Sep 2020

11

Don't forget about your July / August EWSS Sweepback!

The Employment Wage Subsidy Scheme (EWSS) replaced the Temporary Wage Subsidy Scheme (TWSS) which ended on 31st August 2020. As some employees were excluded from the TWSS, eligible employers can backdate a claim for EWSS to 1st July 2020 in respect of certain employees.

If you are currently eligible for EWSS, you may be entitled to receive subsidies and PRSI credits in respect of employees paid by you during July and August.

- If you previously claimed TWSS for July and August, any employee who did not qualify for TWSS may be eligible for an EWSS claim. Essentially, this means that any employee who started with you on or after 1st March, who was not employed by you at any stage during January or February, should be eligible for EWSS in respect of any payments made to them during July or August. The potential claim can be quite substantial e.g. if you had just one employee qualifying for EWSS being paid by you for July and August, the combined subsidy and PRSI credit could exceed €2,000.

- If you did not previously qualify for TWSS but now qualify for EWSS, any employees paid by you at any stage during July or August should be eligible for EWSS.

In order to make a claim, a CSV file listing the PPSN numbers and Employment IDs for all eligible employees must be uploaded on ROS. Our latest software upgrade (available when you launch our software), includes the ability to prepare the CSV file. It will also calculate the estimated claim value for you. This is available in the 'Employees' menu in BrightPay.

Because of the tight timelines in releasing our upgrade and because we may not have access to all payroll data since the start of the year, we cannot guarantee the calculated claim value and it should therefore be viewed as indicative.

The ROS upload facility is expected to be available from 15th September within the “Employer Services” Section on ROS. All applications must be submitted by the employer or agent through ROS before 14th October.

Following receipt of the sweepback CSV, Revenue will then process these files and validate them against the rules of the scheme. If an employee is deemed eligible, Revenue will calculate the total subsidy due to be paid and will arrange for the subsidy to be paid as soon as practicable after 16th September. Payment in respect of additional submissions received after 16th September in respect of July/August will be made weekly thereafter up until 14th October.

Claims could be quite substantial, so we urge you to run the report and, if applicable, submit your claim as soon as possible.

Revenue guidance on the rules surrounding the sweepback and the claim process can be viewed here.

Free Webinar: Employment Wage Subsidy Scheme

Interested in finding out more about EWSS? Join us for our free webinar on 8th October where we discuss everything you need to know about EWSS eligibility, processing subsidy claims and the new guidance in relation to the July/August Sweepback.

Don’t miss out – Places are limited. Click here to book your place now.

Sep 2020

10

Remote Working Is Becoming The New Normal - Here's What That Means For Payroll

2020 has been a transformative year for most businesses. Many employers have had to take a long hard look at how they manage their employees and make significant changes in the wake of COVID-19 in order to adapt to what is quickly becoming the new normal. For a large proportion of these businesses, allowing employees to work remotely is playing a central role in that change. And this throws up some challenges.

Remote working isn’t a new phenomenon. Cloud innovations have made it possible for people to work from home for many years. However, most businesses have been reluctant to embrace this practice up until now. This is because, when employees are spread out, even the most basic tasks such as distributing payslips, applying for annual leave and internal communication can be more difficult.

Today, however, employers are finding themselves in a position where they must allow employees to work remotely and find clever solutions to these challenges. And BrightPay Connect is one such solution that makes remote working easier for everyone.

How Does Remote Working Affect Payroll and HR?

You might not think that remote working has any impact on processing payroll, especially if you’re a small business with just one payroll administrator. But there are a number of ways that remote working can indirectly impact payroll. It also has numerous knock-on effects on human resources management which need to be addressed in order for a business to thrive.

Here are some examples of the payroll and HR challenges presented by remote working:

- Distributing payslips manually can be more time-consuming, costly and less secure when employees are not located in the workplace, and instead payslips must be posted to their home addresses.

- Making sure that the payroll and any employee leave during that particular pay period are aligned can be tricky, especially if a number of different line managers and/or HR staff are operating from different locations.

- Checking that the information for the current pay period is accurate can be challenging with employers and managers working from home with often unreliable internet connections.

