Jan 2021

19

Four ways to introduce payroll as a service to clients

More than ever, accountants are under pressure to diversify their service offering as the profits from doing compliance increasingly diminish. To the profession’s immense credit, firms have embraced new ways of working to not only stay afloat but thrive.

But with more competition, it’s become hard to stand out. Offering payroll processing services has become an overlooked way to set yourself apart. Perhaps understandably: in the past, payroll processing wasn’t a particularly dynamic, easy or, most importantly, profitable service to offer.

Things have changed, however, with the advent of new software that has made offering payroll services more profitable, simpler and innovative.

BrightPay Connect and Cloud Access

BrightPay Connect is a cloud add-on that seamlessly slots into BrightPay payroll software on your desktop. The payroll is still processed on BrightPay’s desktop application, but the payroll information is stored online on a secure cloud server. By introducing the cloud into your payroll services, you can demonstrate value and power up what you offer to clients.

Here are four ways you can introduce a cloud system with payroll access like BrightPay Connect to clients:

- The client self-service dashboard: Clients can see their employer details, employee's contact details and payslips, any outstanding amounts due to Revenue and any reports that have been set up in BrightPay on the desktop application. It’s a collaborative sort of payroll processing that clients will never have experienced before.

- The employee smartphone and tablet app: Not just employers, but their employees too. The self-service app provides a digital payslip platform which employees can access anytime, anywhere. Through the app, your client can offer employees GDPR compliant self-service tools.

- Annual Leave Management Tool: It’s not just payroll or payslips. BrightPay Connect can save your clients money and time with an in-built leave management tool in the self-service portal. Approved leave is automatically added to the employee calendar and synchronised to your payroll software.

- Automatic Cloud Backup: Clients will get the safety and security of a cloud payroll backup when you use BrightPay Connect. The software will automatically backup payroll files every 15 minutes when open and again when the payroll file is closed down. A chronological history of backups will be maintained which can be restored at any time.

Make your and the client’s life easier

There’s so much complication in our modern economy. Businesses and individuals are assaulted on all sides by different technologies and demands for their attention and time.

But it’s important to remember that the right tech can also radically simplify peoples’ lives too. BrightPay Connect, with its suite of HR-centred features, will make payroll processing simple and collaborative.

By empowering your clients via the cloud add-on, you’ll lessen the admin burden on yourself, leaving you to focus on getting the details right. For your client (and their employees), BrightPay Connect will give them control over their leave and payroll data.

Things can – and should – be much simpler. And with BrightPay Connect, that’s the new reality of payroll processing. Book a demo of BrightPay Connect today.

Jan 2021

12

BrightPay Customer Update: January 2021

Welcome to BrightPay's January update. Our most important news this month include:

-

BrightPay: The COVID Heroes of the Accounting World

-

From the support desk: How do I start processing 2021 payroll?

-

How your payroll bureau can survive the COVID-19 crisis

-

How to avoid a payroll nightmare during COVID-19

-

BrightPay 2021 is now available – What's new?

Revenue announce further changes to the EWSS for 2021

Revenue have introduced further changes to the Employment Wage Subsidy Scheme. Join us on 20th January as we recap upcoming changes to the EWSS and what these changes mean for your business. Plus, we will share some of the key lessons learned from processing payroll in a pandemic, and how it prepares us for payroll in the ‘next normal’.

BrightPay Connect – It's better than ever before!

We are committed to consistently improving our software to better serve your needs and enhance your customer experience. This year we have introduced many new features to BrightPay Connect, including improved multi-user / working from home functionality and an extra layer of security.

- Version checking when opening a payroll file

- ‘Other users’ checking when opening a payroll file

- Define and set custom leave types

- Improved calendar functionality

Pricing Strategies that work – what other practices are doing

In this free webinar for accountants and payroll bureaus we explore how you can maximise the value of your payroll service offering. Learn how technology and automation turn daunting payroll tasks into a smooth and profitable process. We look at four tried and tested pricing strategies that will help secure your payroll profitability.

Moving from BrightPay 2020 to BrightPay 2021

Every tax year we release brand new software in line with the new budgetary requirements. Thus, to move your payroll on to a new tax year, simply download the new tax year version of BrightPay. Your software for the new tax year will contain a seamless import facility to bring across your employee details from the previous tax year.

Updates to EWSS Eligibility and Subsidy Rates

There has been a change to the EWSS qualifying criteria for pay dates on or after 1st January 2021. The change relates to the periods to be used for assessing the minimum 30% reduction in sales/orders. Where employers have been availing of EWSS in 2020, they will now need to review expected turnover for the 6 months to 30th June 2021 versus the 6 months ended 30th June 2019 (not 2020). The rates of subsidy have also been revised to better support businesses.

Jan 2021

11

BrightPay Connect – It's better than ever before!

We are committed to consistently improving our software to better serve your needs and enhance your customer experience. This year we have introduced many new features to BrightPay Connect, including improved multi-user / working from home functionality and an extra layer of security.

