Jul 2017

24

GDPR - What businesses need to know

Data protection and how personal data is managed is changing forever. On 25 May 2018 the new General Data Protection Regulation (GDPR) will come into force. The GDPR is a European privacy regulation replacing all existing data protection regulations.

The current data protection legislation in Ireland dates back to 1998 and 2003, predating current levels of internet usage and cloud technology, making it unsuitable for today’s digital economy.

The GDPR will apply to any personal data of EU cititzens, regardless of whether it is stored within or outside the EU. Most, if not all companies, process a level of personal data, whether it is customer details or employee details, therefore businesses need to be aware and plan for the new legislation.

What is Personal Data

The GDPR substantially expands the definition of personal data. Under GDPR, personal data is any information related to a person, for example a name, a photo, an email address, bank details, their personnel file, or a computer IP address.

Key Changes

Some of the key changes included as part of the GDPR include:

Consent must be clear, distinguishable from other matters and provided in an easily accessible form, using clear and plain language. It must be as easy to withdraw consent as it is to give it.

Breach Notifications: where a breach occurs, the Data Protection Commission and affected data subjects must be notified within 72 hours of the breach coming to light.

Data Subjects will have additional rights, including:

- Access Rights: data subjects may obtain from a data controller confirmation as to whether or not personal data concerning them is being processed, where and for what purpose.

- Right to be Forgotten: data subjects will have the right to request that their personal data be erased, or ceased to be processed.

- Data Portability: data subjects will have the right to receive the personal data concerning them, and the right to transmit that data to another controller.

High Penalties

Ignoring the new legislation is ill advised as there are tough new fines for non-compliance. Companies or organisations found to be in breach of the legislation will face fines of up to 4% of annual global revenue or 20 million Euros, whichever is greater. The Data Protection Commissioner is the authority responsible for enforcing data protection obligations in Ireland. In preparation for the legislation, the Commission is doubling it’s workforce, leaving no doubt that they will be taking their new responsibilities extremely seriously.

To Do

If you have yet to start planning for GDPR click here for guidance on how to prepare.

Jul 2017

19

National Minimum Wage Proposed Increase of 30c per hour

The Low Pay Commission has recommended that the National Minimum Wage be increased by 30c per hour, from €9.25 per hour to €9.55 per hour from 1st January 2018. An employee working a 40 hour week will see their gross wage increase by €12.00 a week. Since 2011 this is the fourth increase in the national minimum wage.

In the report the Low Pay Commission has published it has explained with necessary data of its recommendation of the increase, including international competitive and risks to the economy research. In The Low Pay Commission’s findings submissions from interested parties and consultations with employees and employers in relevant economic sectors had taken place.

This increase will affect around 120,000 employees, increasing their national minimum wage by 3%. 10.1% of employees were earning the National Minimum Wage or less last year according to figures published from the Central Statistics Office last April.

While Taoiseach Leo Vardakar said ‘The Government welcomes the recommendation from the Low Pay Commission to increase the National Minimum Wage by 30c to €9.55 per hour’, the Programme for Government commitment for a minimum wage of €10.50 per hour is still a few steps off.

Jul 2017

6

Living Wage increased by 20 cent

The 2017 Living Wage has been set at €11.70 per hour, up from €11.50 last year. The new figure represents an increase of 20 cent per hour on the previous rate. The recommended living wage rate is now nearly a third higher than the legally required minimum wage, which is set at €9.25 an hour.

The 20 cent increase in the Living Wage was arrived at upon consideration of a number of changes in the cost of living and the taxation regime in the last year. The Living Wage for the Republic of Ireland was established in 2014, and is updated in July of each year. It is part of a growing international trend to establish an evidence-based hourly income that a full-time worker needs so that they can experience a socially acceptable minimum standard of living.

Jul 2017

3

Revenue moves to PAYE Modernisation / Real Time Reporting

Following the announcement in last October’s Budget 2016, Revenue entered a consultation on the modernisation of the PAYE system.

Revenue’s proposal is that employers will report pay, tax and other deductions at the same time as they process and finalise their payroll. Similar to Real Time Information (RTI) in the UK, details of employees starting or leaving employment will be reported on the date of commencement/cessation and will eliminate the filing of P30, P35 and P45 forms.

