Apr 2018

10

How will GDPR affect your employee processing?

The General Data Protection Regulation (GDPR) will come into force on 25th May 2018 changing the way we process data forever. The aim of the GDPR is to put greater protection on the way personal data is being processed for all EU citizens. Personal data can be anything from a name, an email address, PPS number, bank details etc so as you can imagine employers process a huge amount of personal data on a daily basis. So how will the GDPR affect employers in terms of processing employee data?

Consent

Data in the employment context, will include information obtained from an employee during the recruitment process (regardless of whether or not they eventually got the job), it will also include the information you hold on current employees and previous employees. All this information may be saved in hard copy personnel files, held on HR systems or it could be information contained in emails or information obtained through employee monitoring.

Under GDPR your employee’s will have increased rights around their data. These rights will include:

- The Right to Access. It’s not a new concept that employees will be able to request access to the data you hold on them. However, there is a new recommendation that where possible employers should provide their employees with access to a secure self-service login where they can view data stored on them. This backs-up the whole concept of transparency and ease of access to data, which underpins the new Regulations.

- The Right to Rectification. Individuals are entitled to have personal data rectified if it is inaccurate or incomplete. This is an existing right and the onus is on the employer to ensure that your employee records are kept up-to-date. To help ensure you maintain up-to-date records, employers should make it easier for employees to update their data.

- The Right to be informed. Employers must be very transparent with employees about what data you hold, why and how long it is held for. Up until now it has been the common practice for many employers to include a standard clause in the employment contract regarding the processing of HR Data, under GDPR that will no longer be sufficient. Employers need to be reviewing their Employee Data Protection Policies and possibly writing new Employee Privacy Policies that go into detail on the processing of employee data.

Employee Self Service

Under the GDPR legislation, where possible employers should be able to provide self-service remote access to a secure system which would allow employees view and manage their personal data online 24/7. Furthermore, the cloud functionality will improve your payroll processing with simple email distribution, safe document upload, easy leave management and improved communication with your employees. By introducing a self-service option, you will be taking steps to be GDPR ready.

Thesaurus Payroll Software | BrightPay Payroll Software

Related articles:

Feb 2018

13

Free Webinar: Irish Employment Law Overview

As busy employers it can be difficult to keep up-to-date with the constant changes in employment law.

Bright Contracts by Thesaurus Software is hosting a free employment law webinar on Thursday 22nd February. Our employment law experts will discuss what is new in employment law, recent Workplace Relations Commission cases and have a look at the most frequently asked questions that come through our support line.

Agenda:

- Employment Law - What’s new?

- Recent WRC cases

- FAQs from our support line

- Bright Contracts: A simple solution

Places are limited - book your place now!!

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Newsletter - Are you missing out?

GDPR is changing how we communicate with you. After May 2018, we will not be able to email you about webinar events, special offers or other news without you subscribing to our newsletter. Don’t miss out - sign up to our newsletter today!

Oct 2017

25

Making an Employee Redundant

A redundancy situation can often arise in the following situations:

- an employee’s job ceases to exist

- the employer ceases to carry on the business

- the requirement for employees has diminished

- an employee is not skilled for work that is to be done

In the event of a redundancy, employees are covered under Redundancy Payments Acts 1967-2014, if they meet the following requirements:

- aged 16 or over

- have at least 2 years continuous service (104 weeks)

- are a full-time employee insurable under PRSI class A, or PRSI Class J for a part-time employee

How to calculate Statutory Redundancy Pay

Statutory Redundancy is payable at a rate of:

- 2 weeks’ pay for each year of service. If the period of employment is not an exact number of years, the excess days are credited as a portion of a year

- plus one week’s pay

The term ‘pay’ refers to the employee’s current normal gross weekly pay, including average regular overtime and benefits in kind. The above, however, is based on a maximum earnings limit of €600 per week (before PAYE, PRSI & USC).

An employer may also choose to pay a redundancy payment above the statutory minimum. In such circumstances, the statutory payment element will be tax free but some of the lump sum payment may be taxable.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

Sep 2017

22

Public Holiday Pay Entitlement

There can often be some confusion surrounding an employee's entitlement to pay for a public holiday particularly where the employee may be part-time or the public holiday falls on a day that the employee does not normally work.

It is also worth noting that not every bank holiday is a public holiday though in most cases they coincide. Good Friday is a bank holiday but it is not a public holiday. The following dates are the official public holidays in Ireland.

- New Year's Day (1 January)

- St. Patrick's Day (17 March)

- Easter Monday

- First Monday in May, June, August

- Last Monday in October

- Christmas Day (25 December)

- St. Stephen's Day (26 December)

Employees who qualify for public holiday benefit will be entitled to one of the following:

- A paid day off on the public holiday

- An additional day of annual leave

- An additional day's pay

- A paid day off within a month of the public holiday

So, who is entitled to a payment?

- Part-time employees qualify for public holiday entitlement if they have worked at least 40 hours in the 5 weeks ending the day before the public holiday.

- Full time employees are not required to have worked up a minimum number of hours.

How to calculate the amount to be paid?

If the public holiday falls on a day which the employee would normally work:

- Full-time employees are entitled to one of the above four options at the employer’s discretion.

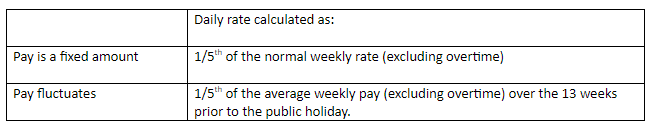

- Part-time employees have the same entitlement, so where the employee’s pay is a fixed amount the normal daily rate can be used. If the pay varies, the daily rate should be calculated over the 13 weeks immediately before the public holiday in question.

If the public holiday falls on a day which the employee does not normally work:

Further information can be found at Organisation of Working Time Act 1997.

Sep 2017

18

Long Service Awards - Appreciation to staff

Have you employees with 20 plus years of service? If so why not say thank you with a gift.

Revenue Commissioners offer tax relief on long service awards, which is considered to be at least 20 years of service. Tax relief on long service awards can be in addition to the small benefit exemption.

Employers can reward employees for long service with tangible articles with a value up to a maximum of €50 per year of service, starting at 20 years of service and every 5 years thereafter.

- 20 years of service – value up to €1,000

- 25 years of service – value up to €1,250

- 30 years of service – value up to €1,500

- 35 years of service – value up to €1,750

The award must be a tangible article e.g. a gold watch, it does not apply to awards made in cash.

Tax will not be charged provided:

• The cost to the employer does not exceed €50 per year of service

• The award is made in respect of service not less than 20 years

• No similar award has been made to the recipient within the previous 5 years

Where any of the conditions are not met PAYE, PRSI & USC must be applied on the full amount.

Details can be found on Revenue's website

New PAYE Modernisation legislation to be in place by Jan 2019