Jul 2019

23

Using intelligent automation to streamline your payroll processing

There’s a part in Joseph Heller’s classic novel Catch-22 where the character asks a military officer: “What do you do when it rains?" The captain answers the question frankly. "I get wet.” The captain’s resignation and simple acceptance echo the accountant’s attitude to admin. What else is there to do when processing payroll? Same as getting wet in the rain, payroll processing comes assigned with a burdensome bureaucracy.

Or does it? There are a lot of boxes to be ticked in the accounting profession. There are laws, statutes, regulations, each adding another bit of work to your already busy schedule. Indeed, the profession will never be without its share of bureaucracy and admin. But payroll doesn’t have to mean legwork and elbow grease. By using intelligent automation and the right system, you can cut out many of the repetitive (and plain tedious aspects) of payroll processing. Repetition becomes a thing of the past, too.

With BrightPay, you only need to set up payroll documentation and reports once. After that, you save them on the BrightPay desktop application for future use. It couldn’t be simpler. These documents and reports will also be automatically synced to BrightPay Connect and will be available to log in and view from anywhere. This includes payslips, periodic reporting, P60s, and P45s.

But perhaps for payroll bureaus the most critical way you can reduce the admin burden is by devolving it, so it’s not all on you. Using the password protected self-service portal, your clients and their employees can login online to view their payroll data. For routine tasks, clients can help themselves. The more mundane aspects of payroll processing hum along in the background while you focus on the important stuff. All while maintaining complete control over the entire process.

So what do you do when it rains? You don’t have to get wet - and if you’re a payroll bureau, there’s a more straightforward, smarter way ahead. Admin doesn’t need to be a by-word for payroll, with BrightPay it can be a profitable, low touch service.

Book a demo today to find out how BrightPay can streamline your payroll processing.

May 2019

31

New User Management Interface for Connect

Our new User Management feature for BrightPay Connect makes it more seamless and quicker for users to be set up or amended. It offers the option to select permissions for multiple employers at one time for a standard user. There is also a new permission to allow standard users to connect and synchronise employers from BrightPay to Connect and a new feature to mark an employer as confidential.

Types of Users for Connect

- An administrator has full control over a BrightPay Connect account, with the ability to edit account settings, add other users, redeem purchase codes, connect employers and manage all employer and employee information and processes.

- A standard user typically has access to just one employer in your BrightPay Connect account, although they can be granted access to multiple employers if required. A standard user can view employer (and associated employees) information with various levels of restrictions and permissions.

User Permissions & Confidential Employers

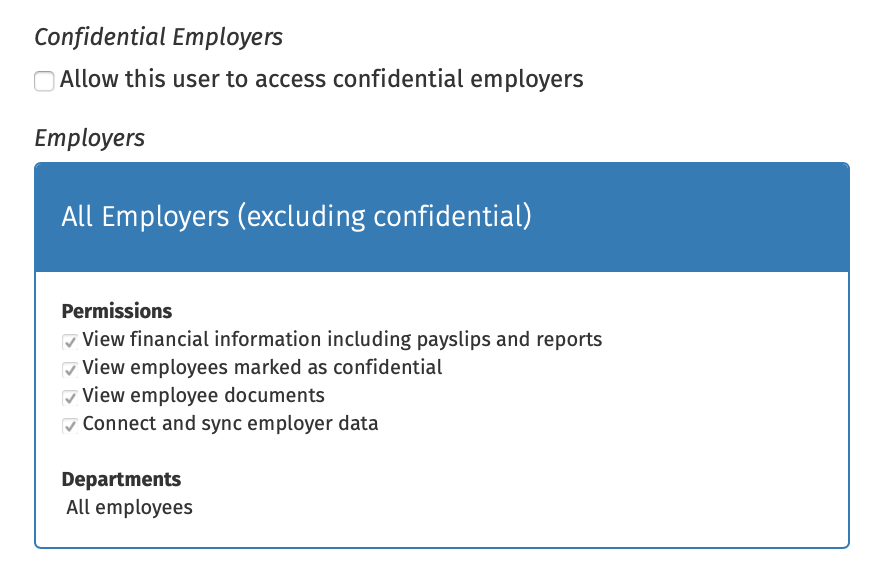

As before, standard users can be set up so that they are restricted by department, so that they can only see information pertaining to employees that are associated with a particular department. They can also be restricted from accessing certain information, such as the ability to:

