Aug 2021

12

7 reasons why you should process payroll in-house

When we weigh up the pros and cons of outsourcing versus in-house payroll, you can see there are many benefits that your business can gain by making the switch to bringing payroll in-house. Internal staff resources can be reassigned to payroll processing to help mitigate the monetary impact of the pandemic on your business's outgoings.

Processing payroll in-house can offer financial rewards and provide several added benefits including:

- Reduced business overheads and potential cost savings

- Increased control over payroll reporting

- Internal flexibility over payroll scheduling and last-minute changes

- Minimal reduction in workload

- Streamlined HR and annual leave processes

- Self-service online access for employees

- Increased accurate reporting through API integration with accounting and bookkeeping software

Although there are some benefits to outsourcing your payroll, you can get the best of both scenarios when you choose the right payroll software.

Having the right provider for your business is crucial and can mean the difference between a laborious payroll process that you dread every pay period, and a quick and easy payroll that you hardly think about at all. But finding the right one isn’t necessarily as easy as it seems. There are so many payroll software providers today that sifting through them can be overwhelming. To make it easier for you, we have summarised the key reasons why you should use BrightPay.

Is BrightPay the right in-house payroll software for your business? If you’re thinking about bringing payroll in-house, now could be the right time to make that transition. Get in touch and book a free 15-minute online demo.

Related articles:

Jul 2021

26

Going paperless: how an employee app can help

COVID-19 has accelerated the move to paperless systems for businesses all over the world. In retail we saw outlets curtailing the use of cash due to fear of spreading the virus; causing payment habits to evolve faster than ever. With more of us working remotely, the office has also seen rapid innovation and it has become crucial that businesses digitalise their paper forms. While some of us may have found the move to digital difficult at first, many of us are now used to it and can easily visualise a future where paper is no longer needed in the workplace. The pros of a paperless workplace far outweigh the cons and it has the ability to revolutionise the way we work.

The move to paperless is nothing new in the world of payroll processing. Going back to a time where payroll was done manually and without the help of software is unimaginable to most payroll processers. However, if you are still using paper anywhere in your workflow, it’s time to make the change.

BrightPay Connect is a cloud add-on to our payroll software that can help you to digitalise payroll and HR processes, allowing you to cut down on your use of paper and even stop using it altogether. So how can BrightPay Connect help you achieve this?

BrightPay Connect digitalises the following tasks:

- Sharing documents with employees such as contracts of employment, staff handbooks etc.

- Distributing payslips to employees

- Annual leave management

What are the benefits of digitalizing payroll processes?

1. Your company can save money

Surveys have found that the average amount spent by businesses on printing is over €800 per employee. With 30% of print jobs not even being picked up from the printer and 50% of print jobs ending up in the bin within 24 hours, businesses are essentially throwing money away. A document such as a staff handbook can be as long as 100 pages. Say you have 40 employees, that adds up to 4000 pages and a lot of money being spent on paper and ink. Sharing the staff handbook through a cloud portal cuts out this cost altogether.

2. It is more convenient for you and your employees

With BrightPay Connect, staff have the ability to access important documents through the employee self-service app on their phone. This means they no longer have to store physical documents that can often be lost or get thrown away. It also means that if you would like to update or change any of the information in the document, it is easy to do so. Once the document has been updated, employees will receive a push notification to let them know the newly updated document is ready to be viewed.

Sharing a document online with a few clicks of a mouse is far more convenient than having to print off, sort through and physically distribute reams of paper. It also doesn’t matter where an employee is; in the office, working from home, or even travelling abroad, everyone will have access to the document at the same time.

3. You can save yourself hours of time

Paper-based processes are notoriously slow and are more prone to error which can end up taking you hours to correct. One way you can save time with BrightPay Connect is by digitalising your annual leave management processes. Instead of having employees submit paper forms, the employee can request leave wherever or whenever suits them; be it from their desk or even in their own time through the BrightPay Connect mobile or tablet app.

Once a request for leave has been made, the relevant manager will receive a notification on their own BrightPay Connect dashboard. From the dashboard, employers can either approve or deny the leave request. Through your dashboard, you can view a real-time, company-wide calendar where you can see which employees are on leave, when they are on leave and the type of leave, saving you hours of time when dealing with annual leave requests.

4. It improves accountability

Another great benefit of using BrightPay Connect's online document sharing feature instead of paper is that it allows for accountability. From the employer dashboard, users have the ability to track who has read the documents which have been shared with them and who hasn’t. When it comes to managing annual leave through BrightPay Connect, you can assign users to manage requests from specific employees. You also will have a record of who has requested leave, when, and who has dealt with the request.

5. It improves security

Employee documents, especially payslips, are highly confidential documents which contain sensitive personal information. It is the responsibility of the employer to ensure that the employees' information is kept safe and secure. If you are still sharing paper payslips with employees, you are leaving them at high risk of a data breach. In the BrightPay Connect mobile app, employees will receive an email and a push notification when their latest payslip becomes available to be viewed or downloaded. From the app, employees can also view and download all historic payslips. BrightPay Connect uses a design structure that maximises security. Each user will have their own login details and unique password. BrightPay Connect utilises the Microsoft Azure platform, keeping the employee’s personal information secure.

