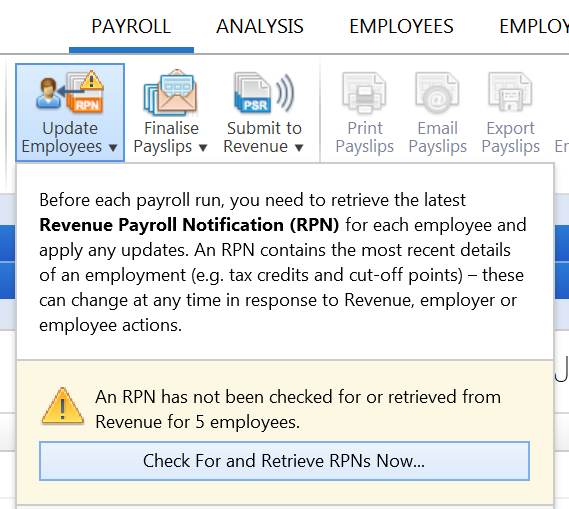

Before processing each payroll run, you will first need to retrieve the latest Revenue Payroll Notifications (RPNs) for your employees from Revenue, in order to ensure the most up-to-date tax credits and cut off points are applied to their pay.

This in turn will also update the 'Revenue Details' section of each applicable employee record accordingly.