- View financial information including payslips and reports

- View employees marked as confidential

- View employee documents

- NEW: Connect and synchronise employer data

- Approve employee self-service requests

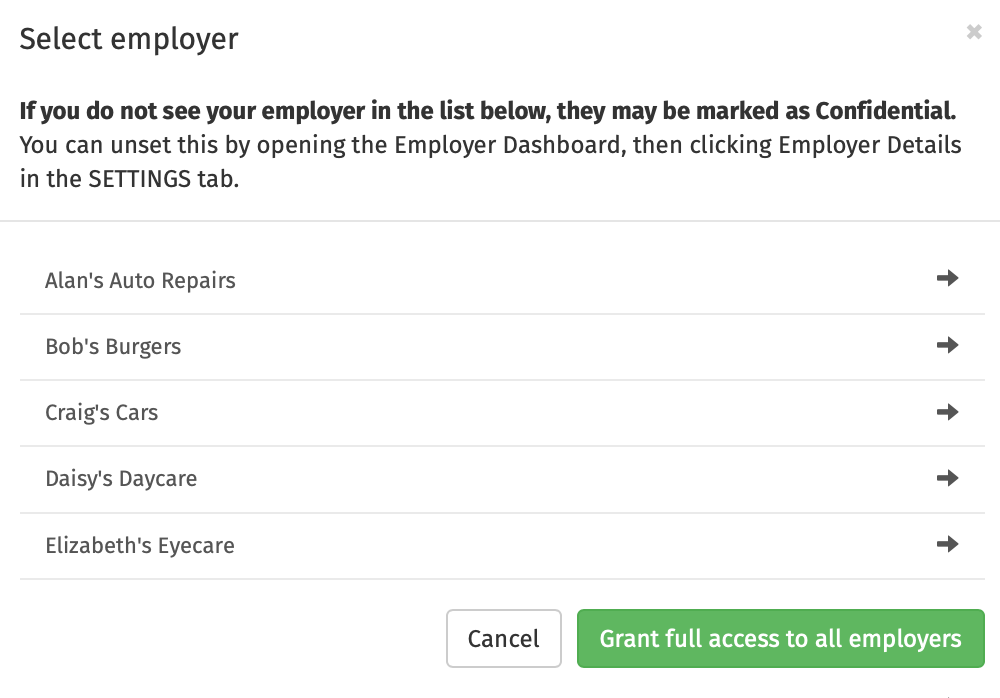

You now also have the option to grant a standard user access to all current employers, along with any new employers linked to the Connect account. Simply select ‘Grant Full Access to all Employers’ and select the permissions you wish to be applied to the user, including the new permission to Connect and Sync employer data.

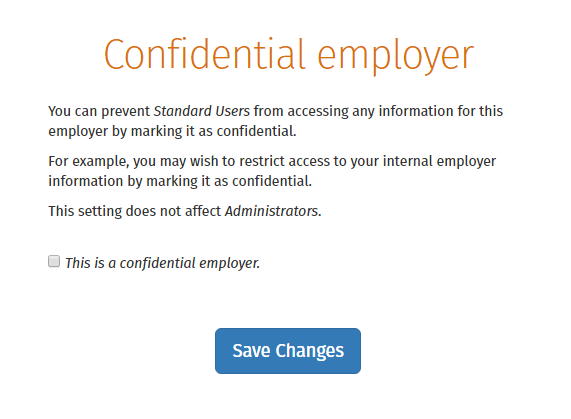

If required, an employer in Connect can be marked as confidential under the settings tab on the employer’s dashboard and only administrators on the Connect account will be able to view this employer. Standard users can only access confidential employers if they are given permission to do so.

Inviting your client as a user

If the employer details are entered in the ‘Client Details’ tab in the employer section in BrightPay, the employer can be added as a standard user by the bureau very quickly and easily. On the employer’s dashboard in Connect, you will see the option to ‘Invite your Client’. Selecting this populates the client’s information for a new standard user and you can then choose the permissions for the client.

May 2019

27

The hidden benefits of an employee self-service system

The ability for employees to view and edit their own data is one of the most important advancements of HR in recent years. Providing employees with remote access to view personal information held is also a best practice recommendation of the GDPR. It's obviously true that employees have a lot to gain from a self-service system, such as BrightPay Connect.