6. It helps you stay ahead of the competition

Technology is always evolving and by not moving from manual paper processes to digital ones, you are at risk of being left behind by the competition. Companies are having to continuously innovate to keep up with customers' expectations and payroll is no different. The digital transformation has changed employees’ expectations. To attract and retain top talent, employers need to replace old manual processes with digital solutions. In a recent employee survey, 91% of employees said they want digital solutions and 88% think that technology is a vital part of the employee experience.

7. You are helping the environment

Lastly, the biggest advantage of going paperless is that you are helping to save the environment. By curtailing the use of paper in the workplace not only are you saving trees, but you are also helping to reduce pollution, save water and cut down on the use of fossil fuels which are used to make ink. Turning a single tree into 17 reams of paper releases around 110 lbs of C02 into the atmosphere. It has become the responsibility of businesses to cut down on carbon emissions and going paperless is the first step you can take.

It is becoming increasingly important for businesses to make more environmentally friendly choices. BrightPay recently conducted a survey of our UK customers and over 70% of respondents said that they would like to make more environmentally friendly decisions for their business. From the same survey, 43% said that it was either extremely important or very important for them to choose suppliers who make a conscious effort to reduce the impact they have on the environment.

Read about our own sustainability efforts here.

Why not book a free online demo of BrightPay Connect today and find out more about its benefits and how it can help your business go paperless.

Related articles:

Mar 2021

30

How does the TWSS Reconciliation affect me?

Are you wondering why you now owe Revenue money as a result of The Temporary Wage Subsidy Scheme (TWSS)?

For the first 6 weeks of the TWSS back in March 2020, during the transitional phase, Revenue refunded a flat rate of €410 per employee per pay period, regardless of the employees' earnings. In a lot of cases this €410 exceeded the subsidy that the employee was entitled to receive, and it was made very clear from the start that there would be a reconciliation to rectify this overpayment.

The scheme was designed to assist employers and employees impacted by COVID-19, and to encourage companies to keep their workers on the payroll. If you didn’t avail of the TWSS then you won’t have a TWSS reconciliation.

On Monday 22nd March 2021, Revenue advised that most employers can now access their TWSS reconciliation balances in Revenue’s Online Service (ROS). The reconciliation balance is based on the actual information provided to Revenue by the employer.

The TWSS reconciliation period opened on 22 March 2021 and employers have until the end of June to review and accept the reconciliation amounts. Revenue are strongly recommending that employers take the time to read & understand the guidance before accepting the reconciliation amounts.

Approximately 40% of the employers that availed of TWSS are balanced. Revenue have said they will not pursue companies that owe a balance of under €500 as they will be considered balanced.

BrightPay hosted a TWSS reconciliation webinar with guest speakers from Revenue on 24th March 2021. During the webinar, we discussed the reconciliation process and had a Questions & Answers session at the end. Watch the webinar on-demand now.

You can also click here to register for our next webinar, which takes place on 21st April 2021

Related Articles:

Jan 2021

26

Lockdown 3.0 - What have payroll processors learned?

Lockdown hasn't been easy for any of us - you could say it's been a bit of a 'coronacoaster'. COVID-19 has made us realise what’s important to us. Whether that be connecting more with family or re-connecting with old friends through the social platforms we are so grateful to have during this time. As we are currently in lockdown 3.0, let's look back on some of the key lessons learned as a payroll processor over the past year during this time of crisis.

Importance of Remote Access

Payroll is one of the core functions of running any business, and so it is something that needs to be completed on time and without errors. When working from home, your staff might not be able to access all the tools and documents that they would normally be able to access, especially if your systems are on-premises solutions and files and documents are physical hard copies.

Due to COVID-19 and having to work remotely from home, it is now a necessity to be able to access your payroll data from home. Your payroll software should easily facilitate remote working with additional user access. BrightPay can be installed on up to 10 PCs per licence key, and this means that payroll processing is possible by up to 10 users, or from 10 different locations. This is very handy for if you have a number of employees working from home, all needing access to the payroll software.

We have also introduced new multi-user features that work in conjunction with BrightPay Connect, our optional cloud add-on, to improve the working from home experience. These new features include ‘version checking’ when opening an employer, and an ‘other users check’ when opening an employer. This new "working from home" integration gives you all the benefits of the cloud while utilising the power and responsiveness of your local device.

Importance of Reliable Software

The past year has been very frustrating for payroll processors. Not only had you the added workload of processing subsidy claims, but you also had to learn about the various schemes and ensure you kept up to date with the latest guidelines. That’s why it’s so important to use reliable payroll software from a reliable company.

We kept BrightPay up to date to cater for the relevant scheme changes, and we tried to automate as much as possible in the payroll software to make your life easier.

In a recent survey, we achieved a 98.7% rating for our overall handling of COVID-19 including customer support, payroll upgrades, COVID-19 webinars and online support. We also won a COVID-19 Hero Award, and this is because of our response to COVID-19 and how we have helped our customers throughout the past few months.