Version checking when opening a payroll file

When you open the payroll, BrightPay Connect will check to see if there is a more up to date version of the employer file, for example, if the payroll was last updated on a different computer. If a more up to date version is available, you will be given the option to use the latest version, or you may also decide to ignore the latest version and continue working on the version that you are trying to open.

‘Other users’ checking when opening a payroll file

When you open the payroll, BrightPay Connect will notify you if someone else is still working on the same employer. BrightPay can notify you when the other user closes out of the payroll, and it will also tell the other user that you are waiting to access the payroll. This new functionality will allow for a completely seamless working from home process where there are multiple people that work on the same employer files.

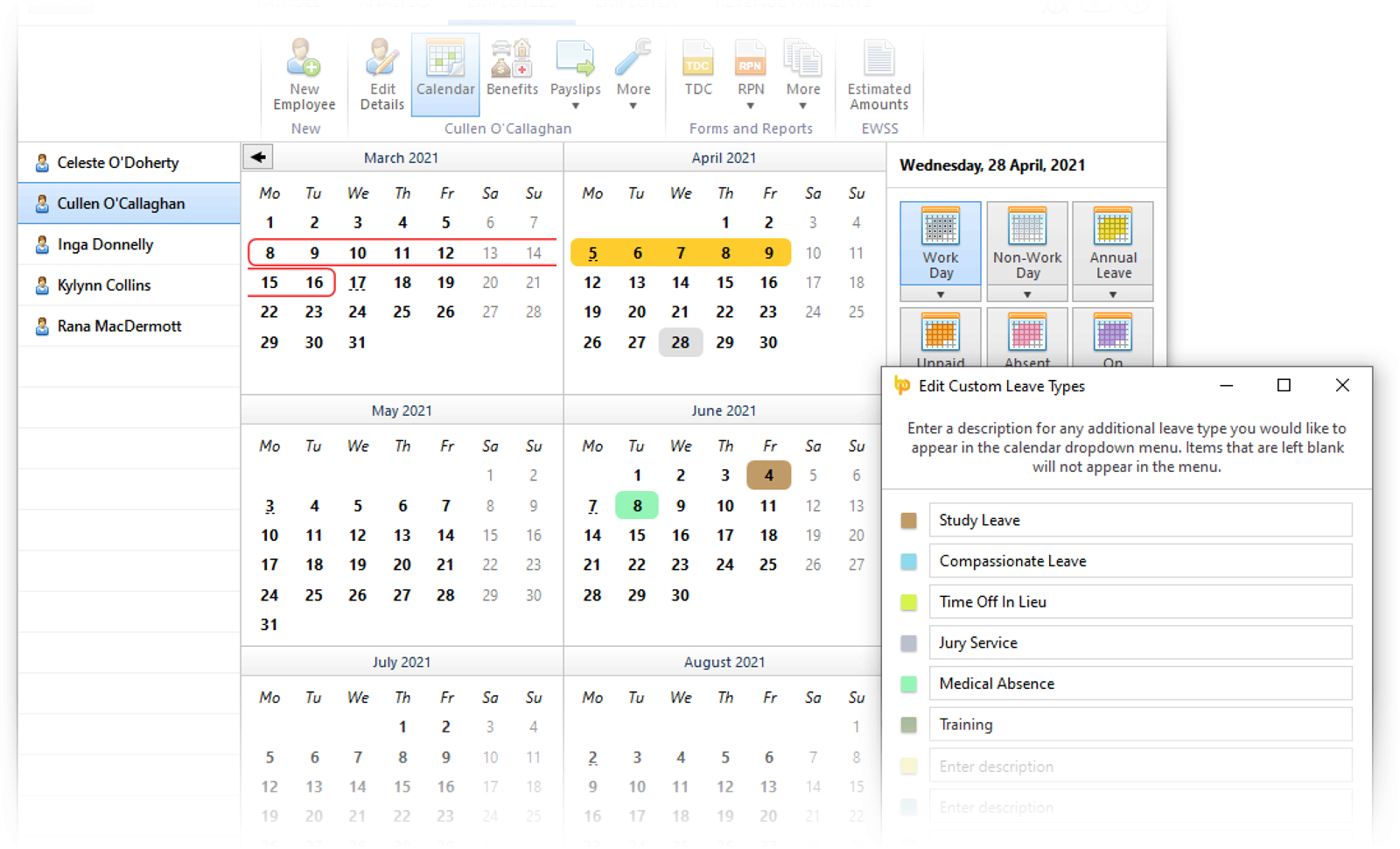

Define and set custom leave types

You can now define up to nine additional custom types of employee leave. Six of the custom types are set up with default descriptions, which you can edit, add, or remove as need be.

Custom leave types act like the existing built-in kinds of leave, in that they are mutually exclusive and can only be applied to working days. They can be set on a per-employee basis, or batch set for multiple employees at once.

Improved calendar functionality

The calendar functionality in BrightPay Connect has been updated and improved, making it more user friendly and graphically appealing for both employers and employees. Improvements such as calendar and leave view, custom leave types and requesting leave are part of the new enhancements.

Book a demo of BrightPay Connect today to discover more features that can help you streamline your payroll and HR processes.