But what about HR personnel, managers and everyone else involved in the payroll and HR process? They benefit too! For administrators, it's a way of delegating the workload that would otherwise be handled solely by them. Implementing an employee self-service system is a way to re-distribute various tasks and bring them to the employee’s level.

On the surface, an employee self-service system seems designed simply to relieve a bit of pressure on your HR department. It cuts out the tedious administrative work involved in everyday tasks such as:

- Printing or emailing payslips

- Responding to payslip requests

- Responding to leave balance enquiries

- Managing annual leave requests

- Updating employee contact details

But the benefits to the business go much deeper than that. Some employee self-service systems also have the following benefits:

- Reduce errors - Entry errors and other mistakes may be avoided by allowing employees to enter their own personal information. By eliminating the need for double entry and allowing employees to evaluate their own information, the chances of inaccurate information may be greatly decreased.

- Reduce sick days - Some businesses have noticed a reduction in sick days since implementing employee self-service systems. As sick days are much more visible on screen to both employees and their managers, this likely acts as an incentive to keep sick days to a minimum.

- Cut costs - The administrative cost of processing leave or printing out payslips should not be underestimated.

- Reduce paper - The ability for employees to access payslips and other documents online can be a time and money saver. By replacing paper documents, you are also reducing your impact on the environment.

- Keep staff up-to-date - An employee self-service system can allow you to notify employees of policy changes or company-wide announcements. Employees don’t need to access their email to view changes - they can simply log in to their self-service employee app wherever they are to stay abreast of any legislative or company-wide changes that may affect them. The employer can then track which employees have viewed the notice, resource or document.

When implemented successfully, a company may see immediate increases in productivity and efficiency. Managers and HR personnel will save labour hours and frustration on a daily basis, and instead, have more time to concentrate on more important tasks.

Book a demo today to find out how BrightPay Connect can transform your business.

Apr 2019

11

Why employees love self-service apps (& you should too!)

As a concept, self-service is nothing new. From paying at the supermarket self-service checkouts to online banking, consumers don’t want to have to wait for something if they know they can get it themselves. It’s no different in the workplace.

An employee self-service is the ultimate tool whereby employees can login from anywhere to view their employment and pay related information. With a self-service system, employees can download payslips, request annual leave, look at policies and HR documents and update personal information - all without once contacting HR personnel.

Benefits for Employees

- Instant Payslips - The employee can login to the employee self-service portal to view and download their most recent payslip, along with all of their historic payslips. Gone are the days of emailing HR chasing lost or past payslips when needed, for example when applying for a mortgage.

- Annual Leave - Employees can submit leave requests instantly through the employee self-service portal. Once the leave is approved, employees will be notified and the approved leave will automatically appear on the employee’s calendar. Employees can also view their leave balance and leave history through their portal.

- HR Documents - Access everything in one central place - a single online login gives the employee instant online access to other employment related documents such as employment contracts or company handbooks and policies.

- Personal Data - With the self-service portal, the employee can view their personal payroll information that the employer has on file. The employee can also amend or update various personal data, including their postal address, contact number, emergency details etc.

- 24/7 Access - Employees can login to the employee self-service through any web browser at any time - meaning they don’t have to be at their desks to use it. They can login from home or anywhere else with an internet connection. Better yet, employees can access their employee self-service directly from their phones using the BrightPay employee app.

Knock-on Effect for Employers

Today’s employees are accustomed to having information readily available. An employee portal can help fulfil that expectation with the added benefit of creating workflow efficiencies. The employee self-service portal eliminates the burden of sending payslips, updating personal information, approving annual leave requests and answering leave balance enquiries for the payroll department. Managers and HR personnel will save administrative hours and frustration on a daily basis when no longer faced with working through these monotonous and time-consuming tasks.

The former way of managing employee data is fast becoming outdated. What was once considered normal in the past is no longer considered normal anymore. Today, the new normal is to implement an employee self-service system whereby workflows are streamlined, with added benefits for both employees and employers.

Book a demo today to find out how BrightPay Connect can transform your business.

Aug 2018

20

BrightPay Connect: The GDPR Survival Toolkit for Employers

BrightPay Connect is tailored to help you overcome some of the key challenges GDPR presents when processing payroll. The payroll itself is still processed on BrightPay’s desktop application, however the payroll information is stored online on a secure cloud server. As the payroll information is stored online, it has allowed us to bring you even more benefits to help you with GDPR compliance.

