Jul 2022

14

How the cloud can improve your business’ security

When you process payroll, sensitive employee data can be at risk of becoming lost or damaged. All it takes is one accidental download or a mistyped email address to expose this data to the wrong person.

That’s why cloud payroll solutions are at the forefront of payroll security nowadays. Utilising the cloud in your payroll process means that you can ensure your payroll data is safe. Depending on what payroll software provider you’re using, features can vary across the board. Below, we’ve put together our top three features that we believe cloud payroll solutions should offer, to ensure the complete security of your employees’ payroll data.

1. Automatic backups

Manually backing up your payroll data to an external hard drive or third-party file hosting service can be time-consuming, tedious, and not as secure as you might think. You should be able to backup your payroll data automatically to the cloud, as you use the software. This ensures that, should your computer crash or be stolen, you won’t lose any important data.

Another factor to consider is are these backups being stored on your desktop, or are they being stored on a secure online platform? It is recommended that you store a chronological history of your backups in a secure online location, which keeps your employees’ data safe from harm’s way. This prevents unnecessary panic down the road, should disaster strike, as you know that you can retrieve and download a previous version of your payroll information, at any time.

2. Employer and employee online portals

Have you ever sent a payslip to the wrong employee, or mismanaged annual leave requests? These everyday problems can now be easily resolved with employer and employee portals. Not only are they a great way to increase the security of your payroll data, they also improve your GDPR compliance, as well as your employees’ job satisfaction.

BrightPay’s employer dashboard for example, allows you to view employees’ payslips, upload important HR documents, manage annual leave requests and view any payments that are due to Revenue, all from one secure location. For further information on what BrightPay’s employer dashboard can offer you, please watch this short one-minute video.

BrightPay’s employee app also provides many security benefits, such as allowing employees to update their personal details from anywhere, at any time. Employees can also easily access an archive of all their payslips from the app, readily available to view, print and download. This gives the employee more control over their personal information from a secure online location, which is in line with GDPR best practices.

3. Two-factor authentication

Did you know that Ireland had the highest increase in cyberattacks in Europe last year? That’s why it’s more important than ever before to have extra security measures, such as two-factor authentication, when accessing sensitive data. Two-factor authentication is usually done through phone, email or an authenticator app and involves a code being sent to the user which they will need to input to gain access to the application. This provides an added layer of security, verifying that only those who are authorised to do so, are accessing, and viewing payroll data.

Where can I learn more about the benefits of cloud payroll tools?

BrightPay’s payroll cloud-extension, BrightPay Connect, offers all of the these features mentioned above, along with many other benefits that can enhance your business, whether you have one or 10,000 employees. BrightPay is a leading Irish payroll software for employers and we work hard to provide the most up-to-date and innovative solutions in payroll software, regularly hosting webinars and creating guides on the latest payroll features. Sign upto our newsletter by clicking the link below to stay in the loop, or sign up for a free 15-minute demo to look at our cloud extension in more detail.

Dec 2021

15

How to avoid employees carrying over their annual leave

For most employers in Ireland, their annual leave year runs from January to December and an employee’s annual leave entitlements will depend on how much they’ve worked that year. As we get closer to the end of 2021, you may notice some employees who still have days or maybe even weeks left to take. Depending on what type of business you’re in, this could be a real headache to deal with. For example, if you are in retail, giving employees time off at Christmas could be impractical.

Some employees may ask if they can carry over their leftover leave into 2022. According to Citizen’s Information, annual leave should be taken within the leave year it was earned. Whether or not an employee can carry over annual leave entitlements will depend on the policy you have in place. Some employers will agree to allow employees to carry over untaken annual leave within 6 months of the relevant leave date, while others may allow employees to carry over leave even further. It is important to note, if an employee is on extended sick leave, then legally, they are allowed to carry over any unused leave for up to 15 months after the end of the year it was earned.

While in most cases allowing an employee to carry over annual leave shouldn’t be a problem, it can become impractical, especially when you have a lot of employees wanting to do so. Making sure your employees take their annual leave within the year it was earned can help avoid employee burnout as it encourages them to take more regular breaks. It also prevents employees saving up their annual leave and using it all in one go which could result in your business being short staffed for a long period.

