Since 1st January 2019, employers are longer required to submit a P45 Part 3 or a P46 to Revenue to register a new employee.

Instead, to commence a new employment, an employer now submits a Revenue Payroll Notification (RPN) request for the new employee.

This will create the employment on Revenue’s side and Revenue will send an RPN response back into the software advising of the tax credits and cut off points etc. to be applied to the employee's pay.

The employee’s start date will subsequently be reported to Revenue in the first Payroll Submission Request (PSR) you submit for that employee.

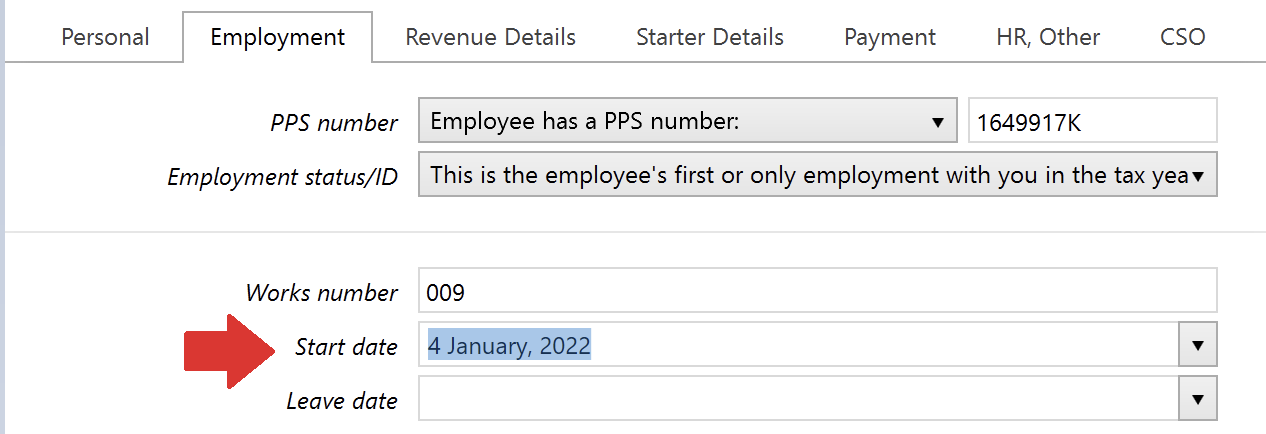

In order to fulfil these new requirements, you will first need to set up an employee record for the new employee in the normal manner within the Employees utility. For assistance with setting up an employee record, please refer to our Employee Setup section.

