Feb 2018

6

The benefits of offering cloud payroll services

Accounting firms and payroll bureaus are increasingly moving into the cloud to offer clients a more flexible and streamlined payroll and HR service. Many believe that payroll isn’t a profitable service due to the complexity of the work, the manual administrative time required and the increasing number of mistakes when it comes to recording employee leave.

The actual process of running payroll is straightforward enough due to easy to use features in your payroll software. But what about the administrative payroll and HR related tasks such as processing & sending payslips, managing & recording employee leave, retrieving lost payslips, backing up your payroll data, sending payroll reports to clients and updating employee records? All of these tasks can take a considerable amount of managerial time to process and correct especially where errors have occurred.

The payroll landscape is changing and many payroll bureaus are offering clients a higher level of cloud HR functionality that automates otherwise time consuming tasks. Online access to payroll information for your clients and their employees offers significant benefits for today's bureau which can streamline many workforce management tasks.

Cloud Backup

Storing payroll information and data protection continues to be a challenge for payroll bureaus. With a cloud backup tool you will never lose your payroll data again. You don’t need to worry about backing up your payroll data. Where your payroll software is integrated with the cloud, your payroll data can be synchronised to the cloud whilst maintaining a chronological history of your backups. You can restore or download any of the backups to your PC at any time.

Eliminate Paper & Postage Processing

The concept of paper payslips that need to be downloaded and emailed or printed and enveloped and then posted is an outdated process. More and more employees want their payslips to be accessible and securely stored online. Payslips and other payroll related documents such as P60s, P45s and employment contracts can be easily accessible on an employee self-service online portal. With the cloud, payroll bureaus can avoid spending time printing, emailing and resending lost documents to employees. An online employee self-service option allows employees to view current and historic payslips and access all employee HR documents.

24/7 Online Accessibility

A cloud client and employee dashboard provides 24/7 flexibility and control of payroll information. Clients can access all employees’ payslips, payroll reports, amounts due to Revenue, employee contact details and can even approve annual leave requests. Employees can access their self-service portal on their computer or via their smartphones to view and access payslips and easily submit holiday requests.

Increased Bureau Productivity

Cloud functionality allows for many payroll related tasks to be synchronized with your payroll software. Payroll bureaus radically save time as they no longer need to send payslips to employees, send payroll reports to clients, resend lost payslips, look up holiday leave remaining for employees or manually process and record employee leave on the payroll software.

Annual Leave Management Tool

Annual leave requests can be approved in the cloud where clients can view a company-wide online calendar to easily approve leave while managing staff availability for their business. Employees can benefit as a cloud portal will calculate accurate leave balances in real time. HR managers or supervisors can be given access to approve holiday requests, without having access to view the payroll information.

Full integration with payroll software

Payroll software systems that offer full integration with the cloud is a must. Integrated payroll and cloud systems enables users to share and synchronise payroll data in real time. An online dashboard can link to clients payroll data that is saved on your payroll software ensuring all information is current and correct.

Embrace cloud payroll functionality

Using the cloud to automate many daily payroll and HR related tasks will improve efficiencies for payroll bureaus, employers/clients and their employees. BrightPay Connect is one such cloud solution that fully integrates with BrightPay Payroll offering:

- Cloud backup

- Bureau / client online dashboard

- Online payroll reporting

- Employee self-service

- Online leave management

- Safely store HR documents online

- Update employee details

- Affordability with discounts for multiple purchases

- Easy of Use

Book a demo to see how BrightPay Connect can improve your payroll service and improve your profits.

Related guides

Benefits of BrightPay Connect for Bureaus

What's New in BrightPay 2018?

PAYE Modernisation - Are You Ready For January 2019?

Dec 2017

20

BrightPay 2018 is now available!

BrightPay 2018 is now available!

BrightPay 2018 is now available to download. The bureau licence is just €299 + VAT per tax year and includes unlimited employers, unlimited employees and free phone and email support.

Book a BrightPay demo and find out why our customers give us a 99% satisfaction rate. Still not convinced? Why not download a 60 day free trial to see what all the fuss is about.

Customer Testimonials:

- “BrightPay is an excellent product. Quick and efficient to use and they have a helpline that is always available to talk you through a query.”

- “I am very happy about BrightPay Payroll, easy to set up, easy to use, very good value for money.”

- “Easy. Efficient. Excellent.The program speaks for itself.”

- “BrightPay has been the perfect fit for our business- it has reduced our workload and in turn increases productivity within our business.”

- “Best payroll software I have used. Couldn't say enough good things about it! I recommend it to all the payroll users I know.”