Whatever you decide, it is important that you have an annual leave policy in place which clearly outlines whether employees can carry over leave from one year to the next. If you would rather a “use it or lose it” policy where employees must take their leave within the year it was earned, then it is important that you carefully track employees’ leave taken and remaining. Doing this will help you avoid having employees on leave, when you may need them most.

If you would like a ready-made annual leave policy which you can tailor to your own needs, visit our sister company Bright Contracts to find out more, or book a free online demo with a member of their team today.

How can I keep track of employees’ annual leave?

If you have a lot of employees, it can be difficult to keep track of everyone’s annual leave. Luckily, your payroll software can help. BrightPay Payroll Software used alongside our optional cloud add-on BrightPay Connect has an annual leave management feature which allows employers and employees to keep track of annual leave taken and remaining.

1. View a company-wide calendar of employees’ past and scheduled leave

When you open up BrightPay Connect’s employer dashboard, from the calendar tab, you can view a company-wide calendar which shows all your employees past and scheduled leave. This calendar is automatically updated when you add leave for an employer in the payroll software. The calendar makes it easier for you when you need to decide whether or not you will approve an employee’s request for time off.

2. Let employees request leave through their phone

BrightPay Connect also includes an employee smartphone app which the employee can use to request leave. From the app the employee simply selects the days which they would like off, the type of leave (paid or un-paid) and the times (eg. a half day). Employees can request leave anytime, anywhere, even on the go.

3. Have approved leave automatically update in your payroll software

Once the leave request has been sent, the employer will receive a notification on the employer dashboard asking them to either approve or deny the request. If the employer approves the request the annual leave will automatically flow through to BrightPay.

4. Let employees know how much leave they have remaining without having to ask you

Another great feature of the BrightPay Connect’s employee app is that when an employee opens the app, they can see how much leave they have used so far that year and the amount of leave they have remaining. When an employee can easily keep track of the amount of leave they have used it means they will be less likely to have leave left over by the end of the year.

While some employees will still need an extra nudge to remind them to take their full annual leave entitlements before the end of the year, BrightPay Connect can greatly help payroll processers in keeping track of who has leave left to take. This can help avoid employees carrying over annual leave days and having too many employees requesting to take leave at the end of the year.

To learn more about how BrightPay Connect can help you manage your employee’s annual leave, why not book a free online demo today.

Related articles:

Oct 2021

21

Payroll App – What your employees can and cannot see

Does the use of an employee payroll app have risks associated with it? Is it possible for employees to see sensitive information that they shouldn’t? What are the chances that they could view their colleague’s payslip or somehow view financial information about the company? These are common concerns many employers have when first hearing about payroll and HR apps.

Employee apps have become increasingly popular, and for good reason. HR departments can share confidential documents with an employee or share a staff-wide update, while the payroll processor can send payslips directly to the employee’s phone. And while you may understand the time-saving benefits of these features, you might still be unsure of whether it can guarantee the privacy of confidential information. Luckily, with an employee app such as BrightPay Connect, you can use the user management system to decide the level of access each employee has; what they can see and what they can’t.

Managing User Permissions in a payroll app:

BrightPay Connect, the optional cloud add-on to BrightPay payroll software, is a popular payroll app among employers. It offers a host of benefits that can make the payroll process quicker for the employer as well as for the employee. At the same time, its user management system offers the necessary security to ensure tight control over who has access to certain payroll information and who doesn’t.

How can you manage user permissions in BrightPay Connect?

BrightPay Connect controls who has access to certain information by its user management system. The user management system is controlled from BrightPay Connect’s employer dashboard. Logging into this dashboard through an online browser, the employer can add different types of users, manage employee leave requests, and view a summary of their employee payroll information.

With the user management system, the employer can add two main types of users: Administrator and Standard User. Each type of user can be granted certain permissions and restrictions.

Administrator

- An administrator has full control over a BrightPay Connect account. They can view the company’s internal payroll if it is associated with the BrightPay Connect account.

- An administrator can edit account settings, add other users, redeem purchase codes, manage all employer and employee information and processes.

- You have the option of having more than one administrator, but we would recommend having as few administrators as possible to keep your payroll information safe.

Standard User

- The more widely used type of user is the standard users. Typically, managers of different departments and employees working in HR are given standard user access.

