Oct 2017

2

Are you ready for PAYE Modernisation?

To raise awareness about forthcoming PAYE Modernisation in 2019, Revenue has commenced its awareness campaign by releasing an information leaflet “PAYE Modernisation – Are You Ready”.

This leaflet highlights the vital steps for new and existing employers to undertake in advance of 1st January 2019, in order to succeed in the imminent taxation system revolution.

The key idea behind PAYE Modernisation is that all communication between employer and Revenue will happen in “real time”. In order to effectively overcome the upcoming challenges, employers are being encouraged to focus on the quality and accuracy of the data they provide to Revenue.

In preparation for PAYE Modernisation, employers are advised to follow several easy steps to guarantee its overall success when it does come into effect in 2019:

- Register as an employer (for new employers)

- Verify the PPSN provided by employees (e.g. check it against a Public Services Card, P45 or other Revenue or DSP correspondence) and where the employee does not hold a PPSN, they should contact the DSP to apply for one.

- Register all employees with Revenue (i.e. P45(3) or P46 where the employee has no P45). Where the new employee has not worked in Ireland before, the employee must register the employment online using the Jobs and Pension service available in myAccount. The Jobs and Pension service can also be used by employees who are changing from one employment to another. Once the employment has been registered, Revenue will issue a tax credit certificate.

- Issue a P45 when an employee ceases employment and submit it to Revenue.

- Ensure an up-to-date tax credit certificate has been received for each employee. The leaflet outlines the basis of tax which should be applied on the first payday of a new tax year in the event that an up-to-date tax credit certificate for that year is not received.

- Ensure a complete PAYE, PRSI and USC record for each employee is held at the end of the tax year.

At Thesaurus Software & BrightPay, we have always strived to deliver excellence in customer service and professional expertise in both Irish and UK payroll. We widely welcome the upcoming PAYE changes. As Paul Byrne, director of Thesaurus Software Ltd, stated during the Revenue's public consultation process held in December 2016:

“Whatever system is adopted, it is important that it represents a step forward for all parties. We are already committed to not charging our customers for the additional development involved. In addition, we are considering making a free version of our software available for micro employers, those with one or two employees.”

Related articles

Sep 2017

27

What do you mean…. “Do I have a backup?”

One of the most common calls I get on the support line is from a distressed customer who tells me they have lost their payroll information. Reasons for the loss of this information are varied and could be anything from a laptop being stolen, a virus attacking the computer, holding files to ransom or fire or water damage to the computers in the office.

The first question I’ll ask on a call of this type will be “do you have a backup?”. Honestly, I can’t tell you the number of people that say “No” to this. People are also mistakenly under the impression that we have a copy of their payroll data. Unfortunately this is never the case, we do not have access to the employer’s payroll information so this can add to the customer's stress levels as you can imagine!

We would always stress the importance of taking a backup of your payroll information. You would have your computers and office equipment insured against anything happening so why would you not do the same for your data? Think of your backup as your information’s insurance policy, after all it is almost irreplaceable or at the very least a major inconvenience to try and rebuild your payroll.

In a lot of cases, the call to our customer support line comes too late for us to be of any real assistance and the only advice we have to give is to start over and process payroll from the beginning again.

We never think anything like this will happen to us, but take it from me, it does, so go ahead and take out that insurance policy and backup before it is too late!

The following links will guide you to taking a backup in your software or book a demo of BrightPay Connect our latest cloud add on that offers an automated online backup feature:

- BrightPay UK: https://www.brightpay.co.uk/docs/17-18/backing-up-restoring-your-payroll/

- BrightPay Ireland: https://www.brightpay.ie/docs/2017/backing-up-restoring-data-files/backing-up-your-payroll-data/

- Thesaurus Payroll Manager: https://www.thesaurus.ie/docs/2017/processing-payroll/backup-data-files/

Sep 2017

26

New Automatic Enrolment Pension System to be in place by 2021?

With better living standards and expanding economy, it is without doubt that Irish people are now living longer and we have a much healthier society. At the same time, we need to face the fact that with the Irish population inevitably getting older, there is the prospect that senior citizens will have to stay in employment long after they have passed retirement age. It is therefore absolutely vital to address the funding of the Irish pension system now if we want our pensioners to be well-protected in the future.

To tackle this issue, Brian Hayes MEP has called on Minister for Social Protection Regina Doherty to start work on the introduction of an automatic enrolment pension system, whereby all Irish private sector employees would be automatically enrolled into a pension scheme. As Mr Hayes stated, "a road map needs to be put in place for the introduction of an auto-enrolment system for all Irish businesses. The Cabinet needs to make it a priority to ensure that auto-enrolment is put into Irish Law by 2021. This is something that can be done through cross-party agreement."

