Jan 2021

26

Lockdown 3.0 - What have payroll processors learned?

Lockdown hasn't been easy for any of us - you could say it's been a bit of a 'coronacoaster'. COVID-19 has made us realise what’s important to us. Whether that be connecting more with family or re-connecting with old friends through the social platforms we are so grateful to have during this time. As we are currently in lockdown 3.0, let's look back on some of the key lessons learned as a payroll processor over the past year during this time of crisis.

Importance of Remote Access

Payroll is one of the core functions of running any business, and so it is something that needs to be completed on time and without errors. When working from home, your staff might not be able to access all the tools and documents that they would normally be able to access, especially if your systems are on-premises solutions and files and documents are physical hard copies.

Due to COVID-19 and having to work remotely from home, it is now a necessity to be able to access your payroll data from home. Your payroll software should easily facilitate remote working with additional user access. BrightPay can be installed on up to 10 PCs per licence key, and this means that payroll processing is possible by up to 10 users, or from 10 different locations. This is very handy for if you have a number of employees working from home, all needing access to the payroll software.

We have also introduced new multi-user features that work in conjunction with BrightPay Connect, our optional cloud add-on, to improve the working from home experience. These new features include ‘version checking’ when opening an employer, and an ‘other users check’ when opening an employer. This new "working from home" integration gives you all the benefits of the cloud while utilising the power and responsiveness of your local device.

Importance of Reliable Software

The past year has been very frustrating for payroll processors. Not only had you the added workload of processing subsidy claims, but you also had to learn about the various schemes and ensure you kept up to date with the latest guidelines. That’s why it’s so important to use reliable payroll software from a reliable company.

We kept BrightPay up to date to cater for the relevant scheme changes, and we tried to automate as much as possible in the payroll software to make your life easier.

In a recent survey, we achieved a 98.7% rating for our overall handling of COVID-19 including customer support, payroll upgrades, COVID-19 webinars and online support. We also won a COVID-19 Hero Award, and this is because of our response to COVID-19 and how we have helped our customers throughout the past few months.

Importance of Cloud Backups

As most businesses are now working remotely for the foreseeable future, it leaves many businesses exposed to data loss. This is why cloud backups are so important.

If you only keep your payroll data on your desktop, you are at risk of losing the information. Have you thought about what would happen if your computer broke down or was hacked? How would you get your payroll data back quickly? Would employees still get paid if the information was lost?

BrightPay Connect is our optional add-on that works alongside the payroll software. BrightPay Connect provides a secure and user-friendly way to automatically backup and restore your payroll data on your PC to and from the cloud. It’s simply an added layer of data protection to keep your payroll data safe so you never lose your payroll data again.

Importance of Automation

Whether you’re an employer processing payroll in-house for your business, or an accountant or bureau processing payroll for a number of clients, automation is key. How much time do you spend managing annual leave, answering employee leave balance enquiries, retrieving lost payslips, and communicating with employees in general? Now is the time to eliminate those admin-heavy tasks!

Self-service online portals are changing the way businesses interact and communicate with their employees, whilst providing the cloud functionality to get things done smarter and faster. BrightPay Connect includes the ability to manage employee leave, communicate with employees, automate payslip distribution, run payroll reports and much more.

Book a demo of BrightPay Connect today to discover more features that can help you streamline your payroll and HR processes.

Jan 2021

19

Four ways to introduce payroll as a service to clients

More than ever, accountants are under pressure to diversify their service offering as the profits from doing compliance increasingly diminish. To the profession’s immense credit, firms have embraced new ways of working to not only stay afloat but thrive.

But with more competition, it’s become hard to stand out. Offering payroll processing services has become an overlooked way to set yourself apart. Perhaps understandably: in the past, payroll processing wasn’t a particularly dynamic, easy or, most importantly, profitable service to offer.

Things have changed, however, with the advent of new software that has made offering payroll services more profitable, simpler and innovative.

BrightPay Connect and Cloud Access

BrightPay Connect is a cloud add-on that seamlessly slots into BrightPay payroll software on your desktop. The payroll is still processed on BrightPay’s desktop application, but the payroll information is stored online on a secure cloud server. By introducing the cloud into your payroll services, you can demonstrate value and power up what you offer to clients.

Here are four ways you can introduce a cloud system with payroll access like BrightPay Connect to clients:

- The client self-service dashboard: Clients can see their employer details, employee's contact details and payslips, any outstanding amounts due to Revenue and any reports that have been set up in BrightPay on the desktop application. It’s a collaborative sort of payroll processing that clients will never have experienced before.