BrightPay Connect Makes Remote Working Easier

BrightPay Connect is a cloud portal add-on to our payroll software. While the payroll software gives you everything you need to process your payroll, BrightPay Connect offers a range of additional features that streamline your human resource management.

The features of BrightPay Connect include:

- An employee self-service app that’s compatible with both iOS and Android. On the app employees can apply for leave, view and edit their personal data, access a secure payslip library and view HR documents, all from their smartphone or tablet.

- An online employer dashboard. Because payroll information is stored online with BrightPay Connect, employers can access their dashboard from their laptops at home. On this dashboard, employers can view a company calendar which displays all past and upcoming employee leave, upload and share documents with employees, and view any outstanding payments due to Revenue. The employer dashboard also shows notifications for any employee leave requests, or requests from the payroll processor.

- Automatic cloud backups. With BrightPay Connect, you don’t need to worry about safely storing your data. BrightPay Connect automatically backs up the payroll data to the cloud and keeps a chronological history of all backups so that you can restore previous versions if needed. This is a great step towards GDPR compliance for businesses who are trying to modernise their data protection practices. The cloud backup is also extremely useful for remote working because everything is stored and accessible via the cloud from any location.

- Clever employee leave management. Employees can request leave directly from their smartphone app. This is beneficial to remote employees because it eliminates the need for employees to visit their line manager or human resources manager in order to fill out leave request paperwork. The request instantly appears as a notification on their manager’s online dashboard. From here, the manager can use the company calendar to see who else is on leave for the dates requested, and either approve or deny the leave request. A time-stamped log of all leave requests is maintained which is particularly useful when a number of different people are managing employee leave as all of the relevant parties can easily see who approved or denied a request, and when.

- Requests for payroll data. Whether you are a payroll bureau processing payroll for a number of clients, or an in-house payroll administrator looking for payroll information from various departmental managers, BrightPay Connect’s payroll entry requests feature can be extremely beneficial when working remotely. You can send a request to your clients or to in-house managers requesting information regarding the employee’s hours and payment information for that particular pay period. Once the payroll information has been entered or uploaded, you will receive a notification on your employer dashboard and can synchronise the information directly to the payroll software. As well as eliminating the need for double entry of payroll information, it also frees up time spent chasing the various managers for the employee timesheets, especially if they are working remotely.

Book Your Free BrightPay Connect Demo Now

If your business is embracing remote working and trying to find ways to facilitate this new practice, then book your free BrightPay Connect demo today and let our team of experts show you just how much easier remote working can be.

Sep 2020

1

BrightPay Customer Update: September 2020

Welcome to BrightPay's September update. Our most important news this month include:

-

Revenue to join BrightPay for free webinar & panel discussion

-

Temporary Wage Subsidy Scheme comes to an end

-

BrightPay Guidance - Employment Wage Subsidy Scheme?

BrightPay now caters for the EWSS

Although the Employment Wage Subsidy Scheme (EWSS) is a subsidy payable to employers only and will not impact employee payslips, several steps need to be performed within BrightPay in order to transition from TWSS to EWSS. BrightPay has now been upgraded to cater for this new scheme.

Join Revenue & BrightPay’s Free Webinar & Panel Discussion

The Employment Wage Subsidy Scheme (EWSS) will replace the Temporary Wage Subsidy Scheme (TWSS) from 1st September 2020. We have teamed up with Revenue to bring you a free webinar where we discuss everything you need to know about TWSS Reconciliation and the Employment Wage Subsidy Scheme.

Register for EWSS before it’s too late!

Eligible employers will be required to register for the EWSS via ROS. Employers must hold up-to-date tax clearance to register for the scheme and receive the subsidy payments. Where an employer files an EWSS payment submission without first registering for EWSS, it will be rejected in full. The date of registration cannot be backdated prior to the date of application, and so it is imperative that registration is undertaken prior to the first pay date in respect of which EWSS is being claimed.

Benefits of employee apps that you never knew (and why employees love them)

BrightPay Connect offers a whole host of additional features, from automatic cloud backup to employee dashboards. However, the employee app is one of the most attractive of these additional features, and for good reason. It enables you to introduce more effective ways of communicating with employees and streamline everyday processes such as annual leave requests.