In 2012, the UK introduced an automatic enrolment system which is working well and providing long-term sustainability. Automatic enrolment systems have also been introduced in Australia and New Zealand, and similar systems exist in the Netherlands, Sweden and Denmark. These countries are recognised as world leaders in pensions.

Mr Hayes has suggested that Ireland should create its own system, whereby every employee will be automatically enrolled into a pension scheme, into which they should contribute at least 1 per cent of their monthly salary, to be matched by their employer.

Mr Hayes also added, “In Ireland we are far too dependent on our state pension system. We have a very low take up of workplace pension schemes. Less than 40% of Irish workers are covered by a workplace pension scheme. The best way to deal with both of these problems is through an auto-enrolment system which reduces dependency on the state system and ensures people have additional pension pots built up.”

A recent global study called the ‘Melbourne Mercer Global Pension Index’ has stated that Ireland's pension system is good but has serious sustainability problems into the future. Elsewhere, Mercer's report found that Ireland will increasingly struggle to afford the provision of a guaranteed pension for everyone, if the current pension system isn’t addressed.

Sep 2017

22

Public Holiday Pay Entitlement

There can often be some confusion surrounding an employee's entitlement to pay for a public holiday particularly where the employee may be part-time or the public holiday falls on a day that the employee does not normally work.

It is also worth noting that not every bank holiday is a public holiday though in most cases they coincide. Good Friday is a bank holiday but it is not a public holiday. The following dates are the official public holidays in Ireland.

- New Year's Day (1 January)

- St. Patrick's Day (17 March)

- Easter Monday

- First Monday in May, June, August

- Last Monday in October

- Christmas Day (25 December)

- St. Stephen's Day (26 December)

Employees who qualify for public holiday benefit will be entitled to one of the following:

- A paid day off on the public holiday

- An additional day of annual leave

- An additional day's pay

- A paid day off within a month of the public holiday

So, who is entitled to a payment?

- Part-time employees qualify for public holiday entitlement if they have worked at least 40 hours in the 5 weeks ending the day before the public holiday.

- Full time employees are not required to have worked up a minimum number of hours.

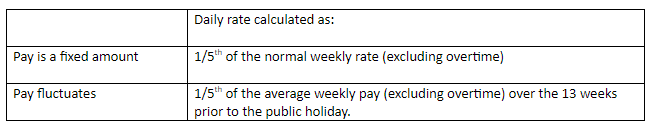

How to calculate the amount to be paid?

If the public holiday falls on a day which the employee would normally work:

- Full-time employees are entitled to one of the above four options at the employer’s discretion.

- Part-time employees have the same entitlement, so where the employee’s pay is a fixed amount the normal daily rate can be used. If the pay varies, the daily rate should be calculated over the 13 weeks immediately before the public holiday in question.

If the public holiday falls on a day which the employee does not normally work:

Further information can be found at Organisation of Working Time Act 1997.

Sep 2017

18

Long Service Awards - Appreciation to staff

Have you employees with 20 plus years of service? If so why not say thank you with a gift.

Revenue Commissioners offer tax relief on long service awards, which is considered to be at least 20 years of service. Tax relief on long service awards can be in addition to the small benefit exemption.

Employers can reward employees for long service with tangible articles with a value up to a maximum of €50 per year of service, starting at 20 years of service and every 5 years thereafter.

- 20 years of service – value up to €1,000

- 25 years of service – value up to €1,250

- 30 years of service – value up to €1,500

- 35 years of service – value up to €1,750

The award must be a tangible article e.g. a gold watch, it does not apply to awards made in cash.

Tax will not be charged provided:

• The cost to the employer does not exceed €50 per year of service

• The award is made in respect of service not less than 20 years

• No similar award has been made to the recipient within the previous 5 years

Where any of the conditions are not met PAYE, PRSI & USC must be applied on the full amount.

Details can be found on Revenue's website

New PAYE Modernisation legislation to be in place by Jan 2019

Sep 2017

11

Key Features you need to know about BrightPay Connect

BrightPay Connect is our latest cloud add-on that works alongside BrightPay Payroll. Automatically store payroll information in the cloud and enable online access anywhere, anytime for payroll bureaus, employers and employees. You’ll be up and running in seconds.

Secure online Backup

- Automatically synchronise and backup data to the cloud protecting against ransomware and cyber attacks.

Payroll Bureau / Client Dashboard

- Online access to clients’ payroll information.

- Invite clients to their own online dashboard which can be branded with your bureau’s logo.

- Clients can access payslips, payroll reports, amounts due to Revenue, annual leave requests and employee documents.

