Since the introduction of PAYE Modernisation, the employer P30 return has been discontinued.

Revenue instead issue you with a monthly statement based on the periodic payroll submissions you have made within the tax month in question. This statement of account becomes available to view within your ROS account by the fifth day of the following month.

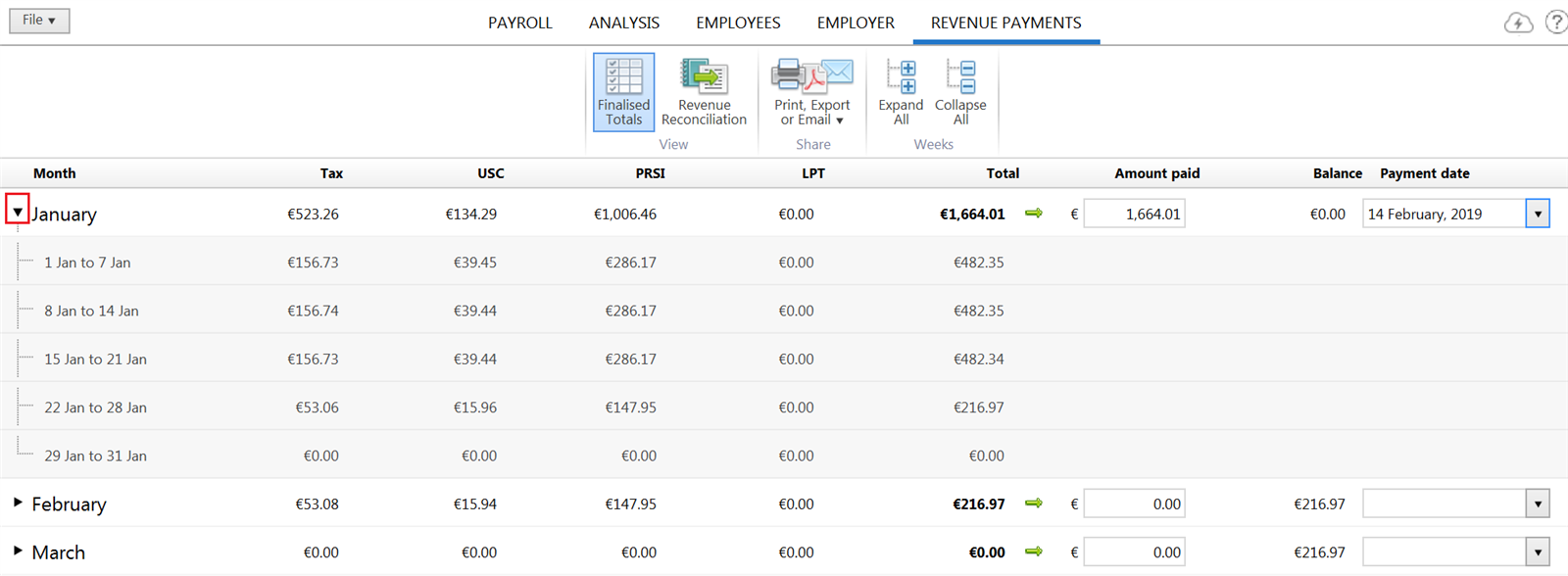

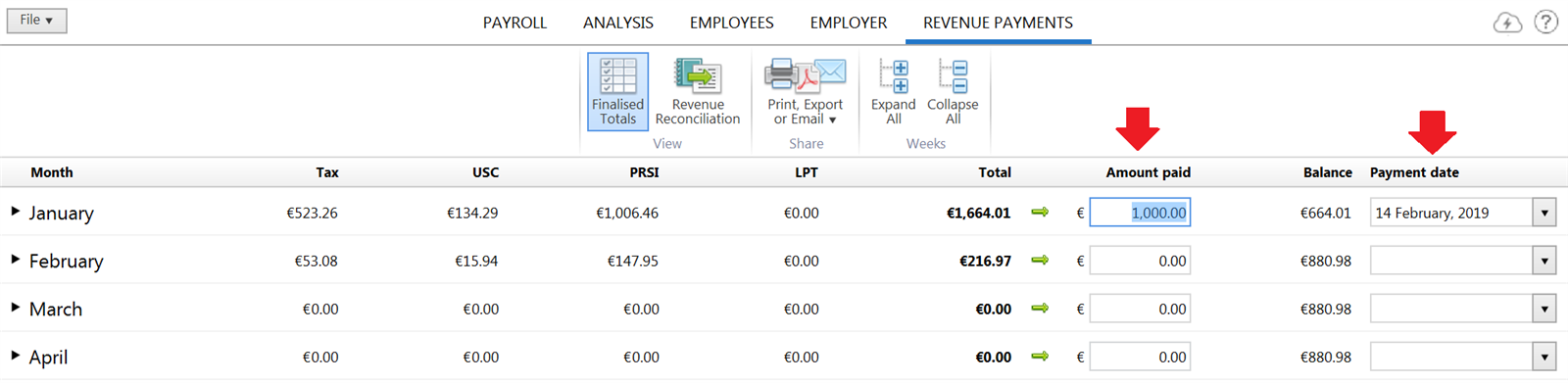

The monthly statement will show a summary of the total liability due, as well as the individual breakdown of your liability for income tax, USC, PRSI and LPT.