TWSS Reconciliation - Coming Soon

During the first few weeks of the Temporary Wage Subsidy Scheme (known as the transitional phase), Revenue refunded a flat rate of €410 per employee per pay period, which, in a lot of cases, exceeded the subsidy that the employee was entitled to receive. Revenue are hoping to commence the TWSS reconciliation in October to address any outstanding subsidy refunds or repayments necessary. TWSS CSV reconciliation files will be uploaded to Revenue to enable them to reconcile the amount of subsidy paid to the employee against the amount refunded by Revenue.

Aug 2020

27

Employment Wage Subsidy Scheme - What you need to know

A new Employment Wage Subsidy Scheme has been introduced, providing a flat-rate subsidy to qualifying employers based on the numbers of paid and eligible employees on the employer’s payroll.

Both the Temporary Wage Subsidy Scheme (TWSS) and Employment Wage Subsidy Scheme (EWSS) will run in parallel from 1 July 2020 until the TWSS ceases at the end of August 2020. The EWSS will replace the TWSS from 1st September 2020. It is expected to continue until 31 March 2021.

Non-TWSS employers, i.e. those who have not previously availed of TWSS, will only be eligible to apply for the EWSS. EWSS support will be backdated to 1 July for eligible employers who did not qualify for the TWSS.

Employers wishing to operate the scheme from July 1st (i.e. for employees not eligible for TWSS) should process the payroll for these employees in the normal manner and Revenue will review these cases at a later date and refund the subsidy due. Revenue plan to cater for this via myEnquiries, this will require employers to provide Revenue with the employee details etc. Payment should be made in September.

Employers who have availed of the TWSS will still be able to rehire eligible employees and continue to operate the TWSS until 31 August 2020. Employees already on TWSS must remain on TWSS until the end of August. From 31 July, TWSS employers can claim for non-TWSS employees under the new EWSS, for example, new hires.

While the concepts behind the two schemes are similar, there are a number of differences between them.

Scheme Eligibility

The EWSS will require employers to reassess their eligibility for wage support. To be eligible for the EWSS, employers must be able to demonstrate that their turnover or customer orders have suffered at least a 30% reduction as a result of Covid-19 between 1st July and 31st December 2020, compared to the same period last year.

There is one exception to this - Registered childcare providers can avail of the EWSS without the requirement to meet the 30% reduction in turnover or customer orders.

Under the EWSS a subsidy will be available for new and seasonal employees, in addition to existing employees.

The EWSS is also open to newly commenced businesses. Where a business commenced after 1st November 2019, the eligibility criteria will be assessed against projected turnover or customer orders had there been no COVID-19 disruption.

Revenue have confirmed that the EWSS can be claimed in respect of proprietary directors, subject to certain conditions - click here to find out more about EWSS & proprietary directors.

Operating the Scheme

Under the EWSS, employers will no longer have to download CSV files.

Eligible employers will be required to register for the EWSS via ROS, using Manage Tax Registrations (under Other Services) in the main ROS screen. Employers must hold up to date tax clearance to register for the scheme and receive the subsidy payments.

The date of registration cannot be back dated prior to the date of application and does not need to be back dated if a claim will be submitted in respect of payments in July & August. Therefore, it is imperative that registration is undertaken prior to the first pay date in respect of which EWSS is being claimed.

The EWSS will be administered by Revenue on a ‘self-assessment’ basis. Employers must review their eligibility status on the last day of every month to ensure they continue to meet the eligibility criteria. If they no longer qualify, they should de-register for EWSS with effect from the following day (that being the 1st of the month).

Subsidy Support

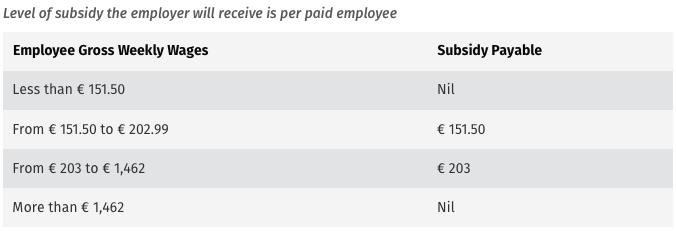

Under the EWSS employers will receive a flat-rate subsidy of up to €203 or €151.50 per employee, per week, depending on the employee’s gross weekly pay. A subsidy will not be available for employee’s whose gross weekly earnings are less than €151.50 or greater than €1,462. The gross pay includes notional pay and is before any deductions for pension, salary sacrifice etc.