- Watch our BrightPay Connect video for payroll bureaus.

Employer Dashboard

- Online access to your payroll information.

- Invite your accountant to instantly access your payroll data 24/7.

- Access all employees payslips, payroll reports, annual leave requests, amounts due to Revenue and employee documents.

- Watch our BrightPay Connect video for employers.

Employee Self Service Portal

- Invite employees to their own online portal.

- Employees can view and download payslips, P60’s and P45’s. Easily submit holiday requests, view leave taken and leave remaining.

HR & Annual Leave Management

- View all upcoming leave in the BrightPay Connect company wide calendar.

- Authorise leave requests with changes automatically flowing back to the payroll.

- Upload HR documents including employee contracts and handbooks.

Book a demo today to see how BrightPay Connect can enhance your payroll processing.

Sep 2017

8

BrightPay – A Breath of Fresh Air

Most small business ask if they can afford to employ someone. Simply, if you pay an employee the minimum wage of €9.25 per hour, it will actually cost you approximately €10. (This includes wage, public holiday, annual leave and PRSI). Additionally, if your accountant is processing your payroll, their charge may be around €3 per employee (weekly wage), you could save money by doing the payroll yourself.

Using BrightPay's features, you can smoothly process your payroll, it is a simple and powerful software. It’s designed with small to medium sized businesses, accountants and other payroll providers in mind. BrightPay has everything you need to manage payroll and it’s easy to learn and use. It caters for the processing of your payroll on a weekly, monthly, fortnightly or 4-weekly basis. More than one payment frequency can be processed at any time within your company’s dataset. For details on this feature, please click here.

If you are moving to BrightPay from another payroll software, we have online documentation to assist you. If you currently use Thesaurus Payroll Manager, our other payroll package, you may wish to change because of the additional features and functionalities BrightPay has to offer. Our step-by-step guide will assist you with this easy process.

Join our next BrightPay demo where we will take you through setting up your company on BrightPay and running your payroll on a day-to-day basis. Download our software for a free 60 day trial.

Sep 2017

5

Businesses need payroll software to be prepared for the future

PAYE Modernisation / Real Time Reporting

With PAYE Modernisation / Real Time Reporting (RTR) arriving sooner than you think, if you process your payroll manually or if you are unhappy with your current system, there is no time like the present to change.

From January 2019, the option to provide annual reports to Revenue will no longer be available to employers. Instead, employers will be required to submit their payroll data on a “pay period” basis throughout the payroll year. This is known as PAYE modernisation. Employers will need to have certain facilities in place to process PAYE modernisation.

BrightPay is working closely with Revenue to ensure we have the functionality required to keep customers up-to-date with all the PAYE Modernisation legislative changes. With our UK version of BrightPay, we have acquired the knowledge and experience needed for a smooth transition in January 2019.

Free PAYE Modernisation Webinar

PAYE Modernisation is probably the biggest overhaul of the PAYE system since PAYE itself was introduced back in 1960. It will have wide ranging effects on all employers and on all bureau payroll providers. Join BrightPay plus guest speaker, Sinead Sweeney from Revenue for a free webinar to learn how PAYE Modernisation will affect your business.

General Data Protection Regulation (GDPR)

Another legislative change arriving in less than a year is the General Data Protection Regulation (GDPR). This change is in relation to data protection, and it will substantially change how companies manage their data. In relation to payroll, this legislative change will mean all employers must ensure that their payroll information is securely stored within their payroll software. Unfortunately for many employers, using an Excel spreadsheet or another alternative manual method to store payroll information will no longer be compliant with GDPR regulations.

Our new add-on, BrightPay Connect provides an automated, secure and user-friendly way to save and restore payroll data to and from the cloud. This will enable employers to securely store their payroll information in the cloud, and as a result comply with their new data protection duties. BrightPay Connect also provides a web/mobile based self-service portal for both employers and their employees. Employees can access their private payroll data at any time in order to view payslips, request annual leave and update their personal details. Once leave is approved by the employer, it will then synchronise back into BrightPay payroll on the employer’s PC. This will keep your payroll data safe and streamline your payroll communications.

GDPR Webinar for Payroll Bureaus

Payroll bureaus process large amounts of personal data, not least in relation to their customers, their customers’ employees, and their own employees. Consequently, the GDPR will impact most if not all areas of the business and the impact it will have cannot be overstated.

Related articles:

- Revenue moves to PAYE Modernisation

- What you need to know about PAYE modernisation?

- What is BrightPay Connect?

