Adoptive Leave & Pay

From 1st January 2023, Adoptive Benefit is now standardised to €262 per week for claimants.

Adoptive Benefit is subject to PAYE. This tax will be collected through the reduction of the individual's tax credits and cut off points by Revenue via the employee's Revenue Payroll Notification (RPN).

- It is extremely important therefore that employers check for updated RPNs before each pay run.

- If the employee receives the benefit payment directly, it does not go through the payroll.

- If the employer receives the benefit to pass on to the employee, it should be processed as a non-taxable addition.

For general information on Adoption Leave, please click here

Processing Adoptive Leave/Adoptive Pay in BrightPay

1) Click ‘Payroll’ on the menu bar and select the relevant employee’s name in the summary view.

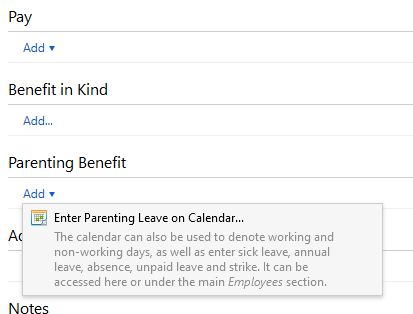

2) Within the ‘Parenting Benefit’ section on the employee’s payslip, click on 'Add'.

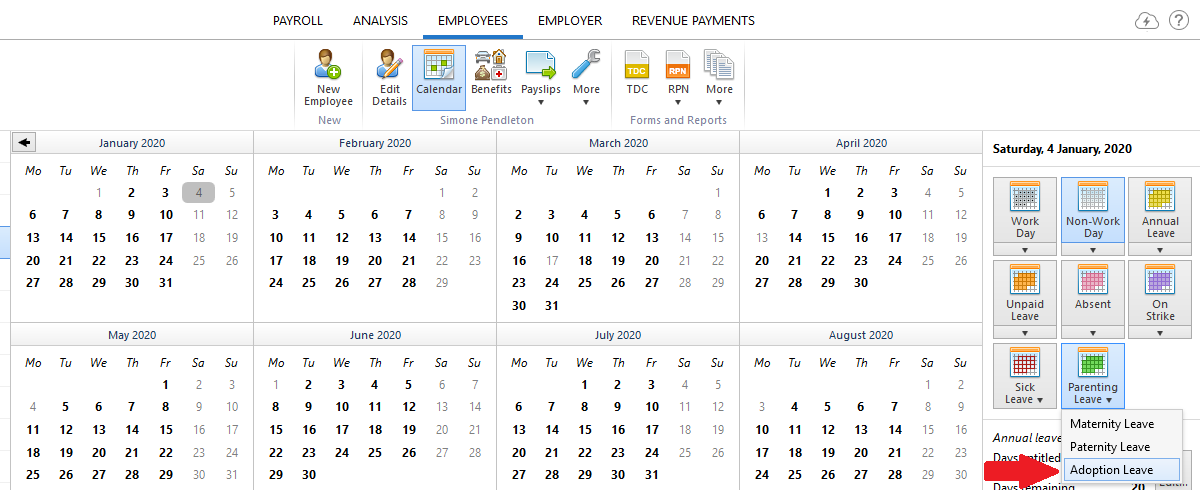

3) Click on the expected placement date of the child and press 'Parenting Leave' > 'Adoption Leave' at the top right of the calendar.

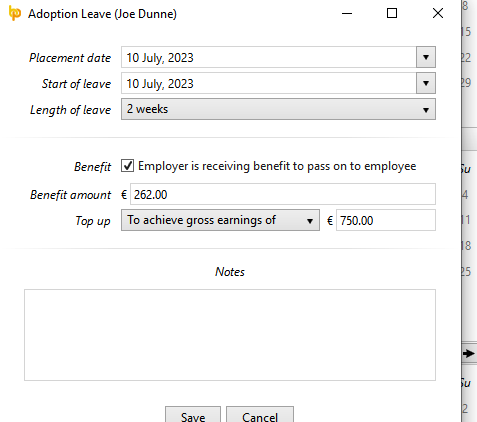

4) Enter the start of leave date and select the length of leave from the drop down menu.

5) If the employer will be receiving the Adoptive Benefit to pass on to the employee, tick the box provided to indicate this and enter the periodic benefit amount.

6) From the drop down menu, select whether the employer will be topping up the adoptive benefit with any pay. If topping up, first ensure that any pay items already entered on the employee's payslip are zero-ised first, then select whether you will be topping up by a fixed amount or to achieve a gross earnings total. Enter the amount of the top-up accordingly.

7) Enter any additional notes, as desired, and click 'Save'.

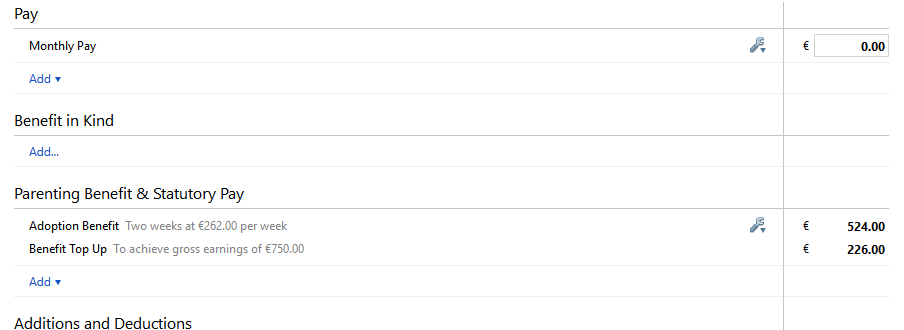

8) Close the calendar to return to the employee's payslip. Any adoptive benefit to be accounted for will be automatically displayed on the affected payslip of the first due benefit payment date.

9) To view/ edit the adoptive leave details at a later stage, simply click the Edit button within the DSP Parenting section, followed by 'View/Edit Details'.

The original entry will be displayed, simply amend the entries and 'Save' if required.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.