Importance of Cloud Backups

As most businesses are now working remotely for the foreseeable future, it leaves many businesses exposed to data loss. This is why cloud backups are so important.

If you only keep your payroll data on your desktop, you are at risk of losing the information. Have you thought about what would happen if your computer broke down or was hacked? How would you get your payroll data back quickly? Would employees still get paid if the information was lost?

BrightPay Connect is our optional add-on that works alongside the payroll software. BrightPay Connect provides a secure and user-friendly way to automatically backup and restore your payroll data on your PC to and from the cloud. It’s simply an added layer of data protection to keep your payroll data safe so you never lose your payroll data again.

Importance of Automation

Whether you’re an employer processing payroll in-house for your business, or an accountant or bureau processing payroll for a number of clients, automation is key. How much time do you spend managing annual leave, answering employee leave balance enquiries, retrieving lost payslips, and communicating with employees in general? Now is the time to eliminate those admin-heavy tasks!

Self-service online portals are changing the way businesses interact and communicate with their employees, whilst providing the cloud functionality to get things done smarter and faster. BrightPay Connect includes the ability to manage employee leave, communicate with employees, automate payslip distribution, run payroll reports and much more.

Book a demo of BrightPay Connect today to discover more features that can help you streamline your payroll and HR processes.

Dec 2020

18

Why not add some sparkle to Christmas with the perfect cloud solution

What springs to mind when you hear the word ‘cloud’ will vary from person to person. Some will think of the weather as they look, grumbling, out their front window. But others will be thinking about all that extra storage on their iPhone. The meaning of the word has changed in recent times and most of us will now think the latter. But what about those who haven’t a notion what you’re on about? What is the cloud?

The cloud is a general term for any computing service that involves hosting over the internet to deliver computing services in lieu of a hard drive. Services such as storage, payroll and HR information. The other key feature is that you can access these services or information anytime, anywhere from any device that is connected to the internet. In fact, you’re already using cloud services if you use social media, Google Drive and Dropbox to name but a few. And now the cloud has become a must-have for any business who wishes to keep up with the times.

I can hear some of you now: “It sounds great, but my employees would never use something like that”. Well, that’s where you’re wrong. A recent survey found that 48% of people believe technological advances will change the face of the workplace and a massive 87% of those said they would be happy to adapt to technological changes if the right tools were given to them. Wow! So how do I know which cloud platform to choose for my business?

I’m glad you asked! Our experts got together for a brainstorming session and found that there are four key things to look out for when choosing the right cloud platform for your business - cost, compliance, simplicity and connection.

- Cost - Your upfront costs should be minimised – using the cloud shouldn’t be an expensive luxury reserved for big corporations. Make sure it provides the option of having multiple users so you can delegate and give access to various people to manage payroll tasks and HR requests on your behalf.

- Compliance - Make sure it takes into account your obligations as an employer with regards to things like the GDPR legislation and record-keeping requirements. A good platform will have compliance built-in as standard and will manage it seamlessly.

- Simplicity - The most important thing to increase the uptake of a cloud platform is to make sure it is user-friendly and reduces the chance of human error. Look out for simplistic interfaces and whether or not training and support are available. The best of the best will offer this support for free. You should also be able to get set up and ready to go with minimal disruption to your business.

- Connection - Make sure it offers features that are attractive to employees such as a downloadable app, a self-service portal and company-wide communication features. Because at the end of the day, your employees won’t give a damn about how excited you might be about something unless it works for them too. These features tie in with our ever-increasing digitally-minded workforce and will make them feel more in control and engaged.

So, there you have it… off you go now! Good luck scouring through the internet trying to find the perfect cloud platform. But…., well, ....it is Christmas after all and I’m feeling generous. Ah, what the heck, I’ll just let you in on a secret which is the best cloud payroll platform for businesses out there: our very own BrightPay Connect.

BrightPay Connect is an add-on to BrightPay’s award-winning payroll software and ticks literally every single box I just mentioned over the course of this post. I’ve done enough talking so instead let me show you. Book a demo today to find out why BrightPay Connect is the perfect fit for your business.

Merry Christmas everyone! Don’t say I didn’t get you anything!

Dec 2020

15

What's New in BrightPay 2021?

BrightPay 2021 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2021 Tax Year Updates

- 2021 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and ASC.

- Support for the Employment Wage Subsidy Scheme (EWSS) continues to be available in the 2021 tax year. The Temporary COVID-19 Wage Subsidy Scheme (TWSS) concluded in 2020 and is no longer available.

- Support for retrieving and using 2021 Revenue Payroll Notifications (RPN).

- Support for creating and sending 2021 Payroll Submission Requests (PSR).