Although, many businesses across Ireland have broadly welcomed the forthcoming introduction, some smaller businesses have expressed concern about the additional administrative burden due to poor internet access and the additional hours it may involve. Many businesses will be a risk as they have not invested in payroll software where they calculate their payroll manually.

Last April Revenue disclosed that it received 77 submissions to the consultation which represented a broad range of interests, both from large and small companies. For larger employers, the transition will be relatively straightforward, but Revenue is looking at alternatives to accommodate smaller employers, in particular, those who may still process their payroll manually.

IBEC state that while most of its members welcome the change, it is important that the system is flexible. A professional services group also warned that the work involved for employers to prepare for the implementation of PAYE modernisation / Real Time Reporting (RTR) should not be underestimated.

BrightPay already has the experience and expertise in developing the same real time features and functions for our UK customers. We are already collaborating with Revenue to ensure the transition for our customers to Real Time Reporting (RTR) / PAYE modernisation is smooth, user-friendly and ready for implementation in January 2019.

Interested in finding out more about PAYE Modernisation? Register now for our free PAYE Modernisation webinar. Click here to find out more.

Related articles

- PAYE Modernisation - an update

- What is PAYE Modernisation Software

- Revenue moves to PAYE Modernisation / Real Time Reporting

For further information, Revenue have provided the following link:

http://www.revenue.ie/en/corporate/consultations-and-submissions/paye-modernisation/index.aspx

May 2017

30

BrightPay Ireland - Customer Update

PAYE Modernisation - An Update

From 1st January 2019, whenever Irish employers pay their employees, a file must be submitted (electronically) to Revenue containing details of these payments. Unlike the annual P35, this file must be submitted each pay period. Find out more about what direct effects this will have on employers.

BrightPay to discontinue Windows XP support

The technology that BrightPay utilises has been updated and improved. As a result of this improvement, BrightPay will no longer be able to run on Windows XP operating systems. This technological enhancement brings many performance, reliability and security improvements.

Cyber Security - Keep your payroll data safe against Ransomware

Ransomware is when your files are held for ransom. It is a type of malware that essentially takes over a computer and prevents users from accessing their data until such time as a ransom is paid. Learn more about keeping your payroll data safe.

Do you need help with your employee contracts?

Our sister product, Bright Contracts enables you to create tailored, professional contracts of employment and staff handbooks. What was once a very expensive and time-consuming process can now be done on your PC.

Be careful of discrimination in job interviews

When conducting an interview, you may veer off your pre-set questions when building rapport with a candidate and to do a little digging in some areas, however asking the wrong question could leave you at risk of a hefty discrimination claim.

Have you tried BrightPay Cloud?

BrightPay Cloud is an optional cloud and HR add-on which offers an online self-service portal for employees, automatic cloud backup, annual leave management, uploading of employee documents (including contracts and handbooks) and much more.

May 2017

23

BrightPay to discontinue Windows XP support

The technology that BrightPay utilises will be updated and improved from January 2018. As a result of this improvement, BrightPay will no longer be able to run on Windows XP operating systems. This technological enhancement will bring many performance, reliability and security improvements, while also opening up new possibilities for our development team to add further functionality. Users will not notice any obvious difference using BrightPay 2018 compared to previous versions as all the changes will be operating in the background.

Microsoft discontinued support for Windows XP in April 2014. This means that Microsoft are no longer releasing upgrades for these systems. Although Windows XP machines may still work normally, it does mean that these PCs are more vulnerable to security risks and viruses.

If you are still using Windows XP, you should consider upgrading to a newer PC or operating system. Due to the greater security risks, more and more programmes and applications are discontinuing support for Windows XP. Internet Explorer 8 is also no longer supported. If your Windows XP PC is connected to the Internet and you use Internet Explorer 8 to surf the web, you might be exposing your PC to additional threats.

These security threats became a reality for many Windows XP users in recent weeks with more than 200,000 organisations becoming victims of the widespread ransomware attack, WannaCry. This cyber attack affected organisations across the globe, including hospitals, banks and government agencies. The majority of these victims were using outdated or older Windows operating systems, such as Windows XP and Windows Vista.

While we do apologise for any inconvenience this change may cause, it is the best decision for our customers’ security and user experience.