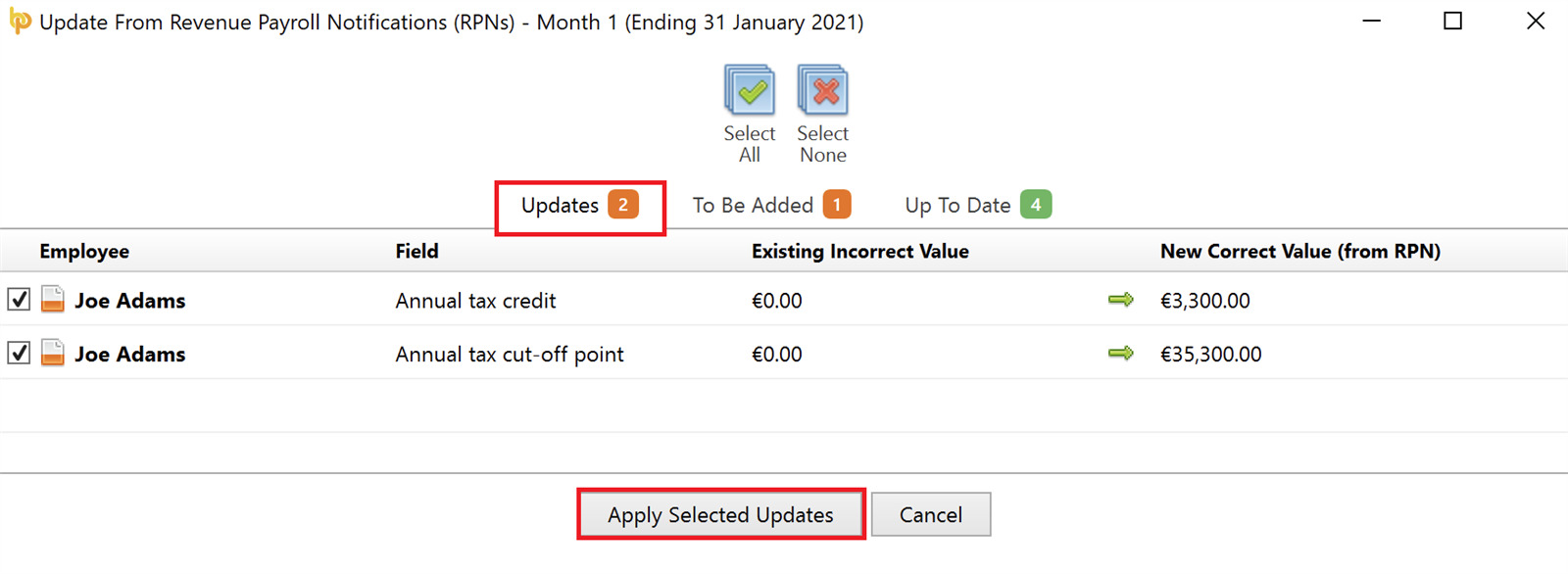

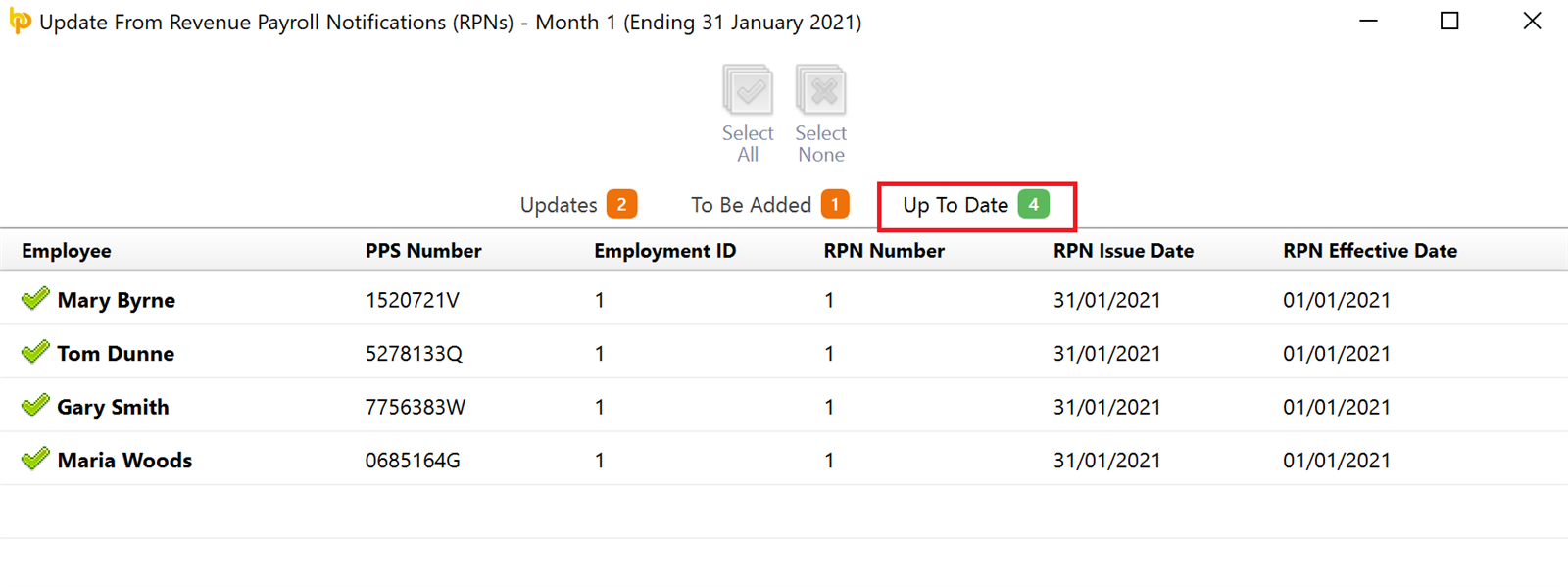

BrightPay will automatically connect to Revenue’s systems and retrieve all available RPNs. It will then match current employee data with the information within the RPNs.

a) if BrightPay detects that an existing employee's current revenue information entered within the software differs from that in their latest RPN, this will be brought to your attention within the 'Updates' section:

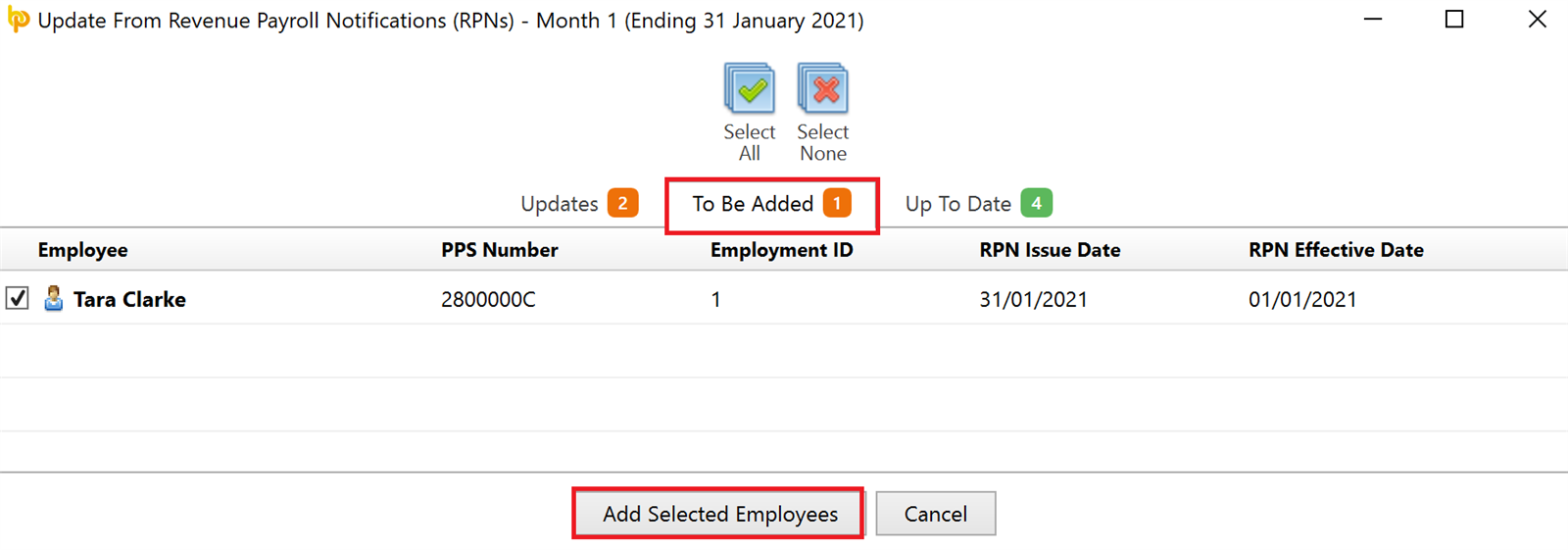

b) if the RPN contains new employees which cannot be matched to an employee record in BrightPay, this will be brought to your attention within the 'To Be Added' section:

Further manual entry may thus be required in each employee record for employee information that is not included in an RPN e.g. the employee's start date, employee’s rate of pay, email address, bank details, annual leave entitlement, departmental allocation etc.

c) where existing employee data matches the data contained within their latest RPN, this will be brought to your attention within the 'Up To Date' section:

Once all necessary updates have been applied, close out of the RPN utility to commence processing your periodic payroll.

Need help? Support is available at 01 8352074 or [email protected].