Upcoming Webinars

25th January: How will PAYE Modernisation affect your payroll bureau - Find out more

22nd February: Irish Employment Law Overview - Find out more

8th March: GDPR for your Payroll Bureau - Find out more

Each webinar is CPD accredited and free to attend. If you are unable to attend a webinar at the specified time, simply register and we will send you the recording afterwards.

Sign up to BrightPay’s newsletter

Do you want to hear more about future CPD events, free ebooks, industry updates and special offers? Sign up to our newsletter. You will have the option to unsubscribe at anytime.

BrightPay Payroll Software | Thesaurus Payroll Software

Related Articles

Nov 2017

20

Taxation of Illness Benefit - 2018

Currently, employers are required to tax Illness Benefit and Occupational Injury Benefit payments paid to employees by the Department of Employment Affairs and Social Protection (DEASP).

With effect from 1st January 2018, employers will no longer be responsible for taxing Illness Benefit. From this date Revenue will tax Illness Benefit by adjusting employee's tax credits and/or rate bands. Revenue will receive real-time interfaces of taxable DEASP income and the adjusted tax credits and/or rate bands will be notified to employers via P2C files. As a result of this change there will be more frequent P2Cs for employees. While payroll operators will no longer need to tax Illness Benefit, it will be extremely important to implement amended P2Cs immediately.

In addition, from 1st January 2018 Illness Benefit letters will no longer be delivered to the ROS Inbox. In light of this change, employers may need to review their sick pay schemes.

Related Articles -

Thesaurus Payroll Software | BrightPay Payroll Software

Nov 2017

14

PAYE Modernisation – What do these changes mean for you?

The existing PAYE (Pay As You Earn) system was introduced nearly sixty years ago ensuring that correct deductions are made relating to pay and tax.

From 1st January 2019, this system for PAYE will undergo a long overdue update, but don’t worry, this update will benefit all involved – including employers and employees.

Employers –

PAYE Modernisation will change how employers report their payroll information to Revenue. Every time an employee is paid a file will need to be submitted (electronically) to Revenue, consisting of all details of employee payments, deductions and leaver information. The contents will be similar to the current annual P35, but this file will be submitted every pay period (weekly, monthly, fortnightly, etc.).

The update will also allow employers to submit a new employee’s information before they commence employment with them. PAYE Modernisation / Real Time Reporting (RTR) will result in a reduction in the occurrence of year end over/underpayments of tax.

This new Revenue reporting system is anticipated to be fully integrated into payroll software. Fortunately, it is envisaged that the workload will not increase as a result of PAYE Modernisation.

Employees –

An online statement will be sent before the start of the new tax year which will detail the employee’s tax credits and standard cut-off point (SRCOP). This will be based on estimated income and details available to Revenue.

Employees will be encouraged to make any adjustments to this online statement, including any claims for additional entitlements. This differs from the current system where an employee is required to wait until the end of the tax year to apply for any refund as a result of overpayment of taxes or to find out if there are amounts due to Revenue as a result of underpayment of taxes.

P60s will be abolished, employees will instead have access to their pay and tax record online, this will be updated on an ongoing basis throughout the year as they are paid. This will enable Revenue to carry out periodic reviews to identify if employees are utilising their tax credits and SRCOP to the maximum effect (e.g. where an employee has 2 employments) and, where applicable, employees will be prompted to reallocate tax credits and SRCOP.

Related articles

- PAYE Modernisation - Are You Ready For January 2019?

- Revenue moves to PAYE Modernisation

- Auto Enrolment Planned for Ireland by 2021

- 2018 and Beyond

Nov 2017

6

PAYE Modernisation - Are You Ready For January 2019?

Revenue has released an information leaflet titled “PAYE Modernisation – Are You Ready?”. This kick-starts their awareness campaign for businesses to get ready for payroll changes called PAYE Modernisation or Real Time Reporting (RTR). Revenue outlines the steps that all employers need to take in order to ensure that their current records and obligations are up-to-date and correct.

PAYE Modernisation will change how employers report payroll information for their employees to Revenue. A file will need to be submitted (electronically) to Revenue, containing all details of employee payments. The contents are similar to the annual P35, however, this file will be submitted every pay period (weekly, monthly, fortnightly, etc.).

If you are an employer who uses payroll software, then the work involved to comply with PAYE Modernisation will be minimal. However, for smaller employers who do not use payroll software, the process of complying with PAYE Modernisation will be time-consuming and stressful. Currently, these employers make one manual submission to Revenue through their annual P35. With PAYE Modernisation, these employers will be required to make an employer submission to Revenue each pay period in real time. The employer submission will contain details comparable to what currently appears on an employer’s P35 return.