Automated Cloud Backup

With the GDPR, it is important to keep a copy of payroll files safe in case of fire, theft, damaged computers or cyber attacks. Essentially BrightPay Connect is an automated cloud backup, keeping employee’s payroll data safe and secure. BrightPay Connect will automatically backup payroll data every 15 minutes when the payroll is open, and again when you close down the employer file. A chronological history of all backups will be maintained which can be downloaded and restored at any time.

Self-Service Remote Access

GDPR includes a recommendation to provide remote access to a secure system, which would provide employees with direct access to their personal data. With BrightPay Connect, employees can be invited to their own password protected self-service portal. Employees can login to the portal 24/7 on any device, including PC’s, Macs, tablets and smartphones (essentially anywhere that they have access to an internet browser) or there is also an employee smartphone app where employees can login and get notifications directly to their device.

Password Protected Payslip Portal

With BrightPay Connect, employees can access a payslip library where they can view and download all historic and current payslips. Employees can also access payroll documents such as P60s, HR documents such as their contract of employment, personal data held by their employer and past and scheduled leave.

Right to Rectification

The right to rectification of personal data held is an important employee right under the GDPR. With the employee self-service portal, employees can update their basic personal details such as their phone number and postal address.

Accurate Employee Records

Data controllers and data processors must ensure that the personal data held is relevant and up-to-date. As employees can update their basic personal details on BrightPay Connect, this ensures that employers and payroll bureaus have the most accurate and current details on file for employees.

User Limitations and Restrictions

With the GDPR, data controllers must ensure that, by default, only personal data which is necessary for each specific purpose of the processing can be accessed. Therefore, payroll processors should only have access to the personal data that is strictly required for processing the payroll. This is referred to as data minimisation, or privacy by default. With BrightPay Connect, users can be set up so that they only have access to the information needed to complete their specific responsibilities. For example, there may be a HR manager who should not have access to employee’s payroll data, or a payroll processor who should not have access to employee documents or employees marked as confidential.

Central Location for Employee Documents

BrightPay Connect acts as an all in one central location to store all things employee related, including payroll, HR and other employment related documents. Employers have the ability to upload documents that apply to all employees (e.g. company handbook), documents that are unique to individual employees (e.g contract of employment), or even documents that are relevant to a particular department.

Secure Document Exchange

If you are a payroll bureau, you can invite your payroll clients to BrightPay Connect to their own online employer dashboard. This is a secure portal for client communications, eliminating the need to send documents with sensitive personal information by email. Clients can view employee payslips as soon as they have been finalised, they can run their own payroll reports and view amounts due to Revenue. This offers an additional layer of GDPR protection for client’s payroll data.

Essentially, by introducing BrightPay Connect in your business, you will be taking steps to be GDPR compliant. Book a demo today to have a look at BrightPay Connect.

Related articles:

Jun 2018

25

BrightPay launch an employee payroll smartphone app

In today’s fast paced environment employees want their payslips at their fingertips. BrightPay’s cloud add-on BrightPay Connect now offers an employee smartphone and tablet app for employees to access their payroll information on the go. The BrightPay Connect app integrates with the BrightPay payroll software application bringing a new level of efficiency and productivity to managers who manage the payroll, leave requests and HR activities. The employee app is available to download for free on any Android or iOS device.

BrightPay Connect offers an online intuitive app, providing employees with the following benefits:

- Manage and access payroll information on the go

- View and download current and historic payslips

- Update and edit personal contact details

- Submit annual leave and unpaid leave requests

- Access an employee leave calendar with approved leave automatically updated

- View leave taken and leave remaining

- Store and access HR documents (e.g. company newsletters, contracts of employment)

- Access the BrightPay Connect employee smartphone & tablet app

BrightPay developed the employee payroll app to improve the payroll processing for accountants, employers and employees. The BrightPay Connect app increases the level of accessibility that employees have to their payroll data while providing innovative features that reduces the overall administrative HR processing time and general payroll related enquiries.

Benefits for Accountants / Payroll Bureaus

Payroll bureaus can now automate the distribution of payslips and eliminate the need to print or email payslips to employees. Employees no longer need to contact their payroll bureaus when they need 6 months’ worth of past payslips when applying for a mortgage or loan. The leave management tool reduces back and forth correspondence between you and your client. All leave requests can now be managed by your client and will automatically be added to the BrightPay payroll software on the bureaus PC. Under the GDPR, it is recommended that you provide individuals with a remote self-service system. BrightPay Connect offers an additional layer of security while providing a self-service app, helping bureaus work towards GDPR compliance.