- Standard users are given certain permissions and restrictions, that can differ from one another.

- Standard users cannot access the company’s internal payroll, but certain standard users can be given permission to view financial information including employee payslips and payroll reports.

Example:

For instance, a HR manager can be set up as a standard user who can view such information and who can also grant leave requests for employees in all departments and share documents directly to the employee’s BrightPay Connect app.

Another example of a standard user is a manager of a department. This manager does not have permission to view payslips but can instead approve leave requests from their own departments only.

Figure 1: The types of permissions given to standard users.

What permissions does an employee have?

A typical employee who does not work on payroll and has no need to view anything beyond their own personal information, is neither an administrator nor a standard user. They are only allowed access to their own personal account by accessing their employee portal on the BrightPay Connect app or on an online browser. In the employee portal, they can:

- View their current and past payslips

- Request leave

- View leave taken and leave remaining

- Update their contact information

- View documents uploaded by the company

They can access this account either online or by downloading the app to their phone or tablet.

Book Your Free BrightPay Connect Demo Now

If you’re interested in learning more, book your free BrightPay Connect demo. A member of our team will walk you through the various features of BrightPay Connect and explain how they can benefit you and your clients.

Related Articles:

Feb 2021

8

BrightPay Connect: Two Factor Authentication Explained

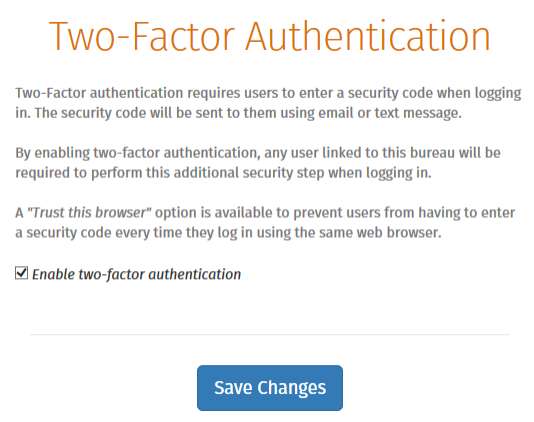

As security is a large concern for many businesses nowadays as data breaches are a threat to all entities, Two Factor Authentication can now be enabled as a feature for users of BrightPay Connect. Two Factor Authentication is a second layer of protection to re-confirm the identity for users logging into Connect through an internet browser or through BrightPay. This improves security, protects against fraud and lowers the risk of data breaches as users can access sensitive employer and employee data in Connect with the increased security layer.

BrightPay Connect is an optional cloud add-on feature that works with BrightPay. BrightPay Connect provides a secure, automated and user-friendly way to backup and a self-service dashboard to both accountants and employers so they can access payslips, payroll reports, amounts due to Revenue, annual leave requests and employee contact details.

How it works

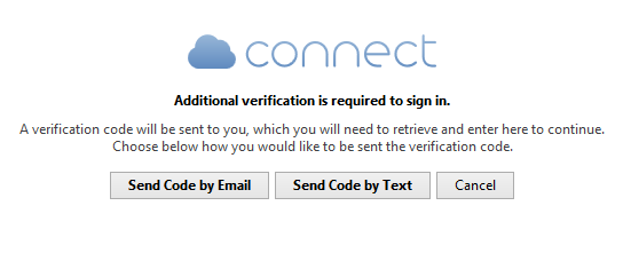

If Two Factor Authentication is enabled for a Connect account, when any user on the Connect account tries to sign into Connect via their internet browser here or through BrightPay, they will be asked to enter in a security code that needs to be sent to them. The user can select to have the security code to be sent by email or by text to the user.

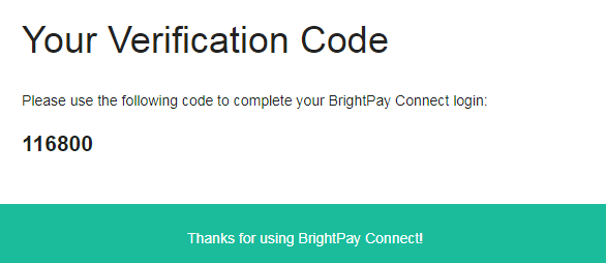

Once the user receives the security code the user enters this in the 'verify code' field and selects 'Verify Code'. The user will only be able to access the security code if they have access to the email account or mobile device. The random generated 6 digit security code will expire after fifteen minutes so a new code will have to be sent if the code is not used in the time limit.