Jan 2021

6

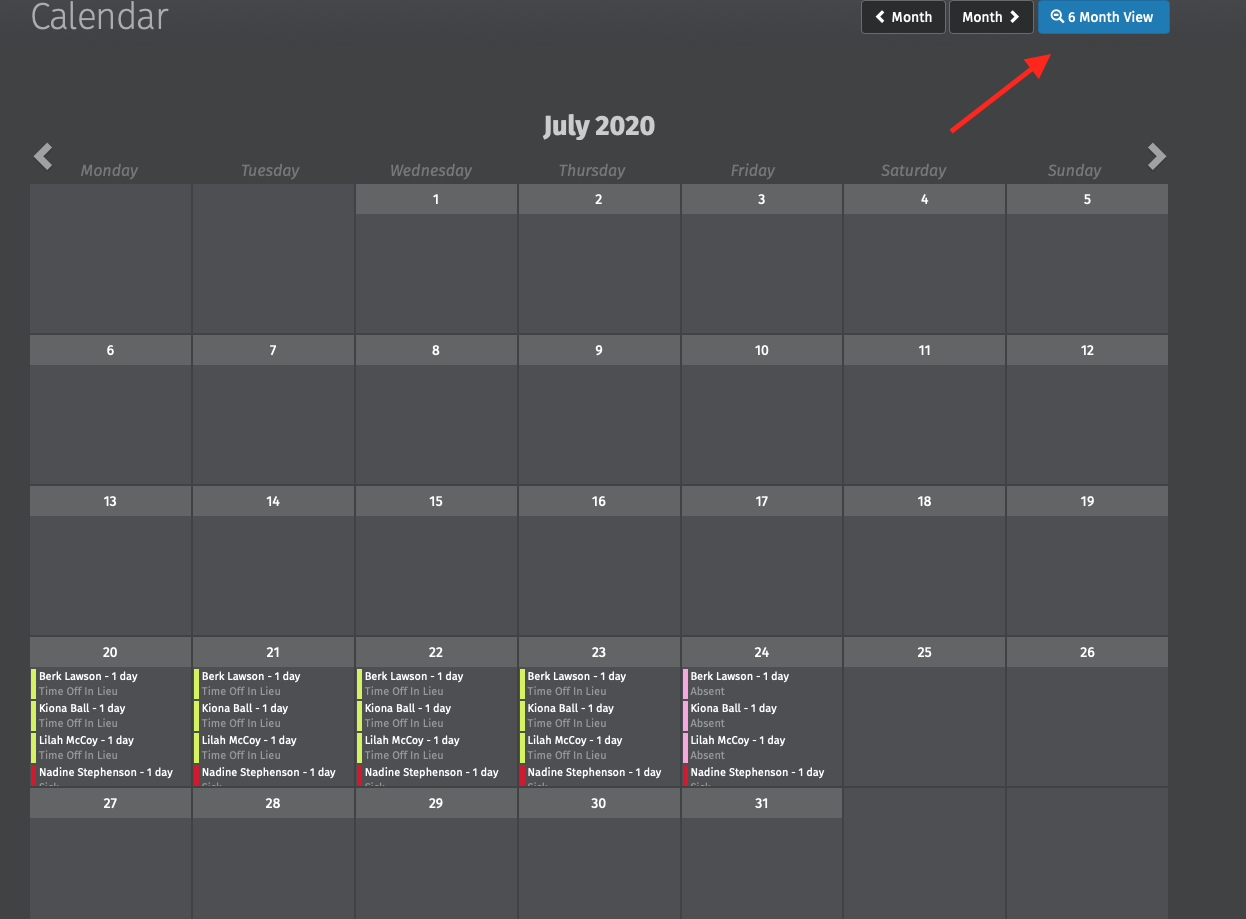

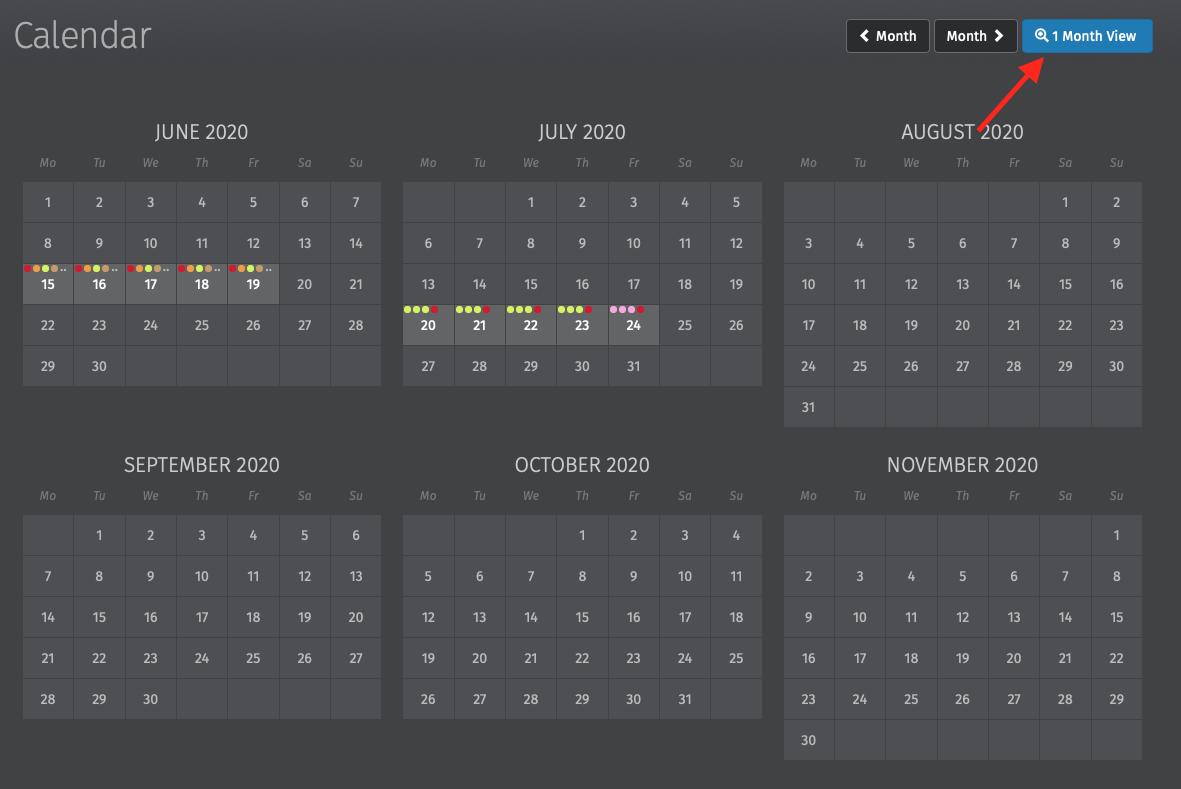

BrightPay Connect Calendar Updates

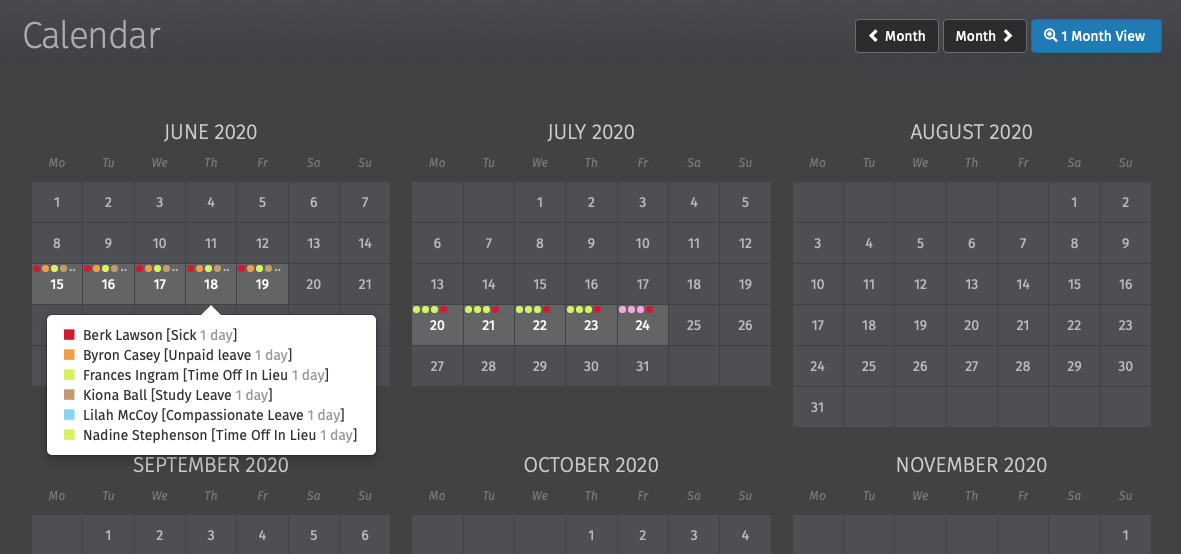

The calendar functionality in BrightPay Connect has been updated and improved, making it more user friendly and graphically appealing for both employers and employees. Improvements such as calendar and leave view, custom leave types and requesting leave are part of the new enhancements.

Calendar Display

The number of months displayed on the calendar for both employers and employees can be selected, the options available are 3 months, 6 months, 9 months and 12 months. This can be selected under the Settings tab in the Employer portal, further details can be found here.

On the Employer or Employee Calendar in Connect, the calendar can be displayed for one month or multiple months. One month view can be seen by selecting the '1 Month View' option. The view can be returned to the default number of months view by selecting ‘3 / 6 / 9 / 12 Month View’. On the ‘1 Month View,’ there are new widgets for scrolling up and down through the number of leave entries on a particular date.

Dates with multiple types of events are dotted with the relevant colours. To see the breakdown, simply hover your mouse over the date. By selecting a date on the calendar, a dialog box will open to show all the entries on that date without having to scroll.