Benefits for Employers / Payroll Clients

Employers can offer their employees a self-service app offering full transparency when accessing payslips and other personal information. The annual leave management tool allows employers or HR managers to seamlessly process leave requests with changes flowing through to BrightPay payroll software. The employer portal provides an overview of all employee leave in the company-wide leave calendar, ensuring that employers have adequate cover at peak times. The smartphone and tablet app allows employees to seamlessly connect and interact with employers and HR managers, cutting down on employee queries, making it a valuable time-saving tool.

Benefits for Employees

The employee payroll app provides a better control process, improved efficiency and an online platform for your team to manage their payroll information and personal contact details. Employees have instant access to their payroll information including payslips, an employee calendar and an annual leave request facility. Employees can also view their annual leave balance and HR documents such as their contract of employment. The BrightPay Connect app offers enhanced GDPR security for the employee’s personal payroll data. BrightPay Connect is powered using the latest web technologies and hosted on Microsoft Azure for ultimate performance, reliability and scalability.

Click here for a full list of employee app features.

Related Articles:

Apr 2018

30

What is BrightPay Connect?

BrightPay Connect is an optional add-on cloud and HR product for BrightPay Payroll. Connect will allow you to sync your BrightPay Payroll employer data to a web based online portal providing the following powerful features:

Secure Online Automated Backup - Users can backup and restore payroll information on your computer to and from the cloud. BrightPay Connect will synchronise any changes you make to your payroll or employee information back to BrightPay Payroll. Your historical backups and data files are accessible and can be restored at any time.

Online Self-Service Portal - The online portal allows payroll bureaus, employers and employees to log in and access their payroll data. Employees can view and access their payroll information. Employers can view their company’s payroll information, a company annual leave calendar, approve employee requests, access reports and Revenue payment details. Payroll bureaus can access an online overview of all of the client's payroll information.

Employee Self-Service - Employees can access their own payroll information by logging into their personal self service portal. The self service allows online access to a personal leave calendar, view remaining holiday days, view sick leave taken, request annual leave, view and change contact information, access payslips and other payroll employment related documents.

Online Payslips - Employee’s payslips are stored securely on BrightPay Connect allowing for easy access on the go for employees. Payslips can be set up by the user to be automatically uploaded onto BrightPay Connect for employees, eliminating the need to manually email them from BrightPay Payroll. Employees can view and download their current and historical payslips at any time.

Employer Online Dashboard - Employers will have access to an overview of their payroll, a company annual leave calendar for all employees, payroll reports, employee information and more. Employers can authorise or approve employee requests such as a change of address or annual leave requests. BrightPay Connect automatically synchronises these changes which are updated on BrightPay Payroll. Even invite your accountant to instantly access your payroll data 24/7. Watch the BrightPay Connect Employer Video here.

Payroll Bureau Dashboard - Bureaus will have online access to an overview of their payroll clients payroll information. Invite clients to their own online dashboard which can be branded with your bureau’s logo. Watch the BrightPay Connect Payroll Bureau Video here.

Annual Leave Calendar - Employees can request holidays through their employee portal. A notification email will be sent to the employer informing them of the employee's request. Employers can then either authorise or reject the annual leave request. Approved leave is recorded and synchronised back to BrightPay Payroll on the desktop.

Payroll Documents & Reports - BrightPay Payroll has the ability to build and save employer reports. Saved reports that have been set up in BrightPay Payroll will then be automatically available on BrightPay Connect. Through the online dashboard, employers can access and view these reports at any time, along with a record of Revenue payments and amounts due.

Data Protection & Security - BrightPay Connect is built using a compartmentalised design structure that maximises security. Each user will have their own login details and password. BrightPay Connect utilises the Microsoft Azure platform to give our customers reliability, scalability, data redundancy, geo-replication and timely security updates out of the box.

HR Solution - BrightPay Connect acts as a HR management package and is an integrated solution that can accelerate HR processes across your organisation. Run your HR operations with ease by managing and simplifying your workforce management. BrightPay Connect covers all of your core HR needs, including employee management and leave management.

- Employee Management: By law you are required to keep and provide certain information about your employees. BrightPay Connect records and stores your employee data, leave & absenteeism and key HR documents in one secure online location. This also allows users to access an overview of employees for employee performance and development purposes.