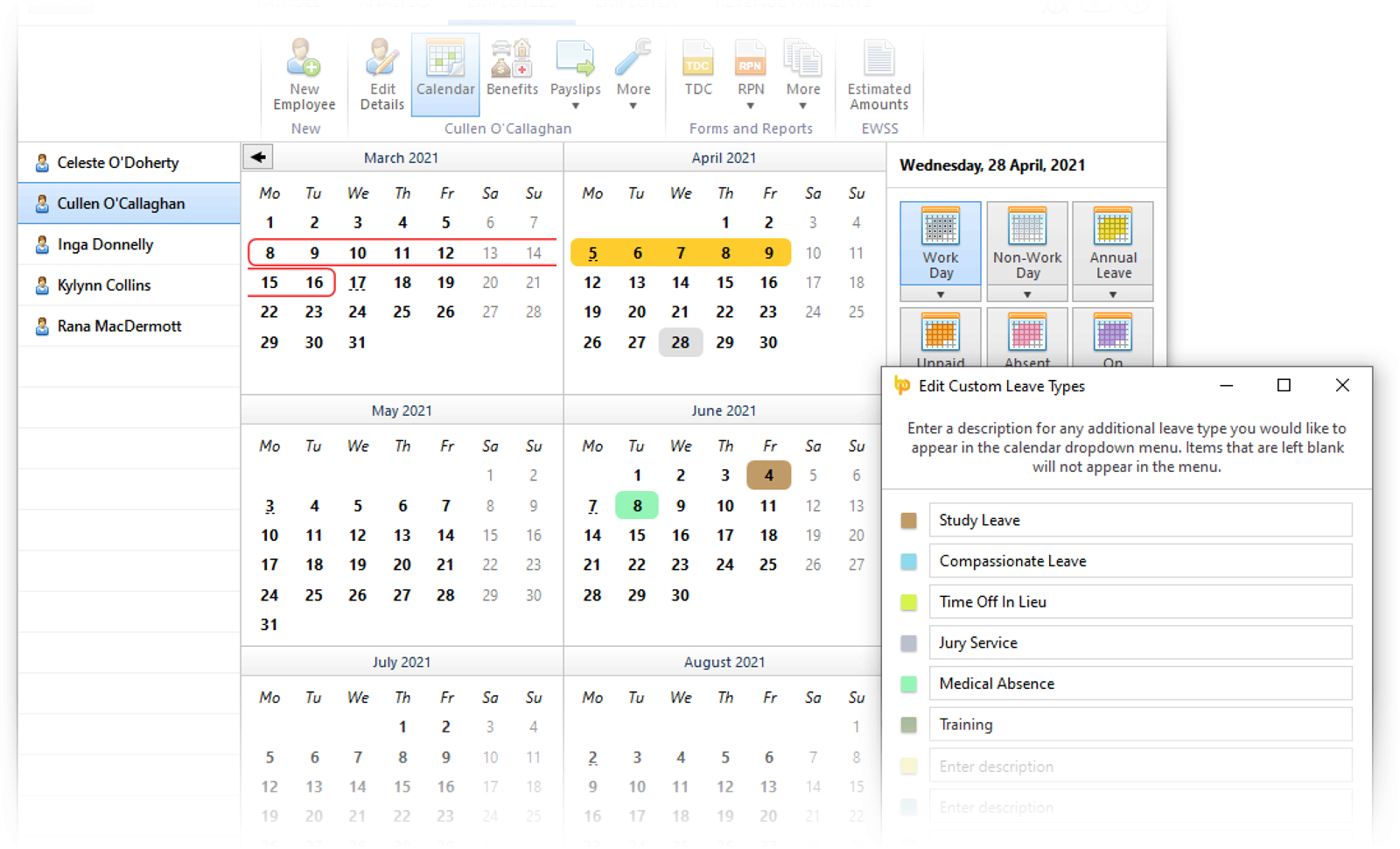

Define and Set Custom Leave Types on Employee Calendar

- You can now define up to nine additional custom types of employee leave. Six of the custom types are set up with default descriptions, which you can edit, add to, or remove as need be.

- Custom leave types act like the existing built-in kinds of leave, in that they are mutually exclusive and can only be applied to working days. They can be set on a per-employee basis, or batch set for multiple employees at once.

- Custom leave types also appear on the employer calendar. Mouse-hover tooltips have been added to the various views of the employer calendar to help determine what each colour indicates where it's not clear.

- A new Calendar Report (which replaces the previous Print Calendar functionality) gives you the power and flexibility to create and/or share a customised report of employee leave that can be filtered by type of leave, and presented individually for each employee, or as a summary containing multiple employees.

