Full guidance on vehicle Benefit in Kind from Revenue is contained here

For further information on Benefit in Kind, click here

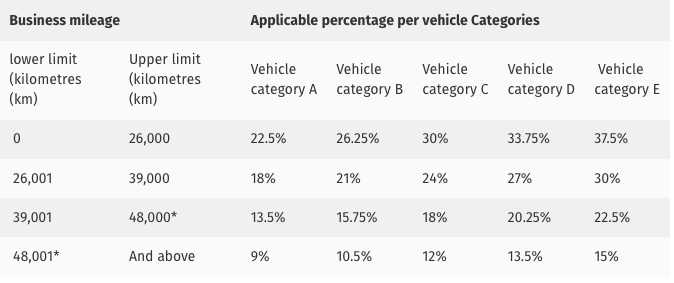

An employee's business kilometres to date and the car's CO2 Emissions will determine the amount of Notional Pay he/she will pay.

To calculate cumulative business kilometres to date:

Annual Business km's / by 52 or by X No. of weeks the car is used by the employee

e.g. Annual Business Km's: 26,000kms/52 weeks = 500 kms per week

500 kms x 10 weeks = 5000 kms

Annual business mileage is defined as total business mileage less a minimum of 8,000 private kms. In line with Revenue regulation, employees should submit periodical mileage records to the employer when an employee is provided with a company car.

Cumulative kilometres to date should be adjusted accordingly within the payroll to record an accurate value to the benefit given to the employee.

*Applies to 2023 and 2024 year of assessment only

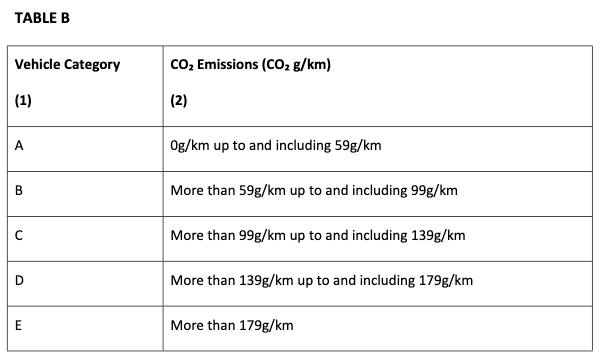

CO2 Emissions table

Employees with a company van will pay a set rate of 8% of the Original Market Value of the van regardless of business mileage.

To access this utility go to Employees, select the employee in question from the listing and click 'Benefits' on the menu toolbar, followed by 'Vehicle'.

1) Type - indicate whether the vehicle is a car or a van.

2) Description - enter a description of the vehicle e.g. make, model or vehicle registration number.

3) Original Market Value (OMV) - enter the OMV of the car/van. The OMV value of a vehicle is the price (including any duty, VRT or VAT) which the vehicle might reasonably have been expected to fetch, if sold in the State singly in a retail sale in the open market, immediately before the date of its first registration in the State or elsewhere.

4) Carbon Class - the carbon class will determine the rate of BIK to be applied to cars.

5) Reduction - tick the field provided if the employee qualifies for the reduced rate, due to being away from premises at least 70% of the time, along with other specific requirements.

6) Start Date - enter the date the employee first started using the vehicle in the current tax year.

7) End Date - if the employee returns the vehicle in the current tax year, enter the date of return.

8) Kilometres - to automatically increment the employee's business kms each pay period, enter the average number of kilometres the employee is expected to do each pay period.

9) Employee Contribution - enter any amount made good by the employee directly to the employer towards the cost of providing and running the vehicle.

9) Click Save to save the Benefit In Kind entry.

The 'Notional Pay' will be added to the employee's gross income each pay period to ensure that the correct PAYE, Universal Social Charge and PRSI are charged.

Where an employer provides an employee or director with an electric car or van between 1st January 2019 and 31st December 2022, no taxable benefit will arise for the employee or director up to a cap of €50,000 on the original market value (OMV) of the car or van that is exempt from BIK. Any amount of the OMV over €50,000 is taxable in the normal manner.

In addition, the BIK exemption for battery electric vehicles will be extended out to 2025 with a tapering effect on the vehicle value. This measure took effect in early 2023. For BIK purposes, the original market value of an electric vehicle will be reduced by €35,000 for 2023, 2024 and 2025. It will reduce by €20,000 in 2026 and €10,000 in 2027.

This exemption is limited to cars or vans which derive their motive power solely from electricity (no exemption is available in respect of hybrid cars or vans).

The provision of charging points on site by an employer for the electric charging of vehicles will not give rise to a taxable benefit for the employee or director from 1 January 2018.

Need help? Support is available at 01 8352074 or [email protected].