There will be an indicator on the payroll submission to indicate that an employee is an eligible employee for EWSS. On receipt of an eligible payslip, Revenue will calculate the subsidy payable based on the gross pay, pay frequency and the insurable weeks.

EWSS is a subsidy paid to an employer, it will not show on a payslip or in myAccount. The subsidy will be paid to employers monthly after the return due date, which is the 14th of the following month. Any changes made to payroll submissions after the return due date will not be processed for subsidy payments.

Under the EWSS, employers will be required to pay employees in the normal manner i.e. calculating and deducting Income Tax, USC and employee PRSI through the payroll.

The normal requirement to operate PAYE on all payments will be re-established under the EWSS.

However, a 0.5% rate of employers PRSI will continue to apply for employments that are eligible for the subsidy. This will be achieved as follows:

- PRSI will be calculated as normal via payroll e.g. on PRSI class A1.

- Revenue will calculate a PRSI credit by calculating the difference between the rate on the normal PRSI class and the 0.5%.

- The credit will show on the Statement of Account to reduce the employer’s liability to Revenue.

For more information on the TWSS and EWSS register for our free webinar which takes place on 3rd September 2020. We will be joined by Revenue to discuss what you need to know about both schemes.

Aug 2020

24

The Temporary Wage Subsidy Scheme comes to an end

The Temporary COVID-19 Wage Subsidy Scheme (TWSS) was introduced in March 2020 to provide financial support to workers affected by the Covid-19 crisis. The scheme enabled employees whose employers are affected by the pandemic to receive significant supports directly from their employer through the payroll system.

The TWSS scheme is ending on 31st August 2020. Therefore, J9 submissions with a pay date after 31st August will be rejected by Revenue.

During the transitional phase of the scheme, Revenue refunded a flat rate of €410 per employee per pay period. In a lot of cases, this amount exceeded the subsidy that the employee was entitled to receive for that week, and this will be rectified when Revenue perform a reconciliation of employer refunds.

The aim of the reconciliation is to:

- Establish the actual subsidy amounts which were paid to each employee

- Determine if the correct amounts were paid to each employee during the transitional phase

- Address any outstanding subsidy refunds or repayments necessary.

Revenue are hoping to commence the TWSS reconciliation in October. TWSS CSV reconciliation files will be uploaded to Revenue to enable them to reconcile the amount of subsidy paid to the employee against the amount refunded by Revenue.

In the interim, to assist in their future reconciliation, employers should continue to retain records of subsidy payments made to employees, records of subsidy refunds and tax refunds received from Revenue and hold any excess of the subsidy payments received for offset against future subsidy payments or for future repayment to Revenue.

In some cases, an employer may decide to repay to Revenue some or all the subsidy refund payment received from Revenue. Employers can repay excess subsidy values to Revenue via a new facility within ROS, this can be done under Payments & Refunds by selecting ’Submit a Payment’ and then TWSS (Employer). Customers should no longer use the Revenue bank account details previously provided for repayments of TWSS.

A new Employment Wage Subsidy Scheme (EWSS) will replace the Temporary Wage Subsidy Scheme from 1st September 2020. It is expected to continue until 31 March 2021.

For more information on the TWSS and EWSS register for our free webinar which takes place on 3rd September. We will be joined by Revenue to discuss what you need to know about both schemes.

Aug 2020

13

The Employment Wage Subsidy Scheme - Important Update

The Employment Wage Subsidy Scheme (EWSS) will replace the Temporary Wage Subsidy Scheme (TWSS) from September 1st 2020. Revenue are currently working through the finer details of the scheme. Below is some information to help you understand the scheme and to help prepare for it should you choose to avail of it.

The scheme provides a flat-rate subsidy to qualifying employers based on the number of paid and eligible employees on the employer’s payroll. The scheme is expected to operate until 31st March 2021.