- The employee smartphone and tablet app: Not just employers, but their employees too. The self-service app provides a digital payslip platform which employees can access anytime, anywhere. Through the app, your client can offer employees GDPR compliant self-service tools.

- Annual Leave Management Tool: It’s not just payroll or payslips. BrightPay Connect can save your clients money and time with an in-built leave management tool in the self-service portal. Approved leave is automatically added to the employee calendar and synchronised to your payroll software.

- Automatic Cloud Backup: Clients will get the safety and security of a cloud payroll backup when you use BrightPay Connect. The software will automatically backup payroll files every 15 minutes when open and again when the payroll file is closed down. A chronological history of backups will be maintained which can be restored at any time.

Make your and the client’s life easier

There’s so much complication in our modern economy. Businesses and individuals are assaulted on all sides by different technologies and demands for their attention and time.

But it’s important to remember that the right tech can also radically simplify peoples’ lives too. BrightPay Connect, with its suite of HR-centred features, will make payroll processing simple and collaborative.

By empowering your clients via the cloud add-on, you’ll lessen the admin burden on yourself, leaving you to focus on getting the details right. For your client (and their employees), BrightPay Connect will give them control over their leave and payroll data.

Things can – and should – be much simpler. And with BrightPay Connect, that’s the new reality of payroll processing. Book a demo of BrightPay Connect today.

Jan 2021

12

BrightPay Customer Update: January 2021

Welcome to BrightPay's January update. Our most important news this month include:

-

BrightPay: The COVID Heroes of the Accounting World

-

From the support desk: How do I start processing 2021 payroll?

-

How your payroll bureau can survive the COVID-19 crisis

-

How to avoid a payroll nightmare during COVID-19

-

BrightPay 2021 is now available – What's new?

Revenue announce further changes to the EWSS for 2021

Revenue have introduced further changes to the Employment Wage Subsidy Scheme. Join us on 20th January as we recap upcoming changes to the EWSS and what these changes mean for your business. Plus, we will share some of the key lessons learned from processing payroll in a pandemic, and how it prepares us for payroll in the ‘next normal’.

BrightPay Connect – It's better than ever before!

We are committed to consistently improving our software to better serve your needs and enhance your customer experience. This year we have introduced many new features to BrightPay Connect, including improved multi-user / working from home functionality and an extra layer of security.

- Version checking when opening a payroll file

- ‘Other users’ checking when opening a payroll file

- Define and set custom leave types

- Improved calendar functionality

Pricing Strategies that work – what other practices are doing

In this free webinar for accountants and payroll bureaus we explore how you can maximise the value of your payroll service offering. Learn how technology and automation turn daunting payroll tasks into a smooth and profitable process. We look at four tried and tested pricing strategies that will help secure your payroll profitability.

Moving from BrightPay 2020 to BrightPay 2021

Every tax year we release brand new software in line with the new budgetary requirements. Thus, to move your payroll on to a new tax year, simply download the new tax year version of BrightPay. Your software for the new tax year will contain a seamless import facility to bring across your employee details from the previous tax year.

Updates to EWSS Eligibility and Subsidy Rates

There has been a change to the EWSS qualifying criteria for pay dates on or after 1st January 2021. The change relates to the periods to be used for assessing the minimum 30% reduction in sales/orders. Where employers have been availing of EWSS in 2020, they will now need to review expected turnover for the 6 months to 30th June 2021 versus the 6 months ended 30th June 2019 (not 2020). The rates of subsidy have also been revised to better support businesses.

Jan 2021

11

BrightPay Connect – It's better than ever before!

We are committed to consistently improving our software to better serve your needs and enhance your customer experience. This year we have introduced many new features to BrightPay Connect, including improved multi-user / working from home functionality and an extra layer of security.

Version checking when opening a payroll file

When you open the payroll, BrightPay Connect will check to see if there is a more up to date version of the employer file, for example, if the payroll was last updated on a different computer. If a more up to date version is available, you will be given the option to use the latest version, or you may also decide to ignore the latest version and continue working on the version that you are trying to open.

‘Other users’ checking when opening a payroll file

When you open the payroll, BrightPay Connect will notify you if someone else is still working on the same employer. BrightPay can notify you when the other user closes out of the payroll, and it will also tell the other user that you are waiting to access the payroll. This new functionality will allow for a completely seamless working from home process where there are multiple people that work on the same employer files.