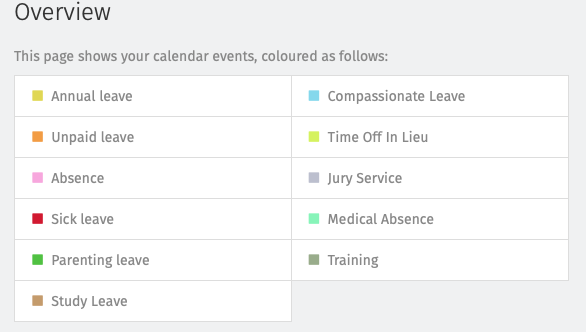

Custom Leave Types

Custom leave types are now available in BrightPay Connect. In BrightPay 2021 you can define nine additional custom leave types for employees. Six of the custom leave types are set up with default descriptions such as time in lieu and study leave. Instructions on how to add, edit or remove these custom leave types can be found here.

When a custom leave type is entered on the employee’s calendar in BrightPay and synchronised to Connect the leave type will be displayed on the calendar for both the employer and the employee to view on their online portal or mobile app. Custom leave can only be entered on an employee’s calendar by a user in Connect or on the employee’s calendar in the BrightPay employer file. Employees cannot request any custom leave types.

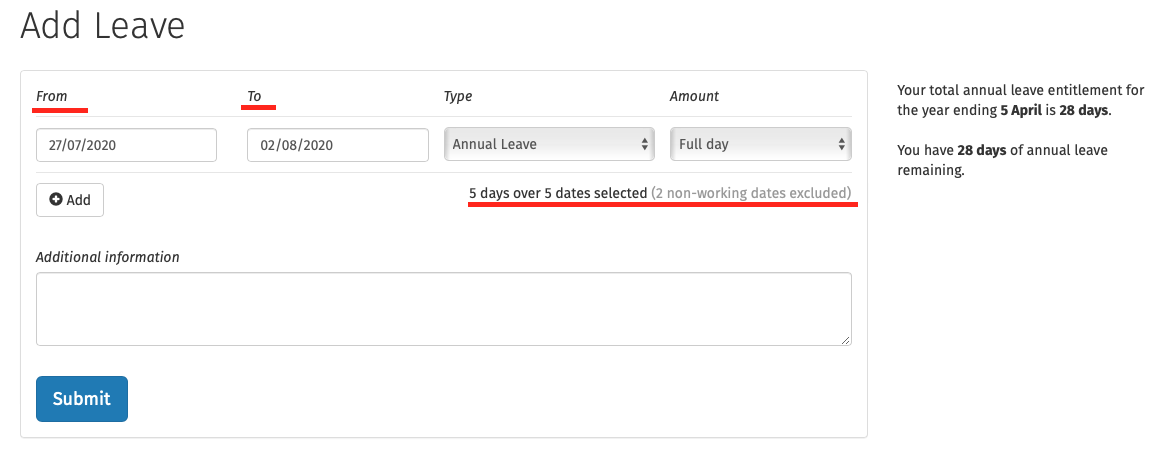

Adding/Requesting Leave

When employers are adding leave on an employee’s calendar in Connect or an employee is requesting leave, they are now entered as date ranges simplifying leave dates being selected. If the employer or an employee enter in an invalid date range (e.g. including non-working days in the date range) it will automatically correct this and only working days will be included in the request.

Interested in finding out more about how BrightPay Connect can streamline your leave management processes? Book an online demo of BrightPay Connect today.

Dec 2020

21

Our Christmas Opening Hours

The management and staff of Thesaurus Software Ltd would like to thank you for your valued custom in 2020 and to take this opportunity to wish you a Merry Christmas and a prosperous New Year.

Here are our opening hours for the Christmas period:

| Monday 21st | 09:00 - 13:00 | 14:00 - 17:00 |

| Tuesday 22nd | 09:30 - 13:00 | 14:00 - 17:00 |

| Wednesday 23rd | 09:00 - 13:00 | 14:00 - 17:00 |

| Thursday 24th | Closed |

| Friday 25th | Closed |

| Saturday 26th | Closed |

| Sunday 27th | Closed |

| Monday 28th | Closed |

| Tuesday 29th | 09:30 - 13:00 | 14:00 - 17:00 |

| Wednesday 30th | 09:00 - 13:00 | 14:00 - 17:00 |

| Thursday 31st | 09:00 - 13:00 | 14:00 - 17:00 |

| Friday 1st | Closed |

Call us on 01 8352074, email us at [email protected] or complete our online form.

Dec 2020

18

Why not add some sparkle to Christmas with the perfect cloud solution

What springs to mind when you hear the word ‘cloud’ will vary from person to person. Some will think of the weather as they look, grumbling, out their front window. But others will be thinking about all that extra storage on their iPhone. The meaning of the word has changed in recent times and most of us will now think the latter. But what about those who haven’t a notion what you’re on about? What is the cloud?

The cloud is a general term for any computing service that involves hosting over the internet to deliver computing services in lieu of a hard drive. Services such as storage, payroll and HR information. The other key feature is that you can access these services or information anytime, anywhere from any device that is connected to the internet. In fact, you’re already using cloud services if you use social media, Google Drive and Dropbox to name but a few. And now the cloud has become a must-have for any business who wishes to keep up with the times.