Useful links:

May 2017

15

Keep your payroll data safe against a Ransomware attack

Ransomware, like the name suggests, is when your files are held for ransom. It is a type of malware that essentially takes over a computer and prevents users from accessing their data until such time as a ransom is paid. The ransomware encrypts data on the computer using an encryption key that only the attacker knows. If you want to decrypt them, you have to pay. If the ransom isn’t paid, the data is often lost forever.

A ransomware attack, also known as WannaCry or WeCrypt, recently spread across the globe and is believed to have affected over 200,000 organisations. The cyber-attack struck banks, hospitals and government agencies in more than 150 countries, exploiting known vulnerabilities in Microsoft operating systems.

How to protect against a ransomware attack?

- Think before you click – It is important to look for malicious email messages that are often concealed as emails from companies or people you regularly interact with online. It is important to avoid clicking on links or opening attachments in those messages, since they could unleash malware. However, unlike many other malicious programs, WannaCry has the ability to move around a network by itself. Once the virus is inside an organisation, it will hunt down vulnerable machines and infect them too.

- Keep software up to date – Users should ensure that security updates are installed on their computer as soon as they are released. Last month, the NSA revealed software vulnerabilities in a Windows Server component which allows files to spread within corporate networks. Since then, Microsoft has released software patches for the security holes. Anyone who applied this patch more than likely was not affected by WannaCry. However, not everyone has installed these updates and so these users are susceptible to an attack. It is also important to note that the vulnerability does not exist within Windows 10, but is present in all versions of Windows prior to that, dating back to Windows XP. Support for Windows XP was discontinued in 2014, and so if you are using XP it is recommended to upgrade to a more secure system. It is important to keep all software packages up to date to maximise protection against attacks.

- Keep backups of data files – Users should regularly back up their data, which will make it possible to restore files without paying a ransom. This can be done by saving files to a USB key, external server or a cloud sharing facility such as Dropbox or Google Drive. Individual software packages may also offer a backup facility, enabling you to automatically back up sensitive data, for example BrightPay Cloud allows users to easily backup payroll data.

How can BrightPay Cloud help?

BrightPay Cloud allows employers to automatically and securely backup payroll data to a highly secure cloud server. Payroll data (including payslips, payroll reports etc.) is automatically backed up every 15 minutes ensuring that you will never lose your payroll data if you are the victim of an attack.

You may decide that you only want to use BrightPay Cloud for payroll backups, however, the features listed below can also be availed of.

With BrightPay Cloud, employers can invite their employees to their own self-service portal. Employees can login to their own personal account, be it on their PC, tablet or smartphone, where they can view payroll documents relevant to them, with a full history of payslips and P60s. Employees can also request annual leave and view annual leave remaining through their portal.

Furthermore, BrightPay Cloud provides users with an annual leave management facility and a document upload facility, where all information is stored within the same location. With the document upload, employers can upload employee contracts & staff handbooks, training manuals, employment documents and much more, which can be accessed by employers and employees on any device.

Find out more about BrightPay Cloud with an online demo.

Apr 2017

19

April Customer Update

Sunday Working - what employers need to know

In today’s world, the reality is that many businesses are open on Sundays, requiring employees to work Sundays. Employers of these businesses need to be aware of the additional responsibilities that apply to Sunday working.

Review Thesaurus Software

We work hard to ensure we offer the best payroll software products and knowledgeable customer service that we can. We are currently building our online presence. As part of this, we are looking for our customers to review Thesaurus Software on google reviews. Would you be willing to take a few minutes to provide a review of Thesaurus Software?

Have you tried our latest cloud add-on?

Thesaurus Cloud is our newest optional add-on that offers powerful automatic backup features and annual leave management facilities. Give your client and their employees online access to their payroll data. Discounts are available for bureaus who wish to purchase multiple licences.

Free Webinar - Keeping your Business Compliant with Employment Legislation

Employment regulations in Ireland are constantly changing. Employers need to keep up if they are to remain compliant as getting it wrong can be extremely costly. Our free webinar will peel back the legislation, giving you the key facts you need to know and easy-to-follow tips on how to manage your employer obligations.

Have you tried our sister product, Bright Contracts?