With PAYE Modernisation in mind, Revenue has contacted nearly 400 employers regarding their P35L returns for 2016. These returns contained employees who were never previously registered as working with the employer. This communication reminds those employers of their obligation to comply with PAYE regulations and requests those employers to submit a P46 for the non linked employees currently in their employment, the commencement date should be input as 1st January 2017 for employees that commenced employment before the current tax year. This action will then result in a new P2C (tax credit certificate) being issued for these employees.

Related articles:

Sep 2017

27

What do you mean…. “Do I have a backup?”

One of the most common calls I get on the support line is from a distressed customer who tells me they have lost their payroll information. Reasons for the loss of this information are varied and could be anything from a laptop being stolen, a virus attacking the computer, holding files to ransom or fire or water damage to the computers in the office.

The first question I’ll ask on a call of this type will be “do you have a backup?”. Honestly, I can’t tell you the number of people that say “No” to this. People are also mistakenly under the impression that we have a copy of their payroll data. Unfortunately this is never the case, we do not have access to the employer’s payroll information so this can add to the customer's stress levels as you can imagine!

We would always stress the importance of taking a backup of your payroll information. You would have your computers and office equipment insured against anything happening so why would you not do the same for your data? Think of your backup as your information’s insurance policy, after all it is almost irreplaceable or at the very least a major inconvenience to try and rebuild your payroll.

In a lot of cases, the call to our customer support line comes too late for us to be of any real assistance and the only advice we have to give is to start over and process payroll from the beginning again.

We never think anything like this will happen to us, but take it from me, it does, so go ahead and take out that insurance policy and backup before it is too late!

The following links will guide you to taking a backup in your software or book a demo of BrightPay Connect our latest cloud add on that offers an automated online backup feature:

- BrightPay UK: https://www.brightpay.co.uk/docs/17-18/backing-up-restoring-your-payroll/

- BrightPay Ireland: https://www.brightpay.ie/docs/2017/backing-up-restoring-data-files/backing-up-your-payroll-data/

- Thesaurus Payroll Manager: https://www.thesaurus.ie/docs/2017/processing-payroll/backup-data-files/

Sep 2017

22

Public Holiday Pay Entitlement

There can often be some confusion surrounding an employee's entitlement to pay for a public holiday particularly where the employee may be part-time or the public holiday falls on a day that the employee does not normally work.

It is also worth noting that not every bank holiday is a public holiday though in most cases they coincide. Good Friday is a bank holiday but it is not a public holiday. The following dates are the official public holidays in Ireland.

- New Year's Day (1 January)

- St. Patrick's Day (17 March)

- Easter Monday

- First Monday in May, June, August

- Last Monday in October

- Christmas Day (25 December)

- St. Stephen's Day (26 December)

Employees who qualify for public holiday benefit will be entitled to one of the following:

- A paid day off on the public holiday

- An additional day of annual leave

- An additional day's pay

- A paid day off within a month of the public holiday

So, who is entitled to a payment?

- Part-time employees qualify for public holiday entitlement if they have worked at least 40 hours in the 5 weeks ending the day before the public holiday.

- Full time employees are not required to have worked up a minimum number of hours.

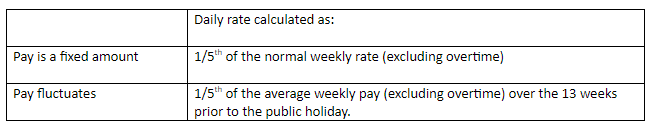

How to calculate the amount to be paid?

If the public holiday falls on a day which the employee would normally work:

- Full-time employees are entitled to one of the above four options at the employer’s discretion.

- Part-time employees have the same entitlement, so where the employee’s pay is a fixed amount the normal daily rate can be used. If the pay varies, the daily rate should be calculated over the 13 weeks immediately before the public holiday in question.

If the public holiday falls on a day which the employee does not normally work:

Further information can be found at Organisation of Working Time Act 1997.

Jul 2017

6

Living Wage increased by 20 cent

The 2017 Living Wage has been set at €11.70 per hour, up from €11.50 last year. The new figure represents an increase of 20 cent per hour on the previous rate. The recommended living wage rate is now nearly a third higher than the legally required minimum wage, which is set at €9.25 an hour.

The 20 cent increase in the Living Wage was arrived at upon consideration of a number of changes in the cost of living and the taxation regime in the last year. The Living Wage for the Republic of Ireland was established in 2014, and is updated in July of each year. It is part of a growing international trend to establish an evidence-based hourly income that a full-time worker needs so that they can experience a socially acceptable minimum standard of living.