This Two Factor Authentication uses a second security measure of identification ensuring the user is the correct user when logging into Connect. It adds an additional layer of security to an already secure hosted platform and gives the user more reassurance that their payroll data is safer and more secure.

To Enable this option in Connect when you are logged in > Go to 'Settings' > Go to 'Two Factor Authentication' > Tick the box > 'Save Changes'.

Related Articles:

Jan 2021

26

Lockdown 3.0 - What have payroll processors learned?

Lockdown hasn't been easy for any of us - you could say it's been a bit of a 'coronacoaster'. COVID-19 has made us realise what’s important to us. Whether that be connecting more with family or re-connecting with old friends through the social platforms we are so grateful to have during this time. As we are currently in lockdown 3.0, let's look back on some of the key lessons learned as a payroll processor over the past year during this time of crisis.

Importance of Remote Access

Payroll is one of the core functions of running any business, and so it is something that needs to be completed on time and without errors. When working from home, your staff might not be able to access all the tools and documents that they would normally be able to access, especially if your systems are on-premises solutions and files and documents are physical hard copies.

Due to COVID-19 and having to work remotely from home, it is now a necessity to be able to access your payroll data from home. Your payroll software should easily facilitate remote working with additional user access. BrightPay can be installed on up to 10 PCs per licence key, and this means that payroll processing is possible by up to 10 users, or from 10 different locations. This is very handy for if you have a number of employees working from home, all needing access to the payroll software.

We have also introduced new multi-user features that work in conjunction with BrightPay Connect, our optional cloud add-on, to improve the working from home experience. These new features include ‘version checking’ when opening an employer, and an ‘other users check’ when opening an employer. This new "working from home" integration gives you all the benefits of the cloud while utilising the power and responsiveness of your local device.

Importance of Reliable Software

The past year has been very frustrating for payroll processors. Not only had you the added workload of processing subsidy claims, but you also had to learn about the various schemes and ensure you kept up to date with the latest guidelines. That’s why it’s so important to use reliable payroll software from a reliable company.

We kept BrightPay up to date to cater for the relevant scheme changes, and we tried to automate as much as possible in the payroll software to make your life easier.

In a recent survey, we achieved a 98.7% rating for our overall handling of COVID-19 including customer support, payroll upgrades, COVID-19 webinars and online support. We also won a COVID-19 Hero Award, and this is because of our response to COVID-19 and how we have helped our customers throughout the past few months.

Importance of Cloud Backups

As most businesses are now working remotely for the foreseeable future, it leaves many businesses exposed to data loss. This is why cloud backups are so important.

If you only keep your payroll data on your desktop, you are at risk of losing the information. Have you thought about what would happen if your computer broke down or was hacked? How would you get your payroll data back quickly? Would employees still get paid if the information was lost?

BrightPay Connect is our optional add-on that works alongside the payroll software. BrightPay Connect provides a secure and user-friendly way to automatically backup and restore your payroll data on your PC to and from the cloud. It’s simply an added layer of data protection to keep your payroll data safe so you never lose your payroll data again.

Importance of Automation

Whether you’re an employer processing payroll in-house for your business, or an accountant or bureau processing payroll for a number of clients, automation is key. How much time do you spend managing annual leave, answering employee leave balance enquiries, retrieving lost payslips, and communicating with employees in general? Now is the time to eliminate those admin-heavy tasks!

Self-service online portals are changing the way businesses interact and communicate with their employees, whilst providing the cloud functionality to get things done smarter and faster. BrightPay Connect includes the ability to manage employee leave, communicate with employees, automate payslip distribution, run payroll reports and much more.

Book a demo of BrightPay Connect today to discover more features that can help you streamline your payroll and HR processes.

Jan 2021

19

Four ways to introduce payroll as a service to clients

More than ever, accountants are under pressure to diversify their service offering as the profits from doing compliance increasingly diminish. To the profession’s immense credit, firms have embraced new ways of working to not only stay afloat but thrive.

But with more competition, it’s become hard to stand out. Offering payroll processing services has become an overlooked way to set yourself apart. Perhaps understandably: in the past, payroll processing wasn’t a particularly dynamic, easy or, most importantly, profitable service to offer.