Bright Contracts has everything you need to create and manage up-to-date staff policies and procedures and contracts of employment. Ideal for your own in-house use, or for offering additional services to your clients.

Auto Enrolment for Ireland? Do you offer a pension scheme?

On a number of occasions, Leo Varadkar, the Minister for Social Protection, has mentioned his desire to introduce auto enrolment in Ireland. This will be a welcome and necessary development as it is unlikely that the current levels of state pension will be sustainable in the medium to long term.

Bright Contracts – Employment Contracts and Handbooks.

BrightPay – Payroll & Software.

Mar 2017

31

Important Information for Employers - Changes to Civil Service Travel Rates

Where employees use their own private cars or motorcycles for business purposes, reimbursement in respect of allowable motoring expenses can be effected by way of flat-rate mileage allowances.

There are two types of mileage allowance schemes which are acceptable for tax purposes if an employee bears all the motoring expenses:

- The prevailing schedule of Civil Service rates; or

- Any other schedule with rates not greater than the Civil Service rates

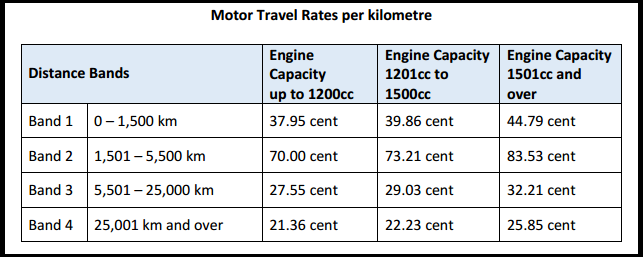

The Department of Public Expenditure and Reform has recently published circulars with new Civil Service Travel Rates, the revised rates are effective from 1st April 2017. The distance bands have increased from two to four with a lower recoupment rate for the first 1,500 kilometres.

Business travel carried out between 1st January and 31st March 2017 will not be affected by these new bands and rates, business travel to date from 1st January 2017 will count towards the cumulative business travel for the year.

Motor Travel Rates - Effective from 1st April 2017

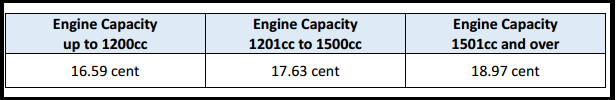

Reduced Motor Travel Rates per kilometre

The reduced rates are payable to Civil Service employees who undertake a journey associated with their job but not solely related to the performance of their duties, such as:

- Attendance at confined promotion competitions

- Attendance at approved courses of education

- Attendance at courses or conferences

- Return visits home at weekends during a period of temporary transfer

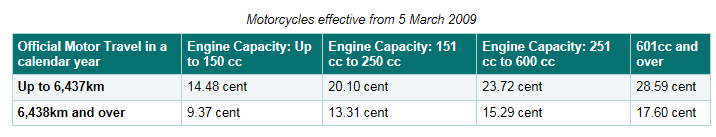

The Motor Travel Rates for motorcycles and bicycles remain unchanged as follows:

Motorcycle:

Bicycle: 8 cent per km

Please note, there are changes to subsistence rates which are also effective from 1st April 2017.

Please click here for the circular on Motor Travel Rates, and here for the circular on Subsistence

Mar 2017

20

New Illness, Maternity and Paternity Benefits rates in effect

Almost all welfare benefits and state pensions are to be increased in 2017.

The maximum weekly Illness Benefit payment will increase by €5.00 from €188 to €193 per week from week commencing 13 March 2017.

Illness benefit is considered as income for tax purposes and thus needs to be taken into account for PAYE purposes by an employer. It remains exempt from USC & PRSI.

No payment is made for the first six days of illness and for any Sunday.

Thesaurus Payroll Manager will automatically apply the increased rate of €193 per week as soon as Week 12 is reached in the software, which users should be aware of. Further information on how to process illness benefit in Payroll Manager can be found here:

In addition, standard Maternity and Paternity payments will increase from €230 to €235 per week from 13 March 2017. These are both taxable sources of income but aren’t liable to USC or PRSI. Unlike illness benefit, however, an employer must not tax these benefits through payroll. Instead, the Revenue will tax Maternity and Paternity Benefit via the employee’s tax credit Certificate by reducing the employee's SRCOP and tax credit on receipt of information from the Department of Social Protection.