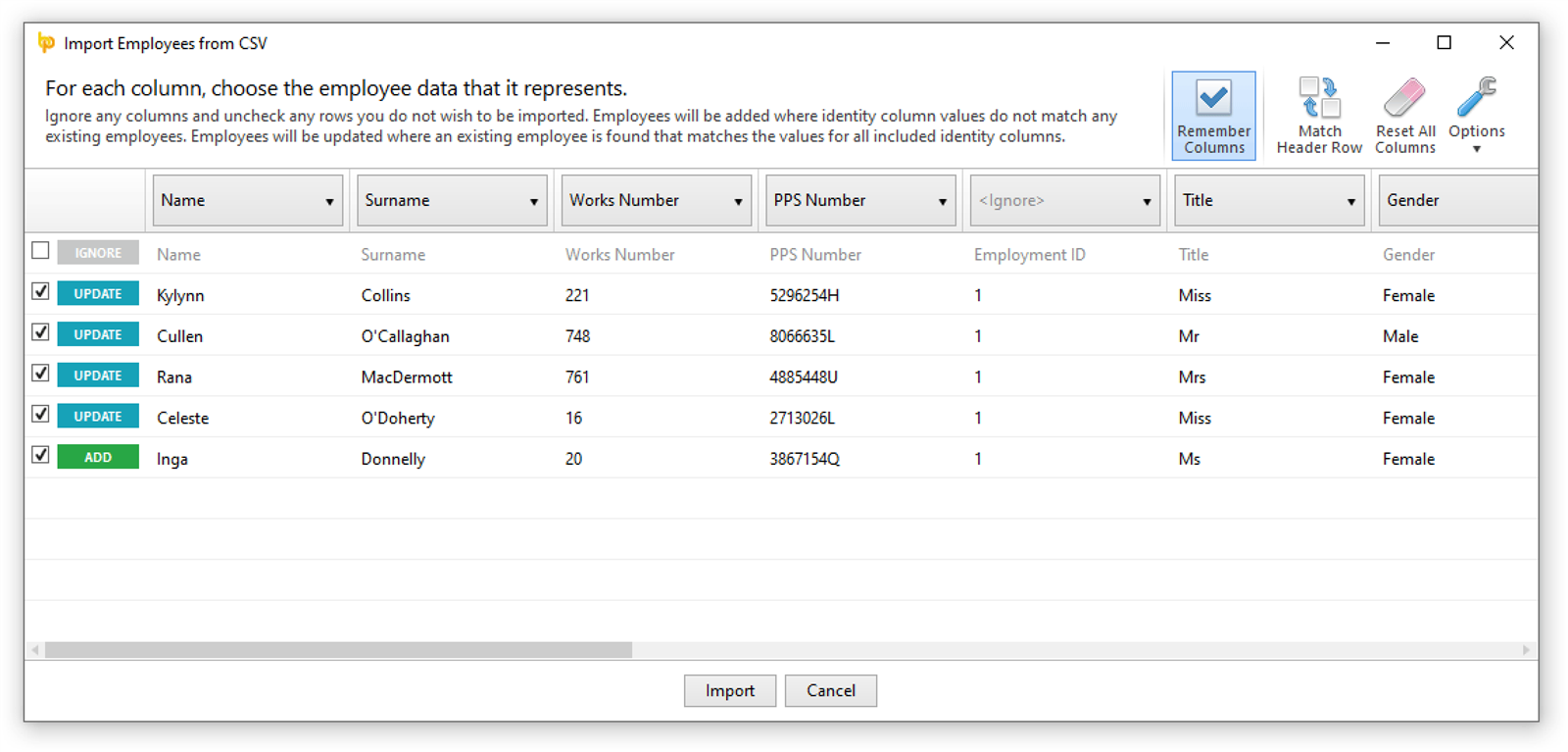

Update Employees from CSV File

BrightPay has traditionally only allowed new employees to be added from a CSV file. Now, you can both add new employees and update existing employees from a CSV file.

BrightPay Connect

- Supports two-factor authentication sign in.

- When you open an employer in BrightPay, and your version of file is older than the version in Connect (i.e. that you or a colleague synchronised to Connect from another computer), you will be immediately prompted to download the latest version.

- When you open an employer in BrightPay that a colleague is currently already working on on another computer, you will be immediately notified in BrightPay (and given the option to be told when the employer is free to work on again).

Other 2021 Updates in BrightPay

- Annual leave entitlement calculations now include 'upcoming booked annual leave days', which can optionally be included on reports and payslips.

- When zero-ising payslips, new options to set amount to zero, or remove items altogether.

- When importing payments from CSV, any lines which failed to import (e.g. due to not matching an employee pay record, or due to the matching pay record being already finalised) are now clearly indicated in the response dialog (instead of the previously unhelpful 'X of Y succeeded' message).

- Public holidays on employee calendar are now shown with a dotted text underline (rather than appearing as if they were non-working days by default).

- Shows RPN “date/time downloaded” in RPN details view.

- Ability to preview CSO EHECS report in a printable/shareable format.

- New CSO columns in analysis.

- Ability to import saved reports from another BrightPay data file into the currently open file.

- Allows one of the added emergency contacts for an employee to be set as the 'primary' contact. New analysis columns (and a new report) for emergency contact details have been added.

- Ability to import hourly/daily payments by rate code

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Dec 2020

10

This Feature Will Make You Want To Move To BrightPay Today

When trying to find the right payroll software provider, it can be overwhelming. There are so many choices available today that you may have trouble simply distinguishing one provider from another. What’s more, the payroll industry jargon used can baffle and confuse. It’s really no wonder that many people find this a tedious and frustrating process.