I can hear some of you now: “It sounds great, but my employees would never use something like that”. Well, that’s where you’re wrong. A recent survey found that 48% of people believe technological advances will change the face of the workplace and a massive 87% of those said they would be happy to adapt to technological changes if the right tools were given to them. Wow! So how do I know which cloud platform to choose for my business?

I’m glad you asked! Our experts got together for a brainstorming session and found that there are four key things to look out for when choosing the right cloud platform for your business - cost, compliance, simplicity and connection.

- Cost - Your upfront costs should be minimised – using the cloud shouldn’t be an expensive luxury reserved for big corporations. Make sure it provides the option of having multiple users so you can delegate and give access to various people to manage payroll tasks and HR requests on your behalf.

- Compliance - Make sure it takes into account your obligations as an employer with regards to things like the GDPR legislation and record-keeping requirements. A good platform will have compliance built-in as standard and will manage it seamlessly.

- Simplicity - The most important thing to increase the uptake of a cloud platform is to make sure it is user-friendly and reduces the chance of human error. Look out for simplistic interfaces and whether or not training and support are available. The best of the best will offer this support for free. You should also be able to get set up and ready to go with minimal disruption to your business.

- Connection - Make sure it offers features that are attractive to employees such as a downloadable app, a self-service portal and company-wide communication features. Because at the end of the day, your employees won’t give a damn about how excited you might be about something unless it works for them too. These features tie in with our ever-increasing digitally-minded workforce and will make them feel more in control and engaged.

So, there you have it… off you go now! Good luck scouring through the internet trying to find the perfect cloud platform. But…., well, ....it is Christmas after all and I’m feeling generous. Ah, what the heck, I’ll just let you in on a secret which is the best cloud payroll platform for businesses out there: our very own BrightPay Connect.

BrightPay Connect is an add-on to BrightPay’s award-winning payroll software and ticks literally every single box I just mentioned over the course of this post. I’ve done enough talking so instead let me show you. Book a demo today to find out why BrightPay Connect is the perfect fit for your business.

Merry Christmas everyone! Don’t say I didn’t get you anything!

Dec 2020

15

What's New in BrightPay 2021?

BrightPay 2021 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2021 Tax Year Updates

- 2021 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and ASC.

- Support for the Employment Wage Subsidy Scheme (EWSS) continues to be available in the 2021 tax year. The Temporary COVID-19 Wage Subsidy Scheme (TWSS) concluded in 2020 and is no longer available.

- Support for retrieving and using 2021 Revenue Payroll Notifications (RPN).

- Support for creating and sending 2021 Payroll Submission Requests (PSR).

Define and Set Custom Leave Types on Employee Calendar

- You can now define up to nine additional custom types of employee leave. Six of the custom types are set up with default descriptions, which you can edit, add to, or remove as need be.

- Custom leave types act like the existing built-in kinds of leave, in that they are mutually exclusive and can only be applied to working days. They can be set on a per-employee basis, or batch set for multiple employees at once.

- Custom leave types also appear on the employer calendar. Mouse-hover tooltips have been added to the various views of the employer calendar to help determine what each colour indicates where it's not clear.

- A new Calendar Report (which replaces the previous Print Calendar functionality) gives you the power and flexibility to create and/or share a customised report of employee leave that can be filtered by type of leave, and presented individually for each employee, or as a summary containing multiple employees.