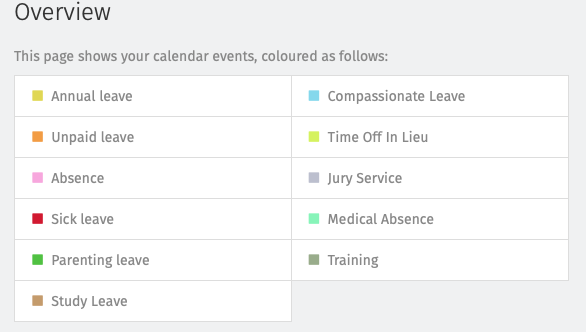

Define and set custom leave types

You can now define up to nine additional custom types of employee leave. Six of the custom types are set up with default descriptions, which you can edit, add, or remove as need be.

Custom leave types act like the existing built-in kinds of leave, in that they are mutually exclusive and can only be applied to working days. They can be set on a per-employee basis, or batch set for multiple employees at once.

Improved calendar functionality

The calendar functionality in BrightPay Connect has been updated and improved, making it more user friendly and graphically appealing for both employers and employees. Improvements such as calendar and leave view, custom leave types and requesting leave are part of the new enhancements.

Book a demo of BrightPay Connect today to discover more features that can help you streamline your payroll and HR processes.

Jan 2021

6

BrightPay Connect Calendar Updates

The calendar functionality in BrightPay Connect has been updated and improved, making it more user friendly and graphically appealing for both employers and employees. Improvements such as calendar and leave view, custom leave types and requesting leave are part of the new enhancements.