The good news is that BrightPay is here to make this the easiest decision you’ve ever made. Our payroll software has won multiple awards, is used by over 300,000 businesses across Ireland and the UK, and has received and maintained an industry-leading 99% customer satisfaction rating. And if all of this wasn’t enough to sway you, then our cloud portal add-on, BrightPay Connect and its document upload feature certainly will.

BrightPay Connect combines automated payroll functionality with innovative human resources features, for a holistic approach to modernisation. It harnesses the latest advances in cloud technology to offer practical solutions to the most common challenges faced by businesses everyday. Its document upload feature is the perfect solution to many of those challenges, and it’s why BrightPay Connect is the best choice for your business.

Document Upload With BrightPay Connect

BrightPay Connect’s document upload feature is one of the best ways to modernise a number of different elements of your business, including payroll, all at once. It was specifically designed to simplify the day-to-day running of a business in a way that benefits both employers and employees. Here are just some examples of how our cloud portal does just that.

Increased GDPR Compliance

Data protection has been a top priority for businesses of all industries since the GDPR came into effect in May 2018. The regulation sets out a list of measures that businesses must take in order to protect the personal data of their employees and customers. For many businesses, complying with these requirements has relied upon making significant changes to how they manage their human resources.

The document upload facility in BrightPay Connect can increase your GDPR compliance dramatically by allowing you to store all employee personnel files in the cloud. This means that they can’t get lost or damaged, and that they’re stored securely, out of sight of anyone else who shouldn’t have access to them.

Improved Internal Communication

Internal communication is vital for any thriving business, especially as remote working is becoming increasingly common. Sharing documents with employees is essential to a streamlined workflow and efficient processes. However, it can be a lot more challenging than expected, particularly as staff numbers grow and more and more people are working remotely. BrightPay Connect’s document upload feature is the perfect answer to this problem.

Employers and managers can upload any document to Connect. Employees can then access these documents from their employee self-service dashboard, or their employee smartphone and tablet app. What makes the feature even more useful is the fact that whoever is uploading the document can choose to make it accessible to an individual employee, a team or department, or the entire organisation.

Employer Protection

Finally, the document upload feature in BrightPay Connect offers employers an added layer of protection when it comes to ensuring that employees adhere to company policies. This is because, as well as choosing who does and doesn’t have access to the uploaded documents, employers can also view a time-stamped log of who has read the document and when.

This means that, for example, if an employee was in breach of a company policy and claimed that they had never seen nor read the policy in question, the employer can simply check the time-stamped log on BrightPay Connect to find the date and time that they accessed the policy.

Book Your Free BrightPay Connect Demo

Need a little more information before deciding if BrightPay Connect is right for you? Book your free demo today and let one of our Connect experts help you make the right choice for your business. They’ll show you all of its features, functionalities and explain the real-life, tangible benefits that they bring.

Oct 2020

14

Revenue Start Compliance Checks and TWSS Reconciliation

The Temporary Wage Subsidy Scheme – also known as TWSS, was in operation since 26th March, and it ended on 31st August. The subsidy was processed through the payroll as a non-taxable addition, and instead, the subsidy will be taxable and USC-able via an end of year review by Revenue.

Employees will be taxed via a reduction in tax credits and cut off points from 2022. Revenue have confirmed that the liability will be collected over 4 years to avoid hardship. Employees will have the opportunity to pay it in full before then if they wish.

Reconciliation Process Stage One

There are two stages to the TWSS Reconciliation process. For stage one, employers are required to report the actual subsidy that they paid to employees on each pay date.

BrightPay makes it easy to create these TWSS CSV Reconciliation files within the 'Employees' section of the payroll software. The CSV file can then be uploaded in the Employer Services section on ROS, as per Revenue's requirements. This file must be uploaded to ROS by 31st October. If you do not provide this data about payments to your employees, Revenue will recoup the total temporary wage subsidy paid and related interest charges.

Stage Two of the Reconciliation Process

Stage two of the reconciliation process is due to commence later this month, and during this stage, the total subsidy payable amounts will be compared against the subsidy amounts paid to the employer. Revenue will then determine the amount of TWSS, if any, owing back to Revenue from employers.

A Statement of Account will be sent to your ROS inbox. You will either be paid any additional amount due to you by Revenue or be required to repay any amount that you owe to Revenue.

In some cases, an employer may decide, or Revenue may instruct the employer, to repay to Revenue some or all the subsidy refund payment received from Revenue. Employers can repay excess subsidy values to Revenue via a new facility within ROS, this can be done under Payments & Refunds by selecting ’Submit a Payment’ and then TWSS (Employer). Customers should no longer use the Revenue bank account details previously provided for repayments of TWSS.

Only subsidy amounts should be repaid to Revenue through this method - Do not include any repayments in respect of income tax and USC through this RevPay facility. This should be done separately under PAYE EMP to ensure that the payment is correctly reflected on the employers PAYE EMP balance.

TWSS Compliance Check Programme

To ensure that the TWSS was operated correctly, Revenue are conducting a programme of compliance checks on all employers who availed of the scheme at any stage. Letters are being issued to employers and tax agents. Revenue were previously sending these to certain employers/agents via MyEnquiries. Since the start of October, Revenue have started sending them direct to the main ROS inbox, along with all other correspondence, so there’s a greater chance that they could be missed.