- It is important to note that TWSS will cease on August 31st 2020.

- Employers wishing to avail of EWSS must register for it via ROS. Revenue are planning to have the registration facility available from August 19th.

- Employers must hold up to date tax clearance to register for the scheme and to receive the subsidy payments.

- Employers must be able to demonstrate that their turnover or customer orders between July 1st and December 31st 2020 are expected to suffer at least a 30% reduction as a result of Covid-19. Further information on the qualifying criteria can be found here.

- Registered childcare providers can avail of the EWSS without the requirement to meet the 30% reduction in turnover or customer orders.

- Employers must review their eligibility status on the last day of every month to ensure they continue to meet the eligibility criteria, if they no longer qualify they should deregister for EWSS with effect from the following day (1st of the month)

- Proprietary directors were due to be excluded from the scheme. It is now expected that they will be included where they retain ‘ordinary’ employees on the payroll.

Subsidy Payment:

- The subsidy will be paid to employers monthly after the return due date (14th of the following month).

- Any changes made to payroll submissions after the return due date will not be processed for subsidy payments.

Please note, gross pay includes notional pay and is before any deductions for pension, salary sacrifice etc

Payroll:

- Employers will be required to pay employees in the normal manner i.e. calculating and deducting Income Tax, USC and employee PRSI through payroll.

- EWSS is a subsidy paid to an employer. It will not show on payslips or in myAccount.

Employer PRSI:

A 0.5% rate of employers PRSI will continue to apply for employments that are eligible for the subsidy. This is expected to work as follows:

- PRSI will be calculated as normal via payroll e.g. on PRSI class A1.

- Revenue will calculate a PRSI credit by calculating the difference between the rate on the normal class and the 0.5%.

- The credit will show on the Statement of Account to reduce the employer’s liability to Revenue.

July/August 2020

TWSS and EWSS will run in parallel from 1st July to 31st August. Employees already on TWSS must remain on TWSS until the end of August. Employers wishing to operate the scheme from July 1st i.e. for employees not eligible for TWSS, should process the payroll for these employees in the normal manner and Revenue will review these cases at a later date and refund the subsidy due.

Revenue plan to cater for this via myEnquiries. This will require employers to provide Revenue with the employee details etc. Payment should be made to employers in September.

Publication

A list of employers availing of EWSS will be published in January 2021 and April 2021 to www.revenue.ie.

Software Upgrades (to cater for EWSS)

We plan to release upgrades for Thesaurus Payroll Manager and BrightPay in the week commencing 24th August. Revenue are still fine tuning the details of the scheme and how it will interact with PAYE Modernisation. Therefore, unfortunately, we will be unable to release upgrades any earlier than this.

Aug 2020

11

3 Benefits of Employee Apps You Never Knew

Employee apps have become a big trend in the digital communications infrastructure of businesses in every industry imaginable over the past few years. Initially, they served little or no real tangible purpose other than to help the business appear to be at the forefront of technology and employment trends. However, more recently, app designers have created apps that deliver real, measurable value for both employees and employers.

Introduced in 2017, the BrightPay employee app is available to all BrightPay Connect customers. Connect is an add-on to the payroll software which offers a whole host of additional features, from automatic cloud backup to employee dashboards. However, the employee app is one of the most attractive of these additional features, and for good reason.

This is because employers and human resource managers are constantly trying to find more effective ways of communicating with their employees, as well as methods to streamline everyday processes such as annual leave requests. Our employee app does all of this and more, and gives employees a crucial sense of engagement that’s invaluable to company culture and the productivity of staff.

But, if you’re an employer or human resources manager who’s considering using an employee app to update your internal comms abilities, you’re going to need to weigh up the benefits of the app and think about how they would apply to your organisation.

Benefits of Employee Apps

So, without further ado, let’s break down the benefits of employee apps so that you can make the best decision for your business.

Leave Requests and Approval

Few people expect that an employee app can help with leave requests, but they can. In the BrightPay Connect employee app, employees can apply for annual leave or unpaid leave directly from their tablet or smartphone. Once they've sent their request, the relevant manager will receive a notification on their BrightPay Connect dashboard.