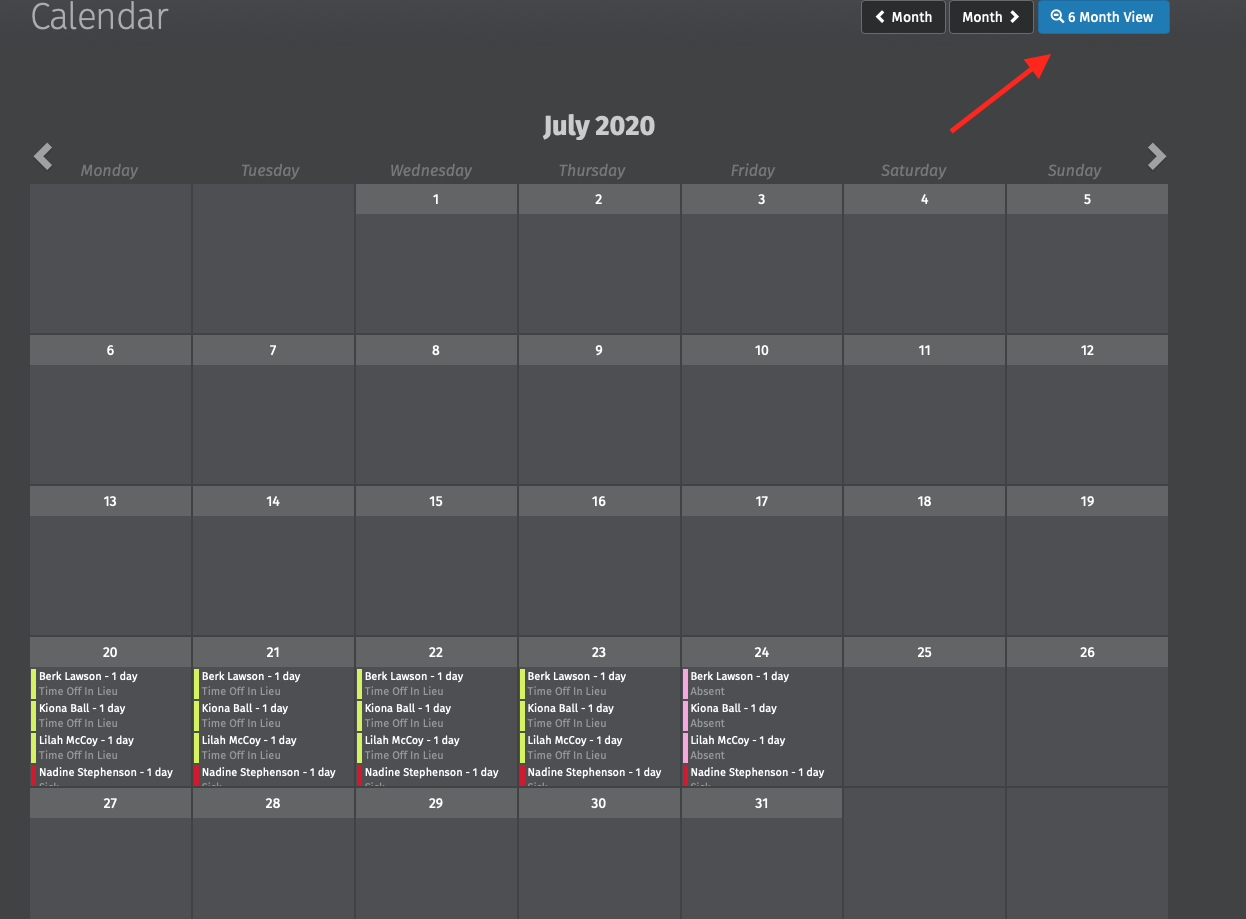

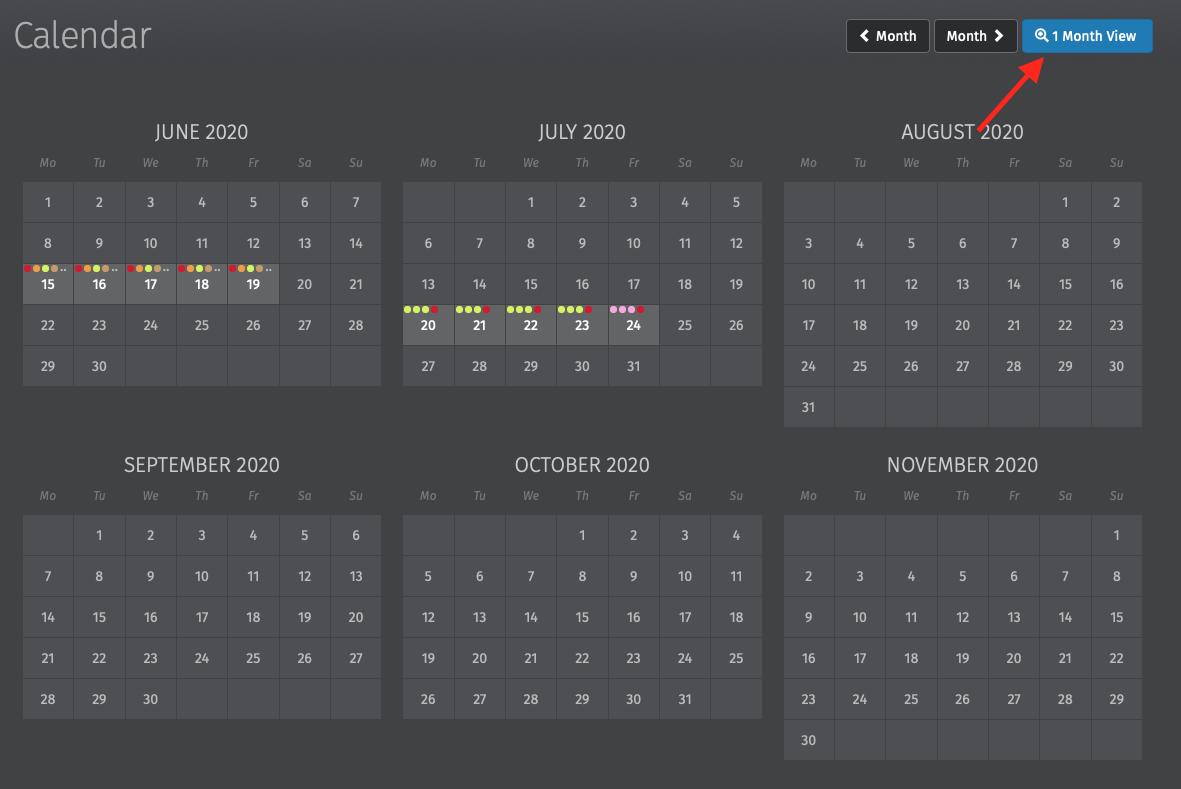

Calendar Display

The number of months displayed on the calendar for both employers and employees can be selected, the options available are 3 months, 6 months, 9 months and 12 months. This can be selected under the Settings tab in the Employer portal, further details can be found here.

On the Employer or Employee Calendar in Connect, the calendar can be displayed for one month or multiple months. One month view can be seen by selecting the '1 Month View' option. The view can be returned to the default number of months view by selecting ‘3 / 6 / 9 / 12 Month View’. On the ‘1 Month View,’ there are new widgets for scrolling up and down through the number of leave entries on a particular date.