Jul 2017

3

Revenue moves to PAYE Modernisation / Real Time Reporting

Following the announcement in last October’s Budget 2016, Revenue entered a consultation on the modernisation of the PAYE system.

Revenue’s proposal is that employers will report pay, tax and other deductions at the same time as they process and finalise their payroll. Similar to Real Time Information (RTI) in the UK, details of employees starting or leaving employment will be reported on the date of commencement/cessation and will eliminate the filing of P30, P35 and P45 forms.

Although, many businesses across Ireland have broadly welcomed the forthcoming introduction, some smaller businesses have expressed concern about the additional administrative burden due to poor internet access and the additional hours it may involve. Many businesses will be a risk as they have not invested in payroll software where they calculate their payroll manually.

Last April Revenue disclosed that it received 77 submissions to the consultation which represented a broad range of interests, both from large and small companies. For larger employers, the transition will be relatively straightforward, but Revenue is looking at alternatives to accommodate smaller employers, in particular, those who may still process their payroll manually.

IBEC state that while most of its members welcome the change, it is important that the system is flexible. A professional services group also warned that the work involved for employers to prepare for the implementation of PAYE modernisation / Real Time Reporting (RTR) should not be underestimated.

BrightPay already has the experience and expertise in developing the same real time features and functions for our UK customers. We are already collaborating with Revenue to ensure the transition for our customers to Real Time Reporting (RTR) / PAYE modernisation is smooth, user-friendly and ready for implementation in January 2019.

Interested in finding out more about PAYE Modernisation? Register now for our free PAYE Modernisation webinar. Click here to find out more.

Related articles

- PAYE Modernisation - an update

- What is PAYE Modernisation Software

- Revenue moves to PAYE Modernisation / Real Time Reporting

For further information, Revenue have provided the following link:

http://www.revenue.ie/en/corporate/consultations-and-submissions/paye-modernisation/index.aspx

Mar 2017

31

Important Information for Employers - Changes to Civil Service Travel Rates

Where employees use their own private cars or motorcycles for business purposes, reimbursement in respect of allowable motoring expenses can be effected by way of flat-rate mileage allowances.

There are two types of mileage allowance schemes which are acceptable for tax purposes if an employee bears all the motoring expenses:

- The prevailing schedule of Civil Service rates; or

- Any other schedule with rates not greater than the Civil Service rates

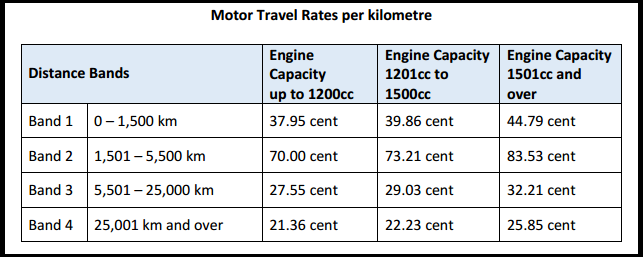

The Department of Public Expenditure and Reform has recently published circulars with new Civil Service Travel Rates, the revised rates are effective from 1st April 2017. The distance bands have increased from two to four with a lower recoupment rate for the first 1,500 kilometres.

Business travel carried out between 1st January and 31st March 2017 will not be affected by these new bands and rates, business travel to date from 1st January 2017 will count towards the cumulative business travel for the year.

Motor Travel Rates - Effective from 1st April 2017

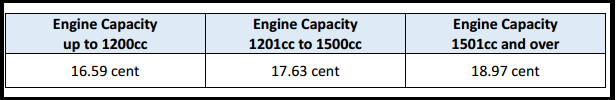

Reduced Motor Travel Rates per kilometre

The reduced rates are payable to Civil Service employees who undertake a journey associated with their job but not solely related to the performance of their duties, such as:

- Attendance at confined promotion competitions

- Attendance at approved courses of education

- Attendance at courses or conferences

- Return visits home at weekends during a period of temporary transfer

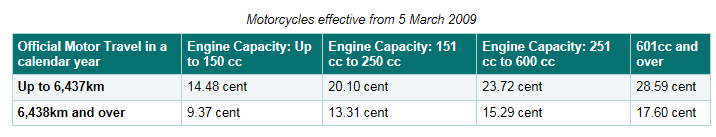

The Motor Travel Rates for motorcycles and bicycles remain unchanged as follows:

Motorcycle:

Bicycle: 8 cent per km

Please note, there are changes to subsistence rates which are also effective from 1st April 2017.

Please click here for the circular on Motor Travel Rates, and here for the circular on Subsistence