Things have changed, however, with the advent of new software that has made offering payroll services more profitable, simpler and innovative.

BrightPay Connect and Cloud Access

BrightPay Connect is a cloud add-on that seamlessly slots into BrightPay payroll software on your desktop. The payroll is still processed on BrightPay’s desktop application, but the payroll information is stored online on a secure cloud server. By introducing the cloud into your payroll services, you can demonstrate value and power up what you offer to clients.

Here are four ways you can introduce a cloud system with payroll access like BrightPay Connect to clients:

- The client self-service dashboard: Clients can see their employer details, employee's contact details and payslips, any outstanding amounts due to Revenue and any reports that have been set up in BrightPay on the desktop application. It’s a collaborative sort of payroll processing that clients will never have experienced before.

- The employee smartphone and tablet app: Not just employers, but their employees too. The self-service app provides a digital payslip platform which employees can access anytime, anywhere. Through the app, your client can offer employees GDPR compliant self-service tools.

- Annual Leave Management Tool: It’s not just payroll or payslips. BrightPay Connect can save your clients money and time with an in-built leave management tool in the self-service portal. Approved leave is automatically added to the employee calendar and synchronised to your payroll software.

- Automatic Cloud Backup: Clients will get the safety and security of a cloud payroll backup when you use BrightPay Connect. The software will automatically backup payroll files every 15 minutes when open and again when the payroll file is closed down. A chronological history of backups will be maintained which can be restored at any time.

Make your and the client’s life easier

There’s so much complication in our modern economy. Businesses and individuals are assaulted on all sides by different technologies and demands for their attention and time.

But it’s important to remember that the right tech can also radically simplify peoples’ lives too. BrightPay Connect, with its suite of HR-centred features, will make payroll processing simple and collaborative.

By empowering your clients via the cloud add-on, you’ll lessen the admin burden on yourself, leaving you to focus on getting the details right. For your client (and their employees), BrightPay Connect will give them control over their leave and payroll data.

Things can – and should – be much simpler. And with BrightPay Connect, that’s the new reality of payroll processing. Book a demo of BrightPay Connect today.

Dec 2020

18

Why not add some sparkle to Christmas with the perfect cloud solution

What springs to mind when you hear the word ‘cloud’ will vary from person to person. Some will think of the weather as they look, grumbling, out their front window. But others will be thinking about all that extra storage on their iPhone. The meaning of the word has changed in recent times and most of us will now think the latter. But what about those who haven’t a notion what you’re on about? What is the cloud?

The cloud is a general term for any computing service that involves hosting over the internet to deliver computing services in lieu of a hard drive. Services such as storage, payroll and HR information. The other key feature is that you can access these services or information anytime, anywhere from any device that is connected to the internet. In fact, you’re already using cloud services if you use social media, Google Drive and Dropbox to name but a few. And now the cloud has become a must-have for any business who wishes to keep up with the times.

I can hear some of you now: “It sounds great, but my employees would never use something like that”. Well, that’s where you’re wrong. A recent survey found that 48% of people believe technological advances will change the face of the workplace and a massive 87% of those said they would be happy to adapt to technological changes if the right tools were given to them. Wow! So how do I know which cloud platform to choose for my business?

I’m glad you asked! Our experts got together for a brainstorming session and found that there are four key things to look out for when choosing the right cloud platform for your business - cost, compliance, simplicity and connection.

- Cost - Your upfront costs should be minimised – using the cloud shouldn’t be an expensive luxury reserved for big corporations. Make sure it provides the option of having multiple users so you can delegate and give access to various people to manage payroll tasks and HR requests on your behalf.

- Compliance - Make sure it takes into account your obligations as an employer with regards to things like the GDPR legislation and record-keeping requirements. A good platform will have compliance built-in as standard and will manage it seamlessly.

- Simplicity - The most important thing to increase the uptake of a cloud platform is to make sure it is user-friendly and reduces the chance of human error. Look out for simplistic interfaces and whether or not training and support are available. The best of the best will offer this support for free. You should also be able to get set up and ready to go with minimal disruption to your business.