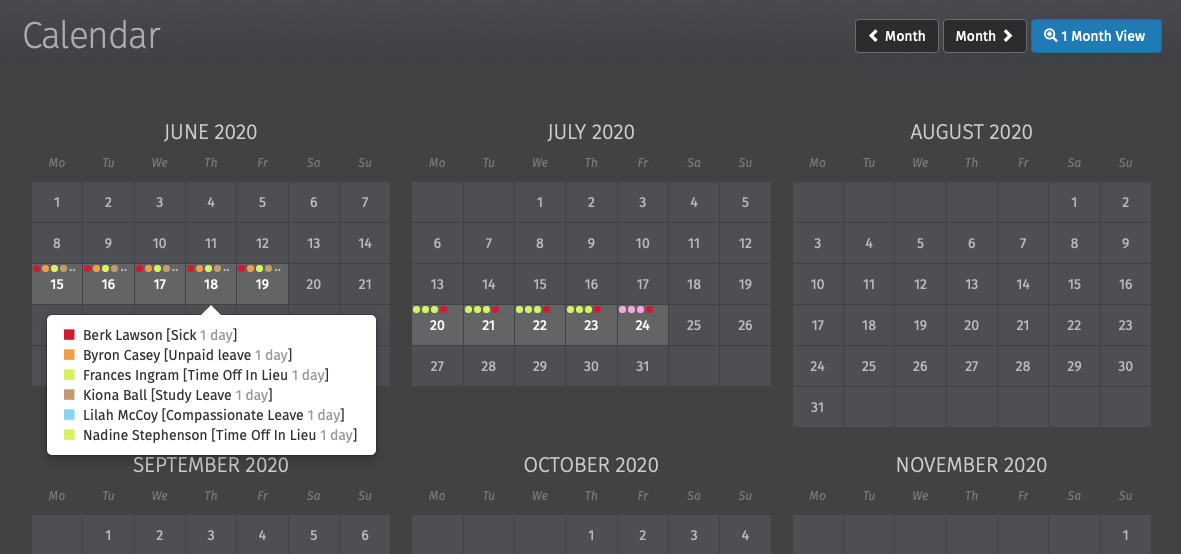

Dates with multiple types of events are dotted with the relevant colours. To see the breakdown, simply hover your mouse over the date. By selecting a date on the calendar, a dialog box will open to show all the entries on that date without having to scroll.

Custom Leave Types

Custom leave types are now available in BrightPay Connect. In BrightPay 2021 you can define nine additional custom leave types for employees. Six of the custom leave types are set up with default descriptions such as time in lieu and study leave. Instructions on how to add, edit or remove these custom leave types can be found here.

When a custom leave type is entered on the employee’s calendar in BrightPay and synchronised to Connect the leave type will be displayed on the calendar for both the employer and the employee to view on their online portal or mobile app. Custom leave can only be entered on an employee’s calendar by a user in Connect or on the employee’s calendar in the BrightPay employer file. Employees cannot request any custom leave types.

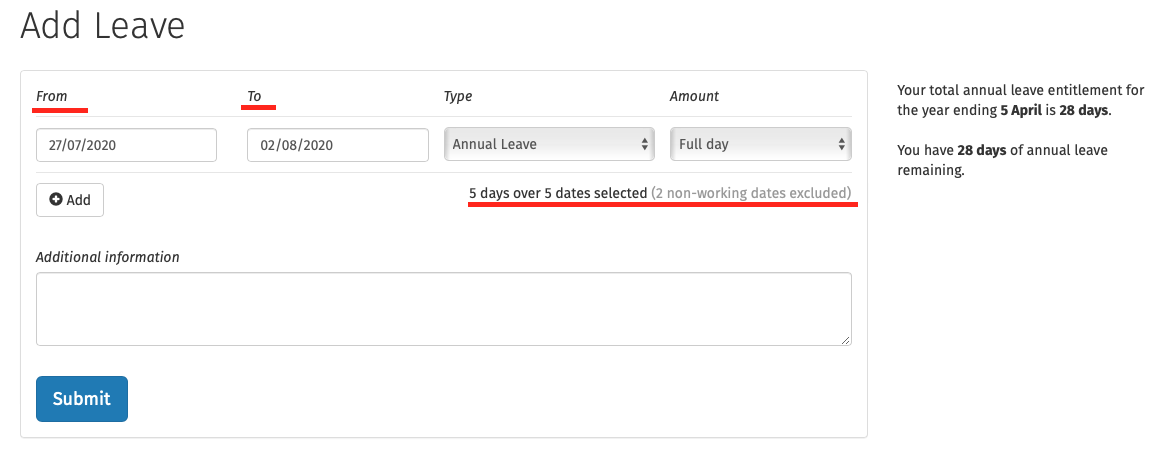

Adding/Requesting Leave

When employers are adding leave on an employee’s calendar in Connect or an employee is requesting leave, they are now entered as date ranges simplifying leave dates being selected. If the employer or an employee enter in an invalid date range (e.g. including non-working days in the date range) it will automatically correct this and only working days will be included in the request.

Interested in finding out more about how BrightPay Connect can streamline your leave management processes? Book an online demo of BrightPay Connect today.