BrightPay for Windows

BrightPay's desktop solution is available on Windows. The easy-to-use payroll software is Revenue compliant and includes full PAYE Modernisation functionality. All BrightPay customers also get complimentary access to BrightExpenses, which is designed to ensure effortless compliance with Revenue's Enhanced Reporting Requirements.All BrightPay licences include free phone and email support. BrightPay's 60-day free trial is a great way for you to discover just how easy BrightPay is to use without having to make any commitment.

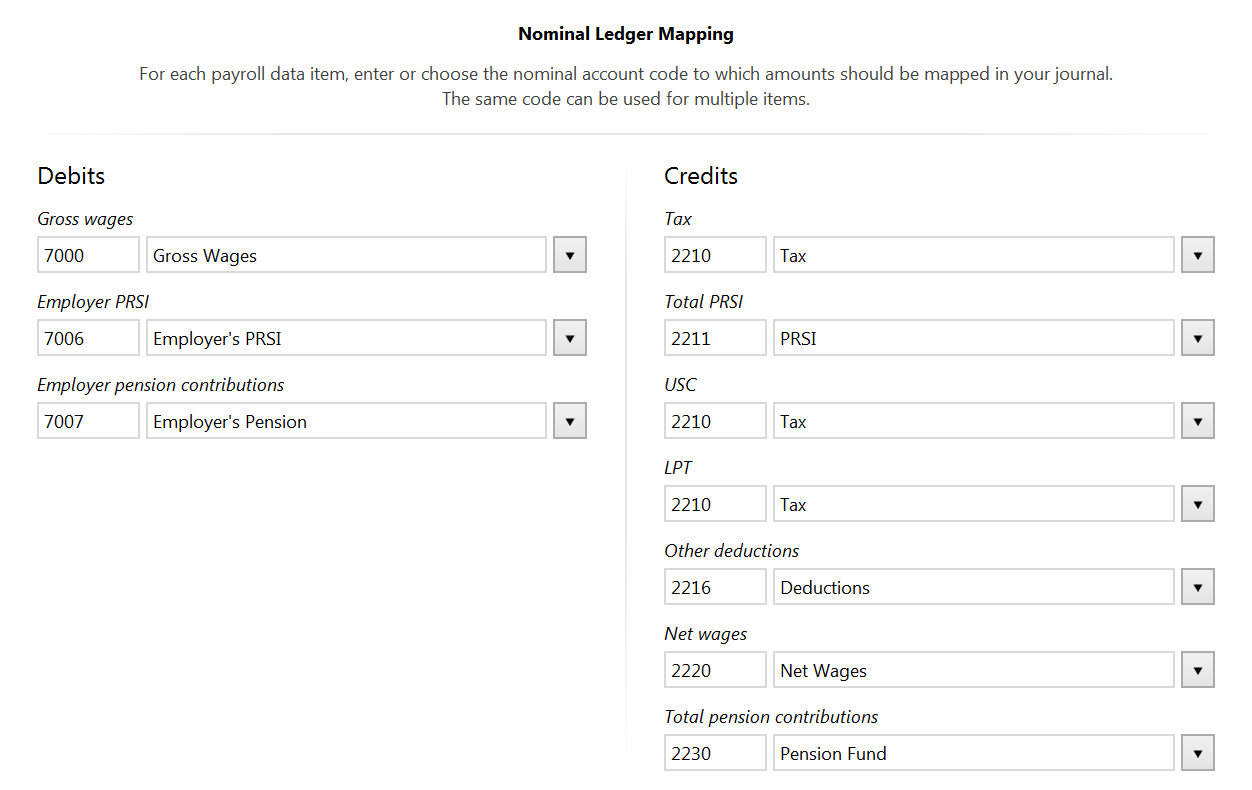

Payroll Journal Integration with Accounting Packages

BrightPay includes payroll journal API integration with a number of accounting packages, including BrightBooks (previously known as Surf Accounts), Xero, Sage Business Cloud Accounting, Quickbooks Online and AccountsIQ. This allows users to send the payroll journal directly to the accounts software from within BrightPay.

Direct Payments in BrightPay

BrightPay’s integration with Modulr will give you a fast, secure and easy way to pay employees through BrightPay. Eliminate the need to create bank files and the manual workload associated with making payments to employees.Enhanced Reporting Requirements

Employers are required to report certain tax-free payments made to employees and directors to Revenue. This is known as Enhanced Reporting Requirements (or ERR). All BrightPay customers get complimentary access to BrightExpenses, which is designed to ensure effortless compliance with Revenue's Enhanced Reporting Requirements.PAYE Modernisation Compliant

BrightPay includes full functionality for PAYE Modernisation and is Revenue-compliant. BrightPay not only ensures you are kept fully compliant with new legislation requirements but makes it really clear and easy to understand. Retrieve Revenue Payroll Notifications (RPNs) each pay period and update employees as required. Send a Payroll Submission Request (PSR) each pay period.BrightPay Connect

With BrightPay Connect, employers have access to an online employer dashboard where they can view payslips, run payroll reports and manage employee leave. Payroll bureaus can request payroll data from their clients through the secure portal, seamlessly synchronising back to the payroll software.Switching to BrightPay

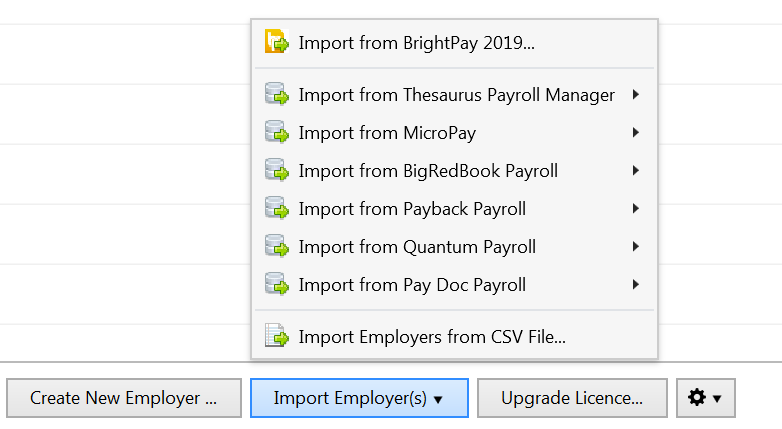

BrightPay provides an import utility to bring across your company and employee details from a number of payroll packages including Thesaurus Payroll Manager, Sage Micropay, Big Red Book and many more. Book a demo today to avail of a free consultation with our migration specialists.

Key Features

Payroll Software you can trust...

Payroll Software of the

Year 2018 - 2023

for over 330,000 businesses

in the UK and Ireland

5 Star Rating on Trustpilot

& Software Advice

Experience Developing

Payroll Software

What customers are saying about BrightPay:

Ready to get started?

online demo

features

free trial

testimonials