- Connection - Make sure it offers features that are attractive to employees such as a downloadable app, a self-service portal and company-wide communication features. Because at the end of the day, your employees won’t give a damn about how excited you might be about something unless it works for them too. These features tie in with our ever-increasing digitally-minded workforce and will make them feel more in control and engaged.

So, there you have it… off you go now! Good luck scouring through the internet trying to find the perfect cloud platform. But…., well, ....it is Christmas after all and I’m feeling generous. Ah, what the heck, I’ll just let you in on a secret which is the best cloud payroll platform for businesses out there: our very own BrightPay Connect.

BrightPay Connect is an add-on to BrightPay’s award-winning payroll software and ticks literally every single box I just mentioned over the course of this post. I’ve done enough talking so instead let me show you. Book a demo today to find out why BrightPay Connect is the perfect fit for your business.

Merry Christmas everyone! Don’t say I didn’t get you anything!

Dec 2020

10

This Feature Will Make You Want To Move To BrightPay Today

When trying to find the right payroll software provider, it can be overwhelming. There are so many choices available today that you may have trouble simply distinguishing one provider from another. What’s more, the payroll industry jargon used can baffle and confuse. It’s really no wonder that many people find this a tedious and frustrating process.

The good news is that BrightPay is here to make this the easiest decision you’ve ever made. Our payroll software has won multiple awards, is used by over 300,000 businesses across Ireland and the UK, and has received and maintained an industry-leading 99% customer satisfaction rating. And if all of this wasn’t enough to sway you, then our cloud portal add-on, BrightPay Connect and its document upload feature certainly will.

BrightPay Connect combines automated payroll functionality with innovative human resources features, for a holistic approach to modernisation. It harnesses the latest advances in cloud technology to offer practical solutions to the most common challenges faced by businesses everyday. Its document upload feature is the perfect solution to many of those challenges, and it’s why BrightPay Connect is the best choice for your business.

Document Upload With BrightPay Connect

BrightPay Connect’s document upload feature is one of the best ways to modernise a number of different elements of your business, including payroll, all at once. It was specifically designed to simplify the day-to-day running of a business in a way that benefits both employers and employees. Here are just some examples of how our cloud portal does just that.

Increased GDPR Compliance

Data protection has been a top priority for businesses of all industries since the GDPR came into effect in May 2018. The regulation sets out a list of measures that businesses must take in order to protect the personal data of their employees and customers. For many businesses, complying with these requirements has relied upon making significant changes to how they manage their human resources.

The document upload facility in BrightPay Connect can increase your GDPR compliance dramatically by allowing you to store all employee personnel files in the cloud. This means that they can’t get lost or damaged, and that they’re stored securely, out of sight of anyone else who shouldn’t have access to them.

Improved Internal Communication

Internal communication is vital for any thriving business, especially as remote working is becoming increasingly common. Sharing documents with employees is essential to a streamlined workflow and efficient processes. However, it can be a lot more challenging than expected, particularly as staff numbers grow and more and more people are working remotely. BrightPay Connect’s document upload feature is the perfect answer to this problem.

Employers and managers can upload any document to Connect. Employees can then access these documents from their employee self-service dashboard, or their employee smartphone and tablet app. What makes the feature even more useful is the fact that whoever is uploading the document can choose to make it accessible to an individual employee, a team or department, or the entire organisation.

Employer Protection

Finally, the document upload feature in BrightPay Connect offers employers an added layer of protection when it comes to ensuring that employees adhere to company policies. This is because, as well as choosing who does and doesn’t have access to the uploaded documents, employers can also view a time-stamped log of who has read the document and when.

This means that, for example, if an employee was in breach of a company policy and claimed that they had never seen nor read the policy in question, the employer can simply check the time-stamped log on BrightPay Connect to find the date and time that they accessed the policy.

Book Your Free BrightPay Connect Demo

Need a little more information before deciding if BrightPay Connect is right for you? Book your free demo today and let one of our Connect experts help you make the right choice for your business. They’ll show you all of its features, functionalities and explain the real-life, tangible benefits that they bring.

Sep 2020

24

5 Common Payroll & HR Problems Solved By BrightPay Connect’s Automation

Automation is transforming how we do business in every industry across the globe. Technological advances now mean that tasks that used to take hours can now take just minutes, and nowhere is this more evident or useful than in the field of payroll and human resources.