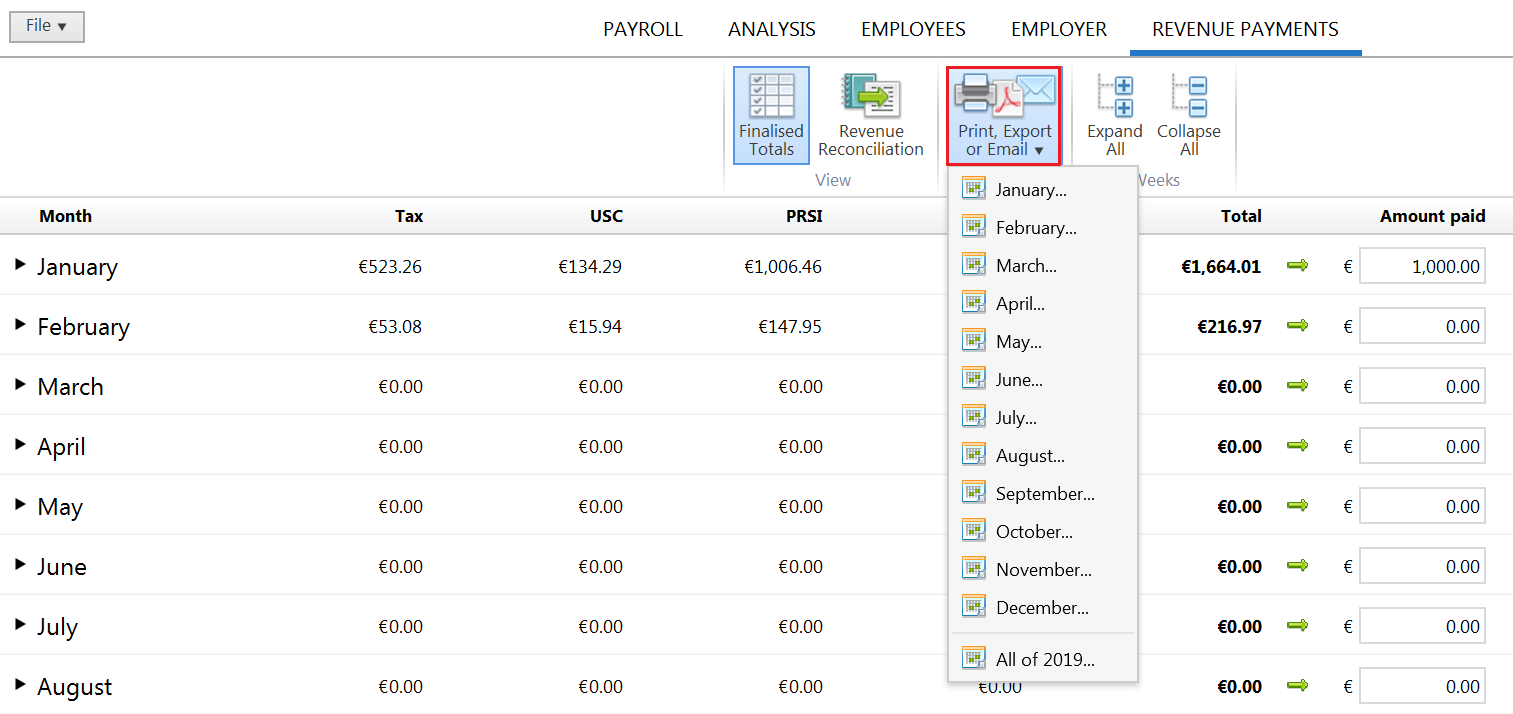

The Finalised Totals option within the Revenue Payments utility allows users to view a breakdown of their liability to Revenue, arising from all finalised payslips. It also allows users to reconcile amounts within the software with those on the monthly statement issued by Revenue.

It is important to note that payment due dates for employers remain unchanged under PAYE Modernisation, despite the fact that Revenue issue a monthly statement to all employers each tax month.

When payment is made to Revenue, this utility can be used to record the amount paid to Revenue as well as the date of payment.

Need help? Support is available at 01 8352074 or [email protected].