Add/Amend Employees

|

|

|

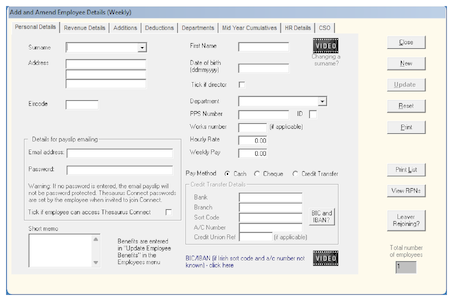

To manually set up or update an employee’s details within the payroll software: Process ICON no. 1 or Employees > Add Amend Employees

|

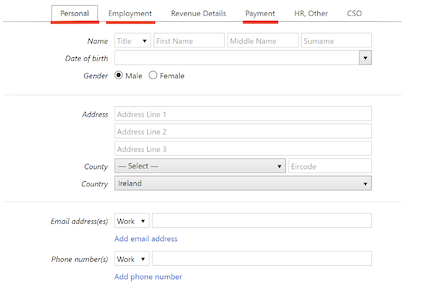

To manually set up or update an employee’s details go to: Employees > New Employee.

|

Personal Details |

|

|

In TPM the Personal Details the Employment Details and EE Bank Details are on the same screen:  |

In BrightPay these screens are separated out and can be found along the different tabs, By clicking into each one you will be able to enter the employees PPSN, Directorship status etc and their bank details:  |

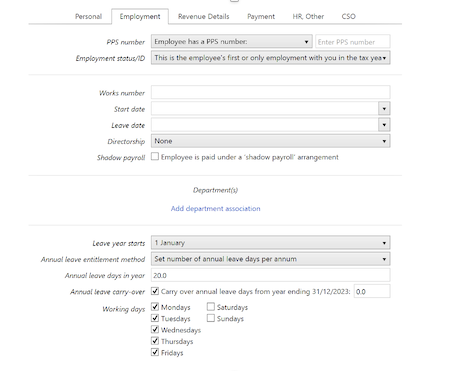

Employment Tab - BrightPay

|

|

|

|

Here is where you enter the employees:

|

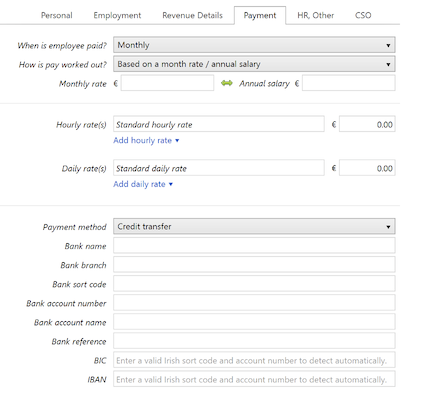

Payment Tab - BrightPay |

|

|

|

Here is where you enter the employees:

|

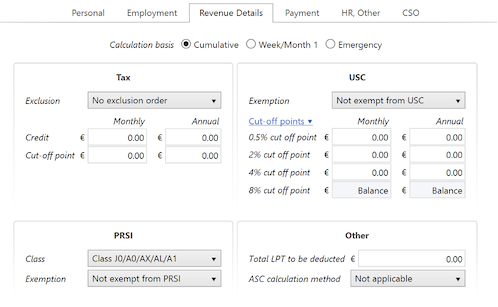

Revenue Details |

|

|

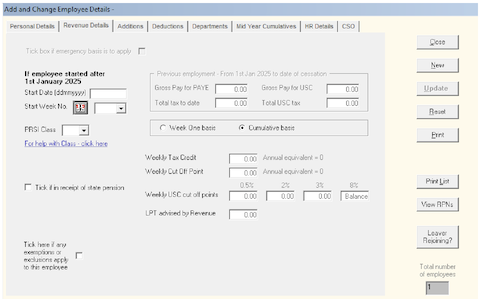

In TPM the employees start date is entered into the Revenue Details screen along with the PRSI Class along with any exemptions or exclusions

|

In BrightPay the PRSI class is selected and any exemptions or exclusions.