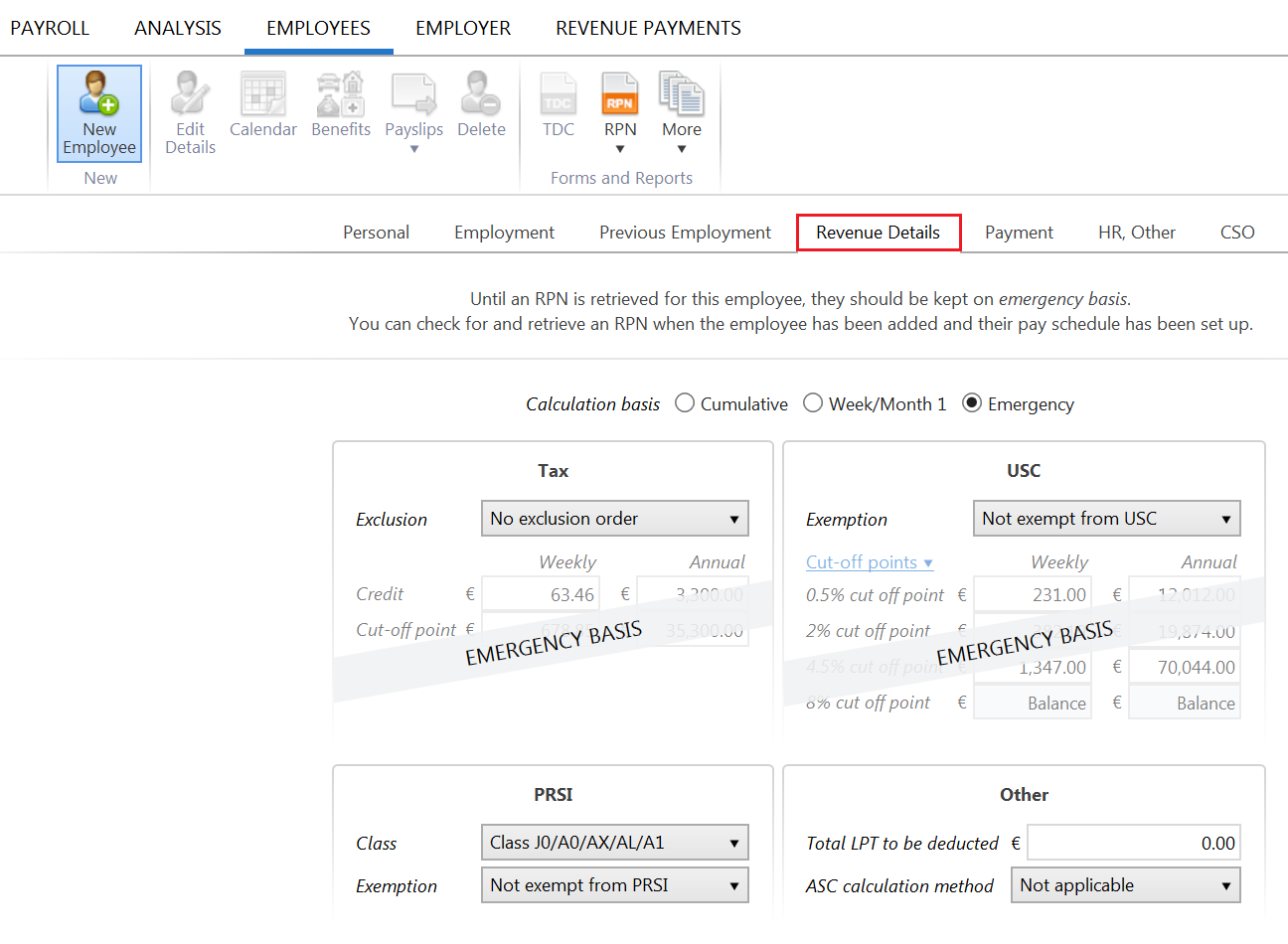

Under PAYE Modernisation, all employees will be placed on emergency tax until they are updated by a Revenue Payroll Notification (RPN). Therefore, when setting up an employee record for a new starter, this will be brought to your attention when you access their Revenue Details utility:

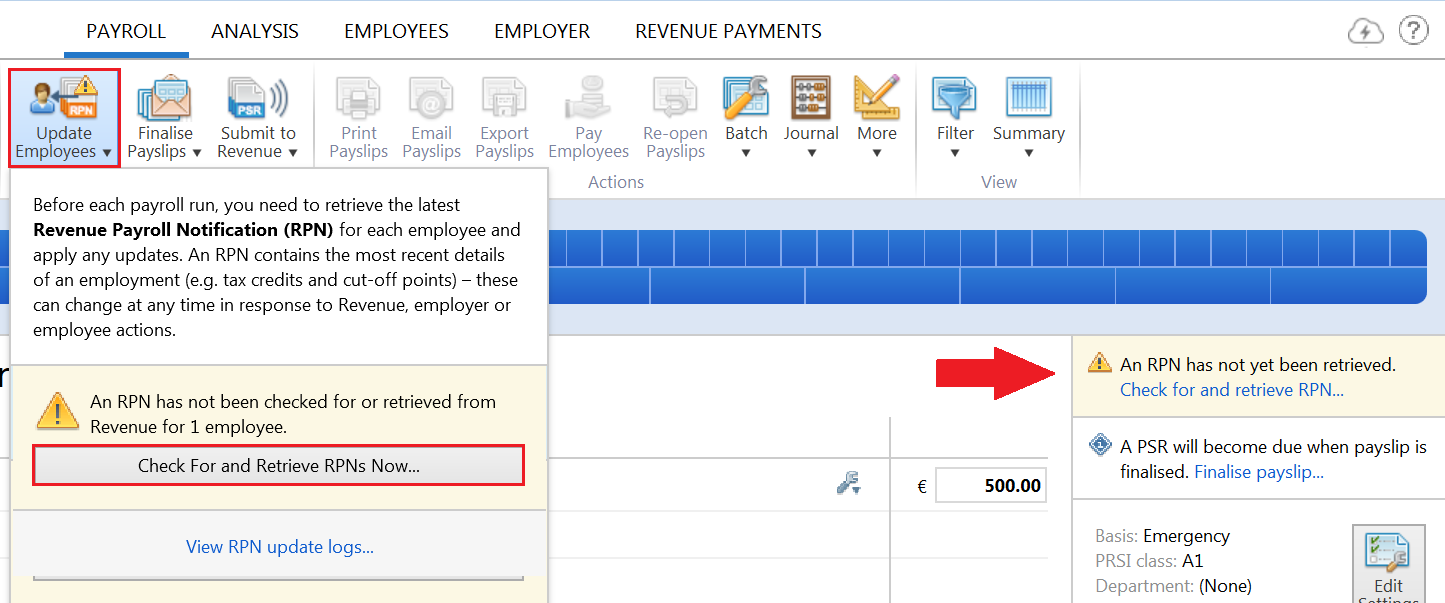

As soon as the employee record is saved, access the Payroll utility. The employee will now appear in the pay period in which their start date falls.

BrightPay will automatically connect to Revenue’s systems and check for an RPN for the new employee.

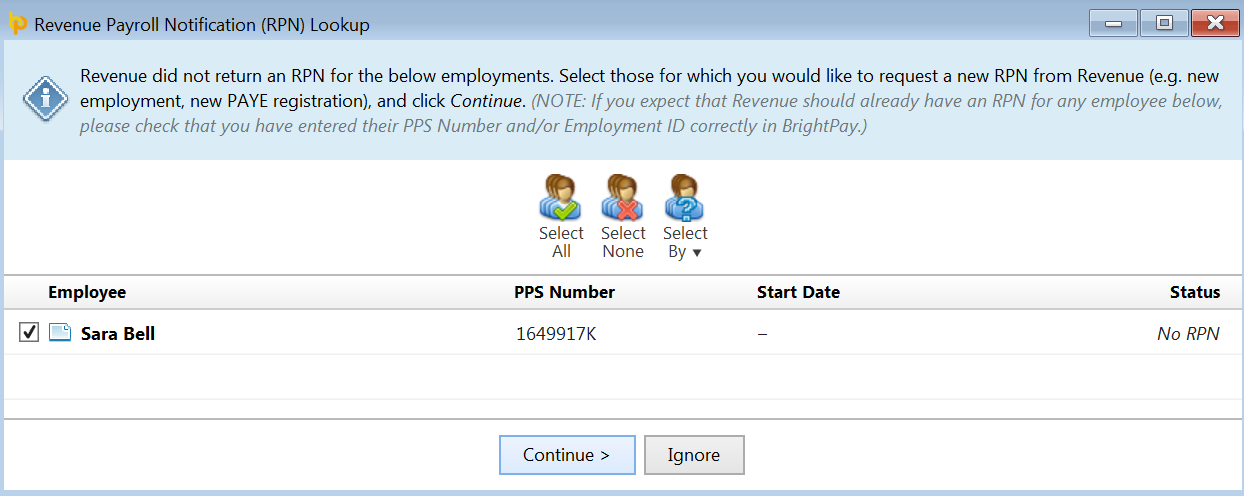

a) If Revenue does not return an RPN for the employee's new employment with you (for example if the employee has not registered their new employment themselves using the Jobs and Pensions service), you will now be prompted to request a new RPN for them.

Please note: an RPN response can only be received from Revenue for an employee where a PPS number has been provided and the PPS number has been entered in their employee record. If no PPS number is given to the employer, emergency tax will continue to apply until such time one is received.

In addition, if it is the employee’s first ever employment in Ireland, they must first register their new employment themselves using the Jobs and Pensions online service before an RPN can be received for them.