Payroll administration first became computerised in the 1960’s and in the decades following, more and more businesses moved their payroll management to company PCs. HR too has become heavily dependent on automation with software streamlining every aspect of HR management from leave management to employee contracts - especially in businesses with large numbers of employees that simply couldn’t be managed manually anymore.

BrightPay Connect has used these advances in technology to incorporate automation in both payroll and HR. In this blog, we’ll break down exactly how Connect’s automation can help you to solve the most common problems faced by employees working in these areas today.

What Is BrightPay Connect?

BrightPay Connect is a cloud add-on to our existing payroll software. Connect customers enjoy a substantial range of exclusive features not available with the payroll software alone. These features offer significant benefits to bureaus, employers, and they have knock on benefits for employees too. They include:

- A self-service employee smartphone/tablet app compatible with iOS and Android.

- Automated and secure cloud backup.

- A document sharing feature which allows employers or line managers to share files with employees working remotely and store them in the cloud.

- A historical payslip archive which allows employees to receive their payslips directly to their device and access them anytime, anywhere.

- Employer dashboards for bureau clients which allow the employer and bureau to communicate and work together more easily and efficiently. It also allows bureaus to view all of their clients in one place and manage their clients in a more streamlined way.

How BrightPay Connect Can Solve Your Business’s Problems

Although BrightPay’s payroll software uses a lot of automation to make processing payroll as streamlined as possible, it’s in Connect when this kind of technology really comes into its own. Our expert team of designers and developers have incorporated automation not just for the sake of it, but in a thoughtful way that aims to address many of the challenges that payroll and HR professionals face everyday. As such, these automations have undeniable, tangible benefits that will make you wonder why you didn’t sign up to BrightPay Connect sooner.

Here are some of the issues that payroll and HR professionals face everyday which can be solved thanks to BrightPay Connect’s clever automation.

1. Payslips Aren't Secure Enough

Still manually printing payslips and handing them out to your employees? Since GDPR came into effect just over two years ago, most businesses have moved to online distribution of payslips. BrightPay Connect increases your data protection compliance by allowing you to send employee payslips directly to the employee’s self-service app. Here they’ll be able to view or download them, and store them securely.

2. There Are Errors In The Payroll

Errors in the payroll are an unnecessary annoyance and can take precious time to correct. For bureaus, this often happens when a client has forgotten to update you on changes to employee hours, new starters or current leave information etc. This can all be avoided thanks to the “Client Entry And Approval” feature on BrightPay Connect.

Bureaus can send a draft of the payroll to their client before finalising. On receiving this draft directly to their online employer dashboard, employers can leave notes for the payroll processor to make amendments, inform them of a new employee and approve or reject the payroll. Bureaus will have a time-stamped log of any changes made by the client and approvals/rejections. This can offer protection if a client says the finalised payroll was inaccurate.

3. Employee Data Is Inaccurate Or Out Of Date

If your business has a large number of employees, then you’ll know how much time is spent on updating phone numbers, changing postal addresses etc. BrightPay Connect frees up this time by allowing employees to make such edits from their employee app, which HR managers can then approve or reject from their online Connect dashboard.

4. Revenue Payments Get Forgotten About Or Missed

A fundamental payroll task of any employer is to keep track of payments due to Revenue. These monthly payments can be easily forgotten about though, especially when you have a hundred other things to think about. BrightPay Connect ensures that you never forget again, as it tracks your next payment date and the amount owed. The payment date and payment amount are clearly displayed at the top of your online employer dashboard, and you can also receive automated emails as the payment date approaches to remind you to make the payment to Revenue.

5. Employee Leave Is Manual And Cumbersome

If your employees are still requesting leave manually then you’re going to love how BrightPay Connect’s automation makes this simpler. Employees can use the calendar on their employee app to request annual leave and this request automatically appears on the HR manager’s Connect dashboard. From here, the manager can check their own calendar which shows them who else is on leave for those dates, and then accept or reject the leave.

The dashboard also keeps a time-stamped record of leave requests and who approved/rejected them, which makes it easier to manage when multiple people are managing leave. This makes the entire process quicker, easier, more efficient and more streamlined for everyone involved.