- GDPR - What businesses need to know

Aug 2017

30

August Customer Update

Revenue moves to PAYE modernisation

In October 2016, the Minister for Finance announced that the current Pay As You Earn (PAYE) system would be revamped and modernised. This new system is known as PAYE Modernisation, which allows for PAYE reporting to be submitted to Revenue in real time.

PAYE Modernisation or real time reporting (RTR) will enable Revenue to ensure that employees are receiving their correct tax credits and cut-off points throughout the year in real time. This compares with the current PAYE reporting which is done through P35s on a yearly basis.

Bright Contracts Webinar: Employee Dismissal – How Easy Is It?

80% of unfair dismissal cases are won by the employee, not because the reason for dismissal was unfair but because the employer did not follow fair procedures. In this webinar we discuss the dangers of dismissing an employee, what rights you have as an employer and outline the relevant steps you need to take to protect your business against an unfair dismissal claim.

Top Tips for Reference Check Questions

The reference check stage of the recruitment process is a crucial stage for an employer to obtain vital information about a candidate and corroborating that what they have said on their CV and in their interview is factual and true. By speaking to references, you can gather more information about the candidate’s work ethics and personality traits that might not be apparent during the interview.

News for Bureaus

Watch our latest video to see how BrightPay Connect can benefit your payroll bureau?

BrightPay Connect our latest cloud add-on works alongside BrightPay Payroll. Payroll information is stored in the cloud and can be accessed online by you and your clients anywhere. BrightPay Connect offers additional innovative payroll and HR features that will enhance client relationships and increase revenue for your bureau.

Revenue moves to PAYE modernisation

PAYE Modernisation (aka Real time reporting) is probably the biggest overhaul of the PAYE system since PAYE itself was introduced back in 1960. It will have wide ranging effects on all employers and on all bureau payroll providers. Main Speaker: Paul Byrne FCA, MD Thesaurus Software, Guest Speakers: Sandra Clarke, FCA, AITI, Partner BCC Accountants and council member of the Irish Tax Institute and Sinead Sweeney, PAYE Modernisation Change Manager, Revenue.

Register: 3rd Oct / Register: 4th Oct

GDPR - What businesses need to know!

Data protection and how personal data is managed is changing forever. On 25 May 2018 the new General Data Protection Regulation (GDPR) will come into force. The GDPR is a European privacy regulation replacing all existing data protection regulations.

Find out More / Register for CPD webinar

News for Employers

Watch our latest video to see how BrightPay Connect can improve your annual leave processing

BrightPay Connect our latest cloud add-on works alongside BrightPay Payroll. Payroll information is stored in the cloud and can be accessed online by you and your employees. BrightPay Connect offers additional innovative payroll and HR features that streamline your annual leave management and payroll processing.

Free Webinar for Employers: What you NEED to know about PAYE Modernisation | Guest Speaker - Revenue

PAYE Modernisation (aka Real time reporting) is probably the biggest overhaul of the PAYE system since PAYE itself was introduced back in 1960. It will have wide ranging effects on all employers. Main Speaker: Paul Byrne FCA, MD Thesaurus Software, Guest Speaker: Sinead Sweeney, PAYE Modernisation Change Manager, Revenue.

Aug 2017

17

Paternity Leave – Uptake lower than expected

In September 2016, fathers of children born in Ireland became eligible for the first time to take up to two weeks’ paternity leave and to receive Paternity Benefit from the Department of Social Protection. Statistics collated from the first few months of the scheme show, however, that just one in four fathers eligible for the scheme chose to avail of it. This is in stark contrast to the expectation that 60% of eligible fathers would avail of the scheme when it was first announced.

Just over 5,000 paternity benefit applications were awarded during the first three months of the scheme going live, with County Longford, Kerry, Roscommon and Clare having the fewest applicants. A larger uptake however was seen in County Dublin, Cork and Kilkenny.

A further 7,500 paternity benefit claims were subsequently awarded in the first four months of 2017.

Under the new scheme, eligible fathers are entitled to two weeks of paternity leave. The two-week leave can be taken at any point within 28 weeks of the birth or adoption of a child, but the two weeks must be taken together.

A social welfare benefit of €235 per week is paid for the two weeks. It is at an employer’s discretion if they wish to top up this payment to the full weekly wage normally earned by the employee.

Despite the low uptake so far, it is hoped that the number of applicants will increase as the scheme enters its second year in September.

Current statistics also don’t reflect fathers who may be delaying their paternity leave, for example fathers whose child was born on February 28 this year can take it at any time up to September 1, 2017.

Guidance on how employers should treat Paternity Benefit and when it should be entered in Thesaurus Payroll Manager can be found here:

https://www.brightpay.ie/docs/2017/parenting-leave/paternity-leave-and-pay/

Related article: