Jul 2020

22

How BrightPay Connect's Document Upload Facility Makes Returning To Work Easier

Right now employers across the country are preparing to bring their employees back to work. This requires some adjustments as we all do our best to adapt to “the new normal”. For businesses where staff can work from home, this means facilitating remote working. And for businesses where staff must come into the workplace, it means finding ways to make the workplace as safe as possible to protect employees.

The good news is that, regardless of which of these two categories your business falls into, BrightPay Connect can help make this transitional phase easier for both employers and employees. In particular, our document upload facility is of huge value when it comes to making the necessary preparations and keeping your employees updated on what changes they can expect when they come back to work.

How Does The Document Upload Facility Work?

Using BrightPay Connect, employers can upload any kind of document to distribute to employees through a secure online portal. These documents can include everything from company policies, handbooks and news items to more sensitive information such as employee files.

When uploading each document to the portal, HR managers can choose which employees can view it. They may choose to make it available to all employees, in the case of a Healthy and Safety policy for example, or they may choose to make it only available to one individual employee or a team/department.

Once the document has been uploaded, employees will receive a notification letting them know. They can view and download it via their employee dashboard on a laptop or PC, or via their BrightPay Connect employee app on a mobile or tablet device. The HR manager or employer will be able to see who has read the document on a time-stamped log.

While this facility offers significant benefits to employers at any time of the year regardless of the circumstances, it is even more beneficial now during the COVID-19 pandemic. This is because under the new Return To Work Safely Protocol (a document released by the Government which outlines what businesses must do to prepare for returning to work), employers are obliged to create and share a significant amount of documentation with employees.

This documentation includes a COVID-19 Response Plan, detailing all points of relevance relating to COVID-19 in your workplace, and Pre-Return To Work Forms, which must be completed by employees at least 3 days before their return to the workplace.

The protocol also specifies that information and guidance should be provided by employers to workers, which should include:

- The signs and symptoms of COVID-19

- How it spreads

- Cleaning routines and waste disposal

- Advice on hand and respiratory hygiene, physical distancing, use of Personal Protection Equipment (PPE) and work equipment, where relevant

- What a worker should do if they develop symptoms of COVID-19

- Identification of points of contact from the employer and the workers

- Any other sector specific advice that is relevant.

By making all of these documents available on BrightPay Connect, employees can access everything they need in one secure online hub and download anything they need straight to their smartphone. Employers can also send out reminders to employees who haven’t accessed a particular document, to make sure they do so before they come back to work.

What Are The Benefits Of Uploading Documents To Connect?

In addition to the usefulness of BrightPay Connect’s document upload facility in making preparations for returning to work, it has several benefits in more general terms.

1. It’s More Sustainable

It goes without saying that uploading documents to an online portal is significantly more sustainable than printing them all off and sending them out to each employee. This is a great way to add to your businesses efforts to “go green” where possible.

2. It’s Faster

It’s also much faster to upload your company documents in this way than to send them out via post. Plus, being able to track when your employees have opened, read or downloaded them means that you can ensure everyone is ready before returning to work.

3. It’s Trackable

The fact that employers can check who has read the uploaded documents is crucial to ensuring that your staff comply with new government guidelines on workplace safety during COVID-19. For example, if an employee was to ignore health and safety measures and claim that they didn’t know such measures existed, you could simply check whether or not they had read the document on your employer dashboard. This adds a level of protection for employers if any potential disputes arise.

4. It’s Customizable

Human resource managers will love the fact that they can choose who can and cannot view documents. That’s because not only does BrightPay Connect allow them to store and share all company-wide information online, but it also provides them with a secure portal where they can store all employee-related files, without worrying about employees seeing them.

5. It’s Secure

Finally, BrightPay Connect provides much needed security at a time when data protection has never been more vital. Infinitely safer than storing paper-based files and sensitive information, Connect’s cloud backup means that you don’t need to worry about losing data or having it fall into the wrong hands.

Register for our free webinar

Join BrightPay on Thursday 13th of August at 10.30am for a free COVID-19 & Payroll webinar. In this webinar, we explore some key changes to the Temporary Wage Subsidy Scheme, the payroll implications or rehiring employees and employee’s annual leave entitlements during COVID-19.

Register today for your free place, and if you can’t make it on the day, don’t worry. You’ll be able to watch the webinar on demand at any time that suits you.

Jul 2020

16

3 extra weeks of Parents’ Leave for Pandemic Parents

Roderic O’Gorman, Minister for Children has announced that three additional weeks of parents leave has been proposed for Cabinet approval for parents of children born during the Covid-19 pandemic. This means parents leave will increase from two weeks to five weeks for new parents with children born after 1st November 2019. The rate of pay for this additional parents leave will be €245 per week. But this additional parents’ leave will not be available until it comes into effect in November 2020.

Every parent is currently entitled to two weeks’ parents leave in the first year when their child is born or adopted on or after 1st November 2019. Parental leave is different where a parent is entitled to take unpaid leave from work up to a current maximum of twenty two weeks to look after their children. This is changing to twenty six weeks on 1st September 2020.

Subscribe to our mailing list for more information on this and other important updates.

Mar 2020

10

Covid-19 - are you ready?

In light of the recent Coronavirus outbreak, many employers are starting to prepare for the possibility of employees needing to work from home.

Have you Internet?

Whether you are a single employer or a bureau, you will need an internet connection for transmitting files to Revenue.

Are you using a computer other than your work computer?

Where you are using a different computer, BrightPay will need to be installed on that computer. This is a quick download from our website. Then, simply enter the activation key that was included on your invoice. If you can’t find this key, we can resend it to you.

You will also need to ensure that you have a valid ROS digital cert installed on this computer as this will be required for retrieval of RPNs and submission of PSRs. Help on doing this is contained at the bottom of this article.

Okay, you have an internet connection and a computer with BrightPay installed on it, what about the payroll file(s)?

Are you a single employer?

- Using your work computer - you already have the file and need read no further.

- Using Dropbox or Google Drive as your file save location - the files will automatically be available to you on any other machine which is also signed in to the shared drive.

- Using Connect - you can simply restore your payroll data into your BrightPay software by signing into your Connect account at home through the software.

Alternatively, before leaving the office, simply copy the payroll file to a USB key or email it to yourself.

There are some useful help links at the bottom of this article to help with any of these options.

Are you a payroll bureau?

- Using Connect – An Administrator can set relevant payroll staff members up as a user and give them access to the companies that they need to work on. Users can then simply restore the required payroll data into their BrightPay software from their Connect account and also synchronise completed payroll back up to Connect. Users will be able to log in to their Connect account at home through the software and restore in the latest cloud backup. Care however must be taken that synchronisation is up to date and that other users are not working on the same data file at the same time. When restoring in from a cloud backup, you will see the time and date of the most recent backup that was done. Setting up a user in Connect and Restoring from Connect are covered in the help articles below.

- Using remote desktop – log in to your remote desktop as normal. No further action is required.

- Using a shared drive (e.g. Dropbox) – Once your PC is logged in to the shared drive and BrightPay’s file save location was set as this drive, then all payroll files should be available within your home environment. You may need to browse to the shared file location when opening an employer.

Alternatively, before leaving the office, staff members may wish to save their payroll file(s) to an external drive, then follow the help below on Transferring BrightPay from one PC to another.

Help articles

Mar 2020

10

Don’t let Covid-19 stop you from running your payroll

As of 10 March, the number of confirmed cases of coronavirus increased to 24 in Ireland, with cases across Europe also surging. With the number of cases bound to escalate, Leo Varakar has said that if the coronavirus outbreak worsens, between 50% and 60% of the Irish population could be affected.

With panic over coronavirus soaring, many workers are being asked to stay away from the office and do day-to-day tasks from the comfort of their home. Not going into the office is an effective way of preventing the spread of coronavirus, because it minimises the risk of you coming into contact with someone carrying the disease.

Flexible working is becoming a growing trend

The reality is, working from home is already very popular, potential pandemic or not. Flexible working is a trend that has emerged in the last decade as more people seek that ideal work-life balance instead of work-life burnout.

Nearly a quarter of Britain’s workforce now work flexibly, that is, they work part of the week in an office and part at home, highlighting how quickly this trend is growing. Flexible working brings many work-life balance benefits as employees have more time to see their family, exercise and dedicate time to themselves. Seven in 10 of those who work flexibly say they are less stressed as a result of their working arrangement.

As well as the health benefits, it often results in happier employees. They then potentially work harder and are more productive. For employers, flexible working also helps to attract and retain talented employees. Additionally, it can result in increased loyalty and reduced office space cost.

Businesses need to carefully consider which processes and tools will make flexible work as productive and positive as possible for their employees. You need to make sure that they have essentials such as laptops, a reliable internet connection and being able to connect to systems remotely. This would have been difficult a few years ago, but thanks to the cloud, you can have everything you need at all times.

Flexible working with BrightPay Payroll

Although the payroll itself cannot be processed online with BrightPay Connect, the payroll software is still very flexible. Each BrightPay licence can be installed on up to 10 PCs where users have the option to process the payroll from 10 separate locations meaning you don’t need cloud payroll to operate and process your payroll. In addition, you can log into your BrightPay Connect account to view your payroll information at any time. You no longer need to be seated at your desk in the office to access the system - all the data you need to do your job is available on any of the 10 PC’s that the BrightPay application is installed on.

If you are not using the BrightPay Connect add-on, you can still access the payroll data file through a cloud environment to process the payroll. Again, the software itself can be installed to the local C drive of up to 10 PCs, be it a home computer or a laptop. The payroll files can be stored on a secure server or cloud environment, such as Dropbox or Google Drive, where the payroll information can be accessed from multiple computers.

With BrightPay Connect’s automatic cloud backup, payroll information is stored online and can be accessed by employers anywhere, anytime. Employers can also use BrightPay Connect to remotely manage employee’s leave, upload employee documents and send communications to employees that are working remotely.

Will coronavirus lead to long-term changes?

Will 2020 be the year in which office employees working more from home becomes the norm? Although many employers have implemented a mandatory ‘work from home’ policy as a precaution against coronavirus, it could also be the turning point for many businesses to recognise just how beneficial flexible working can be.

Book a demo today to discover how you can process payroll remotely with BrightPay.

Jan 2020

28

Your concerns about auto- enrolment addressed

Finally, after years of promises, the Irish Government has set a date for auto- enrolment to be rolled out in Ireland in the year 2022. It’s exciting news because it has been apparent for a long time that the current State pension is just not enough to have a decent standard of living. But while the need for auto- enrolment is unanimously agreed upon, people still have opinions on the means of delivering it.

Look, it was never going to be easy. Regina Doherty, Minister for Employment Affairs and Social Protection (aka the woman behind the wheel) has previously described auto- enrolment as “perhaps the most fundamental policy reform in a generation”. Not an easy feat! With such a momentous task there will always be a diverse range of feedback, which is a polite way of saying that people have some concerns.

So what are these concerns? While there are valid opinions from actuaries and the like, I want to just concentrate on us little folk; the regular Joes and Jills and how auto- enrolment may affect us. The most resounding criticism at this level is the exclusion of certain groups of workers, including those under 23 or over 60, those earning below €20,000 and the self-employed. However, although not automatically enrolled, members of these groups would still be able to opt in to the system.

A lot of people are also wondering about the State pension - isn’t it enough? Well, the answer is no. Although promised in the past, the State pension has still not increased in line with wages or inflation and let’s face it, €12,000 a year won’t be enough for a bag of cough drops and a couple of pints in a few years, let alone a decent standard of living!

The number of people over 65 in Ireland is set to double in the coming years, and it’s estimated that two- thirds of them are currently employed and do not have a workplace pension. Don’t worry, the State pension won’t be gotten rid of altogether. Auto- enrolment is seen as a top-up, starting at the proposed 1% of your wages, and rising to 6% after 10 years. With employers required to contribute the same amount, 12% of your salary will be going towards your pension pot. Not bad right?

And what about employers? “How much is this going to cost me?” and “How much extra work is involved” I hear them grumble. While it’s true that employers will have the additional financial cost of contributing towards their employees’ pension schemes, it doesn’t mean it has to break the bank. If you’re fortunate enough to use a good payroll software then this will handle and automate the administrative duties for you. If you aren’t fortunate enough then let me tell you about BrightPay.

With BrightPay it’s simple. We have the experience to guide you through the process, having already rolled out a similar system in the UK. BrightPay will automate auto- enrolment duties at no additional cost. All BrightPay payroll packages will include auto- enrolment plus free phone and email support to help you through your auto- enrolment journey.

Like it or not, auto- enrolment is on its way. It’s normal to have doubts and concerns, but given our savings rates, demographics and the increasing number of people who rely on State pension, then auto- enrolment is definitely the right path for Ireland and all of us future golden oldies.

BrightPay Payroll Software will be able to seamlessly cater for Auto Enrolment without any additional costs to the software, and also includes free phone and email support.

Jan 2020

22

Child’s play: Amazing payroll software that’s simple to use

All of us, in the hyper-connected internet era, have found ourselves at a loss when using some software, website or app. You just want to do one thing, or you want to set something up and...you just can’t.

It might feel like specific software or apps are testing us in some way. Only those who can navigate through the narrow tunnels of this software are genuinely worthy, in some weird twist on the Arthurian legend of Excalibur.

But all of this struggle defeats the entire purpose of working digitally and efficiently, particularly for already busy professionals like accountants. All payroll software should be straightforward to use and set up. This is true for BrightPay’s payroll software, and even easier again is BrightPay Connect - the payroll add-on offering cloud integration and an online portal.

BrightPay Connect requires no downloads or manual data input. Everything is automatically available for your clients, where your clients can just log in to their own password-protected portal anytime, anywhere. The online portal gives clients access to all employee payslips, employee leave and payroll reports that you would have previously emailed to clients each pay period.

And there are levels to this, too. Senior employees or managers can be given different levels of administration to approve leave, change employee details, view employee payslips, and access payroll reports.

We understand that you don’t offer one-size-fits-all service to your clients, and your payroll software functionality needs to match that. BrightPay is flexible, and your involvement in the payroll process can be ramped up or scaled back as required.

BrightPay’s employer self-service portal has built-in features giving your clients a ready-to-go and easy-to-use HR solution. HR documents can be uploaded including employee handbooks and contracts, disciplinary documents, company newsletters, training material and more.

Clients can also manage all leave for their employees. These features will automate and streamline many of the day-to-day HR functions that your clients deal with. The benefits of the payroll service you offer cascades down throughout the business.

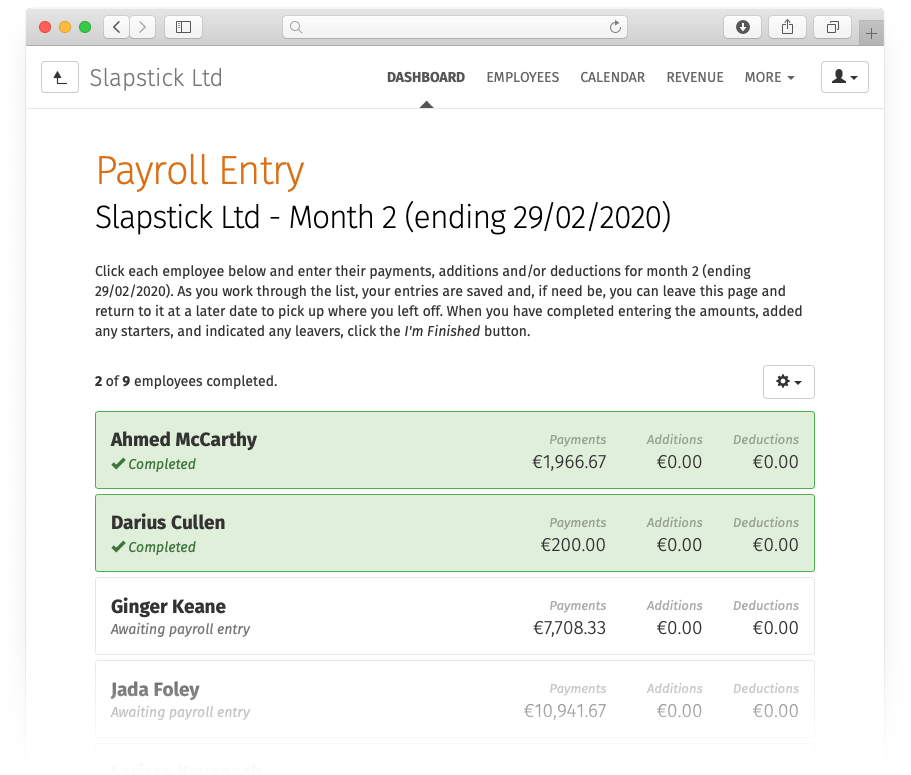

BrightPay Connect gives accountants the ability to send requests to their clients where the clients can now enter payments, additions and deductions for their employees and can also add new starters through their online employer dashboard.

From there, BrightPay Connect goes one step further with the approval feature allowing you to securely send clients a payroll summary for them to approve before the payroll is finalised. Ultimately, your client will be accountable for ensuring that the payroll information is 100% correct before the payroll is finalised.

Very quickly, your payroll bureau becomes an indispensable part of the business’s administration. By embracing cloud innovation, accountants can really streamline and automate much of the payroll process. And with BrightPay’s easy-to-use, automated software, it’s a low touch, easy-to-manage process. What more can you ask for?

Book a demo today to discover how BrightPay’s award-winning software can improve your payroll processes and save you time.

Jan 2020

3

New Year, New HR Goals!

Start 2020 with some HR goals to put you on the front foot. Make your goals achievable and easy and you won’t be one of the 80% of people whose resolutions have fallen by the wayside by February 1st! Consider how technology could help you achieve a leaner you in 2020…

1. Cut out the fat…

Hate all those repetitive admin tasks that keep popping up over and over like manually recording your employees annual leave, amending employees’ personal details, making sure they are receiving and reading important company updates? Well, now is the time to get rid of them. Consider how an online platform could take care of those tasks and many more.

2. Get out and about more…

Manage your HR tasks from almost anywhere by using your Employer Dashboard to monitor your employees annual leave requests, review your payroll reports and keep an eye on your Revenue payments. As long as you have an internet enabled device, it can all be at your fingertips… anytime, anywhere!

3. Communicate better…

Use online document upload features to distribute, track and manage any information you want your staff to have access to. Contracts, policies, training, schedules, you name it. You have the peace of mind of knowing your employees have that information at their fingertips and that you can see a log of when and how often they are accessing it.

4. Face your fears….

GDPR and cybersecurity. The two scariest words in the English language. Free yourself from that fear with a robust online portal. Fully secure servers, individually password protected and fully GDPR compliant.

Book a demo today to discover how you can revolutionise your business processes for 2020 and beyond.

Dec 2019

17

What's New in BrightPay 2020?

BrightPay 2020 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2020 Tax Year Updates

- 2020 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and ASC.

PAYE Modernisation

- Support for retrieving and using 2020 Revenue Payroll Notifications (RPN).

- Support for creating and sending 2020 Payroll Submission Requests (PSR).

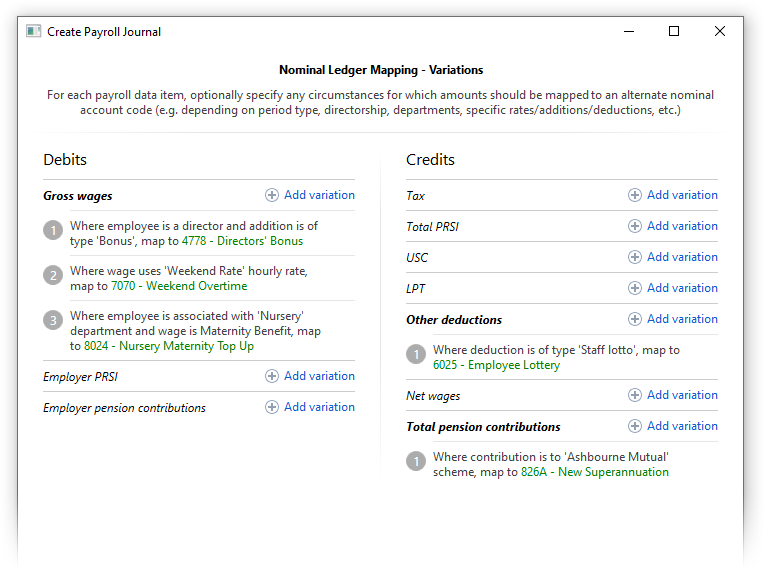

More Flexible Journals

A popular customer request has been to create a 'departmental' payroll journal in BrightPay. We've went one step further, allowing not only for a simple departmental mapping of nominal account codes, but for an advanced multi-option mapping as well.

For example, if you want to map commission paid to directors on a weekly basis in the sales department to a particular account code, you now can.

For Xero journals, BrightPay now supports including the department as the Xero tracking option, including where employees are split across multiple departments.

To make all this easier to manage, the Create Journal window in BrightPay now remembers it's size and position between usages.

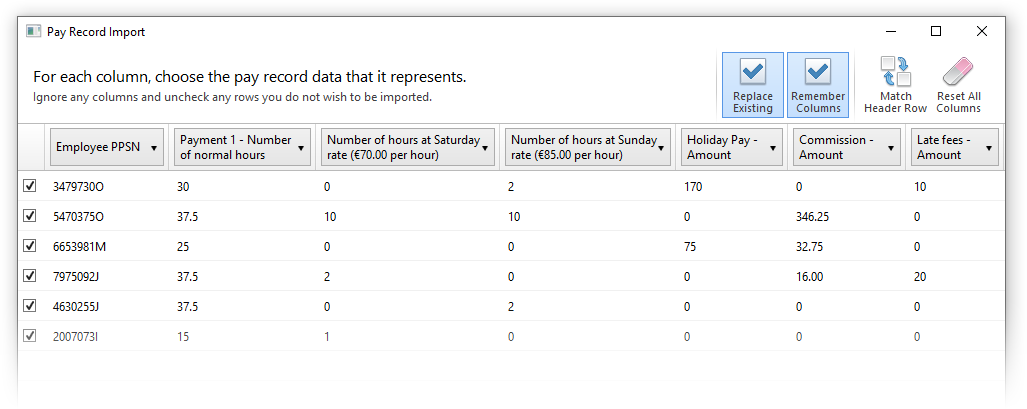

Importing Pay Records from CSV

We have significantly improved the power and flexibility of how pay records are imported from CSV, effectively allowing an entire pay run to be imported from a single CSV file if need be.

- Multiple pay items (of a single payment type, or mixed types) can now be imported from a single CSV line.

- Daily/hourly payments can more easily be imported under a named employer-wide daily/hourly rate

- Additions/deductions can more easily be imported under an employer-wide addition/deduction type

BrightPay Connect

In late 2019 we introduced a powerful new feature for Bureau customers of BrightPay Connect: the ability to request client payroll entry and/or approval for a payroll run, which is then automatically facilitated though a secure, GDPR-compliant process within the BrightPay Connect dashboard.

Sign in to your BrightPay Connect account and click the Requests header link to find out more.

Other Connect updates in BrightPay 2020 include:

- The Connect tab on the start-up window now directly shows your sign-in status.

- The list of employers (in the Open/Create Employer tab of start-up window) now shows cloud icons for employers that are linked to the signed-in BrightPay account.

- Ability to download and import a 2019 Connect backup into BrightPay 2020 (only applies for employers which have not yet been linked and synchronised for 2020).

- When an employer is opened in BrightPay 2020 that is not linked to Connect, but it is known that the 2019 version of that file was linked to Connect, BrightPay will now automatically prompt you to link the 2020 file to Connect.

Other 2020 Updates in BrightPay

- Ability to quickly create a new/additional employment for a previous/existing employee.

- Ability to print/export/email 'DRAFT' payslips.

- New period summary column options to see amounts in previous period.

- When selecting which analysis columns to include in a report, they are now grouped by category.

- New A4 payslip template, designed to be used where there are too many items to fit on the A5 template.

- New Bureau statistics report.

- As part of our new licensing model, Bureau customers can now view/edit the list of employers for which they have access.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Dec 2019

3

The evolution of the payroll bureau

If you are an accountant working in practice, you may know that I was once one of you, before I escaped to the leafy suburbs of IT.

While in practice, part of my income came from providing a payroll bureau service.

This came with its challenges as I was tied to it, it wasn't very profitable and not all of my payroll clients understood that I actually needed to have the employees' hours before I could do the payroll.

I would send them their payslips with a summary report, reminded them when to pay Revenue and, in return, they would grudgingly pay my fees.

That was twenty years ago. A lot has happened since then, the two main things being technology and PAYE Modernisation.

I wish that PAYE Modernisation had been around in my time. I could really have used it to convince some of my less conscientious clients to change their ways or else. The "or else" being the big stick of Revenue fines.

Technology has enabled a lot of things. The arrival of the smart phone, cloud services and increased internet speeds have been transformative.

In my practice days, I had one client who considered themselves at the forefront of technology. They would have been blown away seeing the way their employees could now receive their payslips on their smart phone and all the other cool things e.g. holiday requests, a document portal and so on. Mind you, if I was still practising and had that same client, I think that these are things they would expect.

That same client would also expect to be able to log on to their own portal and get whatever payroll information they wanted 24/7.

What we are starting to see now is that this type of client is becoming more of a thing. A large part of the driving force for this is their increasingly youthful workforce. Millennials grow up with a smart phone attached to them and they want as much of their life on it as possible.

Another feature that I wish had been around in my time is getting clients to effectively update their own payroll. What I mean by this is that instead of the various ways they would send the hours (word documents, emails, scraps of paper), they would now log in to their portal, update the hours and these would flow seamlessly in to the payroll. Plus everything would be logged and time stamped, so they couldn't blame me if an employee was overpaid or not paid at all.

All of the above would have certainly transformed my basic payroll service of 20 years ago and forged a client base less likely to defect to some new accountant trending on social media.

The clients would still be getting the same attention as always but the "value added" would be enormous. They get to look much more modern with their employees, which can help with attracting and retaining employees. They also gain access to a HR tool with which they can manage holidays, roll out documents and ensure that employee contact information is always current. The vast majority of small/micro employers have nothing like this.

In the UK, this value added payroll service is more common than it is here and I have asked accountants there what they charge. As you can imagine it varies quite a bit and will depend on the type and size of business, but I have heard rates as high as £10 per payslip for higher net worth clients with the average closer to £5.

This type of pricing would certainly have catapulted my small bureau service in to one of my more profitable activities as the cost of all this technology can be as little as 8c per employee per month.

Paul Byrne fca

Recommended reading:

Thesaurus Connect for Payroll Bureaus & Accountants

Jan 2019

14

PAYE Modernisation, One Month On!! New Year, New Payroll Legislation

PAYE Modernisation was introduced on the 1st of January 2019 and affects the way all employers process payroll. It is the most significant change ever to the Irish PAYE system. It is important that all employers and payroll processors understand their new real time reporting obligations.

Free PAYE Modernisation Webinars

Thesaurus Software and Revenue have teamed up for another series of free, CPD accredited PAYE Modernisation webinars. These upcoming webinars have a new agenda. We will look at what has happened since PAYE Modernisation has gone live and at the challenges businesses are facing.

The webinars are aimed at giving you an overview of how the new real time reporting works, the benefits of this new system and how to make sure that your business is PAYE Modernisation compliant. We will peel back the PAYE Modernisation legislation to outline clearly how PAYE Modernisation affects the payroll process and what is expected from you in 2019 and going forward.

Due to the high level of interest, it is expected that the training webinars will soon be completely booked out. Book your place now to avoid disappointment.

Webinar Agenda

- What is PAYE Modernisation and how to comply?

- How PAYE Modernisation will streamline your processes

- The benefits of PAYE Modernisation

- Recent updates and changes to PAYE Modernisation

- Reporting to Revenue in real time

- Making corrections to the payroll

- The approach to non-compliance and penalties

- How Thesaurus Payroll Manager & BrightPay are supporting your PAYE Modernisation journey.

- Guest Speaker: Revenue

The first webinar in the series takes place on January 30th and is CPD accredited for accountants and payroll bureaus. Due to phenomenal demand, we have also added more dates in February.

Thesaurus Software & PAYE Modernisation

Thesaurus Software is the number one payroll software provider in Ireland with two different payroll packages to choose from - Thesaurus Payroll Manager and BrightPay. Both systems include full PAYE Modernisation functionality at no extra cost. We have worked closely with Revenue to ensure that both systems are fully PAYE Modernisation compliant.

Our products are used to process the payroll for over 125,000 business across Ireland and the UK. BrightPay won the Payroll Software of the Year 2018 award at this year’s Accounting Excellence awards. With a 99% customer satisfaction rate, our customers can rest assured that all required functionality is catered for.

We have made it easier than ever before to switch to BrightPay or Thesaurus Payroll Manager - You can import your payroll data from Sage, Collsoft, Big Red Book, and many others in a matter of minutes.