From here, they can approve or reject the request. The calendar on their dashboard will show them all of the scheduled leave for the relevant dates, so they can see who else is on leave at that time. If they choose to approve it, the leave will automatically appear in the company calendar on both the online dashboard and the employee app.

This is particularly useful to companies with large numbers of employees whereby a significant amount of time is spent processing employee leave requests and manually updating the company calendar.

Internal Communications

Another major benefit of using a self-service employee app is the vast improvement in internal communications. Employers can upload any type of documents they want to be available on the employee app. These documents are then stored in the cloud, where employees can easily access them from anywhere in the world.

What makes this feature even more useful is that the employer can choose who has access to which documents. For example, you may upload three documents at once. One is an updated Health and Safety policy, another is a new budget document for the marketing team, and another is an employee file for a recent starter.

Our document sharing feature will allow you to make your Health and Safety policy available to everyone in the company, make the budget document available only to the marketing team, and make the new employee file only visible to yourself and your human resources manager. You can customize the access permissions for each document, and change that access at any time. And you can see who has opened and read the various documents via a time-stamped historical log.

This means that, not only can you use the document sharing facility to distribute important documents to your employees, but you can also use Connect as a secure online hub, where you store all employee data and documents safely.

Payslip Archive

One of the features of the BrightPay Connect employee app that your employees will really love is the handy payslip archive. Via the app, payslips are distributed directly to employee smartphones or tablets where they can be viewed, downloaded and printed in just a few clicks. But, in addition to this, the payslips are kept on the app in a historical archive that dates back to when you started using BrightPay Payroll - even if it’s before you introduced the app or started using BrightPay Connect.

This is great news for employees for two reasons. Firstly, because they cannot lose payslips in their email inbox or accidentally delete them and have to ask for them to be resent. And secondly, because it makes applying for mortgages or other personal finance banking options simpler as they can easily access and print as many payslips as their bank requires.

Find out more about the BrightPay Connect Employee App today

If you think that the BrightPay Connect employee app could benefit your business, why not book a free demo with our team of Connect experts? They will talk you through all of its many features, including the app and so much more.

Aug 2020

7

BrightPay Customer Update: August 2020

Welcome to BrightPay's August update. Our most important news this month include:

-

July Jobs Stimulus Plan – Employer Focus

-

Key Changes to the Temporary Wage Subsidy Scheme

-

How Connect's Document Upload Facility Makes Returning To Work Easier

Free COVID-19 & Payroll Webinar

Join BrightPay on 13th August for a free COVID-19 & Payroll webinar. In this webinar, we explore the key changes to the Temporary Wage Subsidy Scheme and what we know so far about the new Employment Wage Subsidy Scheme. The EWSS will run in parallel to the Temporary Wage Subsidy Scheme from 31st July. Places are limited. Click here to book your place now.

Automate Annual Leave Management with BrightPay Connect

After months of lockdown, many people are embracing the idea of staycations in a bid to save what’s left of the summer. For employers, however, managing employee leave can be far from relaxing if it is a manual process. BrightPay Connect’s online leave management tools eliminate cumbersome people management tasks. It’s more than just payroll software, it’s a ready-to-go, easy-to-use HR software solution. The staycation trend should be a reason to be excited, not an admin nightmare.

Processing Employee Hours Made Simple With BrightPay Connect

We’re always keen to hear what the biggest challenges are for payroll bureaus and how we can help make their job easier. One of the most common issues we understand is that requesting payroll information from clients can be an inefficient, time-consuming and often, frustrating process. The good news is that BrightPay Connect makes this process so much simpler. It has become a must-have tool for bureaus who want to streamline their payroll process and increase efficiency.

July Jobs Stimulus Plan – Employer Focus

Newly appointed Taoiseach Micheál Martin announced the July Stimulus package worth €5.2 billion which included 50 new measures to help businesses and in turn help with the recovery of our economy. Here we have summarised the major employer-related measures introduced in this package.