- Document Upload: Users can store and manage sensitive employee documents securely in the cloud. BrightPay Connect allows you to upload employee documents such as company newsletters, employment contracts and handbooks, appraisal documents, company pension information and even disciplinary correspondence. Users can also see a notification of when employees view HR or company documents.

- Training Management: Using the document upload feature, users can store qualifications and certs for each employee. These documents will be available to both the employer and the employee. Company training documents can also be uploaded and easily distributed to all employees online.

- Manage Staff Leave: BrightPay Connect takes the burden out of managing staff leave by streamlining the process. Users can easily reduce the processing time of leave requests. Employee leave that is approved or recorded by an employer in BrightPay Connect is then automatically synced back to BrightPay Payroll. Employers can approve employee leave requests in minutes which allows you to monitor staff leave to ensure you have adequate cover at all times.

Additional Users - Adding new users to BrightPay Connect is easy. Employers can grant access for additional users to view the company payroll data, authorise annual leave requests, process payroll and more. Employers can invite their accountant to their BrightPay Connect account. There is no limit to the amount of additional users that can be set up. There are two types of users:

- An administrator has full control over a BrightPay Connect account, with the ability to edit account settings, add other users, redeem purchase codes, connect employers and manage all employer and employee information and processes.

- A standard user typically has access to just one employer in your BrightPay Connect account, although they can be granted access to multiple employers if required. A standard user can view all employer (and associated employees) information and process employee self-service requests.

User Access - Users may wish to give senior employees, supervisors or management access to certain functions on BrightPay Connect. Employees can be set up with restricted access to the high level payroll information but can be given varying degrees of access to approve employee leave requests, change employee contact details, view financial information including payslips and payroll reports, view employee HR documents and view high level employees such as directors.

Processing Payroll - BrightPay Connect will not have the ability to process payroll. This function will be only be available through the BrightPay Payroll desktop application.

GDPR Ready - BrightPay Connect is tailored to help you overcome the challenge that GDPR presents. The cloud functionality will improve your payroll processing with simple email distribution, keep employee records up- to- date, safe document upload, easy leave management and keep a secure backup of your payroll records.

For a single employer, BrightPay Connect costs €59 + VAT per year. This price includes cloud backup, employer dashboard and the employee self service portal for all employees. For bureau customers who have multiple payroll clients, we offer bulk discounts for several BrightPay Connect licences.

Thesaurus Payroll Software | BrightPay Payroll Software

Related Articles:

Aug 2017

30

August Customer Update

Revenue moves to PAYE modernisation

In October 2016, the Minister for Finance announced that the current Pay As You Earn (PAYE) system would be revamped and modernised. This new system is known as PAYE Modernisation, which allows for PAYE reporting to be submitted to Revenue in real time.

PAYE Modernisation or real time reporting (RTR) will enable Revenue to ensure that employees are receiving their correct tax credits and cut-off points throughout the year in real time. This compares with the current PAYE reporting which is done through P35s on a yearly basis.

Bright Contracts Webinar: Employee Dismissal – How Easy Is It?

80% of unfair dismissal cases are won by the employee, not because the reason for dismissal was unfair but because the employer did not follow fair procedures. In this webinar we discuss the dangers of dismissing an employee, what rights you have as an employer and outline the relevant steps you need to take to protect your business against an unfair dismissal claim.

Top Tips for Reference Check Questions

The reference check stage of the recruitment process is a crucial stage for an employer to obtain vital information about a candidate and corroborating that what they have said on their CV and in their interview is factual and true. By speaking to references, you can gather more information about the candidate’s work ethics and personality traits that might not be apparent during the interview.

News for Bureaus

Watch our latest video to see how BrightPay Connect can benefit your payroll bureau?

BrightPay Connect our latest cloud add-on works alongside BrightPay Payroll. Payroll information is stored in the cloud and can be accessed online by you and your clients anywhere. BrightPay Connect offers additional innovative payroll and HR features that will enhance client relationships and increase revenue for your bureau.

Revenue moves to PAYE modernisation

PAYE Modernisation (aka Real time reporting) is probably the biggest overhaul of the PAYE system since PAYE itself was introduced back in 1960. It will have wide ranging effects on all employers and on all bureau payroll providers. Main Speaker: Paul Byrne FCA, MD Thesaurus Software, Guest Speakers: Sandra Clarke, FCA, AITI, Partner BCC Accountants and council member of the Irish Tax Institute and Sinead Sweeney, PAYE Modernisation Change Manager, Revenue.