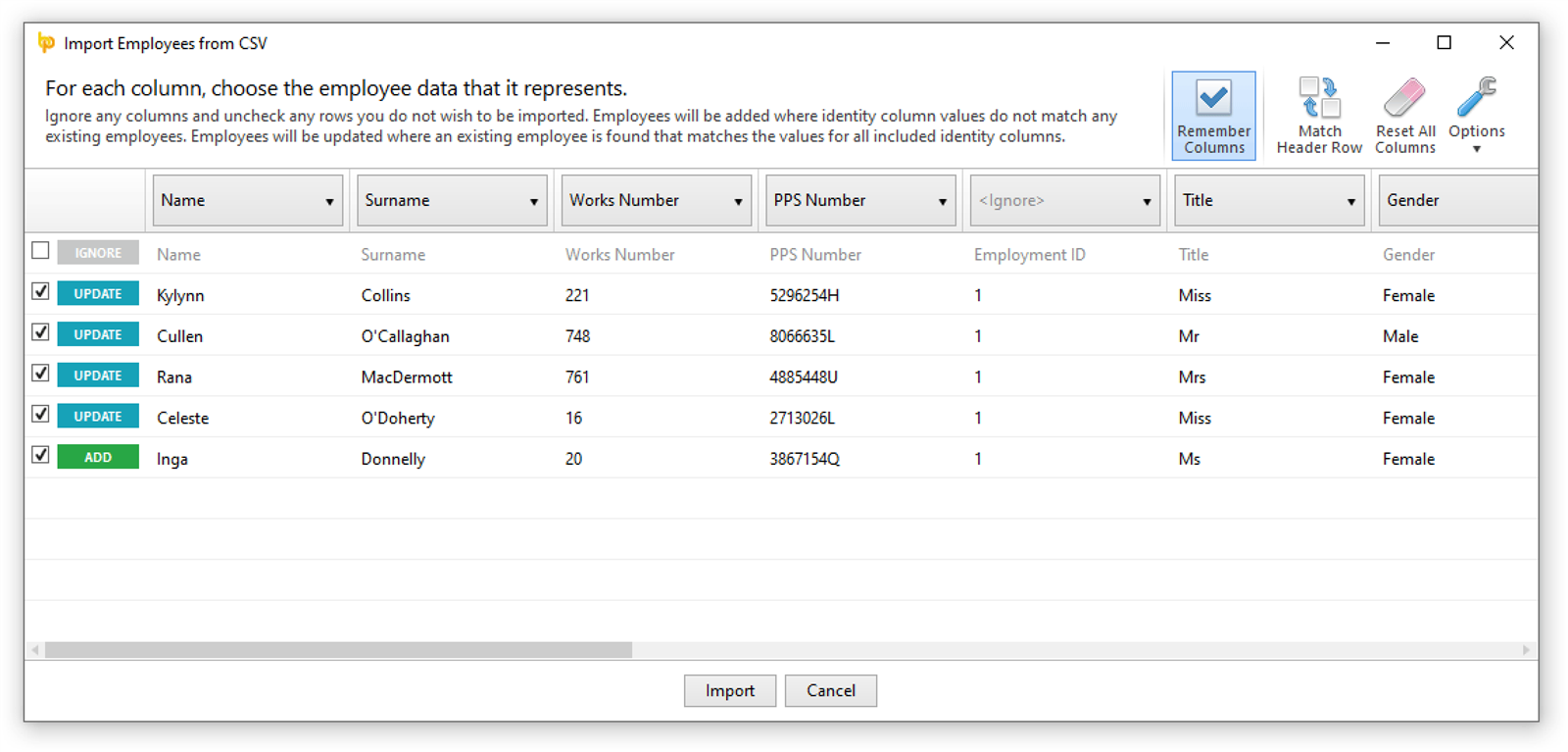

Update Employees from CSV File

BrightPay has traditionally only allowed new employees to be added from a CSV file. Now, you can both add new employees and update existing employees from a CSV file.

BrightPay Connect

- Supports two-factor authentication sign in.

- When you open an employer in BrightPay, and your version of file is older than the version in Connect (i.e. that you or a colleague synchronised to Connect from another computer), you will be immediately prompted to download the latest version.

- When you open an employer in BrightPay that a colleague is currently already working on on another computer, you will be immediately notified in BrightPay (and given the option to be told when the employer is free to work on again).

Other 2021 Updates in BrightPay

- Annual leave entitlement calculations now include 'upcoming booked annual leave days', which can optionally be included on reports and payslips.

- When zero-ising payslips, new options to set amount to zero, or remove items altogether.

- When importing payments from CSV, any lines which failed to import (e.g. due to not matching an employee pay record, or due to the matching pay record being already finalised) are now clearly indicated in the response dialog (instead of the previously unhelpful 'X of Y succeeded' message).

- Public holidays on employee calendar are now shown with a dotted text underline (rather than appearing as if they were non-working days by default).

- Shows RPN “date/time downloaded” in RPN details view.

- Ability to preview CSO EHECS report in a printable/shareable format.

- New CSO columns in analysis.

- Ability to import saved reports from another BrightPay data file into the currently open file.

- Allows one of the added emergency contacts for an employee to be set as the 'primary' contact. New analysis columns (and a new report) for emergency contact details have been added.

- Ability to import hourly/daily payments by rate code

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Dec 2020

10

This Feature Will Make You Want To Move To BrightPay Today

When trying to find the right payroll software provider, it can be overwhelming. There are so many choices available today that you may have trouble simply distinguishing one provider from another. What’s more, the payroll industry jargon used can baffle and confuse. It’s really no wonder that many people find this a tedious and frustrating process.

The good news is that BrightPay is here to make this the easiest decision you’ve ever made. Our payroll software has won multiple awards, is used by over 300,000 businesses across Ireland and the UK, and has received and maintained an industry-leading 99% customer satisfaction rating. And if all of this wasn’t enough to sway you, then our cloud portal add-on, BrightPay Connect and its document upload feature certainly will.

BrightPay Connect combines automated payroll functionality with innovative human resources features, for a holistic approach to modernisation. It harnesses the latest advances in cloud technology to offer practical solutions to the most common challenges faced by businesses everyday. Its document upload feature is the perfect solution to many of those challenges, and it’s why BrightPay Connect is the best choice for your business.

Document Upload With BrightPay Connect

BrightPay Connect’s document upload feature is one of the best ways to modernise a number of different elements of your business, including payroll, all at once. It was specifically designed to simplify the day-to-day running of a business in a way that benefits both employers and employees. Here are just some examples of how our cloud portal does just that.

Increased GDPR Compliance

Data protection has been a top priority for businesses of all industries since the GDPR came into effect in May 2018. The regulation sets out a list of measures that businesses must take in order to protect the personal data of their employees and customers. For many businesses, complying with these requirements has relied upon making significant changes to how they manage their human resources.