Wage Subsidy Scheme Reconciliation and Repayment to Revenue

Details of both the reconciliation process and the process for employers to follow when returning excess Wage Subsidy Scheme funds to Revenue will be published in due course. In the interim, to assist in their future reconciliation, employers should continue to retain records of subsidy payments made to employees, records of subsidy refunds and tax refunds received from Revenue and hold any excess of the subsidy payments received for offset against future subsidy payments or for future repayment to Revenue.

Aug 2020

5

8 Tips for HR Managers Post-Coronavirus

In May the Government published the Return to Work Safely Protocol. This comprehensive document sets out a number of measures that employers must take in order to help prevent the spread of COVID-19 in the workplace as we reopen our economy.

The Health Service Authority (HSA) is responsible for ensuring that employers are following the protocol and preparing and putting systems and controls in place. They will also be carrying out workplace inspections to ensure the Protocol is being implemented.

The document and possible inspections pose a new challenge for Human Resources managers. As they try to keep on top of all of the latest advice and guidance relating to how business should adapt to the current environment, it can feel overwhelming. To help, we’ve compiled this list of 8 things that HR managers can do to not only ensure they are compliant with government guidelines but also protect staff and cultivate a safe workplace.

1. Use Employee App To Upload Documents

BrightPay Connect is the perfect cloud portal to assist HR managers at this time thanks to its employee app with document sharing functionality. HR managers can send out important COVID-19 related policies, updates, forms and other documents to either a single employee, specific teams or departments, or all employees across the board. They can also track who has read the information sent as a time-stamped log is kept in the cloud.

You can book a free demo of BrightPay Connect for employers today to learn more about how Connect can improve your HR operations.

2. COVID-19 Induction Training

Communication is key and employees coming back to work are likely to have a lot of questions about everything from how the pandemic has affected their annual leave entitlements to what measures the employer is taking to minimise the risk of exposure in the workplace. You will also have new policies and procedures to share with employees. Not only is a COVID-19 Induction Training Session mandatory, but it is also a great way to share all of this information, answer any questions that employees may have and facilitate discussion. This training is required as set out in the Return to Work Safely Protocol.

3. Develop A COVID-19 Response Plan

This is the key element of your compliance with the Protocol. It is best thought of as a comprehensive catch-all document that deals with all points of relevance relating to COVID-19 and the workplace in one place. This plan needs to outline the following:

- How the business will handle suspected cases of COVID-19

- Hygiene practices that have been introduced

- Social distancing measures taken

- Internal communication methods

- Company approach to employee mental health

Once finalised, this plan should be dispersed amongst employees. A great way to do this is by using the BrightPay Connect employee app.

4. Review Existing Policies

In addition to creating new policies and procedures, all existing policies should be reviewed. In particular, your Health And Safety, Sick Leave and Annual Leave policies will need to be updated. However, you may find that other policies too need to be tweaked in order to reflect the current workplace environment and to comply with the Government Protocol.

5. Send Out Pre-Return To Work Forms

Before your employees return to the workplace, it’s important to send out what are called “Pre-Return To Work Forms”. These forms must be filled out at least 3 days before employees return to work and must include a set of prescribed questions as set out in the Protocol. However, additional questions can be added to cater to your business needs and any unique circumstances that apply to your employees. A Pre-Return To Work Form template has been made available on the HSA website.

5. Appoint A Lead Worker Representative

Every workplace must appoint at least one lead worker representative. This person, along with management, will be responsible for ensuring that the new COVID-19 measures which have been introduced are strictly adhered to in their place of work by all employees. The HR manager will need to work closely with this person to ensure that they are fully informed of the company's new policies and can share information with other employees in regard to them.

7. Be Clear About Annual Leave

One of the things that many employees are confused about is how the Coronavirus has affected annual leave entitlements. Many employees are worried that they won't accrue leave for the time that they spent on lay-off, or that they won't be able to carry their leave into 2021 despite not being able to book holidays abroad as normal in 2020. The best thing that a HR manager can do to address these worries is to make the businesses position on annual leave very clear from the outset, including any changes that have been made to the existing leave policy.

Again, the BrightPay Connect employee app is the perfect vessel for distributing this information as HR managers can check who has received and read the updated policy and who hasn’t.