|

Additions Tab |

|

|

This is where you can add Taxable and Non-Taxable addition in TPM

|

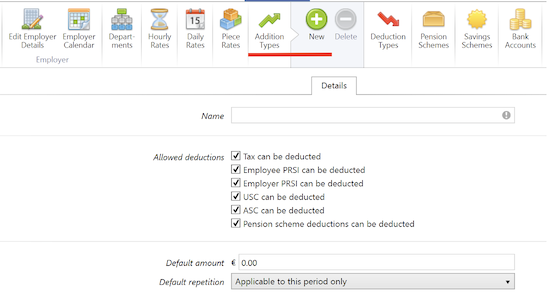

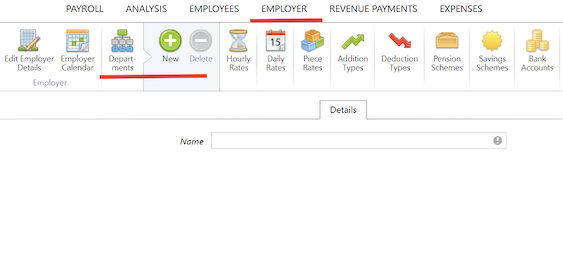

To do this in BrightPay go to the Employer Tab > Addition Type > Add

|

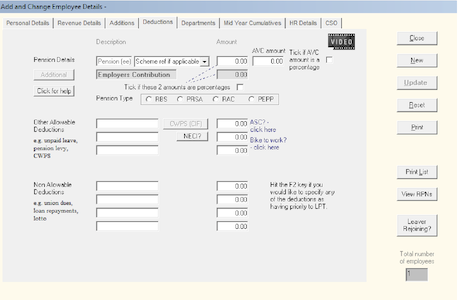

Deductions Tab |

|

|

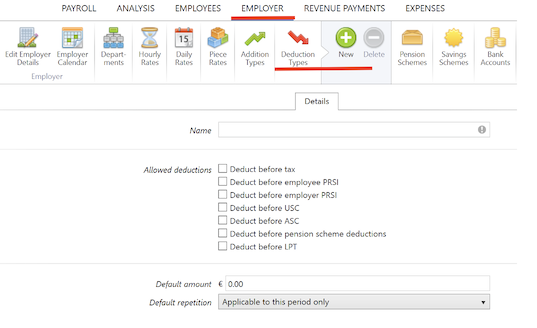

This is where you can add:

|

To add a deduction in BrightPay go to the Employer Tab > Deduction Type > Add

|

Deductions/Pensions Tab |

|

| This is where you can add:

|

To add a Pension Scheme in BrightPay go to the Employer Tab > Pension Scheme > Add

|

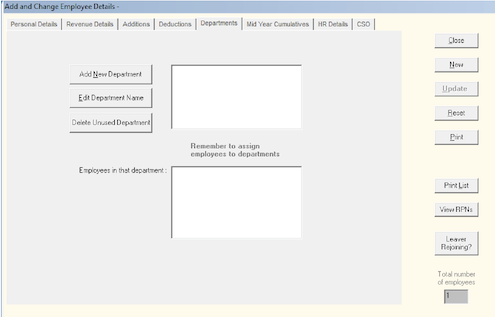

Department Tab |

|

|

Here is where you set up your company departments

|

To add Departments in BrightPay go to the Employer Tab > Departments > Add

|

Mid Year Cumulative Tab |

|

|

If you are starting mid-year this is where you will enter the employees Year to Date totals

|

To add Mid Year Total in BrightPay go to the Employees Tab > Select the employee > Mid-Year Totals

|

Mid Year Cumulative Tab - Continued |

|

|

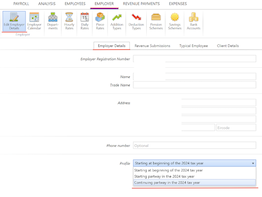

To add mid-year totals in BrightPay the correct profile needs to be selected, to ensure you have selected the correct one, go to Employer > Edit Employer Details > Profile > Continue Partway the 2025 tax year > Save Changes

|

|

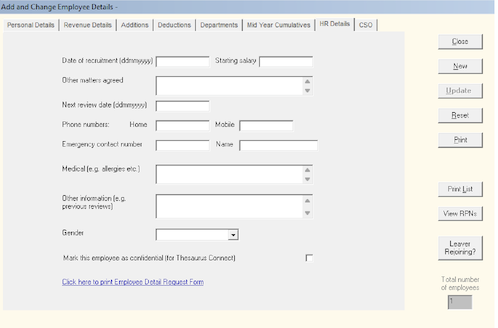

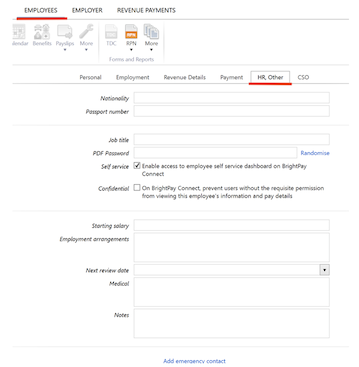

HR Details Tab |

|

This screen is used to record personnel information such as recruitment date, emergency contact details etc.

|

To add this information in BrightPay go to Employees > Select your employee > HR, Other:  |

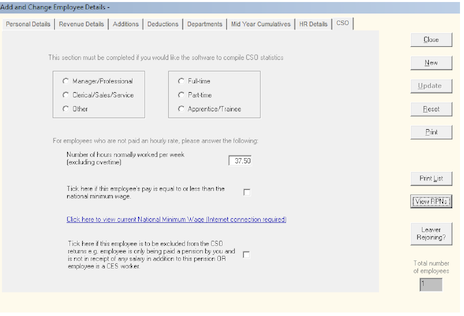

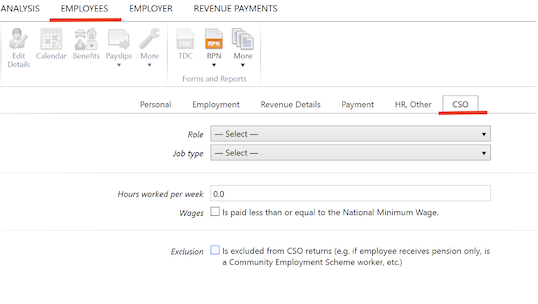

CSO Tab |

|

|

CSO Tab in TPM:  |

This is located in the Employees Tab > Select the applicable employee > CSO:  |

Need help? Support is available at 01 8352074 or [email protected].