Register: 3rd Oct / Register: 4th Oct

GDPR - What businesses need to know!

Data protection and how personal data is managed is changing forever. On 25 May 2018 the new General Data Protection Regulation (GDPR) will come into force. The GDPR is a European privacy regulation replacing all existing data protection regulations.

Find out More / Register for CPD webinar

News for Employers

Watch our latest video to see how BrightPay Connect can improve your annual leave processing

BrightPay Connect our latest cloud add-on works alongside BrightPay Payroll. Payroll information is stored in the cloud and can be accessed online by you and your employees. BrightPay Connect offers additional innovative payroll and HR features that streamline your annual leave management and payroll processing.

Free Webinar for Employers: What you NEED to know about PAYE Modernisation | Guest Speaker - Revenue

PAYE Modernisation (aka Real time reporting) is probably the biggest overhaul of the PAYE system since PAYE itself was introduced back in 1960. It will have wide ranging effects on all employers. Main Speaker: Paul Byrne FCA, MD Thesaurus Software, Guest Speaker: Sinead Sweeney, PAYE Modernisation Change Manager, Revenue.

May 2017

15

Keep your payroll data safe against a Ransomware attack

Ransomware, like the name suggests, is when your files are held for ransom. It is a type of malware that essentially takes over a computer and prevents users from accessing their data until such time as a ransom is paid. The ransomware encrypts data on the computer using an encryption key that only the attacker knows. If you want to decrypt them, you have to pay. If the ransom isn’t paid, the data is often lost forever.

A ransomware attack, also known as WannaCry or WeCrypt, recently spread across the globe and is believed to have affected over 200,000 organisations. The cyber-attack struck banks, hospitals and government agencies in more than 150 countries, exploiting known vulnerabilities in Microsoft operating systems.

How to protect against a ransomware attack?

- Think before you click – It is important to look for malicious email messages that are often concealed as emails from companies or people you regularly interact with online. It is important to avoid clicking on links or opening attachments in those messages, since they could unleash malware. However, unlike many other malicious programs, WannaCry has the ability to move around a network by itself. Once the virus is inside an organisation, it will hunt down vulnerable machines and infect them too.

- Keep software up to date – Users should ensure that security updates are installed on their computer as soon as they are released. Last month, the NSA revealed software vulnerabilities in a Windows Server component which allows files to spread within corporate networks. Since then, Microsoft has released software patches for the security holes. Anyone who applied this patch more than likely was not affected by WannaCry. However, not everyone has installed these updates and so these users are susceptible to an attack. It is also important to note that the vulnerability does not exist within Windows 10, but is present in all versions of Windows prior to that, dating back to Windows XP. Support for Windows XP was discontinued in 2014, and so if you are using XP it is recommended to upgrade to a more secure system. It is important to keep all software packages up to date to maximise protection against attacks.

- Keep backups of data files – Users should regularly back up their data, which will make it possible to restore files without paying a ransom. This can be done by saving files to a USB key, external server or a cloud sharing facility such as Dropbox or Google Drive. Individual software packages may also offer a backup facility, enabling you to automatically back up sensitive data, for example BrightPay Cloud allows users to easily backup payroll data.

How can BrightPay Cloud help?

BrightPay Cloud allows employers to automatically and securely backup payroll data to a highly secure cloud server. Payroll data (including payslips, payroll reports etc.) is automatically backed up every 15 minutes ensuring that you will never lose your payroll data if you are the victim of an attack.

You may decide that you only want to use BrightPay Cloud for payroll backups, however, the features listed below can also be availed of.

With BrightPay Cloud, employers can invite their employees to their own self-service portal. Employees can login to their own personal account, be it on their PC, tablet or smartphone, where they can view payroll documents relevant to them, with a full history of payslips and P60s. Employees can also request annual leave and view annual leave remaining through their portal.

Furthermore, BrightPay Cloud provides users with an annual leave management facility and a document upload facility, where all information is stored within the same location. With the document upload, employers can upload employee contracts & staff handbooks, training manuals, employment documents and much more, which can be accessed by employers and employees on any device.

Find out more about BrightPay Cloud with an online demo.