The letter will set out the steps that employers need to take to verify their compliance with the regulations of the TWSS.

Employers will need to confirm:

- That they have met the eligibility criteria (e.g. details of the negative impact suffered, business closure dates, evidence of meeting 25% reduction in turnover)

- That employees received the correct amount of subsidy

- That the subsidy was recorded correctly on the payslips (e.g. copies of payslips)

At this point employers are not expected to provide detailed documentation to prove that they have met the employer eligibility criteria but based on the summary provided, Revenue may look for more detailed information in some cases.

What to do if you receive a letter

If you receive such a letter, please note that there is a 5-day time limit to respond to the Revenue’s request. It is essential that employers respond promptly as failure to do so will lead to immediate escalation. Therefore, it is important that employers keep an eye on both the ROS inbox and MyEnquiries or the letter.

This Revenue compliance check is not part of an audit or intervention. Instead, it is a request for information to provide assurance that the scheme was operated as intended by employers.

In addition, the compliance check programme will address any issues identified in respect of the operation of PAYE Modernisation by employers over 2019 and 2020. It will also provide an opportunity for employers to address any other outstanding tax issues that they may have.

For the latest payroll updates don’t miss our next free webinar, where we are joined by Revenue.

Webinar: Wage Subsidy Scheme with Revenue

10.30am | 19th November

Webinar Agenda

- TWSS Reconciliation

- Employment Wage Subsidy Scheme - Key Points

- Employer & Employee Eligibility Criteria

- Operation of Payroll & Processing of Subsidy Claims

- Operating EWSS with BrightPay & Thesaurus Payroll Manager

- Q&A Panel Discussion

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Related Articles:

BrightPay COVID-19 Resource Hub

Blog: Customer update October 2020

On-demand COVID-19 Webinars

Sep 2020

30

Is BrightPay the right fit for your business?

As we approach the final few months of 2020, many employers are wondering if their current payroll software is the right fit for their business. Having the right provider for your business is crucial and can mean the difference between a laborious payroll process that you dread every pay period, and a quick and easy payroll that you hardly think about at all.

The key to making the right choice for your business is finding out what options are available, and then exploring whether or not they can make your life easier.

But finding the right one isn’t necessarily as easy as it seems. There are so many payroll software providers today that sifting through them can be overwhelming. To make it easier for you, we have summarised the key reasons why you should switch to BrightPay today.

Book a demo today to discover more about BrightPay or read on to find out more.

8 Reasons to Switch to BrightPay Today

- At the forefront for COVID-19...

With the Temporary Wage Subsidy Scheme and the Employment Wage Subsidy Scheme being processed through payroll software, our development and support teams have been working hard to provide a quick response with ample payroll upgrades. We have been at the forefront for our customers both with product upgrades and expert guidance - over the past few months we’ve hosted 32 informative free COVID-19 webinars, with a massive 25,000 attendees. - Revenue compliant payroll software...

BrightPay includes full functionality for PAYE Modernisation and is Revenue compliant. BrightPay not only ensures you are kept fully compliant with the new requirements, but makes it really clear and easy. Retrieve Revenue Payroll Notifications (RPNs) each pay period and update employees as required. Seamlessly submit payroll submissions (PSRs) to Revenue each pay period. - Payroll software you can trust...

BrightPay is created by Thesaurus Software – the number one payroll software provider in Ireland. With over 25 years’ developing payroll software, our products are trusted by over 320,000 businesses across Ireland and the UK. With a 99% customer satisfaction rate, it’s no surprise that BrightPay won Payroll Software of the Year awards in both 2018 & 2019. - Supporting you when you need it most...

We're here to help you every step of the way with FREE phone and email support. We also have a whole range of step-by-step guides and video tutorials available on our website. Not only do our team of experts offer product advice, but we also run free online webinars and distribute free eBooks regarding legislative updates and changes. Whether it’s PAYE Modernisation, GDPR, Employment Legislation or COVID-19 Wage Subsidy Schemes, you will always be kept one step ahead. - It’s easy to get up and running...

BrightPay installation is quick and simple, with the ability to import employees from RPN, CSV, Thesaurus Payroll Manager or from many other payroll software packages. Start at the beginning of the tax year, start in the middle of the tax year, or continue partway in the tax year from migrated payroll records. Better still, our designated migration team are at hand if you require assistance with getting up and running. - Online access anywhere, anytime...

With our BrightPay Connect optional add-on, you can access a whole range of payroll and HR features anywhere anytime. As well as the peace of mind of having your payroll data automatically backed up to the cloud, you will also have access to a secure online employer dashboard. Access employee payslips, run payroll reports, view amounts due to Revenue, manage your employees’ leave, upload and distribute HR documents, send notifications to employees and much more. - Improve employee satisfaction...

BrightPay Connect also enables you to invite employees to their own online employee self-service portal which is accessible through a free Android and iOS app. Employees can access a payslip library, view payroll & HR documents, update their personal contact details, get notifications from their employer or manager, view their leave calendar and leave balance remaining, and request leave on the go, directly from their smartphone or tablet. Click here to discover how the employee app can improve employee satisfaction. - Cost-effective solution with a 60-day free trial...