Book A Demo

BrightPay Connect comes with many more automation features and benefits that can address many of the challenges your payroll and HR managers are facing today. Why not book a free demo with our BrightPay Connect team and discover how you and your business can benefit from them today?

Sep 2020

10

Remote Working Is Becoming The New Normal - Here's What That Means For Payroll

2020 has been a transformative year for most businesses. Many employers have had to take a long hard look at how they manage their employees and make significant changes in the wake of COVID-19 in order to adapt to what is quickly becoming the new normal. For a large proportion of these businesses, allowing employees to work remotely is playing a central role in that change. And this throws up some challenges.

Remote working isn’t a new phenomenon. Cloud innovations have made it possible for people to work from home for many years. However, most businesses have been reluctant to embrace this practice up until now. This is because, when employees are spread out, even the most basic tasks such as distributing payslips, applying for annual leave and internal communication can be more difficult.

Today, however, employers are finding themselves in a position where they must allow employees to work remotely and find clever solutions to these challenges. And BrightPay Connect is one such solution that makes remote working easier for everyone.

How Does Remote Working Affect Payroll and HR?

You might not think that remote working has any impact on processing payroll, especially if you’re a small business with just one payroll administrator. But there are a number of ways that remote working can indirectly impact payroll. It also has numerous knock-on effects on human resources management which need to be addressed in order for a business to thrive.

Here are some examples of the payroll and HR challenges presented by remote working:

- Distributing payslips manually can be more time-consuming, costly and less secure when employees are not located in the workplace, and instead payslips must be posted to their home addresses.

- Making sure that the payroll and any employee leave during that particular pay period are aligned can be tricky, especially if a number of different line managers and/or HR staff are operating from different locations.

- Checking that the information for the current pay period is accurate can be challenging with employers and managers working from home with often unreliable internet connections.

BrightPay Connect Makes Remote Working Easier

BrightPay Connect is a cloud portal add-on to our payroll software. While the payroll software gives you everything you need to process your payroll, BrightPay Connect offers a range of additional features that streamline your human resource management.

The features of BrightPay Connect include:

- An employee self-service app that’s compatible with both iOS and Android. On the app employees can apply for leave, view and edit their personal data, access a secure payslip library and view HR documents, all from their smartphone or tablet.

- An online employer dashboard. Because payroll information is stored online with BrightPay Connect, employers can access their dashboard from their laptops at home. On this dashboard, employers can view a company calendar which displays all past and upcoming employee leave, upload and share documents with employees, and view any outstanding payments due to Revenue. The employer dashboard also shows notifications for any employee leave requests, or requests from the payroll processor.

- Automatic cloud backups. With BrightPay Connect, you don’t need to worry about safely storing your data. BrightPay Connect automatically backs up the payroll data to the cloud and keeps a chronological history of all backups so that you can restore previous versions if needed. This is a great step towards GDPR compliance for businesses who are trying to modernise their data protection practices. The cloud backup is also extremely useful for remote working because everything is stored and accessible via the cloud from any location.

- Clever employee leave management. Employees can request leave directly from their smartphone app. This is beneficial to remote employees because it eliminates the need for employees to visit their line manager or human resources manager in order to fill out leave request paperwork. The request instantly appears as a notification on their manager’s online dashboard. From here, the manager can use the company calendar to see who else is on leave for the dates requested, and either approve or deny the leave request. A time-stamped log of all leave requests is maintained which is particularly useful when a number of different people are managing employee leave as all of the relevant parties can easily see who approved or denied a request, and when.

- Requests for payroll data. Whether you are a payroll bureau processing payroll for a number of clients, or an in-house payroll administrator looking for payroll information from various departmental managers, BrightPay Connect’s payroll entry requests feature can be extremely beneficial when working remotely. You can send a request to your clients or to in-house managers requesting information regarding the employee’s hours and payment information for that particular pay period. Once the payroll information has been entered or uploaded, you will receive a notification on your employer dashboard and can synchronise the information directly to the payroll software. As well as eliminating the need for double entry of payroll information, it also frees up time spent chasing the various managers for the employee timesheets, especially if they are working remotely.

Book Your Free BrightPay Connect Demo Now

If your business is embracing remote working and trying to find ways to facilitate this new practice, then book your free BrightPay Connect demo today and let our team of experts show you just how much easier remote working can be.