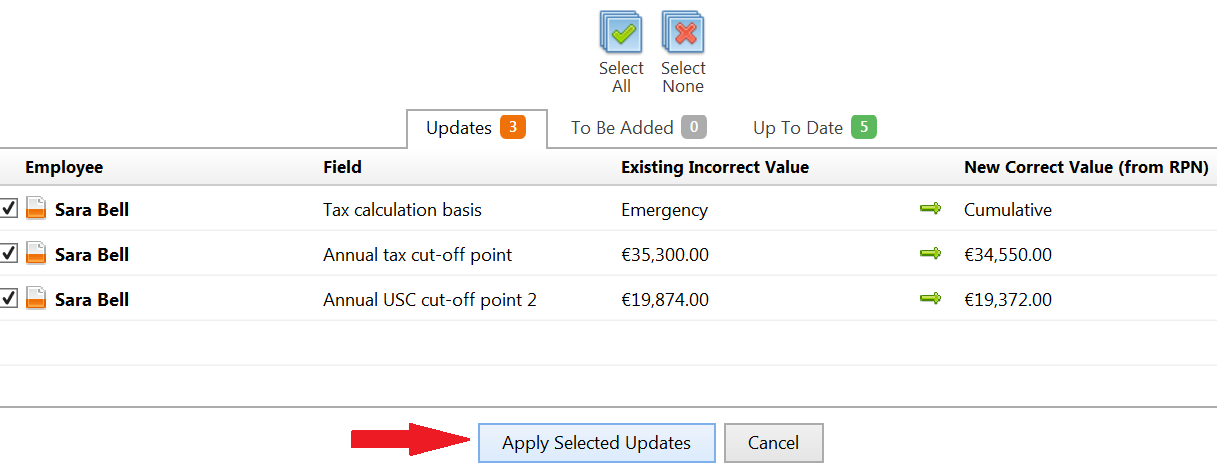

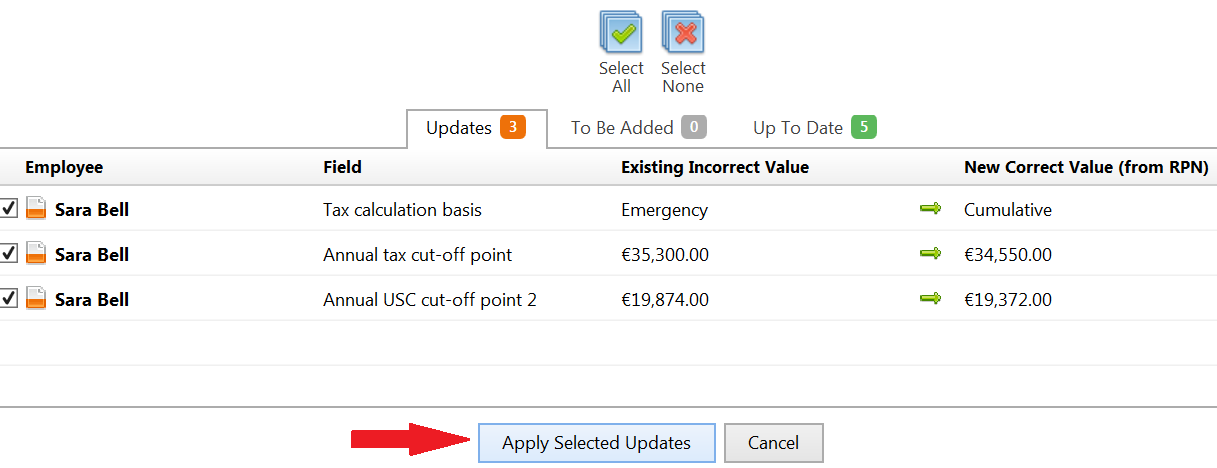

b) if the employee has already registered their new employment themselves using the Jobs and Pensions service, an RPN will be retrieved for the employee, eliminating the need for the employer to register the new employment for them.

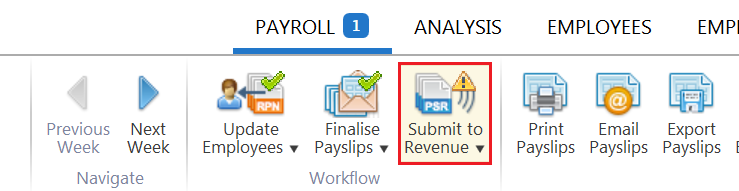

To subsequently report the employee’s start date to Revenue, the employee and their start date will be included in the next Payroll Submission (PSR) you make to Revenue.

Need help? Support is available at 01 8352074 or [email protected].