The document upload facility in BrightPay Connect can increase your GDPR compliance dramatically by allowing you to store all employee personnel files in the cloud. This means that they can’t get lost or damaged, and that they’re stored securely, out of sight of anyone else who shouldn’t have access to them.

Improved Internal Communication

Internal communication is vital for any thriving business, especially as remote working is becoming increasingly common. Sharing documents with employees is essential to a streamlined workflow and efficient processes. However, it can be a lot more challenging than expected, particularly as staff numbers grow and more and more people are working remotely. BrightPay Connect’s document upload feature is the perfect answer to this problem.

Employers and managers can upload any document to Connect. Employees can then access these documents from their employee self-service dashboard, or their employee smartphone and tablet app. What makes the feature even more useful is the fact that whoever is uploading the document can choose to make it accessible to an individual employee, a team or department, or the entire organisation.

Employer Protection

Finally, the document upload feature in BrightPay Connect offers employers an added layer of protection when it comes to ensuring that employees adhere to company policies. This is because, as well as choosing who does and doesn’t have access to the uploaded documents, employers can also view a time-stamped log of who has read the document and when.

This means that, for example, if an employee was in breach of a company policy and claimed that they had never seen nor read the policy in question, the employer can simply check the time-stamped log on BrightPay Connect to find the date and time that they accessed the policy.

Book Your Free BrightPay Connect Demo

Need a little more information before deciding if BrightPay Connect is right for you? Book your free demo today and let one of our Connect experts help you make the right choice for your business. They’ll show you all of its features, functionalities and explain the real-life, tangible benefits that they bring.

Dec 2020

4

BrightPay: The COVID Heroes of the Accounting World

BrightPay has been announced as the winner of COVID-19 Hero Award (supplier) at the Accounting Excellence Awards. The judges recognised that BrightPay went above and beyond to support payroll professionals at a time when they were under pressure with government schemes and trying to interpret guidance.

Paying employees was one of the areas most impacted by COVID-19 and we recognised customers would struggle to implement government schemes. The main challenge for BrightPay has been delivering upgrades to minimise the stress for customers. Our COVID-19 upgrades were released in advance of scheme changes being implemented. In most cases, we were first to the market with upgrade releases with other providers taking longer or needing additional software bug fixes, not automating scheme calculations or not implementing functionality for every change.

Our speedy upgrades to the payroll software focused on automation functionality to accurately calculate scheme payments and claims which meant customers were prepared and compliant.

Our customer support strategy involved additional staffing and increased hours. Our comprehensive webinar, blog and email strategy educated and informed customers about COVID-19 processes and presented demonstrations of how to action these schemes in our payroll products. Our multi-channel approach guided our customers to easily implement government measures.

Speaking at the Accounting Excellence Awards, host extraordinaire Mike Goldsmith said “the judges saw that BrightPay went above and beyond to support their client base and payroll professionals at a time when they were under pressure with furlough claims and interpreting guidance. BrightPay did this through a coordinated strategy that went beyond product enhancement. Their success in this was evidenced by high customer satisfaction and impressive reach with their support material.”

Find out more about BrightPay’s COVID-19 Response Plan and how we have helped our customers throughout the pandemic.

Make sure you’re using a payroll software provider that can support your business during difficult times. Book a demo of BrightPay today.

Related Articles:

Payroll in a Pandemic - Make sure your practice isn't left behind

BrightPay’s COVID-19 Response Plan

Free Webinar: EWSS Explained | Guest: Revenue

Dec 2020

1

BrightPay Customer Update: December 2020

Welcome to BrightPay's December update. Our most important news this month include:

-

National Minimum Wage to increase by 10c per hour

-

BrightPay’s Response to COVID-19

-

A Thank You Note...

*** Extra Dates Added to COVID-19 Webinar Series ***

Still confused about the Wage Subsidy Scheme? Don’t worry you’re not alone. Due to phenomenal demand, extra dates have been added to our COVID-19 & payroll webinar series. Join us on 9th December for our free webinar: Important Updates to the Wage Subsidy Scheme | Guest Speaker: Revenue

Time to Renew your 2021 Payroll Licence – What's the Quickest Way?

Due to the impact of the pandemic, our phone lines are busier than ever before which is leading to longer than normal wait times. The quickest and easiest way to purchase your 2021 licence is online. The order process is straightforward and takes approximately 3 minutes to complete. Once your order is complete you will receive your invoice along with your licence key which you will need to activate your 2021 licence.

Please note: BrightPay has not been released yet. We will send you another email once the software is available to download and install.

New improved ‘working from home’ functionality (Coming 2021)

BrightPay 2021 in tandem with BrightPay Connect will allow for completely seamless ‘working from home’ process where there are multiple individuals who work on or require access to the same employer files. This new functionality improves the remote working experience, giving you all the benefits of the cloud while utilising the power and responsiveness of your local device.

Payroll in a Pandemic - Make sure your practice isn't left behind

Accountants and payroll bureaus are urged to plan and prepare for the upcoming challenges COVID-19 brings to their payroll services. Now is the time to plan and future-proof your payroll bureau for survival. This guide highlights practical tips to ensure COVID-19 doesn’t affect your payroll performance.