8. Facilitate Working From Home

Finally, it should go without saying that allowing your employees to work from home is still preferable in all cases where possible. Of course, for many businesses it simply isn’t possible to have all staff working remotely at all times. If your business falls into this category, perhaps you could have employees spend 2 or 3 days per week working from home on a staggered basis, so that there is always someone in the office but never more people than necessary. Where working from home is not an option, make sure to put social distancing measures in place with clear signage to help protect employees.

The key point here is to find what works best for your business and do your absolute best to allow employees to work from home as much as is possible.

Watch Return-To-Work Webinar On Demand

On the 25th of June BrightPay held a free webinar to share information on returning to work post-lockdown and what employers and HR managers need to know. You can watch this webinar on demand today to keep up-to-date on the latest advice and guidance.

Jul 2020

28

Make Sure Your Business Is Doing These 5 Things Before You Bring Employees Back

Are you an employer struggling to keep on top of everything you need to do before bringing your employees back to work? The government recently released the Return To Work Safely Protocol. This is a comprehensive 29 page document in which they outline the details of these expectations clearly. In order to ensure that your business is complying with the Protocol, you need to understand exactly what those expectations are and take the appropriate measures to meet them as best you can. The Health & Safety Authority (HSA) has been given powers to inspect businesses and their compliance under the Protocol.

As a result, many employers are feeling overwhelmed as they try to keep track of everything they need to do before bringing their employees back to the workplace. However, when you break it down and get organised, the task at hand isn’t so daunting, and we are here to help.

5 Things Employers Need To Do Before Bringing Employees Back To Work

Whether you’re a business in the retail industry where employees must come into the workplace everyday, or in other industries where employees can largely work from home, all employers must prepare for “the new normal”. From reviewing and amending existing Health And Safety policies to electing a Lead Worker Representative, there’s a lot to do. Thankfully, we’ve put together this list so that you can make sure you’re complying with the Government’s Return To Work Safely Protocol.

-

COVID-19 Induction Training - The Protocol requires that you hold induction training with your employees. This training should be designed to share with your staff all of the changes that you’ve made to the physical workspace, as well as new rules and procedures for work. Depending on your business, these rules might include social distancing measures, the implementation of “one way” traffic zones on your premises, staggered break times, increased hygiene facilities, new communication processes for working from home etc. It should also include any changes you’re making to existing policies, the use of Pre-Return To Work Forms, the Lead Worker Representative and your COVID-19 Response Plan. Read on for more details on these steps.

-

Pre-Return To Work Forms - Pre-Return To Work Forms are required by the government as one of the most important steps a business should take before bringing employees back to work. The Return to Work form must include a list of prescribed questions, as set out in the HSA’s template provided here. The return to work form must be completed by employees at least 3 days before their return to the workplace. There are many other template checklists on the HSAs website, and these are a great way to help your employees prepare for their return to work, reassure them that you’re doing everything possible to make the workplace safe for them, and identify any concerns that they have which you could address.

-

Review Existing Policies - The Protocol also states that all existing policies should be reviewed and amended where relevant. One example of this is your Health And Safety Policy, which should now include a detailed section dedicated to preventing the spread of COVID-19 in the workplace. It is also advisable that you include any changes you will make to how your business is approaching mental health. This is because many of your employees are likely to be experiencing varying levels of anxiety at present.

-

COVID-19 Response Plan - Every business must create a COVID-19 Response Plan. This plan should outline the following areas:

• How the business will handle suspected and/or confirmed cases of COVID-19 among staff

• Any new hygiene practices that have been introduced

• All social distancing measures that have been brought in

• How the business is taking care to promote employee mental health

• A list of internal communication methods used to disperse this information among employees -

Lead Worker Representative - Businesses should appoint a Lead Worker Representative. This person will liaise with management, relaying any concerns/frustrations/questions from staff, assisting in the sharing of information across the company, and representing employees as new policies and procedures are put in place. This is a vital role to ensure that both employer and employees work together in a collaborative effort to make the workplace safer for everyone.

Watch Our Webinars On Demand

Want to learn more about what your business could be doing to follow government guidelines? Check out our previous webinars, all of which you can watch on demand, in which we talk through all of the government advice and what it means for employers.