BrightPay's 60 day free trial is a great way for you to discover just how easy BrightPay is to use without having to make any commitment. The trial version has full functionality with no limitations on any of the features. You can submit PSRs to Revenue, retrieve up-to-date RPNs, email payslips and much more. There is no obligation to buy. We will not ask you for any credit card details or get you to sign any contract. Should you decide to purchase BrightPay, our pricing structure is simple and straightforward with no hidden charges, in-year upgrade charges or additional charges for customer support.

But don’t just take our word for it. Have a read of our customer testimonials to see why 99% of customers would recommend BrightPay. Book a free online demo of BrightPay, and a member of our team can talk you through what your business’s payroll needs are, why your current provider isn’t meeting those needs, and explore whether or not BrightPay is the right choice for you and your business.

Sep 2020

10

Remote Working Is Becoming The New Normal - Here's What That Means For Payroll

2020 has been a transformative year for most businesses. Many employers have had to take a long hard look at how they manage their employees and make significant changes in the wake of COVID-19 in order to adapt to what is quickly becoming the new normal. For a large proportion of these businesses, allowing employees to work remotely is playing a central role in that change. And this throws up some challenges.

Remote working isn’t a new phenomenon. Cloud innovations have made it possible for people to work from home for many years. However, most businesses have been reluctant to embrace this practice up until now. This is because, when employees are spread out, even the most basic tasks such as distributing payslips, applying for annual leave and internal communication can be more difficult.

Today, however, employers are finding themselves in a position where they must allow employees to work remotely and find clever solutions to these challenges. And BrightPay Connect is one such solution that makes remote working easier for everyone.

How Does Remote Working Affect Payroll and HR?

You might not think that remote working has any impact on processing payroll, especially if you’re a small business with just one payroll administrator. But there are a number of ways that remote working can indirectly impact payroll. It also has numerous knock-on effects on human resources management which need to be addressed in order for a business to thrive.

Here are some examples of the payroll and HR challenges presented by remote working:

- Distributing payslips manually can be more time-consuming, costly and less secure when employees are not located in the workplace, and instead payslips must be posted to their home addresses.

- Making sure that the payroll and any employee leave during that particular pay period are aligned can be tricky, especially if a number of different line managers and/or HR staff are operating from different locations.

- Checking that the information for the current pay period is accurate can be challenging with employers and managers working from home with often unreliable internet connections.

BrightPay Connect Makes Remote Working Easier

BrightPay Connect is a cloud portal add-on to our payroll software. While the payroll software gives you everything you need to process your payroll, BrightPay Connect offers a range of additional features that streamline your human resource management.

The features of BrightPay Connect include:

- An employee self-service app that’s compatible with both iOS and Android. On the app employees can apply for leave, view and edit their personal data, access a secure payslip library and view HR documents, all from their smartphone or tablet.

- An online employer dashboard. Because payroll information is stored online with BrightPay Connect, employers can access their dashboard from their laptops at home. On this dashboard, employers can view a company calendar which displays all past and upcoming employee leave, upload and share documents with employees, and view any outstanding payments due to Revenue. The employer dashboard also shows notifications for any employee leave requests, or requests from the payroll processor.

- Automatic cloud backups. With BrightPay Connect, you don’t need to worry about safely storing your data. BrightPay Connect automatically backs up the payroll data to the cloud and keeps a chronological history of all backups so that you can restore previous versions if needed. This is a great step towards GDPR compliance for businesses who are trying to modernise their data protection practices. The cloud backup is also extremely useful for remote working because everything is stored and accessible via the cloud from any location.

- Clever employee leave management. Employees can request leave directly from their smartphone app. This is beneficial to remote employees because it eliminates the need for employees to visit their line manager or human resources manager in order to fill out leave request paperwork. The request instantly appears as a notification on their manager’s online dashboard. From here, the manager can use the company calendar to see who else is on leave for the dates requested, and either approve or deny the leave request. A time-stamped log of all leave requests is maintained which is particularly useful when a number of different people are managing employee leave as all of the relevant parties can easily see who approved or denied a request, and when.

- Requests for payroll data. Whether you are a payroll bureau processing payroll for a number of clients, or an in-house payroll administrator looking for payroll information from various departmental managers, BrightPay Connect’s payroll entry requests feature can be extremely beneficial when working remotely. You can send a request to your clients or to in-house managers requesting information regarding the employee’s hours and payment information for that particular pay period. Once the payroll information has been entered or uploaded, you will receive a notification on your employer dashboard and can synchronise the information directly to the payroll software. As well as eliminating the need for double entry of payroll information, it also frees up time spent chasing the various managers for the employee timesheets, especially if they are working remotely.

Book Your Free BrightPay Connect Demo Now

If your business is embracing remote working and trying to find ways to facilitate this new practice, then book your free BrightPay Connect demo today and let our team of experts show you just how much easier remote working can be.